CATEGORY

Commercial Real Estate Services

The real estate management incudes the various services related to finance, operations, taxations, renewals, etc., under one roof, which helps clients to bring clear understanding about property portfolio and enable to design the objectives for the organization.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Commercial Real Estate Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCommercial Real Estate Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Commercial Real Estate Services category is 9.00%

Payment Terms

(in days)

The industry average payment terms in Commercial Real Estate Services category for the current quarter is 54.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

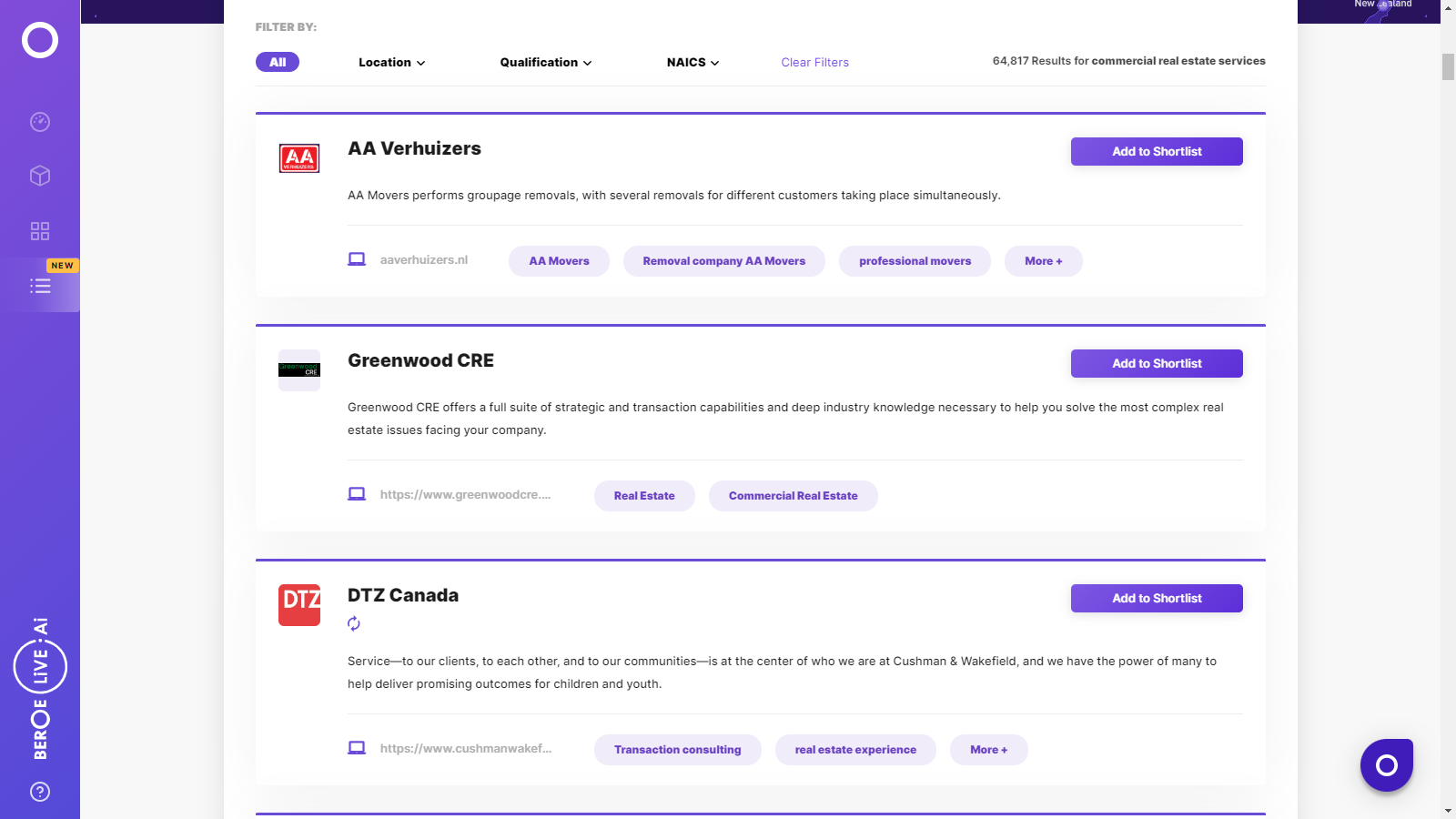

Commercial Real Estate Services Suppliers

Find the right-fit commercial real estate services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Commercial Real Estate Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCommercial Real Estate Services market frequently asked questions

As per Beroe's study, the main KPIs of the commercial real estate market are: Acquisition and Disposals Landlord and Tenants Data Analysis Data Capture

As per Beroe's analysis, the total global investment volume for the CRE market is expected to grow at an average rate of 6 percent by 2021.

The names of top service providers globally are: CBRE Jones Lang Lasalle (JLL) Colliers International Cushman and Wakefield (C&W) Savills Knight Frank

Following the insights from the real estate market intelligence report, the major cost components are: Management Fee Administrative Fee Collection Fee Maintenance Fee Other Unspecified Fee

The two main pricing models prevalent in the CRE market are: Fixed-price model Flat-price model

As per the data report generated by Beroe, the high-market maturity region includes the following countries: U.S. U.K. Australia Germany France Qatar Dubai Singapore And, the medium-market maturity regions include: U.A.E. Eastern Europe China India

The average duration of all the contracts within the real estate market is usually between three to five years.

