CATEGORY

Integrated Facilities Management

The report covers the global market dynamics for IFM services along with detailed global and regional supplier list in addition to aspects such as commercial models, analysis of sourcing strategies, cost saving avenues etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Integrated Facilities Management.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Labor Shortage Threatens FM Services

January 17, 2023ISS A/S to expand in Switzerland

November 16, 2022FM Services Continuity Under Threat, Amid Winter Flu and Covid.

November 03, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Integrated Facilities Management

Schedule a DemoIntegrated Facilities Management Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Integrated Facilities Management category is 6.40%

Payment Terms

(in days)

The industry average payment terms in Integrated Facilities Management category for the current quarter is 70.3 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Integrated Facilities Management Suppliers

Find the right-fit integrated facilities management supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Integrated Facilities Management market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIntegrated Facilities Management market frequently asked questions

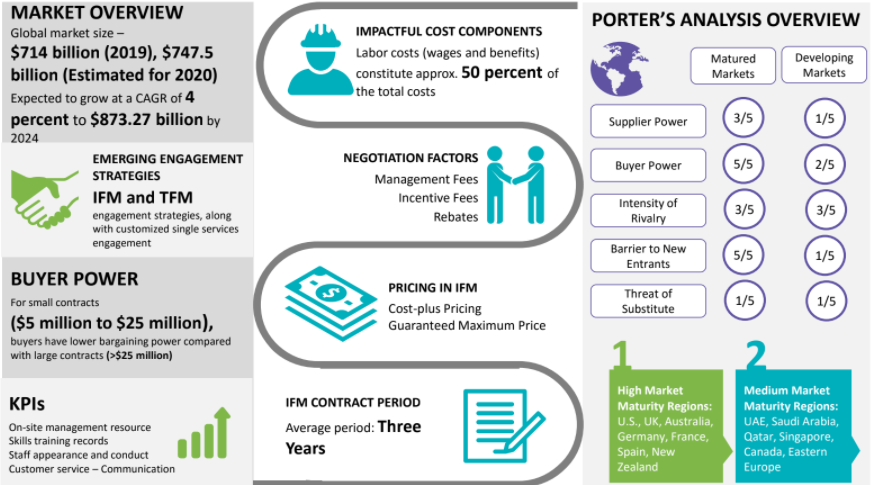

The integrated facilities management market is projected to reach $858.6 billion by 2022. With the improvement in the economic conditions across developing countries, the demand for outsourced IFM services has gone up. However, the advent of the user and occupant experience along with business productivity and integration of cognitive technology poses a certain challenge for the IFM industry

The markets of Western Europe, North America, and some parts of APAC, including Australia, Japan, Hong Kong, and Singapore are witnessing a high growth rate. According to the facilities management market analysis, these high growth market regions adopt large bundled engagement contracts as well as outsource integrated facility management services.APAC and parts of the Middle East and LATAM seem to be promising growth drivers for facilities management services until 2020.

As of 2016, the global IFM marker was valued at $612 billion.

The industry is going through a tough phase due to high competition among suppliers, longer payment terms and financial stress due to hike in input costs. It has also been found that suppliers are having a hard time surviving in the market, leading to disruptions in operations.

The suppliers are improving their supply capability while adopting performance-based metrics for evaluation and performance monitoring. The need to outsource FM services has emerged due to the increasing expansion of global multinationals in the APAC and parts of MEA regions. Global suppliers like Sodexo and ISS since 2010 have carried out mergers and acquisitions to increase their market presence in these regions.

Integrated Facilities Management market report transcript

Integrated Facilities Management Market Size and Global Outlook

The impact on FM will likely be indirect, as the effects of the conflict feed through into commodity prices, inflation, and ultimately perhaps economic growth. The main impact will likely be through higher energy prices, which add to the inflationary forces already being felt across most European economies and now visible at a global level.

-

The North American FM market in 2022 grew moderately with high demand for services, like security, cleaning and catering services, hard service, which were impacted, due to component shortage half the year in 2022, but 2023 seems positive

-

Europe is still facing the energy crisis, which seems to settle down by H1 2023, but in 2022, the region’s growth was impacted, due to the Russia–Ukraine war

-

Other regions, including APAC and MEA FM markets, will also grow, due to increasing demand and buyer’s maturity in 2023, though in 2022 slow growth was observed

Integrated Facilities Management Global Market Maturity

-

IFM penetration is still low outside Western Europe and North America

-

IFM contracts form about 25-30 percent of all FM outsourcing contracts in developed markets

-

APAC and LATAM are witnessing increasing IFM adoption because large scale construction and efforts of large global buyers to consolidate supply

Integrated Facilities Management Industry Trends

-

Suppliers are building best practices, which includes social distancing practices, technology adoption to limit human touch etc.

-

Buyer has the largest bargaining power for small/medium FM service providers

-

Suppliers are maintaining minimum essential workforce at client sites, by providing incentives and other benefits like food and accommodation

Integrated Facilities Management Drivers and Constraints

-

Political and economic unrest in Europe, owing to BREXIT and other factors, are expected to slow the growth of service in Europe

Drivers

Improving economies and growth of industries

-

With the improvement in economic conditions across developing countries and large-scale industrial development, allied industries, such as construction and real estate, have prospered, leading to a higher demand for outsourced FM services

Multigenerational workforce

-

Large multinationals today have multiple generations of employees working together and each have their own set of values and priorities. This is driving the demand for workspace strategies that can bridge the gap and foster collaboration, and FM has a major role to play in this, as it directly impacts the employees’ perception of the workplace and work environment

Operational benefits

-

Large buyers have a very complex portfolio of property, including office space, warehouses, manufacturing units, etc., which lead to issues related to managing and standardization of services

-

Outsourcing to a single FM supplier would allow buyers to standardize the level of services across various locations. Productivity and efficiency could be enhanced through the introduction of various KPIs and compliance clauses in the contract

Constraints

Subcontracting practices

-

Subcontracting, a common practice in the FM industry, indirectly affects the buyer, since subcontractors charge a margin to the service provider, which is eventually passed onto the buyer. This margin-on-margin increases the spend of the buyer, which is essentially a trade-off for exploiting local synergies at a tactical level

Awareness of FM outsourcing

-

There is also a low level of awareness among buyers in developing markets about the opportunities presented by outsourcing FM services with respect to cost savings and operational efficiencies

Why You Should Buy This Report

- The report includes a thorough facilities management market analysis and gives information about emerging and developed markets.

- It details the current trends and growth potential of regional markets.

- The report lists out key facility management suppliers regionally and globally.

- It contains a full SWOT analysis of ISS, CBRE, Sodexo, etc.

- It explains the cost structure, pricing and the best procurement practices of the facility management industry.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now