CATEGORY

Catering Services

Catering services covers aspects such as Employee meals, Cafeteria services, Vending, Kitchen equipment etc

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Catering Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Meta & Google are Cutting Employee Meal Perks to Reduce Cost

April 20, 2023Global Sugar Supply Affected by Adverse Weather Conditions

April 18, 2023Compass Group achieves 36% reduction in animal protein emissions

February 07, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Catering Services

Schedule a DemoCatering Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Catering Services category is 10.00%

Payment Terms

(in days)

The industry average payment terms in Catering Services category for the current quarter is 58.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Catering Services Suppliers

Find the right-fit catering services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Catering Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCatering Services market frequently asked questions

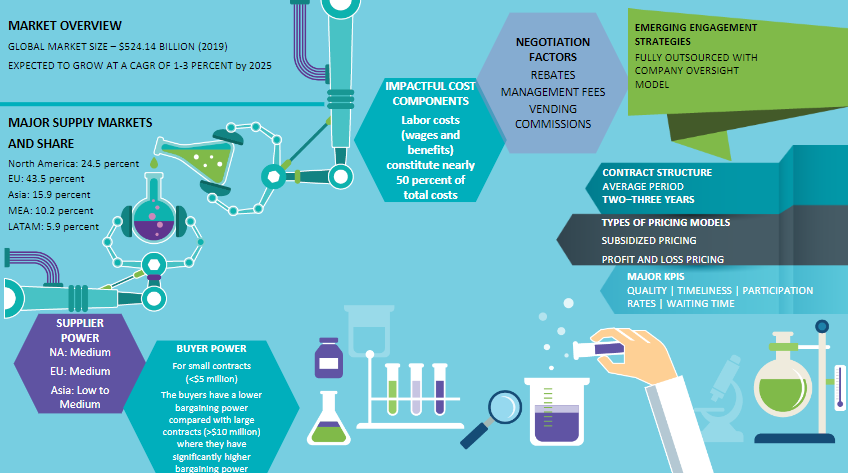

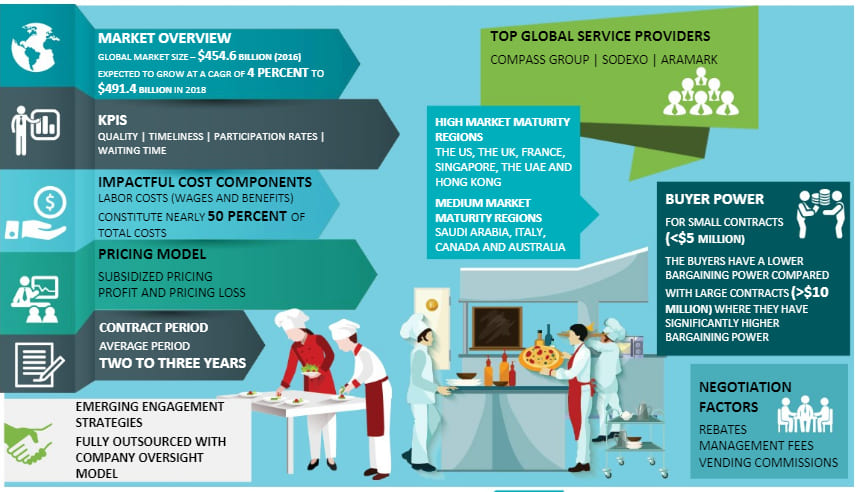

According to Beroe's catering services market forecast, by 2023, the catering services market size is expected to reach $616.24 billion while growing at a constant CAGR of 4.5 percent.

Western European countries, like the U.K., France, and Italy, along with countries such as the U.S., Singapore, the UAE, and Hong Kong, have high market maturity. Countries such as Saudi Arabia, Turkey, Canada, Japan, and Australia are expected to be potential growth markets for catering services by 2020.

From the catering services market reports by Beroe, the demand in the food service industry is mostly driven by large corporate spending. Other market trends include Suppliers are adopting performance-based metrics for evaluation and performance monitoring while improving their supply capability. Increase in outsourcing of commissary and catering services as a result of increasing expansions of global multinationals in APAC and parts of MEA. Global suppliers are focusing on expanding their footprints through mergers and acquisitions with local vendors.

From Beroe's catering services market outlook and analysis reports, here are the factors impacting the market growth - In fast-growing regions like APAC, the market is highly fragmented and the demand from buyers for organized catering. The absence of major suppliers leads to subcontracting services that buyers avoid. In the European market, the growth is expected to slow down due to political and economic unrest owing to BREXIT.

The catering services market faces constraints in its growth due to the following. The growing number of the mobile workforce will negatively affect corporate dining services. There is a low level of awareness among buyers regarding the cost savings, regulatory compliance, and operational efficiency that outsourcing catering services can present.

