CATEGORY

Gold

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Gold.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoGold Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoGold Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Gold category is 6.44%

Payment Terms

(in days)

The industry average payment terms in Gold category for the current quarter is 64.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

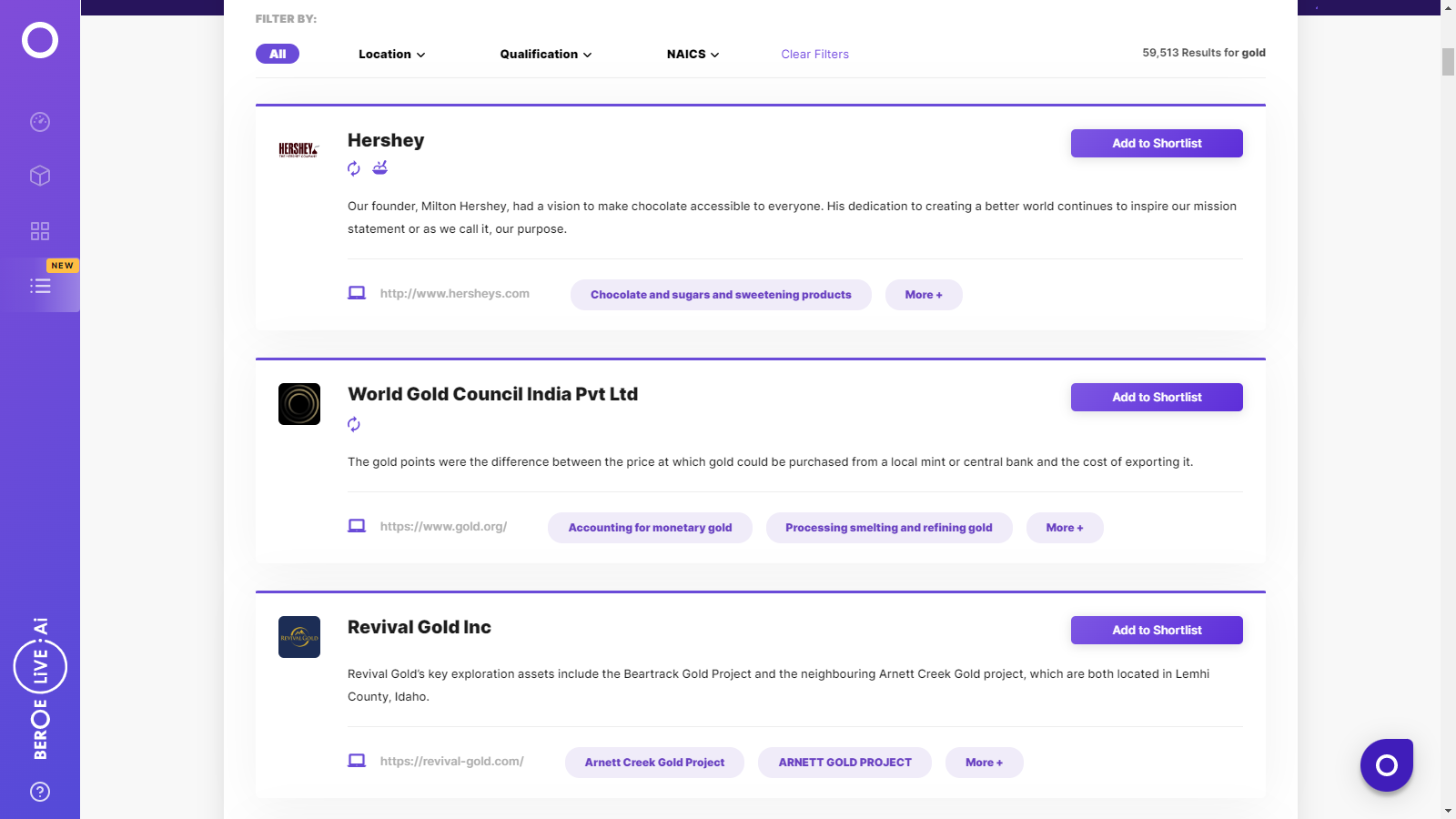

Gold Suppliers

Find the right-fit gold supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Gold market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoGold market report transcript

Gold Global Market Outlook

-

China contribute to about 11 percent of the gold globally followed by Russia and Australia who supplies 9.9 percent and 9.8 percent respectively. China has been the largest gold producing country for many years, however the production volumes have decline steadily over the past few years

-

In 2020 gold accounted for about 52 percent of the total global exploration budget. The spike in gold prices for several months in 2020 drove the financing for projects

Impact of COVID-19 on Gold Industry

-

The global gold supply market was affected due to the pandemic in 2020. The gold supply from mines dropped by 5 percent. Demand for gold as an investment was high during 2020 which led to the price increase in global market, however the demand for gold as jewellery items reduced in 2020.

-

Although China has been a dominant player in the gold mining industry, volume of gold mined from the country has been decreasing over the last few years due to tighter environmental and mining regulations. In terms of volume mined Russia and Australia are closed behind China. Moreover Russia is expected to surpass China as the largest gold producer by 2029. Escalating tensions and trade sanctions with US have incentivized the Russian central bank to increase its gold reserve.

-

The demand for gold will be moderate-high in 2021, as the demand from end user segment like investment and jewelry is expected to increase commodities. The cost of labor is expected to increase in the short-term. Labor shortage and unemployment benefit claims suggest firms’ need to raise wages & salaries which is expected to result in higher wage growth in the medium term supporting demand growth prospect.

Global Gold Market: Drivers and Constraints

Industry Drivers

Economic Recovery:

-

Economic recovery in developed as well as emerging markets could support gold consumption in the form of investments

-

Investors could see the low interest rates on gold as an opportunity to add risk assets like gold onto their portfolio

Improved mine production:

- Gold mining companies have set well defined protocols and guidelines which would lead to reduce the risk of mine closures if subsequent waves of COVID-19 infections impact the producing countries

Constraints

Rise in operating and capital costs:

-

The increase in the prices of commodities like steel ,oil and its derivative products have led to an increase in the operating costs. The operating expenditure could increase by 3-5 percent for the reset of the year due to increase in input materials like steel and grinding media

Mining Regulation:

-

Tighter environment policies and regulations could result in lower volumes from small scale mining companies. For example regulations towards the use of cyanide for gold extraction in China resulted in a drop in volumes of gold mined in the country

Illegal mining:

-

Illegal mining remains one of the main threats to gold market. Globally government has committed to reduce illegally sourced material by introducing a raw material tracing system and granting great powers to raid and prosecute illegal miners, separators, and distributors

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now