CATEGORY

Lighting Services

Lighting is the use of lights and lighting fixtures in order to illuminate the interior or exterior of a structure. Lighting is used as a source of light at night and as an aesthetic aspect in sectors such as retail, commercial, etc. Lighting fixtures can be automated with the use of technologies which also brings about energy efficiency

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Lighting Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Build Back Better Awards has nominated innovative outdoor lighting with environmental concise

July 12, 2022Build Back Better Awards has nominated innovative outdoor lighting with environmental concise

July 12, 2022Build Back Better Awards has nominated innovative outdoor lighting with environmental concise

July 12, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Lighting Services

Schedule a DemoLighting Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoLighting Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Lighting Services category is 10.00%

Payment Terms

(in days)

The industry average payment terms in Lighting Services category for the current quarter is 90.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Lighting Services Suppliers

Find the right-fit lighting services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Lighting Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLighting Services market report transcript

Lighting Services Market Analysis and Global Outlook

-

The global lighting market is valued at $166.9 billion and is anticipated to grow at a CAGR of 4–5 percent during 2022 to 2028. Economic slowdown is impacting the overall demand

-

The global lighting market is dominated by Asian countries, due to the low manufacturing cost, followed by Europe and North America, with shares of 21 percent and 17 percent, respectively

-

The lighting sector is anticipated to continue further in Q3 2022, owing to the recovery of demand in construction and automotive

-

The $63 billion global LED lighting market is the highest growth driver with CAGR of 11 – 12 percent and expected to cross $130 billion by 2028

Major Trends Observed

-

Emergence of a new business model: LaaS. In this model, clients do not procure lighting equipment, rather they engage with LaaS service providers for their complete lighting needs

-

Adoption of germicidal UV in the pharmaceutical, healthcare, and commercial sectors to improve workplace health and productivity

-

Adoption of a new sourcing model: Sub-contracting retail store lighting services separately to third-party firms as integrated design and execution contract

-

Increasing adoption of sensor based lighting solutions

Drivers and Constraints in the Global Lighting Services Market

-

Rising construction activities and volumes across the globe drives the market and demand for lighting services. Within this sector, technology enablement, smart lighting solutions and sustainability are the major drivers. Rising raw material prices are major concern for the growth, added up with increasing inflationary pressures due to freight charges and energy prices

Drivers

-

Favorable Regulatory Environment: The US Federal Government offers incentives to commercial entities on adoption of energy-efficient lighting systems. Incentives are offered through rebates and corporate tax reductions. Rebate of $0.30–1.80 per square foot is offered to commercial entities, such as retail stores and offices, by the US Federal Government. Due to the high rebates provided, general merchandize retailers in the US are repeatedly adopting energy-efficient LED lights.

-

Innovation in General Lighting Segment: New innovations in the lighting space are drastically increasing. This had led the way to new products, such as Human Centric Lighting and Connected Lighting Systems. These new lighting products have reduced the energy consumption in buildings.

-

Increasing Global Infrastructure Projects: Several countries are planning infrastructure construction and modification at a large scale, which will provide a huge boost to the lighting industry in the future.

Constraints

-

Lack of In-house Lighting Design Team: Global fashion retailers are reluctant to have an in-house store lighting design team, primarily to optimize cost. The lack of in-house lighting designers might also result in inadequate lighting, especially in retail stores, increased costs, and a lag, in terms of innovation and technology.

-

Issues Faced in Maintenance Services: Many global fashion retailers repeatedly face issues in lighting maintenance, such as repair and new installation in lighting products, across their stores in various regions. To reduce this issue, global lighting suppliers started providing bundled service, such as maintenance-as-a-service, along with lighting products.

-

Increasing inflation and Economic Slowdown: Economies across the globe are facing the harsh inflationary pressure and earlier incentivizing renovation towards energy efficient programs are slowly drawing back due to shift in focus, this could restrict the market conditions for lighting upliftment and renovation activities in developed regions

Global Lighting Market: Global Scenario

-

Due to COVID-19, lighting industry was severely effected due to muted demand as well as supply shortcomings over sourcing challenges in electric components, and the demand was contracted during 2019-21 period. The slower market recovery trend is being continued in H2 2022 and it estimated to be reach nearly $170 billion by the end of 2022 and grow further with a CAGR of 4 - 5% during 2022 - 2028

Market Outlook

-

The previously contracted global lighting market is slowly recovering as the productions and logistical constraints are diminishing from the last quarters, and it is expected to grow at a CAGR of around 4–5 percent between 2022 and 2028 and it is anticipated to reach 223.5 billion by 2028

-

Huge proposed pipeline of investments in public infrastructure and rapid urbanisation drives the market demand across the geographies, seconded by replacement with high energy efficient lighting fixtures in both residential and non-residential segments could boost the recovery rate of demand

-

Rapid recovery in the construction services across various geographies has led to an increase in demand for lighting services, especially for smart lighting solutions with proprietary energy ratings and sustainable human sensitive enabled innovations

-

APAC region holds the major share of global market with USD 57 billion in 2022, seconded by Europe and North America with accounting together nearly 40 percent of total market

-

Residential and commercial segments of the global lighting could drive the demand with an estimated growth of CAGR of 6.5 percent and 5 percent respectively from 2022 to 2028

Global Lighting Market: Key Market Segments

-

Lions share of the general lighting is occupied by the global lighting segment, that contributes more than 80 percent.

