CATEGORY

Change Management Services South Africa

Report covers suppliers in South Africa for Change management services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Change Management Services South Africa.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

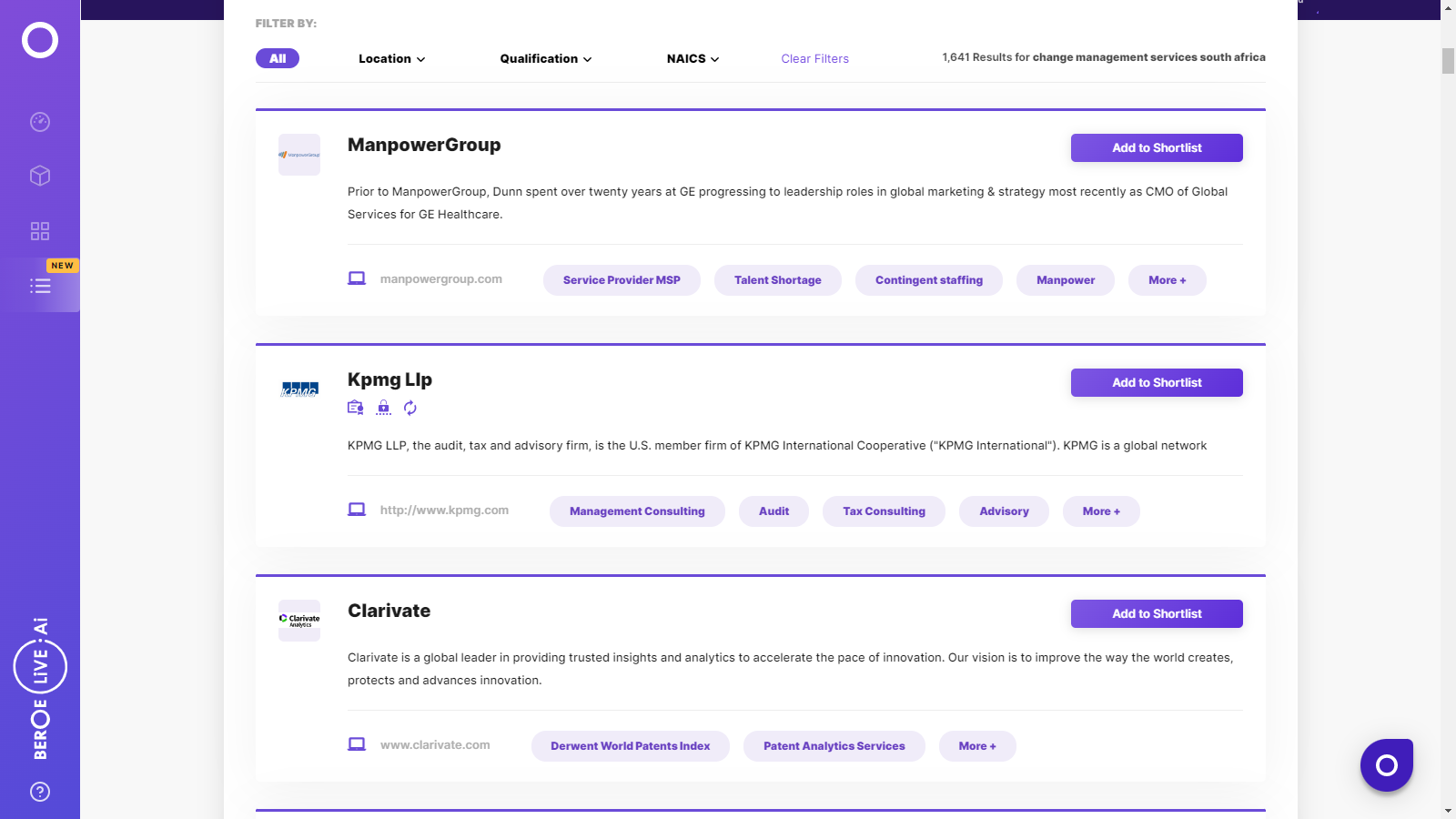

Change Management Services South Africa Suppliers

Find the right-fit change management services south africa supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Change Management Services South Africa market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoChange Management Services South Africa market report transcript

