CATEGORY

Integrated Facilities Management Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Integrated Facilities Management Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

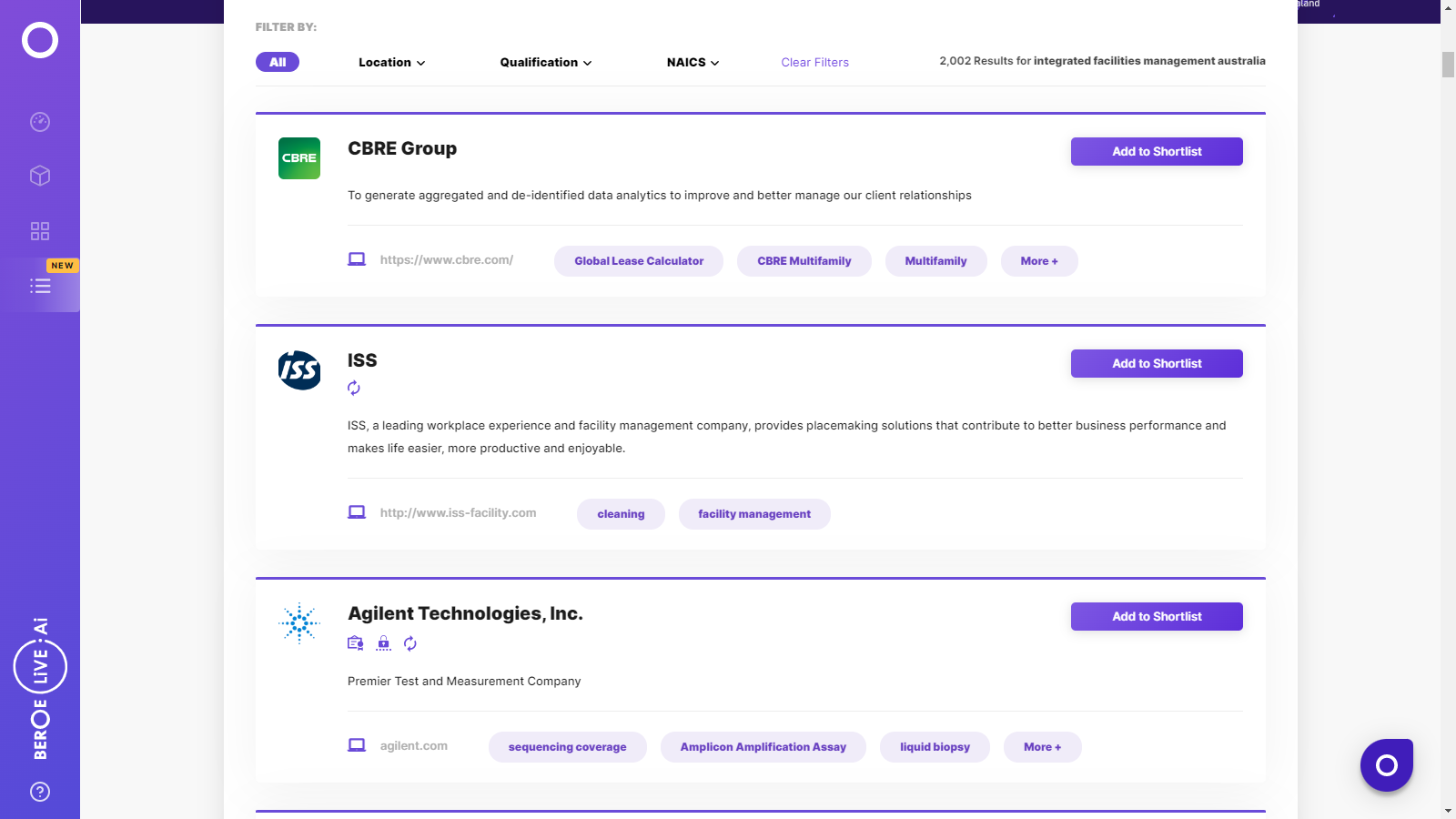

Integrated Facilities Management Australia Suppliers

Find the right-fit integrated facilities management australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Integrated Facilities Management Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIntegrated Facilities Management Australia market report transcript

Regional Market Outlook on Integrated Facilities Management

Trends (current/future) and characteristics of facilities management services

Market Consolidation

- High level of regional consolidation is seen and within the next few years, we can expect a handful of national level service providers who will be able to extensively cover across the country

