CATEGORY

Laundry Services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Laundry Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Plant Shutdown

July 25, 2022Plant Shutdown

July 25, 2022Plant Shutdown

July 25, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Laundry Services

Schedule a DemoLaundry Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoLaundry Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Laundry Services category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Laundry Services category for the current quarter is 70.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

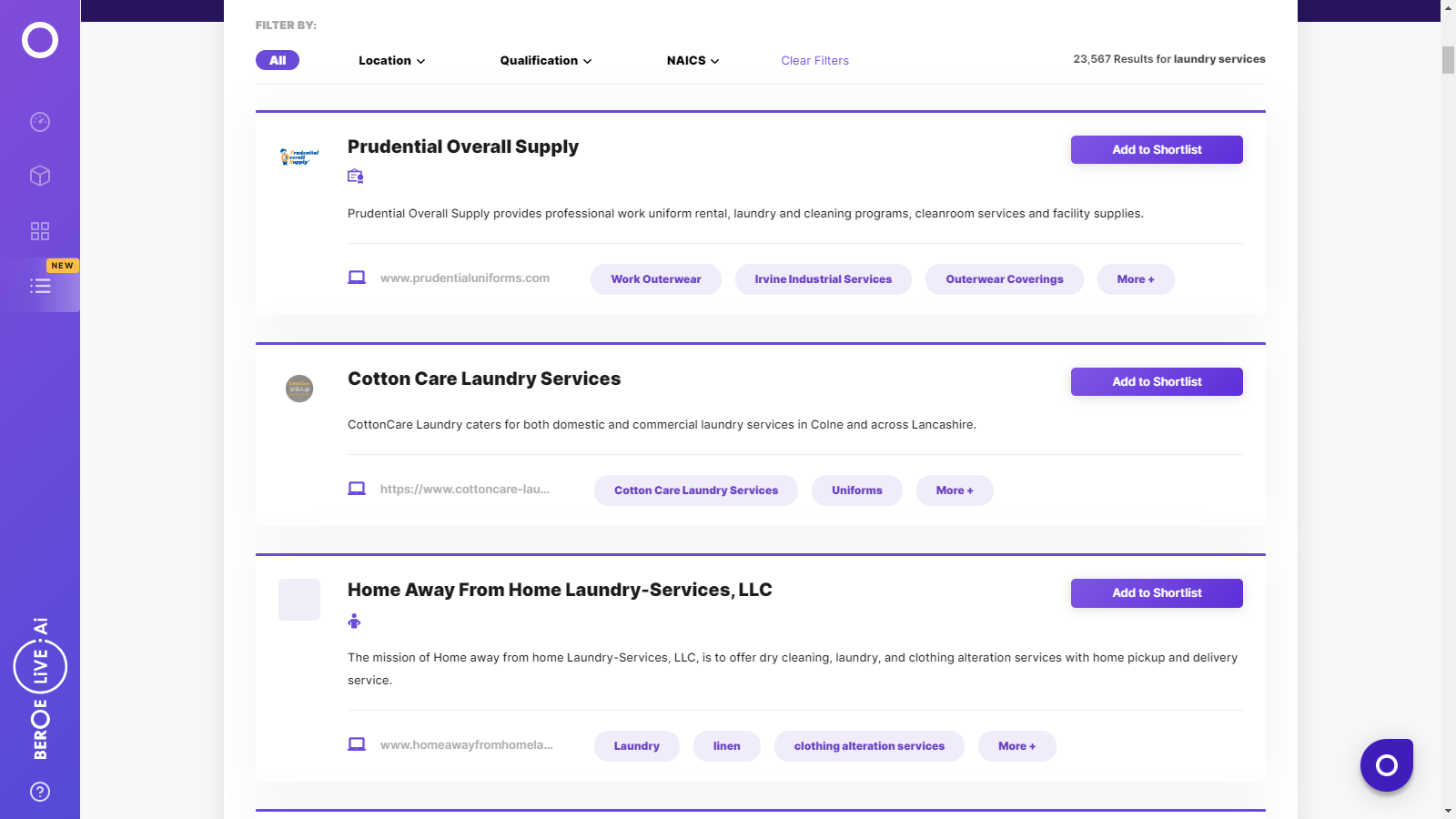

Laundry Services Suppliers

Find the right-fit laundry services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Laundry Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLaundry Services market frequently asked questions

The global laundry services market is receiving major impetus from the healthcare sector, where the COVID-19 pandemic has underscored the need to ensure a safer and hygienic work ecosystem. Moreover, the vacancy rates have directly impacted the procurement of laundry services in the commercial realms. As such, declining vacancy rates are setting high hopes for laundry service providers.

The global laundry services market is receiving major impetus from the healthcare sector, where the COVID-19 pandemic has underscored the need to ensure a safer and hygienic work ecosystem. Moreover, the vacancy rates have directly impacted the procurement of laundry services in the commercial realms. As such, declining vacancy rates are setting high hopes for laundry service providers.