According to the report, the most emerging engagement strategy is the bundling of the CRE market with FM services in a single contract.

As per the commercial real estate market data, the bundling of the CRE market with FM will affect the following parameters: Quality Achievement ' High Cost-Effectiveness ' Medium Execution Risk ' Medium Adoption Rate ' Rapidly increasing

The report from Beroe indicates the following as the main negotiating factors in the CRE market: Share of savings Fee at risk Scope additions Contract tenure

The parameters that suppliers must fulfill are: Experience to manage large volumes of transactions The ability of service providers to provide integrated real estate services Capable of serving single buyers with large-size multiple properties in one geographical location Focused on resource management and expertise in software to manage real estate services

Between North America and the Asia Pacific, the latter is on the higher end with market size of $874.8 Bn, while NA captures a market size of $529.4 Bn.

Commercial Real Estate Services market report transcript

Global Market Outlook on Commercial Real Estate Services (CRE)

-

The global market for CRE investment was valued at $280–300 billion in Q3 2022 , which is a percent year-over-year higher compared to Q2 2021. This indicates market recovery to pre-COVID levels

-

Americas CRE investment volume increased by 47 percent and 25% in EMEA. The US is the major contributor, with around half of the global CRE investments

-

After a decline in investment volumes in Q1 2021, the increase in investments in Q1 2022 indicate recovering markets

Global CRE Industry - Drivers and Constraints

Drivers

-

Transfer of operational risk: Outsourcing allows buyers to transfer the operational risk to their service providers. The legal responsibility for regulatory compliance would still be the buyer’s, but risk can be transferred to the suppliers through regulatory compliance contract clauses

-

Dealing at a local level with an internal team is always tedious and time-consuming. Engaging on a regional or a global level increases the ability to solve contract complexity, which enhances buyer skills

-

Increasing asset complexities and companies buying properties across the globe triggers the need to outsource the property management services

-

During the requirement for quick-completion requests, suppliers can leverage their contacts to buy or sell the properties immediately

Constraints

-

On an operational level, the buyer feels that initially it is difficult to freeze the scope of services if operations are on a local level and with a wide property portfolio

-

Different business unit heads may feel that they have greater bargaining power over a local level supplier, which might lead to resistance in outsourcing the services to a large regional or global supplier

-

Services providers still lack self-performance capabilities, which is one of the main expectations of the buyers, as it can reduce the margin on sub-contracting

Supply Trends and Insights

Supply market outlook

-

The highly competitive real estate/FM market, together with increased focus on security and sustainability, has been pushing service providers towards innovation

-

The introduction of IFM/TFM will result in strong growth, driven by the increasing role of technology, along with the demand for services, such as energy management and real estate management. This is driving the market towards consolidation

-

The market is gradually shifting from single service to bundled services and further towards IFM, so major service providers are increasing their competency through M&A

Engagement Model

-

Most adopted model globally: Fixed price and flat fee

-

Most large companies, typically, look at a regional/global engagement as it addresses any one of the following scenarios:

–Large spread of properties internationally

–Properties in markets that are opaque

What to look for in suppliers before awarding large contracts?

-

Suppliers should have the experience to manage the large volume of transactions

-

Ability of service providers to provide integrated real estate services

– Global suppliers have a strong presence with a wide range of service capabilities -

Service providers' capability to serve single buyers with large -size multiple properties in one geographic region

– High-value accounts have been managed by global service providers -

Software used to manage real estate services

-

Supplier focus on resource management

– Focus is largely on high priority contracts and leveraging economies of scale

Market Overview

Global players have the capabilities to provide end-to-end services.

The major fee components are management fee. The management fee can be a percentage of the monthly gross rent or a flat fee. It pays for the property manager’s time spent in commercial real estate marketing, administering lease agreements, screening applicants and resolving tenant issues. Administration fee: Services, like managing dispute resolution with tenants, sending out statements and providing reports to the property owner, require an additional fee on top of the management fee. Collection fee: encompasses a collection of all rents, fees, revenue and delinquencies. Maintenance fee: Maintenance fees are special costs tailored specifically to the upkeep of buyers’ properties, and others. Generally, the contract period is between three and five years. The pricing is fixed.

Why You Should Buy This Report

- This real estate market intelligence report gives the global and regional commercial real estate market analysis, global commercial real estate market size, trends and Porter’s five force analysis.

- It gives supply trends and insights and provides SWOT analysis of major players like CBRE, JLL, Cushman & Wakefield, etc.

- The report gives the commercial real estate market cost structure breakdown, pricing trends, etc.

- It details the best sourcing, engagement and pricing models and analyzes the commercial real estate market data to list out the SLAs and KPIs.

- It thoroughly analyzes the saving opportunities and the cost structure. It provides a supplier scorecard too.

- The report provides procurement best practices including pricing structure, pricing model, office space management, engagement models, and contract lengths.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now