CATEGORY

Cleaning Services

Cleaning services mostly relates to commercial and industrial. Workplaces, Offices ,Retail spaces come under commercial and manufacturing plants ,its equipment are under industrial

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cleaning Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Diversey to be acquired by a leading manufacturer of specialty chemicals in the US.

April 04, 2023Prices of Cleaning Consumables & Office Supplies are expected to increase in South Africa

February 15, 2023Atlas FM has acquired Essex based cleaning firm.

November 22, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Cleaning Services

Schedule a DemoCleaning Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Cleaning Services category is 7.50%

Payment Terms

(in days)

The industry average payment terms in Cleaning Services category for the current quarter is 62.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

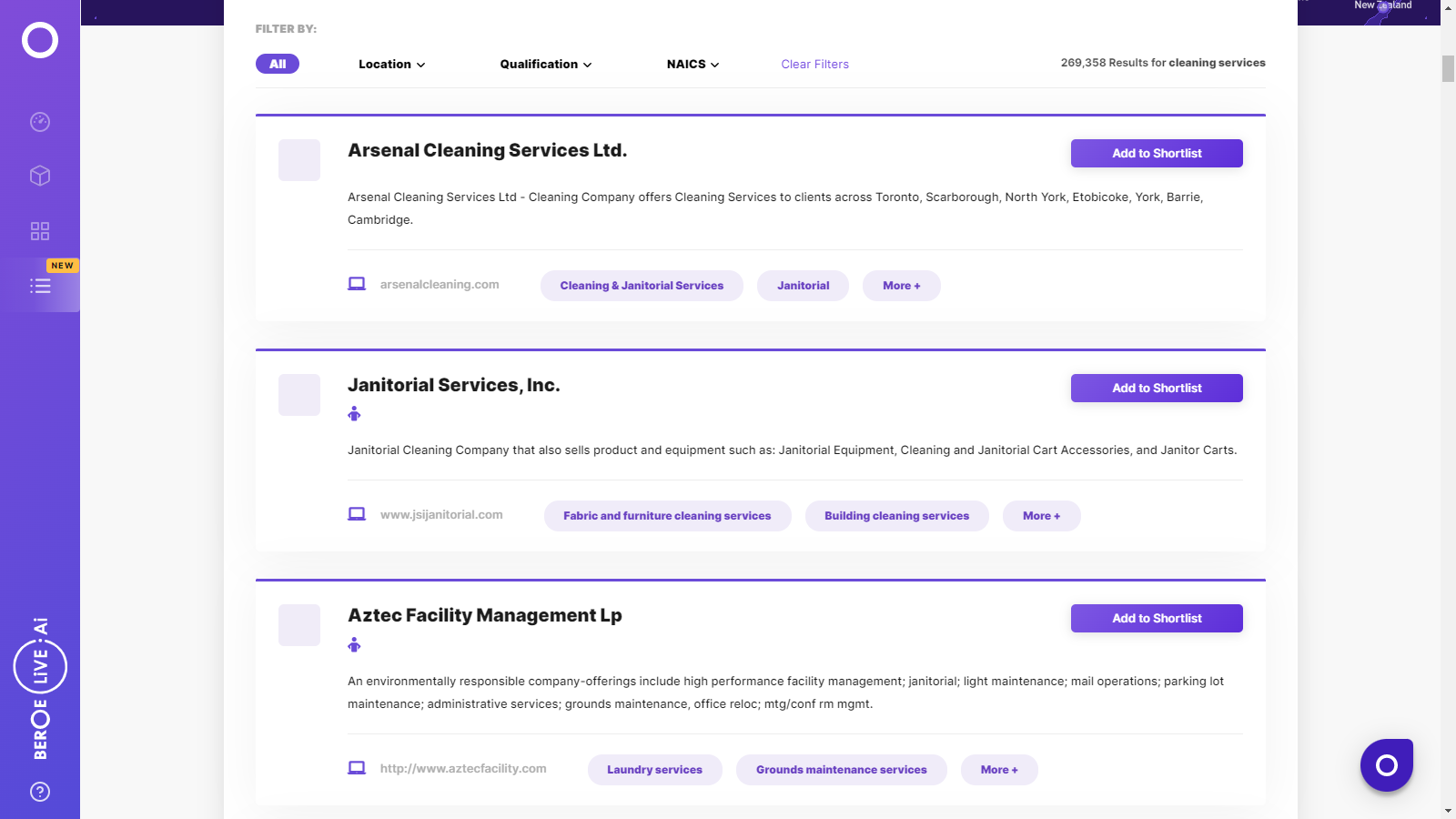

Cleaning Services Suppliers

Find the right-fit cleaning services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Cleaning Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCleaning Services market report transcript