-

LED lighting is highly penetrating in almost all the segments, with new projects volume due to high energy efficiency

Market Outlook

-

General lighting is the largest lighting market segment, with the total market size of almost $135 billion in 2022. The general lighting market is estimated to constitute to more than 80 percent of the total lighting market in 2022

-

APAC accounts for the largest share in the general lighting segment with 45 percent, i.e., ~$60 billion. China accounts for ~$28 billion which contributes for 47 percent of the APAC general lighting. Europe accounts for 30 percent of the market share in the general lighting segment

-

The automotive lighting segment is also seen a recovery post massive downfall over the last two years, however challenges are still prevailing in this segment over increasing inflation levels globally, and the growth is expected to grow at a rate of 2–4 percent from 2022 to 2025

-

New innovations in the lighting space are drastically increasing. This had led the way to new products, such as OLED and connected lighting systems

-

Aesthetics plays a huge role in attractiveness of the store, which leads to high demand in the retail sector

Technology Trends in Lighting Market

Intelligent lighting

-

Sensors in light systems collects data on people congregation, creating data pool of time of engagement, head count, location and ancillary datum which can be used to plan and monitor the social distancing norms making future ready smart solutions.

-

Heat maps developed from real time data modelling used to alert the occupants by auto-change in colors and by altering intensities of light.

-

As an illustration, incase of crowd gathered in cafeteria is beyond the pre-defined limit, sensors will detect the count of people in that area and then intensifies the white light to red, thus alerting people to segregate and move to next less denser locations indicated in low intensity lights; this paves for effective management of social distancing norms by facility managers helps in containing viral spread to an extent.

Germicidal UV

-

Germicidal UV is generally used to kill microbes that are present in the air, water, and other surfaces.

-

Germicidal lamps produce wavelengths similar to UV rays that have disinfection properties. It is being widely adopted in healthcare facilities, educational institutions, hospitality, food & beverage service and processing centers, hotels, and the Commercial/industrial sectors

Integrative Lighting

-

Integrative Lighting - Specially designed lighting that produces a beneficial physiological effect upon humans with motive of “DO NOT HARM”.

-

Integrative lighting is referred to as advancement to HCL which inculcates the aspect of health and well-being exposure to artificial lighting.

-

Human Centric Lighting (HCL) is LED, which has been developed with greater sensitivity toward the human factor in commercial settings. It helps in improving operational efficiency of lighting systems and to control lighting in a retail space, based on the occupancy

-

HCL is expected to grow at a CAGR of approximately 25 percent in 2021–2027

WSN

-

Wireless Sensor-based Network is still in the nascent stage, as installation of these networks require huge initial investments

-

Demand for WSN in smart lighting systems is expected to increase, owing to developments in the sensor technologies, which will help remove unnecessary complications in the technology

-

WSN is anticipated to grow at a rate of 10–12 percent from 2021 to 2026

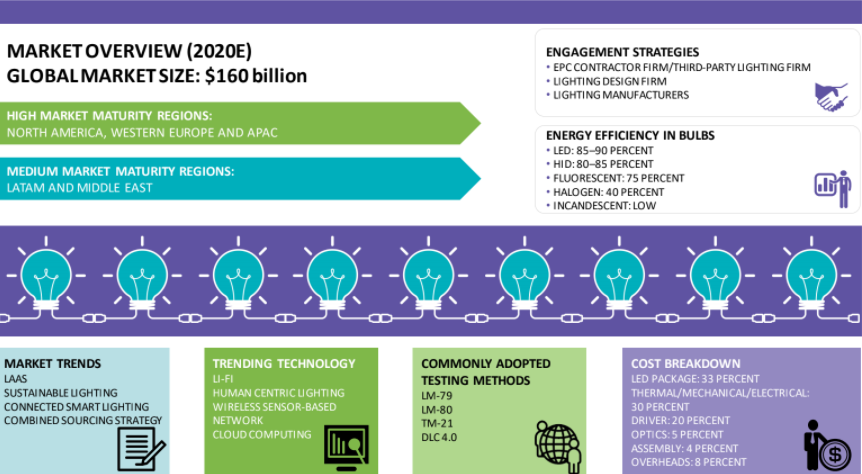

Cost Structure for Lighting

-

The costs mentioned in the break-up for lighting services in retail stores is mostly dependent on external factors, such as the application of new technologies in the manufacturing and functioning of products, quality of products available in the market, etc.

-

However, the application of technologies has resulted in decreased lighting energy and maintenance costs.

-

The actual cost of lighting is also affected by factors, like building type, geographical location, market segments, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now