CATEGORY

Cash-in-Transit Service Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cash-in-Transit Service Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

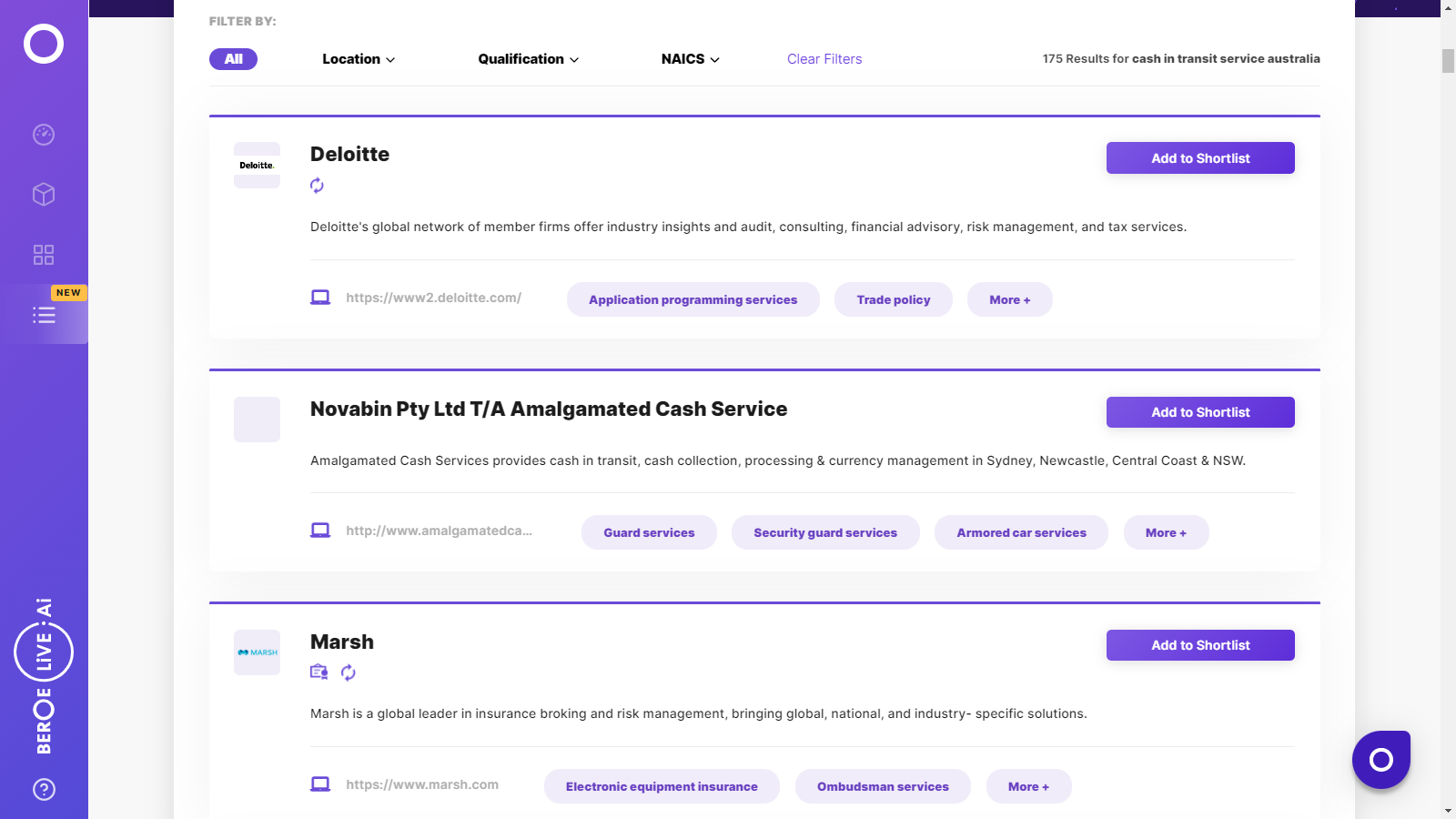

Cash-in-Transit Service Australia Suppliers

Find the right-fit cash-in-transit service australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Cash-in-Transit Service Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCash-in-Transit Service Australia market report transcript

Regional Market Outlook on Cash-in-Transit Service

-

Market size (2022) - $5.54 billion

-

Locations with high maturity - Japan, Singapore, Australia, and New Zealand

-

Maturity of Service Providers - Scattered presence of global service providers and regional service providers. Local service providers are very high in this region.

-

Maturity of Buyers - Outsourcing by modern retail and large corporate houses is increasing, as they realize potential cost savings and compliance with regulations. Owing to the presence of emerging nations in the region, maturity is expected to increase.

Market Dynamics and Trends

Consolidation of suppliers

- A shift in consolidation of suppliers has been witnessed in the last few years in Australia. A major reason being the increase in pressure on cost of staff, fuel and other elements are not reducing for the suppliers, making the profitability low

Growth in cash management services

- Cash management consists of verifying, reconciling, processing, forecasting, storing, and total management of customer cash and coin in a seamless and transparent manner for the customer

- Processing and managing currency has grown tremendously with the service providers dedicating state-of-the art facilities for currency processing and management

Retail cash automation

- Cash dispensers, smart-safes, and recyclers have been at the forefront when it comes to automating the cash handling process

- By providing the capability to accept, authenticate, sort, count, and in some cases dispense cash, these devices automate the back-office cash handling and provide significant labor savings to the merchant or bank using them

Growth in electronic payments

- The proliferation of payment options other than cash, including credit cards, debit cards, stored-value cards, mobile payments and on-line purchase activity, has resulted in a reduced volumes for the cash in transit companies

Growth in “Soft skin” CIT operations

- Historically, the CIT work had been completed by armored trucks but increasingly soft skin operators have commenced completing larger amounts of work in the sector. “Soft skin” CIT operations have a single guard who does not wear a uniform, an unmarked, unarmored vehicle with limited security features

Industry Drivers and Constraints

Drivers

Integrated/Bundled solutions

- The clients are leaning towards integrated solutions which can cover both cash management services and armored car services

Increase in ATMs

- ATM management has been a major driver of armored car services and cash management

- Installations of ATMs is forecasted to grow at a CAGR of 6.3% until 2019 in North America, which will continue to drive demand for armored car services

Increase in crime rate

- Increase in crime rate has driven the outsourcing of cash handling to specialist service providers, thus reducing the risk for customers

Laws and regulations

- Complying with laws and regulations related to Cash-In-Transit (CIT) has driven the outsourcing of these services to specialist service providers

Constraints

Rise in insurance premiums

- Increasing crime and theft rates calls for rise in insurance premiums

- Increase in pension liability

Pricing pressure

- Significant competition and pricing pressures in most markets

Decreased use of cash

- Decreased use of cash in developed markets

- Closure of numerous local bank offices has reduced access to cash

Porter's Five Forces Analysis – Australia

Supplier Power

- The cash-in-transit market in Australia is a duopoly and hence the supplier power is high

- The CIT industry is both a labor intensive and capital intensive industry, where established players like Armaguard and Prosegur dominate the market due to their service capabilities

Barriers to New Entrants

- High supplier consolidation becomes a threat for the prospective vendors in terms of creating a market space for themselves

Intensity of Rivalry

- The rivalry among competitors is pretty low as there are only a handful of suppliers who can provide integrated cash management solutions and they have a reasonable market share for themselves

Threat of Substitutes

- Large buyers can leverage volume of contract as a bargaining power, in an otherwise supplier dominated market

- Large buyers make an attractive client for any supplier in terms of contract volume, thereby gain better negotiating power

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now