CATEGORY

Mechanical, Electrical and Plumbing Services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Mechanical, Electrical and Plumbing Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoMechanical, Electrical and Plumbing Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoMechanical, Electrical and Plumbing Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Mechanical, Electrical and Plumbing Services category is 8.10%

Payment Terms

(in days)

The industry average payment terms in Mechanical, Electrical and Plumbing Services category for the current quarter is 30.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

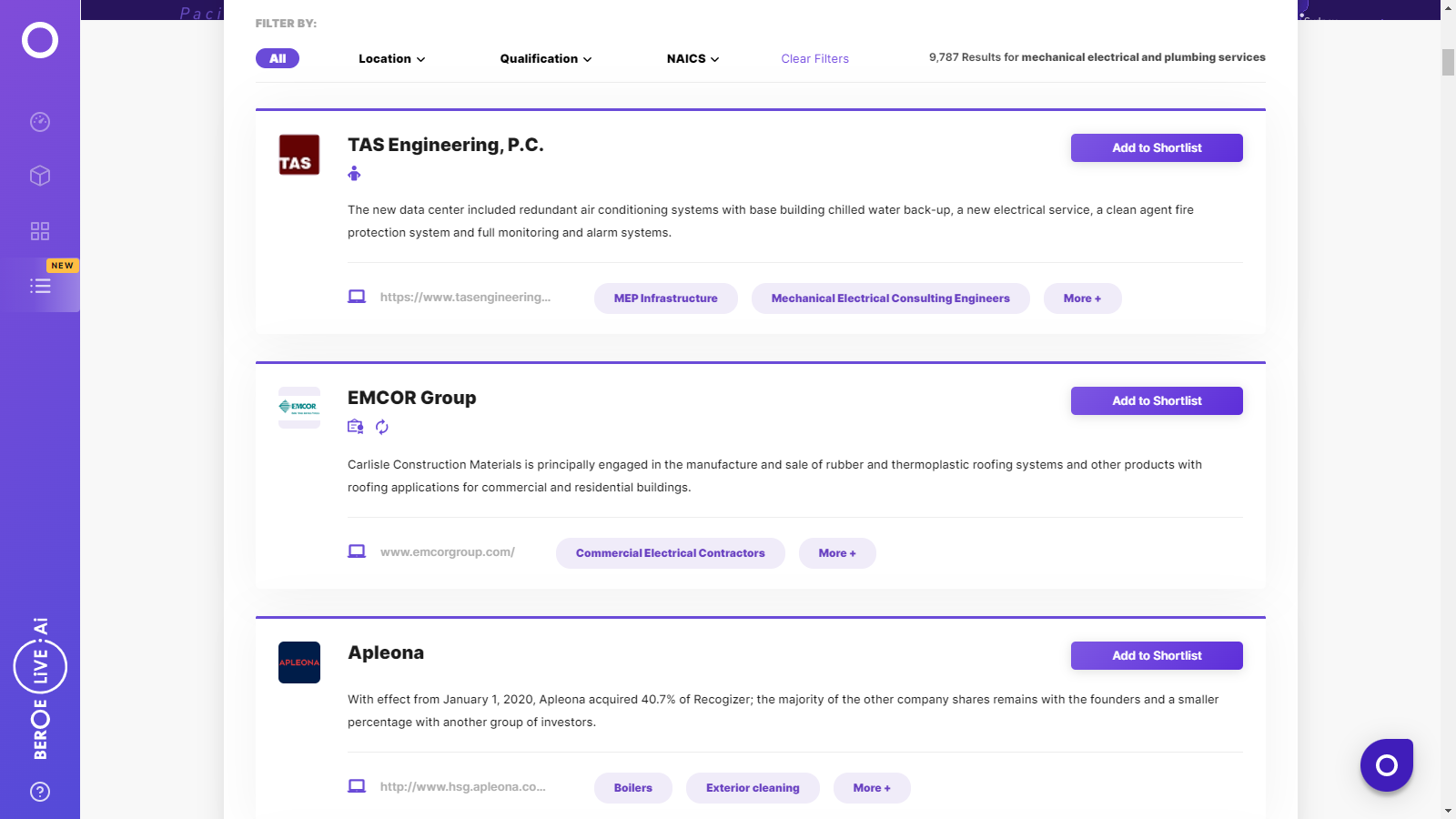

Mechanical, Electrical and Plumbing Services Suppliers

Find the right-fit mechanical, electrical and plumbing services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Mechanical, Electrical and Plumbing Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMechanical, Electrical and Plumbing Services market report transcript

Electrical Mechanical and Plumbing Services Global Market Outlook:

MARKET OVERVIEW (2023 E)

GLOBAL MARKET SIZE: $1,186 BILLION

-

The global MEP market is expected to reach $1186 billion in 2023 and is forecasted to reach $1264 billion by 2025 with a CAGR of 3–4 percent

-

The MEP market is primarily driven by the increasing investment in construction. The global increase in population leads to more urbanization of many tier 2 and tier 3 cities, which requires a lot of infrastructural development

-

MEP services are being designed by various software, which enhances the multiple contractors working for different sub-services

-

The bigger challenge in MEP service is that the safety regulation keeps changing that the contractors have to complete the project before new regulations arrive

Cost Structure of MEP Services

-

The labor and overhead costs can contribute to 50-60 percent of the MEP contractor’s cost. Their gross profits range between 18-24 percent. The major overhead expense of MEP contractors typically rests with executive and administrative payrolls, reducing the net profit margins to 4-10 percent. Negotiation levers can be used to control the overheads and material costs as contractors tend to inflate material prices.

Porter's Analysis on Electrical Mechanical and Plumbing Services

Supplier Power

-

The MEP services market is highly competitive with large global firms and regional medium and small-scale firms

-

Supplier power remains low to medium, based on the current economic conditions that are prevailing across the globe

-

Currently, the market is struggling, due to economic conditions, hence, suppliers/contractors are highly competitive in the bidding process

-

Over the next few years, the supplier power in the industry may gradually increase, due to the inflow of various capital projects from both the public and private sectors

Barriers to New Entrants

-

Barrier to entry remains high, due to:

– High upfront capital required

– Requirement of skilled workforce in a tight labor market -

As the engineering and construction market is consolidated, new entrants from other geographical locations via possible mergers and acquisitions, which is less in the sub -sector

-

Building codes and regulations are highly complex, which has further raised the barrier

Intensity of Rivalry

-

The MEP service are a highly competitive market with several players, offering services

-

The market is highly dominated by top regional and global, who has high expertise in the engineering sector.

-

Leveraging the use of technology to provide better quality for the buyers and develop partnerships, to improve backlog period intensifies competition

Threat of Substitutes

-

MEP’s are one of the major essentials in construction industry and hence there is no substitutes for their role.

-

The only alternative position for buyers is to manage the MEP requirements internally, if they have any large investment plans for the near future.

Buyer Power

-

High fragmentation in the market keeps the buyer power medium to high.

-

Buyer power typically depends on the level of investment by the buyers.

-

The evolving nature of service contracts such as the long-term relationship between the suppliers and buyers or combining multiple projects in a region would increase the buyer power.

-

There are capable regional/local medium to small scale MEP companies in the market and increasing the competition between incumbents suppliers to retain current contract at respective locations will give higher buyer power to small buyers.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now