CATEGORY

Pre-Fabricated Buildings & Structures

A Pre-Fabricated Buildings & Structures provide advantages in terms of cost and schedule for many projects. Incorporating pre-engineered metal buildings into a design-build project contributes to a fast track schedule and enhances the project cost control process.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pre-Fabricated Buildings & Structures.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

3D Printing Technology gained ground in the Modular and Prefabricated Construction Market

October 20, 2022Azure to use recycled plastic for 3D print prefab homes

August 29, 2022HA-HA to design modular house from Timber

August 29, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Pre-Fabricated Buildings & Structures

Schedule a DemoPre-Fabricated Buildings & Structures Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Pre-Fabricated Buildings & Structures category is 8.10%

Payment Terms

(in days)

The industry average payment terms in Pre-Fabricated Buildings & Structures category for the current quarter is 30.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Pre-Fabricated Buildings & Structures Suppliers

Find the right-fit pre-fabricated buildings & structures supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pre-Fabricated Buildings & Structures market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPre-Fabricated Buildings & Structures market report transcript

Global Market Pre-Fabricated Buildings & Structures Outlook

-

The PEMB market is anticipated to grow at a rate of 8.3 percent by the end of 2023, as a result of the growing need for more efficient, affordable, and environmentally friendly construction methods

-

As a result of high inflation, rising interest rates, and segmentation across various markets, it is anticipated that the construction industry will experience different growth trajectories, with high competition, and increased uncertainty in 2023

-

Margin pressure comes from lengthened lead times and fluctuating material costs. Transport delays and geopolitical unpredictability over the past two years have revealed weaknesses in supply chain

Global Pre-Fabricated Buildings & Structures Market Overview

Key Growth Drivers for pre-engineered buildings market

-

Increased focus toward green building: Various construction companies across the globe are taking initiatives to reduce the energy consumption levels in their buildings and achieve green building certifications, such as LEED (the US Green Building Council's certification) and BREEAM (the UK-based Building Research Establishment Environmental Assessment Method). Pre-fabricated structures are made using green products, with no environmental impact

-

Eco-friendly: PEBs are eco-friendly, as its components are manufactured from sustainable and recyclable products. Steel is one of the world’s most recycled materials, therefore, depending on the manufacturing process, close to 95 percent of the components of a newly manufactured steel product can be recycled

-

Better adoption of BIM: Increased adoption of BIM across various nations has also triggered the usage of pre-fabricated construction, as BIM would make the design flow easier and provides data-centric information, based on the design, specification, and construction issues. In addition to all the other benefits, the usage of BIM to track time, errors, and the cost is a major benefit driving the market in all regions

-

Warehousing needs: Since pandemic, surging demand for goods has triggered a huge demand for warehouses across the globe. There is an increased inclination toward the use of pre-fabricated steel buildings to meet the warehousing needs, as it saves a lot of time and cost given for the fixed design of a warehouse. Due to this increasing demand, the market has seen a lot of local, small suppliers enter into the pre-fabrication market

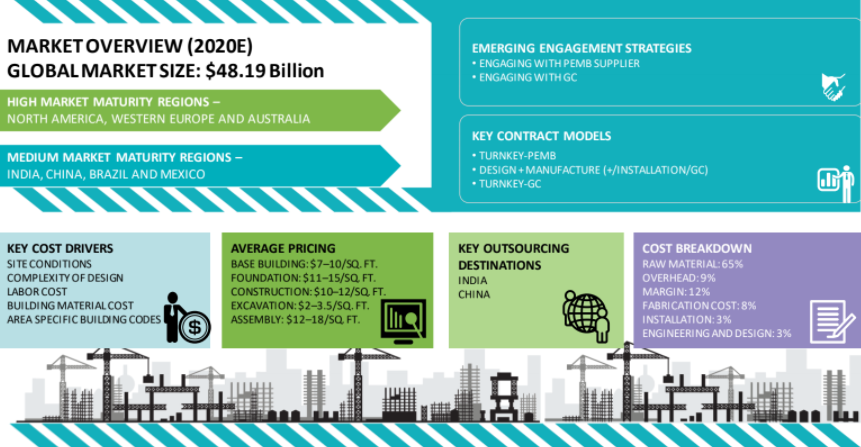

Cost Structure of Pre-Fabricated Buildings & Structures

-

The cost of construction is determined on the basis of four major components: cost of materials, cost of labor, cost of construction equipment and administrative expenses. Labor cost contributes to a maximum of 35–40 percent of the overall cost of construction, labor cost differs widely, depending on the availability of skilled labor in the particular country.

Pre-Fabricated Buildings & Structures Technological Trends

Technological Shift in Design Trends

-

Designing is one of the most critical aspects of PEMB. Designing is done by using various software like MBS, Staad Pro, E-TAB with consideration of Seismic zones, Design codes, loading factor, wind speed, etc. A major shift seen from 2D to 3D detailing of PEB buildings. Lean IPD integrates people, systems, business structures, and that collaboratively harnesses the talents and insights of entire project team to reduce waste and optimize efficiency through all phases of design, MEP fabrication, and construction.

Transition from being “Box Buildings”

-

Earlier, the usage of PEMB’s were restricted to only warehouses with limited height and considerable span, but the technology has transformed drastically and grab the industrial construction market more than 80 percent. After entering into Industrial and Commercial sectors PEB is now becoming popular in residential sectors as well. One more major change observed in construction industry is on usable space and PEB, these are best suited to provide large span buildings without any Intermediate column.

Composite Construction

-

Composite Construction has been a breakthrough technology for the PEMB industry shifting its application from Normal warehouse to Complex low and high-rise multistory steel buildings commonly used for Hospitals, Shopping complex, Commercial buildings etc. The composite slab consist of profiled decking with an in-situ reinforced concrete. The decking is tightened with the shear stud, and this acts as a permanent framework and together with concrete they act as composite structure.

Reusable material

-

The base material used in manufacturing of Pre-Engineered Buildings is Steel which is recognized as most recyclable and reusable material in the world along with many green characteristics such as great durability and needs relatively low amounts of energy to produce. Due to its unique magnetic properties, Steel can be easily recovered from waste and can be recycled without loosing strength. Additionally, the use of galvanized steel make these buildings rust resistant which, as a matter of fact, minimizes the maintenance cost.

Pre-Fabricated Buildings & Structures Market Outlook : North America

-

The industry has recovered strongly in 2022, following a dip in 2021, and experience a considerable growth in the next two years, owing to the huge investments in the infrastructure and industrial sectors in the coming years

-

Science and CHIPS Act with $280 billion investments and $1 trillion infrastructure bill will improve the existing facilities and build new manufacturing clusters and other public infrastructure. The Canadian government is investing $9.4 billion in three years on various sectors, such as transportation, green infrastructure, and connectivity, whereas Mexico is investing $14 billion in infrastructure

-

Since the epidemic, infrastructure and residential construction have been the main drivers of the region's construction industry. By the end of 2022, a growth of 13 percent and 3 percent recorded in non-residential and residential sectors, respectively

-

More than 90 percent of contractors in the area say there is a shortage of labor and building supplies despite the rise in activity. Prices for building supplies, like steel, rebar, lumber, and cement, have each climbed by more than 30 percent

-

Due to the rise in price of construction materials, the input costs increased by nearly 8 percent Y-o-Y in the end of 2022, and when compared to Covid times of 2020, input costs were inflated around 35 percent

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now