CATEGORY

Cleanroom Gowning and Work Apparel US

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cleanroom Gowning and Work Apparel US.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

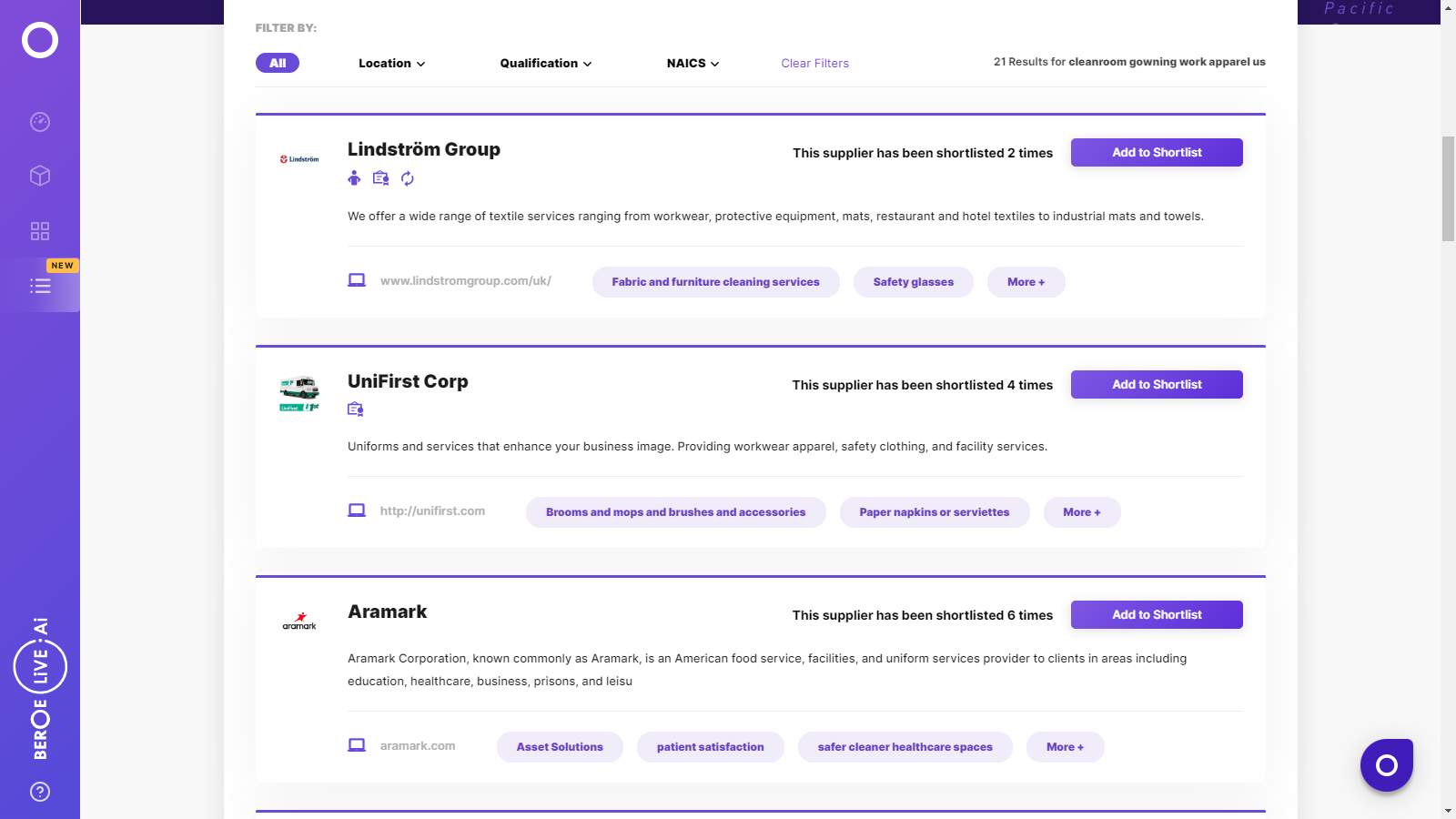

Cleanroom Gowning and Work Apparel US Suppliers

Find the right-fit cleanroom gowning and work apparel us supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Cleanroom Gowning and Work Apparel US market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCleanroom Gowning and Work Apparel US market report transcript