Global Market Outlook on Cleaning Services

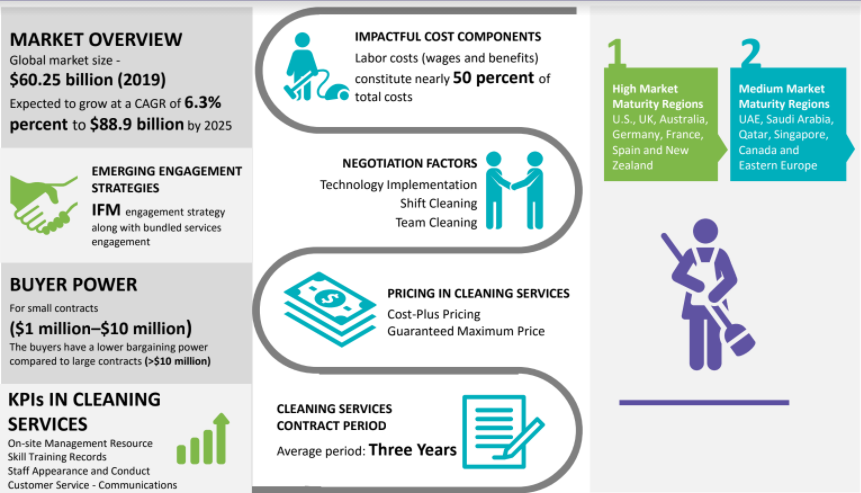

MARKET OVERVIEW

Estimated global market size: $65.42 billion (2022)

Expected to grow at a CAGR of 7.1 percent to $92.18 billion by 2027.

-

In 2022, the global cleaning services market was estimated at $65.42 billion. The market is forecasted to grow at a CAGR of 7.1 percent to $92.18 billion by 2027. With the opening of offices and other commercial places, the demand might shoot up in all the countries, due to the urge the industries feel to keep up the workplace clean and safe for their employees

-

North America, Europe, and some parts of the APAC, such as Australia, have high market maturity

-

The APAC and parts of LATAM are expected to be the future growth-driving markets for cleaning services

Global Cleaning Services Market Maturity

-

Cleaning services penetration is still low outside Europe and North America

-

APAC and LATAM are witnessing increasing adoption, due to the efforts by large global buyers to consolidate supply bases

Global Cleaning Services Industry Trends

-

The cleaning industry has matured in tandem with other FM services in developed markets such as Europe and the US

-

In developing regions, the trends related to bundling, outsourcing and value-based approaches are emerging steadily. They will gain further strong footholds. The increasing need to create a safer work environment due to COVID19 pandemic along with adhering to the environmental and regulatory compliances is further expected to propel the market growth

-

The cleaning industry has matured in tandem with other FM services in developed markets such as Europe and the US. Sustainability has become a major concentrating point in both developed and developing countries

-

In developing regions, the trends related to bundling, outsourcing and value-based approaches are still in an emerging stage and yet to reach its due prominence. They are expected to gain strong footholds

Global Cleaning Services Market: Drivers and Constraints

Drivers

-

Macroeconomic Background: High inflation rates in developing countries have a direct impact on the rising demand for wages. Rises in labor costs are crucial for the cleaning services industry, as they drive costs in a direct proportion

-

Outsourcing vs. Insourcing: Despite the difficult global economic conditions, outsourcing of cleaning services is the preferred model, compared to performing such services in-house

-

The global cleaning industry continues to be profitable, mainly riding upon the growth of the healthcare industry and the recent COVID19 pandemic has raised the need to create a safer work environment propelling the growth rate

