CATEGORY

Lead

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Lead.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoLead Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoLead Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Lead category is 6.44%

Payment Terms

(in days)

The industry average payment terms in Lead category for the current quarter is 64.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

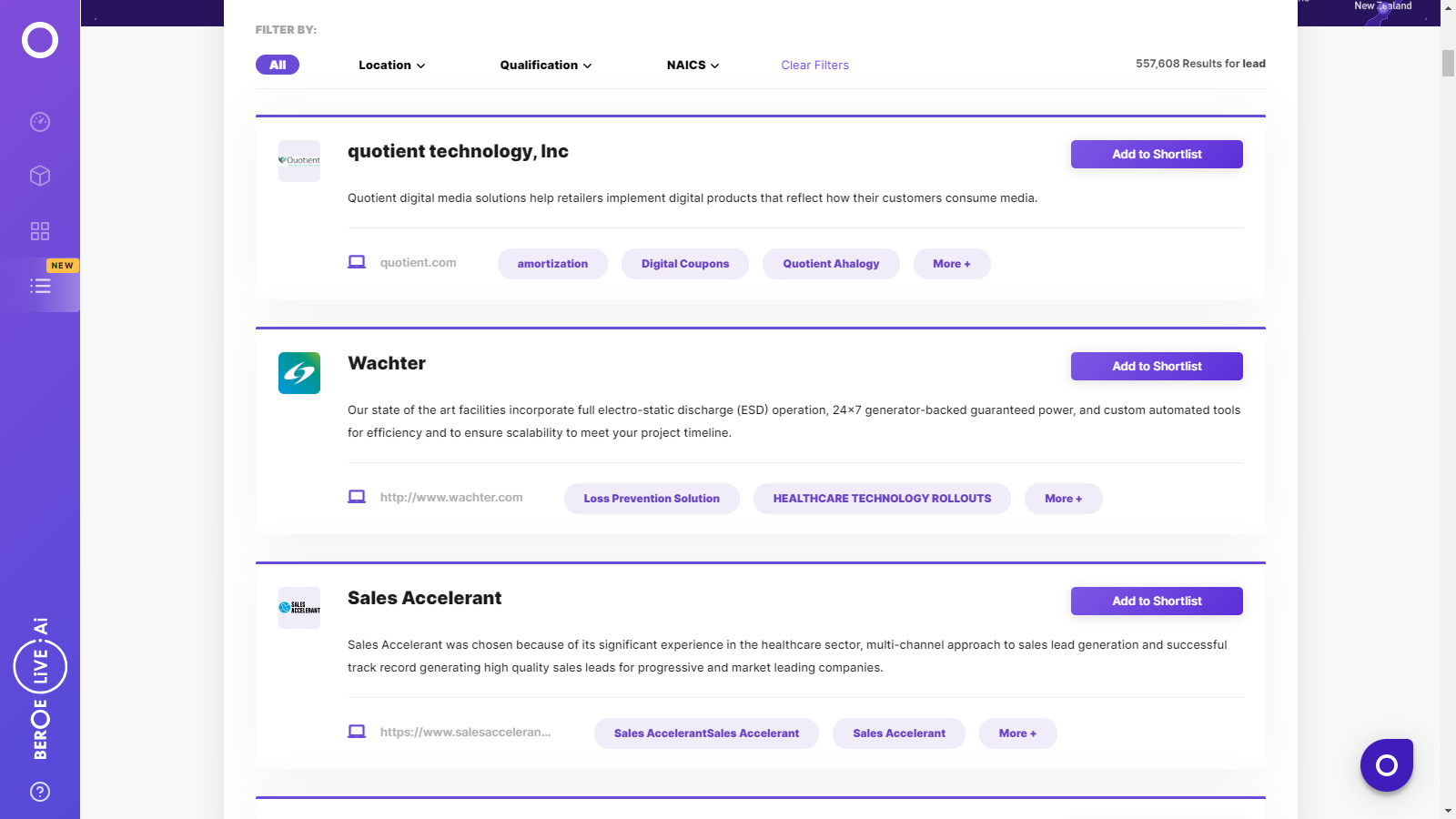

Lead Suppliers

Find the right-fit lead supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Lead market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLead market report transcript

Lead Global Market Outlook

-

Global lead demand increased by 4 percent Y-o-Y in 2021, driven by an increase in demand for energy storage devices in the renewable energy sector and in battery operated equipment like forklifts, etc.

-

Electricity rationing in China has been pushing the demand for electricity storage devices, like inverters and UPSes, may drive the demand for lead acid batteries

Impact of COVID-19 on Lead Industry

-

Resurgence of COVID-19 in the US, Europe, and South Asia, may impact the economic recovery and consumer confidence, impacting lead demand in the short term.

-

Lead smelters in key producing regions, like China, Australia, North America, and Europe, have largely resumed normal operations by the end of Q2 2021. However, regional resurgence of COVID-19, impacted demand for automobiles in Europe and the US

-

Subsequent waves of the pandemic in US, South Asia, and Europe, have disrupted operations in the downstream industries, affecting lead demand

Porter’s Five Forces Analysis on Lead Industry

Supplier Power

-

Supply base regionally concentrated. Over 80 percent of the global refined lead production is concentrated in countries producing over 100 kT of lead per year

-

Top five lead producing companies account for over 40 percent of global lead supply

Barriers to New Entrants

-

Entry barriers, in the recycling segment, is moderately high. Lead recycling is fairly simple process, but capital intensive in nature, due to environmental regulations, inn terms of waste handling and management

-

Lead mining has high entry barriers, as lead is generally obtained as a by product of zinc, copper and silver ore refining process, which is highly capital intensive in nature

Intensity of Rivalry

-

Intensity of rivalry is low to moderate, due to growing demand from energy storage industry

-

Price benchmarks and regional premiums are based on LME trades

Threat of Substitutes

-

In he recent years, there has been increase in substitution of lead in applications, like paints and coatings (due to toxicity issues), as well as in the car batteries segment (with lithium ion emerging as a growing substitute). However, due to its cost effectiveness and high thermal stability, the demand for lead, in battery applications, is still on an uptrend

Buyer Power

-

Largest buyer of lead metal, mainly lead acid battery manufacturers, account for close to 80 percent of the global demand for the material

-

Apart from a few integrated large players, like Exide, Ebat, EnerSys, etc., the market for OEM lead acid batteries is moderately fragmented, especially in Asia

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now