Catering Services market report transcript

Catering Services Global Industry Outlook

-

The global food service industry was valued at $533.10 billion in 2022, the market is forecasted to grow at the CAGR of 5–7 percent by 2025

-

Western European countries, such as the UK, France, and Italy, along with countries, such as the US, Singapore, the UAE, and Hong Kong, are the regions that have a high market maturity

-

Middle Eastern regions, India, China, Canada, Mexico, Japan, and Australia, are expected to be the potential growth centers for catering services

-

Economic unrest, due to COVID-19 pandemic, has reduced the overall growth rate of catering service across the globe

Catering Services Global Market Maturity

-

Catering services as a standalone specialized outsourced function is gaining traction, especially outside the developed markets

-

About 60–70 percent of the total outsourced catering contracts developed markets are still a part of IFM contracts

-

The end-use industry participation levels are highest for sports/leisure business, followed by B&I, education (including both C&U and K-12), and Healthcare/Seniors

Catering Services Industry Trends

-

Major buyers are looking to go beyond just catering service offerings to employees and create a contactless service delivery models to enhance employee safety through the adoption of technology and social distancing practices

-

Suppliers are also improving their supply capability while adopting performance-based metrics for evaluation and performance monitoring

-

Growing emphasis on adoption of technology to improve the customer experience and reduce time wasted waiting for food

-

Rapid growth of global multinationals in the region has triggered an increase in demand for specialized catering services

-

Global suppliers continue to aggressively increase their footprints in these regions through mergers and acquisitions as well as partnerships with local vendors. For example, Having set-up operation in India by acquisition of two of the largest local suppliers, Elior continues to look at expanding its operations in India through acquisitions

Catering Services Drivers and Constraints

-

In the fastest growing regions like developing countries which have a highly fragmented market for catering services and a very high demand from buyers for organized catering

-

The absence of major suppliers or their direct operational presence across all locations leads to subcontracting services which is avoided by buyers

-

Global impact of COVID-19 pandemic is expected to slow the growth of the service providers

Drivers

Catering as a Talent Attraction and Retention Tool

-

More and more companies are showcasing their dining services as an additional employee benefit, rather than just a meal to attract and retain talent. Having their own customized menus and dining experiences, while still charging employees a subsidized rate for meals is becoming a norm in the competitive market to attract and retain the best talent

Demand for Fresh and Healthy Food

-

There has been a growing demand for fresh and healthy food among corporate buyers, and food service operators have been focusing on offering healthier meals prepared from fresh ingredients at the location’s kitchen and decreasing their reliance on frozen, pre-prepared foods

Food Safety Compliance

-

Due to recent food safety-related incidents, the FDA has produced tighter norms and regulations for controlling the quality and standards of food being served. These, along with the global push for food safety, is driving demand for outsourcing catering services

Constraints

Mobile Workforce

-

Corporate dining services are negatively affected by increasingly mobile workforces. More and more companies are allowing employees to work from home or other off-site locations, and fewer employees on-site reduces the number of customers in employee cafés, making it difficult for employee dining services to be self-sustaining

Awareness Regarding Catering Outsourcing

-

There is also a low level of awareness among buyers in developing markets regarding opportunities presented by outsourcing catering services with respect to cost savings, regulatory compliance, and operational efficiency

Supply Market Outlook

Supply Trends and Insights

Global/Regional Supplier

Supplier Operation Disruptions:

- Increasing cases of supply disruptions owing to suppliers' inability to perform and survive in the market due to factors such as remote working practices, extremely high competition, low margins and high expectations from clients

Increase in M&A:

- Suppliers are enhancing their service capabilities both organically as well as through M&A to create value proposition in large contracts from large buyers

Customized Services:

- With increasing demand from large buyers for customized dining experiences and menus, large global suppliers are continually improving their menus and offerings to match the latest trends in customer tastes and preferences

Tier 2/Local Supplier

-

Self-performing Capability: Local suppliers typically self-perform the services, which will eventually reduce the troubleshooting escalation matrix for the buyer

-

Innovative Service Offering: Suppliers are producing new contract models and service options for the buyers to negate competition with large global suppliers

-

Sustainability Solutions: Local suppliers are aware of the business environment at the location and, hence, can have a sustainable sourcing channel incorporated to have limited impact on the client

Engagement Trends

-

Most Adopted Model Globally: Bundled sourcing strategy with other soft FM services

-

Why: To achieve volume leverage for cost savings

-

Contract Length: Contract renewals can be considered for short term (6 to 12 months), due to market volatility and lower participation rates. However, after the market stabilizes, adopt a long term (2 to 3 years) contract can be opted

-

Pricing Strategy: P&L is by far the most widely adopted model for large contracts in developed nations; however, subsidized contracts and cost plus and fixed price models are also equally significant in cases of smaller contracts and in developing regions

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now