Considering the presence of several suppliers in the laundry services market, industry heavyweights are increasingly turning to innovative technologies to ensure greater interoperability among different laundry equipment and complete the tasks faster with limited resources. Furthermore, market players are going green with eco-friendly laundry chemicals and processes to remain compliant with the stringent regulatory framework and maintain their competitive edge.

Considering the presence of several suppliers in the laundry services market, industry heavyweights are increasingly turning to innovative technologies to ensure greater interoperability among different laundry equipment and complete the tasks faster with limited resources. Furthermore, market players are going green with eco-friendly laundry chemicals and processes to remain compliant with the stringent regulatory framework and maintain their competitive edge.

The demand for laundry services increased marginally despite the COVID-19 wrath, given rising health concerns among several companies and a greater focus on COVID-19 treatments at healthcare institutes. While the demand-supply gap was insignificant, the workforce shortage increased the turnaround time (TAT). Nevertheless, market players are unlikely to witness considerable slumps in their key markets.

The demand for laundry services increased marginally despite the COVID-19 wrath, given rising health concerns among several companies and a greater focus on COVID-19 treatments at healthcare institutes. While the demand-supply gap was insignificant, the workforce shortage increased the turnaround time (TAT). Nevertheless, market players are unlikely to witness considerable slumps in their key markets.

The global laundry services market revenue pegged $115.32 Bn in 2020, down by a 2.1% CAGR due to the COVID-19-induced stressors. By 2026, the global revenue pool will expand at a 7% CAGR, reaching $180 Bn.

The global laundry services market revenue pegged $115.32 Bn in 2020, down by a 2.1% CAGR due to the COVID-19-induced stressors. By 2026, the global revenue pool will expand at a 7% CAGR, reaching $180 Bn.

Beroe’s category intelligence report suggests laundry service providers continue to eye Asia Pacific (APAC), which holds about a third of the overall revenue, for lucrative growth prospects. While markets in Europe and North America have attained maturity, LATAM and MENA will remain the potential growth engines for laundry service vendors.

Beroe’s category intelligence report suggests laundry service providers continue to eye Asia Pacific (APAC), which holds about a third of the overall revenue, for lucrative growth prospects. While markets in Europe and North America have attained maturity, LATAM and MENA will remain the potential growth engines for laundry service vendors.

Laundry Services market report transcript

Global laundry Services Industry Outlook

-

In 2022, the laundry services market was valued at $133.12 billion. The market is forecasted to grow at a CAGR of 12-15 percent by 2028. With the recent COVID-19 outbreak/challenge, the demand might shoot up in all the countries, due to the urge the industries feel to keep up the workplace and workwear clean and safe for their employees

-

APAC holds the 34–36 percent of the laundry market, North America, Europe have high market maturity

-

MENA and LATAM are expected to be the future growth-driving markets for laundry services

Global Laundry Services Market Overview

Key Trends Applicable

-

High-tech industrial washers and polymer bead technology

-

Smart laundry management systems

-

Hydrofinity system

Growth drivers for Laundry Services

-

The demand for laundry services, however, is majorly dictated by the demand from residential and commercial spaces, like office, healthcare and public buildings, manufacturing, retail spaces, etc., due to health and safety concerns

-

Majority of the washing clothes originate in residential areas, due to their convenience, online laundry services are becoming more and more popular, and working-class populations have grown dramatically

-

Technology advances and new product offerings, like green laundry soaps and detergents, that guarantee safe wash also aided in increasing the adoption rate for laundry services

Laundry Services Market Global Drivers and Constraints

-

Macroeconomic Background: High inflation rates in developing countries have a direct impact on the rising demand for wages. Rises in labor costs are crucial for the laundry services industry, as they drive costs in a direct proportion

-

Outsourcing versus Insourcing: Despite the difficult global economic conditions, outsourcing of laundry services is the preferred model, compared to performing such services in-house

Drivers

-

The global laundry industry continues to be profitable, mainly riding upon the growth of the healthcare industry and outbreaks of diseases pandemic have raised the need to create a safer work environment propelling the growth rate

-

Vacancy rates have a direct impact on procuring laundry services for commercial spaces. Vacancy rates are on the decline, providing the impetus for the laundry services industry

-

In a short period, new technologies, more interoperability among different laundry equipment and more suppliers in the market have resulted in higher growth. This evolution of laundry equipment has become an advantage for laundry service in the retail industry, which helps them to complete the task in a short time with limited resources

-

Green laundry products (chemicals) and procedures will have a higher impact in the future. Hence, businesses should focus on going green and realizing the benefits therein

Constraints

-

Labor costs generally represent 50-60 percent of total operational costs. In addition to the native workers, most of the laborers are immigrants and the Regulations associated with such workers can play a major role in managing laundry services effectively in a particular country

-

Recent economic conditions may have negative consequences on the labor supply, and thereby, poses a threat of increasing labor costs

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now