- Apart from this, some section of the suppliers will continue to build industry related capabilities. This is especially growing for the retail and restaurant industry

Support through qualification

- Various means of accreditation for expertise in Facilities management is being popularized in Australia

- Several courses from the certificate level to the degree level are available

- This will lead to FM being a more organized and well managed sector in the coming years, while also making it more operationally efficient

Early adopters of technology

- Usage of RFID tags to track the consumables used for day to day engineering maintenance is prospective trends FM players can embrace. This can lead to savings of as much as 10 percent

- Usage of BIM and IWMS technology, adopting usage of shared services will all be embraced to a larger extent by the FM industry in the coming years

Growth Drivers of Facilities Management Services

Real Estate

- After the negative growth rate during the economic downturn, the construction industry has been slowly gaining momentum and commercial construction is averaging at about 6-7 percent

- Along with growth of support buildings like data centers and warehouses will continue to aid FM demand

Buyer Industries

- The growth of key buyer industries has resulted in them using more square footage of working space with top notch amenities

- Increased activity in the financial space and increase in footfalls in retail banking locations will also be a major driver for FM services

Environmental Concerns

- Energy consumption by HVAC systems accounts for 32 percent of the energy consumed by buildings

- Thus, energy conservation efforts by all commercial buildings encourage regular maintenance and investment of these systems. This will be a key driver of growth

End-user Driven Demand

- High level of demand from the end-users with respect to quality of facilities and work space will be a key driver for growth of FM outsourcing, especially in the technology space

Porter's Five Forces Analysis: Australia

- Large buyers have strong power because of the large consolidated business volumes

- Suppliers are trying to improve their supply capabilities to offer a holistic service portfolio and thereby gain some negotiation power

Supplier Power

- Owing to the emergence of a global integrated business model, service providers are likely to enjoy significant leverage. However, supplier power will be constrained with the advent of open-book pricing

- Buyers can strictly monitor pass-through costs to ensure no mark-ups and deny payment of profits to service providers in the case of the non-compliance of KPIs

Barriers to New Entrants

- On adopting a global integrated business model, service providers should have significant capabilities in terms of service offerings and geographical spread

Intensity of Rivalry

- Owing to the complexity of the outsourcing category and the volume of business involved, there will be considerable competition between major service providers

Threat of Substitutes

- Threat of substitution will be very low as in-house manufacturing or partial outsourcing will not prove to be cost-efficient for buyers

Buyer Power

- With the advent of complex, integrated outsourcing categories, buyers' power will increase because of the volume of business outsourced

- Open-book pricing will also increase buyers' power, as they can decide on the subcontractors involved and make profit payments conditional on the compliance of KPIs

Australian Integrated Facilities Management Market Overview

-

IFM/TFM strategies are increasingly adopted across Australia market

-

Most local service providers self-perform services, whereas property management firms subcontract FM services

-

The FM outsourcing levels are as high as 70 per cent in Government and is catching up in other industries as well

-

Increasing energy costs have forced buyers to look into FM services for optimizing their energy utilization and smart buildings and technology are enabling a reduction in associated costs while improving service efficiency

-

Owing to increasing environmental regulations, the prominence of sustainability will rise in the near future. Green Sourcing and LEED certification play a significant driver in Australia and New Zealand region

-

Variation in KPIs is increasing significantly and this is going to trigger the shift

-

Extensive outsourcing - Increasing number of buyers are adopting options to outsource FM services, so as to focus on core activities and leverage the expertise and experience of external service providers

-

The approach is believed to create value to the maintenance by leveraging the best expertise in FM services, based on the supplier’s experience of handling other large clients and various troubleshooting activities

-

Focus on predictive and reliability-based maintenance - MRO services market is moving towards improved plant reliability through precision skills, which is bringing a significant change in attitude and thinking at all levels in the maintenance organization

-

Additionally, the MRO organization invests significantly to add value through good engineering and maintenance experience, the staff’s accumulated plant knowledge, proven technologies, systems and services.

Why You Should Buy This Report

-

Information on the Australian integrated facilities management market size, overview, key trends, market trends, etc.

-

Porter’s five forces analysis of the Australian integrated facilities management industry

-

Sourcing models, bundling services, engagement models, etc.

-

Cost structure, KPIs, etc.

-

Supplier analysis, shortlisting criteria, profiles and SWOT analysis of key players like ISS, CBRE, SODEXO, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now