-

Vacancy rates have a direct impact on procuring cleaning services for commercial spaces. Vacancy rates are on the decline, providing the impetus for the cleaning services industry

-

In a short period, new technologies, more interoperability among different cleaning equipment and more suppliers in the market have resulted in higher growth. This evolution of cleaning equipment's has become an advantage for cleaning service in the retail industry, which helps them to complete the task in a short time with limited resources

-

Green cleaning products and procedures will have a higher impact in the future. Hence, businesses should focus on going green and realizing the benefits therein

Constraints

-

Labor costs generally represent 80 percent of total operational costs. In addition to the native workers, most of the labor are immigrants and the Regulations associated with such workers can play a major role in managing cleaning services effectively in a particular country

-

Britain leaving the European Union (EU) may have had negative consequences on the labor supply and thereby poses a threat of increasing labour costs

-

The COVID-19 pandemic has resulted in lot of cleaning staff attrition, due to which, the market is witnessing a demand–supply ratio, due to labor gap

Impact of COVID-19 on Commercial Cleaning Services

-

Cleaning services is in more demand during the pandemic due to the health concerns of organisations as well as more focus on COVID-19 treatments at the hospitals. Supply–demand gap was felt and is still present due to the shortage of staffs and increased turnaround time.

-

As businesses faced with unexpected closures and slowly opening across the globe post lockdown demand has raised and the supply demand gap would eventually increase hampering the ongoing clinical researches

-

Cleaning companies are overloaded by ongoing pandemic– leading to increasing supply demand gap of supplies and man power

Supply Trends and Insights

Global / Regional Supplier

Increase in M&A, Divestments:•

-

On November 2022, CBRE announced that it has acquired Full Spectrum Group for 110 million USD deal.

-

On December 2022, CBRE has announced that it is set to acquire Swedish technical maintenance and property management services firm H2M

-

On August 2022, CBRE has acquired AI/ML data driven technology firm E2C technology.

-

On July 2022, JLL has announced that it has acquired Envio Systems, a Berlin based technology company.

-

On October 2022, Sodexo subsidiary Entegra has acquired Beacon Purchasing to expand its footprints in UK.

Tier-2/Local Supplier

-

M&A: Spotless Commercial Cleaning Ltd has acquired two of its rivals Purity Group and Clearsprings Support Services Ltd

-

Self-performing Capability: Tier-2 suppliers prevalently self-perform services, which will eventually reduce the troubleshooting escalation matrix for the buyer

-

Innovative Service Offering: Suppliers are coming up with new contract models and service options for buyers

-

Sustainability Solutions: A programmed facilities management company introduced a new service called sustainable solutions, which takes care of energy, water and emission savings. This shows that the suppliers are interested in providing critical services

Engagement Trends

-

Most Adopted Model Globally: Bundled sourcing strategy

-

Why: To achieve spending visibility and cost savings

-

Contract Length: Three to five years, with an option of contract extension based on performance linked with SLAs

-

Pricing Strategy: Shifting from value-based pricing to target, or performance-based contracting and linked with SLAs

Pricing Analysis

Price Forecast

Price Breakdown Forecast

-

The price breakup for various categories of cleaning services are expected to remain almost consistent in the upcoming years

-

This is because there is limited potential for additional mechanization in the facilities management industry

-

There may be some scope for manned cleaning to move to technological advancement in that service category

-

Facilities management is largely a labor- centric industry as most services are people-based

Price Change Forecast

-

The UK does show potential for a price rise in the market in the upcoming years

-

This rise is attributed to the improving economic conditions with reduced unemployment

-

Any change in workplace/employment legislations in the UK can result in an increase in the cost

-

Shortage of specialized skills can cause the cost of a specific service to rise

Why You Should Buy This Report

This research study on the cleaning services industry offers a comprehensive analysis, industry size and forecast, growth drivers, trends, and challenges, as well as competitor analysis covering numerous vendors.

The study provides an updated assessment of the current global cleaning service marketing scenario and the overall market environment. It includes the end-user segment and geographical landscapes.

The data presented in the report is reliable and based on holistic research - both primary and secondary. Furthermore, the cleaning market research study provides an overall competitive landscape and comprehensive vendor selection approach and analysis using quantitative and qualitative research to project accurate market growth.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now