Regional Outlook on Cleanroom Gowning and Work Apparel US

The uniform service market is expected to grow at a 2-3% annual rate through 2020. North America is a highly matured market with regards to the cleanroom gowning and work apparel service.

Commercial and industrial uniform services include the rental and laundering of garments, and the provision of dust- removal and cleaning services and supplies such as mats, mops and rugs. Services are typically provided using vehicle fleets and offsite laundries

Market Snapshot

Uniform Rental and Laundry services market in North America is highly consolidated and matured. The trend is towards consolidation. The market players are majorly into Rental, which means rental model continues to dominate. Holistic service capability catering to a large number of requirements is present with large players such as Cintas, Aramark. There is lack of emerging players who can provide an end-to-end portfolio required by the industry.

Sourcing Model

Approximately 90% of the pharmaceutical companies in North America use renting model to source the cleanroom garments and work apparel.

Engagement Model

Most organizations prefer rental model over buying or leasing; although suppliers are capable of providing all models.

Pricing Model

Garments are priced per item regardless of the usage, while process and maintenance activities are billed based on the usage of the wearer.

Contract Model

The optimal contract period followed by buyers in North America and Canada are 3-5 years.

Supplier Base

Uniform rental and laundry services industry in North America has a mix of small, mid sized and large suppliers. The market is witnessing consolidation now. Top suppliers like Aramark, Cintas, UniFirst and other top players account for 40% of the market share.

Market Maturity

Overall, the region is highly matured in terms of sourcing and cleaning of garments.

- Pioneer Markets: North America

- Matured Markets: Canada, Mexico

Industry – Drivers and Constraints

The industry is moving towards outsourcing non-core activities and focusing more on the core and strategic activity. Hence, the drivers towards outsourcing/ renting cleanroom gowns and work apparel are significant.

Drivers

- The major cost associated with cleanroom gowning and flame resistant garments is the specialized laundry and maintenance (including repair) requirements; which requires significant initial cost of establishment and maintenance

- With increased pressure to reduce cost on in-direct spend, pharmaceutical companies are in an urge to outsource non-core activities and source with suppliers to reap maximum benefit and reduce total cost

Constraints

- Labor costs generally represent 70-75 percent of total operational costs. In addition to the native workers, most of the labor are immigrants and the regulations associated with such workers can play a major role in managing the service

- The costs associated with replacement and customization is an add on cost, which is difficult to estimate at the start of the contract

Best fit model - Rent

Buying garments is an ever growing expense that will always follow an upward trend, which will ultimately result in high inventory and total cost for the company. Best in class organizations choose between Renting or Leasing.

Since most of the rental players offer laundry services, the overall management becomes lesser for the organization. Hence, organizations are choosing renting over leasing.

Pros

- Garment maintenance – With a managed program, uniforms are maintained, washed, and replaced by the service provider

- Convenience – A contracted program eliminates the need to manage a uniform program in-house

- Contamination contact – Industrial laundering programs are better able to handle proper wash requirements for uniforms that come into contact with food or hazardous materials

- Quality – Uniforms maintain higher quality standards longer when properly maintained

- Cost savings – With no upfront purchase costs and inclusive laundering, plus any needed repairs and replacements of all workwear, managed uniform programs can help businesses realize significant cost savings

- Storage space – Contracting uniform service frees up required storage space for other uses

- Uniform program management – Uniforms are often used as a level of security and safety for employees, and the service provider helps in managing the process through inventory, maintenance, repair, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now