Regional Market Outlook on Change Management Services

Engagement Strategies for Office Relocation Services

- A hybrid supplier engagement approach is an upcoming strategy, which helps the buyer to maintain good employee experience with increased visibility in costs and policy exceptions

- Companies with an annual relocation transfer volume greater that 300 follow a frequent bid schedule with suppliers every three years

- Companies with a higher number of annual relocations usually follow certain bid cycles for soliciting bids from service providers

- The frequency of the bid not only depends on the annual transfer volume, but also on the existing supplier performance

- Supplier performance is measured, in terms of global employee mobility experience, assignee satisfaction, updating technological capabilities, ability to reduce cost, better compliance, and consistent application of policy conditions

Supplier Engagement Types

Host Model Approach

A consultant is positioned in the host country, as the primary point of coordination for the assignee. As major activities and services are in the host country, the majority of the time is spent by the consultant on preparing an assignment in the host country

Origin Service Delivery Approach

Relocations will be managed by the business unit in the original location. For example, a relocation from China to the UK will be coordinated by the business unit in China.

Hybrid Approach

One consultant in the home country starts the process and then hands it over midway to a consultant in the host region.

Centralized Approach

There is a single point of contact for every buyer (usually the account manager) who takes care of all tracking, reporting, and direct liaison with the buyer, usually executed by the global account manager.

Cost Structure Analysis for Office Relocation/Change Management

- The change management services industry provides removal, transport, storage and packing services to individuals, corporations, and governments

- The South Africa industry is fragmented: the 10 largest companies hold about 45% of the market

- The nature of service is fairly simple with no major technological or capital prowess required

- It is a labor centric industry with only a moderate level of capital expenditure

- Expenditure on wages accounts for a larger proportion of revenue

- Labor expenses include the wages and salaries paid to truck drivers, mechanics, cleaners, movers, and administrative staff

Labor Cost 50%

- Labor constitutes the maximum percentage of cost for the short distance move services

- The office move services require different types of labors:

–Project managers

–Supervisors

–Drivers

–Packaging and material handling labors

- The labor rates are determined by the rates given in the CBRE cost analysis

Transport Cost 30%

- Transport constitutes the second highest element of cost for the move services

- The transport cost has the following elements:

- –Truck/Trailer/Tractor

- –Fuel

- The fuel constitutes a bulk amount in case of long distance moves

Other Expenses 10%

- For the purpose of relocation of office, the material to be moved requires proper packaging, so as to prevent any breakage in transit

- While the contribution of packaging, in terms of cost is not very high, it is an important aspect against which the quality of the service is assessed

- The cost is constituted by various supplies, like bubble wrap, cartons, and other material required to pack

Price Benchmarking for Office Relocation Services

- The labor falling in the category of transportation and material moving forms the maximum percentage of the total labor component, and hence, has been the focus for negotiation scope

- The rates of these categories of labors must be renegotiated, as there is plenty room for cost cut down

Negotiation Levers Pertaining to the Office Relocation/Change Management Services

- The supplier market has a huge competition, as the number of suppliers is very large, which makes it important for the current supplier to negotiate, in order to retain industry

- Since current supplier “Change Logic” has experience of more than 7,000 number of moves, it is recommended to re-negotiate the contract, instead of new contract, which may cause disruption in plans for relocation

Why should industry negotiate?

- Cost of conducting RFPS and evaluating bids can take a long time.

- Transition cost may be involved.

- Some degree of operational disruption may occur, owing to a new supplier.

- Industry possesses the bargaining power to renegotiate.

Why will the current supplier negotiate?

- Industry is a very important client to the supplier, as the project promises huge volume of work.

- While the market mostly offers short-term contracts, the current project can get the supplier a long-term contract spanning a year or more.

- The market has sever competition, as there are a very large number of suppliers, and hence retaining a client shall be on priority for the supplier.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now