CATEGORY

Lithium

Lithium is a soft silver-white element of the alkali metal group that is the lightest metal known and that is used especially in alloys and glass, in chemical synthesis, and in storage batteries

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Lithium.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoLithium Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoLithium Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Lithium category is 6.44%

Payment Terms

(in days)

The industry average payment terms in Lithium category for the current quarter is 64.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Lithium Suppliers

Find the right-fit lithium supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Lithium market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLithium market frequently asked questions

During the 2017-18 forecast, the global LCE supply was in deficit. Post that, new capacity additions were expected to contribute to the market supply and ease the situation. Market conditions will still remain tight for the supply of high-grade lithium derivatives as the inventory holdings will be used to cater to the electromobility market, thus making it less available for other uses like healthcare and ceramics.Looking at the lithium market trends during the 2017-2020 period, lithium brine production will be increasing due to the support from capacity additions by major manufacturers.

As the demand for rechargeable lithium batteries is rising due to the growing market for portable electronics, electric vehicles, grid storage applications, etc., the consumption of lithium has significantly increased in the recent years.

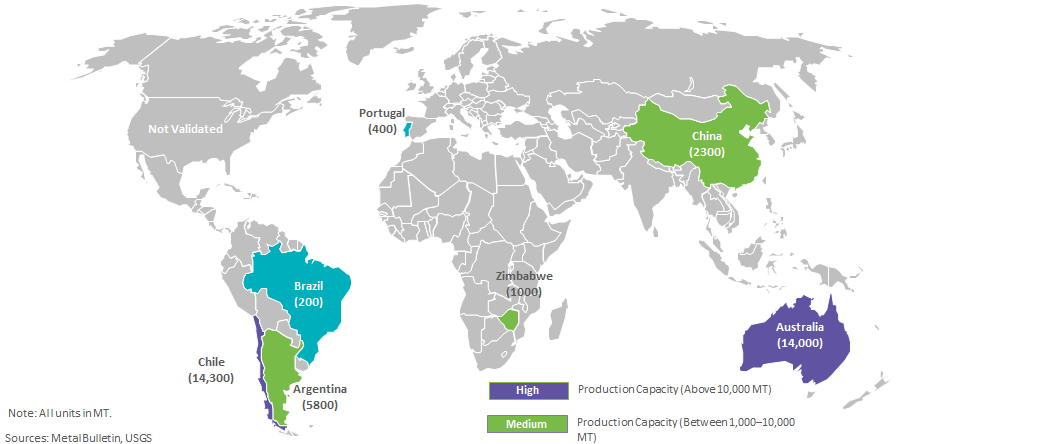

The regions leading in the lithium production capacity are Argentina, Australia, and Chile.

The demand for lithium carbonates has been growing at a CAGR of 8 percent from 2015 to 2020. A significant part of the demand is driven by the rechargeable batteries market. As per Beroe's lithium market update for 2020, the demand share for lithium from electric vehicles will increase from 6 percent to 30 percent which will lead to a rise in the price of the metal.

The factors driving the growth of the global lithium market are ' - Adoption of renewable energy sources (lithium-ion batteries) to avoid fossil fuel and greenhouse gas emissions - Major companies like Tesla, BMW, Nissan encouraging vehicle manufacturers to go electric - Fast-growing population increasingly dependent on smartphones, smartwatches, laptops running on lithium-ion batteries

Lithium market report transcript

Global Market Outlook on Lithium

- Global LCE supply is expected to remain in deficit during 2017–18, post which, capacity additions are expected to add supply into the market and ease the tightened situation

- Supply of battery grade (high grade) lithium derivatives is likely to remain tight, due to anticipated stockpiling/inventory holdings by suppliers to meet the demand from electro mobility market, thereby making it less available for other end uses like heath care, ceramics, etc.

Lithium consumption for batteries has increased significantly in the recent year because rechargeable lithium batteries are used extensively in the growing market for portable electronic devices and increasingly are used in electric tools, electric vehicles, and grid storage applications. Lithium minerals were use directly as ore concentrates in ceramics and glass applications.

- Worldwide lithium production increased by an estimated 13 percent to 43,000 tons in 2017 in response to increased lithium demand for battery applications

- Consumption of lithium in 2017 was projected to be about 41,500 tons, up from 36,700 tons in 2016. Production in Australia increased by approximately 34% as two new Spodumene operations ramped up production of concentrate throughout 2017

- The leading lithium producers in Argentina, Australia, and Chile reported strong sales; however, heavy snowfall limited production at Argentina's new brine operation. Worldwide lithium production capacity was estimated to be 58,000 tons per year in 2016

- Owing to continuing exploration, lithium resources have increased substantially worldwide and total more than 53 million tons. Identified lithium resources in the US, from continental brines, geothermal brines, hectorite, oilfield brines, and pegmatites, have been revised to 6.8 million tons

Global LCE Market Snapshot

- Despite an expectation of a marginal surplus during 2017 (4,000 MT), the global lithium market is expected to remain tight during the year supported by the demand from major end-use industries. Lithium brine production is expected to be in the increasing trend during 2017–2020, supported by capacity additions by major manufacturers

- Demand for the lithium carbonates is expected to grow by a CAGR of 8 percent from 2015 to 2020, primarily driven by the rechargeable batteries market. Demand share for lithium from electric vehicles is expected to increase from 6 percent to 30 percent by 2020, thereby supporting an increase in the price of the metal

- Brines and hard rock ores (pegmatite) are the main sources for commercial Lithium production. There are three main types of brine deposit – continental, geothermal, and oil field with the most common being continental saline desert basins. It constitutes the majority share of Lithium production, as it is easier to explore and the cost of production is cheaper compared to hard rock mining

- Lithium concentration in pegmatite's is much higher than in brines. Thus, deposits with extremely high lithium values may be economically viable in comparison to brine harvesting

Drivers and Constraints

Drivers

- Pollution, due to fossil fuel emissions, kills millions every year, and greenhouse gas emissions are causing rapid climate change. The world is thus increasingly switching to renewable energy sources, which due to their “peaks and troughs” in power production require cheap, efficient energy storage to ensure smooth delivery to the end-user. This requires rechargeable lithium-ion batteries

- For the same reasons, an array of major companies, including Tesla, Apple, Google, and all the largest car manufacturers, including BMW, Nissan & Chevrolet are all betting on the electrification of vehicles, using lithium-ion batteries. Ex- Recent Volkswagen emissions scandal, with more such scandals expected in other automotive companies, will only put more pressure on vehicle manufacturers to go electric

- A fast-growing global middle class is causing an enormous uptake of new smartphones, smart watches and laptops. These require lithium-ion batteries

Constraints

- In the long term, increasing demand for lithium battery compounds are expected to increase the prices of lithium metal in the global market. Supply tightness is expected to prevail, as most of the major battery expansions are due to come into production by 2020

- China's government took some major regulatory steps in 2017 to control the nation's pollution level, which is at record highs. China launched an aggressive campaign to curb the existing pollution levels by mandating production cuts by producers

- The price rise was governed by a slew of factors on the demand, as well as the supply sides. The supply in China became tighter due to strict environmental norms dictated by the Chinese government and closure of all small factories manufacturing from Q1 2017. Growth of Electric Vehicles market is expected to be a major driver for the increasing demand for the lithium metal globally. This, in turn, is anticipated to push the prices of lithium metal further upward

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now