CATEGORY

Palladium

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Palladium.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoPalladium Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPalladium Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Palladium category is 6.44%

Payment Terms

(in days)

The industry average payment terms in Palladium category for the current quarter is 64.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

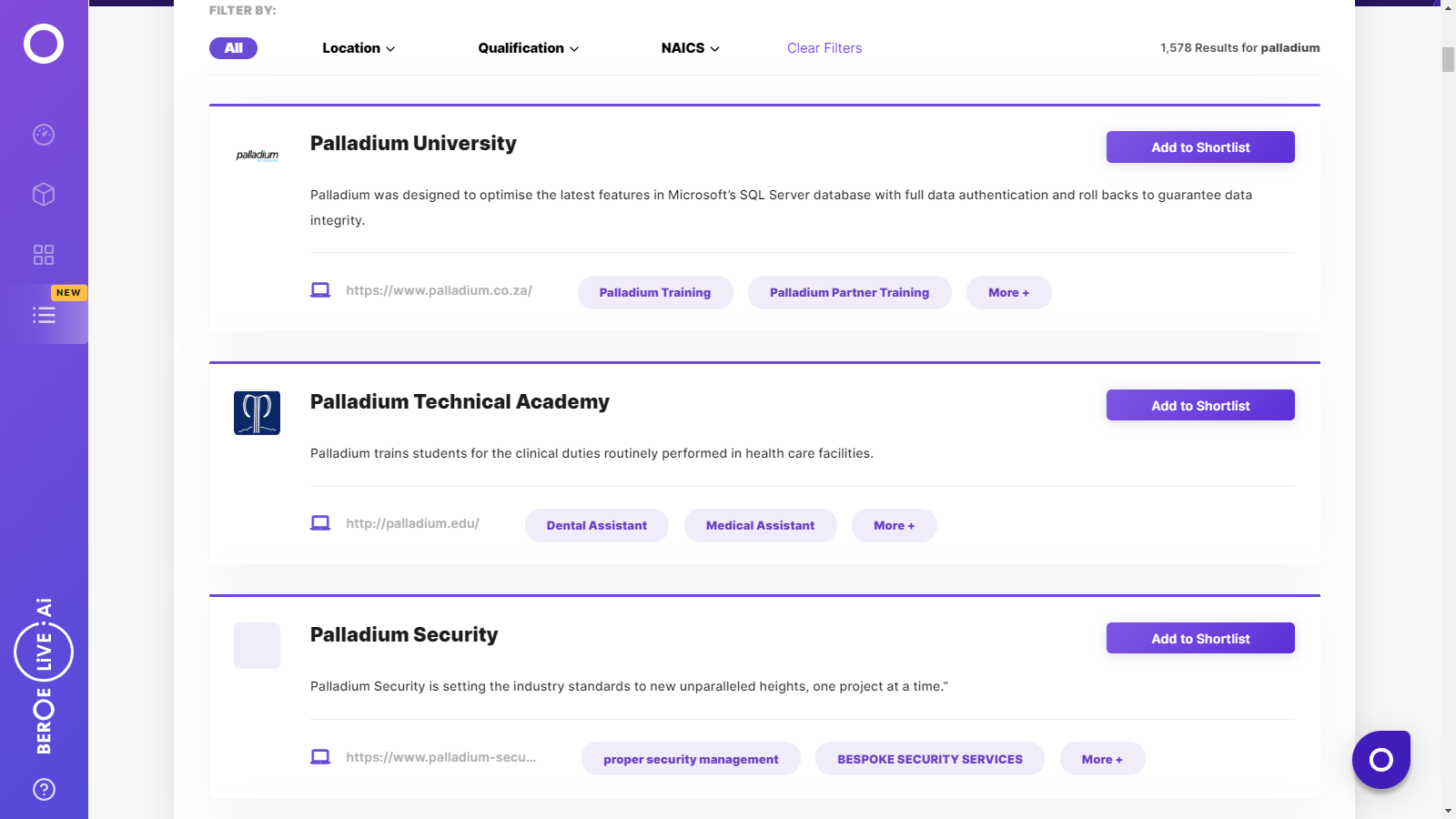

Palladium Suppliers

Find the right-fit palladium supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Palladium market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPalladium market report transcript

Palladium Global Market Outlook

-

The global demand for palladium is expected to grow at approx. 6–8 percent CAGR through 2020–2023

-

The automotive and chemical sectors shall be the major growth drivers

-

In 2020, Russia is expected to have accounted for the largest share of the world’s palladium production, holding nearly 44 percent of the global market share, followed by South Africa accounting for 29 percent of global production

Impact of COVID-19 on Palladium Industry

-

Engaging in short-term contracts/partnerships with sourcing destinations, which are affected to a lesser degree, will help to alleviate a certain degree of uncertainty in the market.

-

Suspension of operations in South Africa, due to COVID-19-led lockdowns, coupled with a slow ramp up of production, due to stringent safety measures, along with labor shortages, had led to loss of production between 10 percent and 40 percent in most of the mines in South Africa during the first nine months in 2020

-

Russia and North America reported a marginal pandemic-related impact on the production in 2020

-

The auto-catalyst segment, which was the most affected, continues to be affected due to semiconductor shortage. Production levels also declined, owing to shutdowns, production cuts, etc.

Global Palladium Market: Drivers and Constraints

Industry Drivers

-

End Use Market: Increase in automotive output, especially gasoline vehicle, with more palladium loading, as countries across tighten emissions. Demand from the chemical industry shall witness robust growth, where palladium catalysts are used in bulk chemical process, like MEG and purified terephthalic acid (pTA) hydrogen peroxide (with large capacity additions in China) productions.

-

High Prices: Current multi-year high prices are expected to incentivise supplier to maintain supply level stable and destock to benefit from high prices. The worlds largest palladium producer, Nornickel, has even announced contest for scientist to find new ways to use palladium.

Constraints

-

EV: Growth in EV shall dent the demand for palladium, as no catalyst is required in EVs.

-

Substitutions: In the electronics sector, nickel has widely replaced palladium used in electronic pastes in capacitor with palladium now being only used in niche application. Current high prices of palladium is also making automakers to look to some platinum based formulations to be used as catalysts.

-

High Operation Costs & Over-reliance: Environmental concerns (high waste & tailings), high production costs are also a major constraints to development of new projects. The over reliance on South Africa & Russia for production exposes supply chain to disruptions.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now