CATEGORY

Cobalt

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cobalt.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCobalt Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCobalt Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Cobalt category is 6.44%

Payment Terms

(in days)

The industry average payment terms in Cobalt category for the current quarter is 64.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

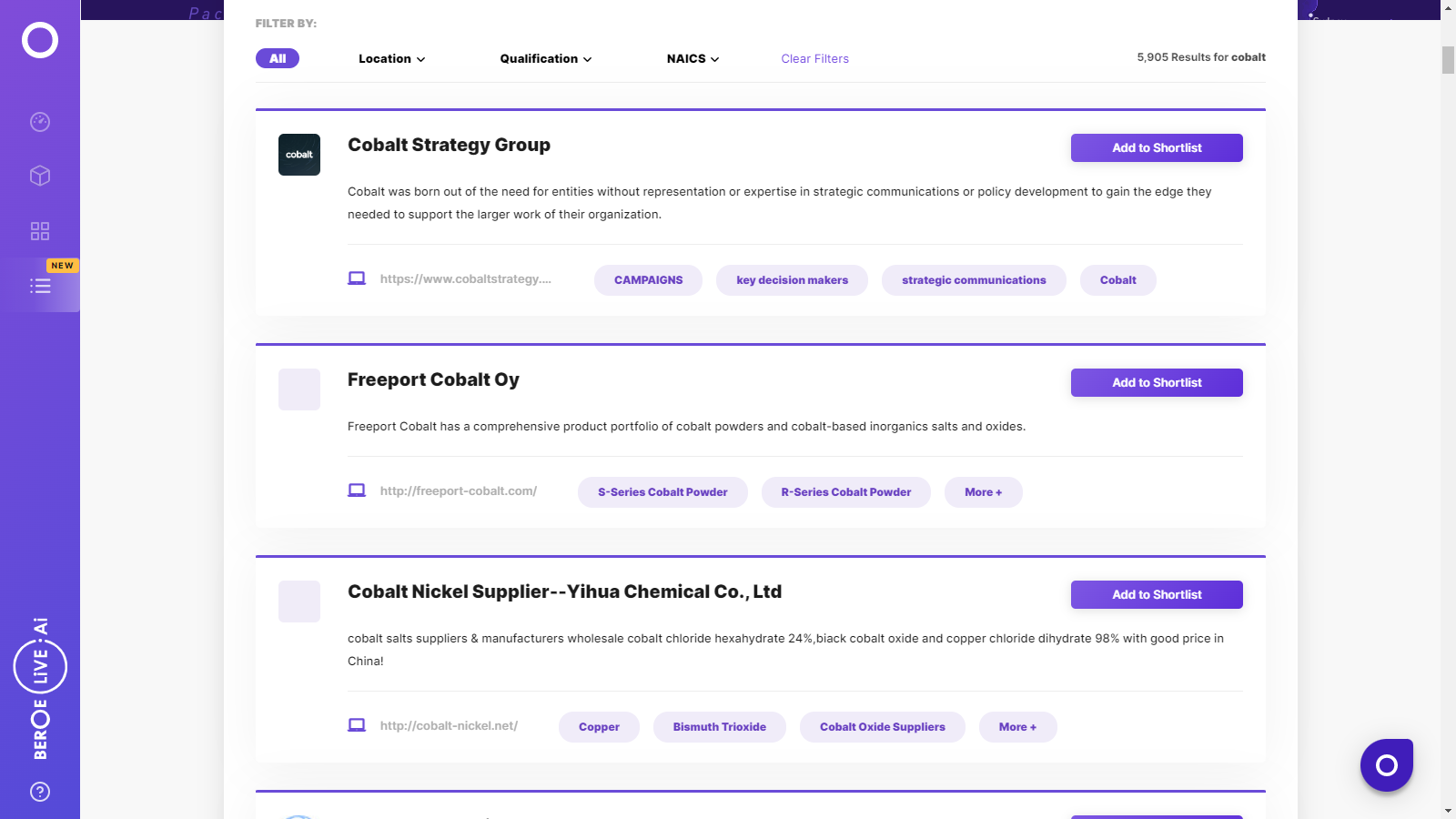

Cobalt Suppliers

Find the right-fit cobalt supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Cobalt Market Intelligence

global market outlook

- The global Consumer Events market is estimated to be 750 billion USD in 2022. Market size in North America is the highest at $260 Billion, followed by Europe with a market size of $180 Billion. APAC is estimated to have a market size of 155 Billion.

- Global players in the Consumer Events industry includes Jack Morton Worldwide, George P Johnson, MKTG, Momentum WW, Mosaic.

According to industry experts, the global demand is expected to grow at around 9% CAGR (2021-2026F). - The top three industries that contribute to the Consumer Events market are FMCG, Retail, and FBT.

- Consumer event companies have begun to employ new technologies, such as AR to aid consumers in better connecting with brands throughout the event's many stages. Data collecting increased during events because of online registration and smartphone technology.

Use the Cobalt market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCobalt market report transcript

Cobalt Global Market Outlook

-

The Democratic Republic of Congo (DRC) continued to dominate the global market share, in terms of mine supply, supplying nearly 70 percent of the mined cobalt

-

Cobalt mine and refined production is estimated to have decreased in 2020, due to the impact of the COVID-19 pandemic

Impact of COVID-19 on Cobalt Industry

-

Mine production of the metal witnessed a slump in 2020, owing to the restrictions due to COVID-19 pandemic, and the prices witnessed a downtrend in 2020, as compared to 2019.

-

Positive demand outlook for the metal is likely during Q4 2021 and beyond, supported by robustly rising demand from the electric vehicles sector

-

The spread of the new COVID variant, Omicron, in South Africa, has sparked concerns over cobalt supply , as South Africa remains the largest transit point for cobalt transportation in Africa

-

Slack demand from the downstream industries, due to the outbreak of the COVID-19 pandemic, weighed on the cobalt market through 2020. However, recovery in market demand and prices can be well expected in 2021.

Global Cobalt Market: Drivers and Constraints

Rapidly rising demand, particularly from the electric vehicles sector, will continue to remain as the most significant growth driver of the cobalt metal.

Industry Drivers

-

Lithium Ion Batteries – Growth in NEV sales

-

Firm demand from portable electronics, amid roll out of 5G technology

-

Recovery in the aerospace sector to the pre-pandemic levels

Constraints

-

Uncertainty in the demand for the metal due to the impact of COVID-19

-

Logistics disruptions in Africa, affecting the global supply of the material

-

Volatility in Copper and Nickel market

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now