CATEGORY

Graphite

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Graphite.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoGraphite Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoGraphite Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Graphite category is 6.44%

Payment Terms

(in days)

The industry average payment terms in Graphite category for the current quarter is 64.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

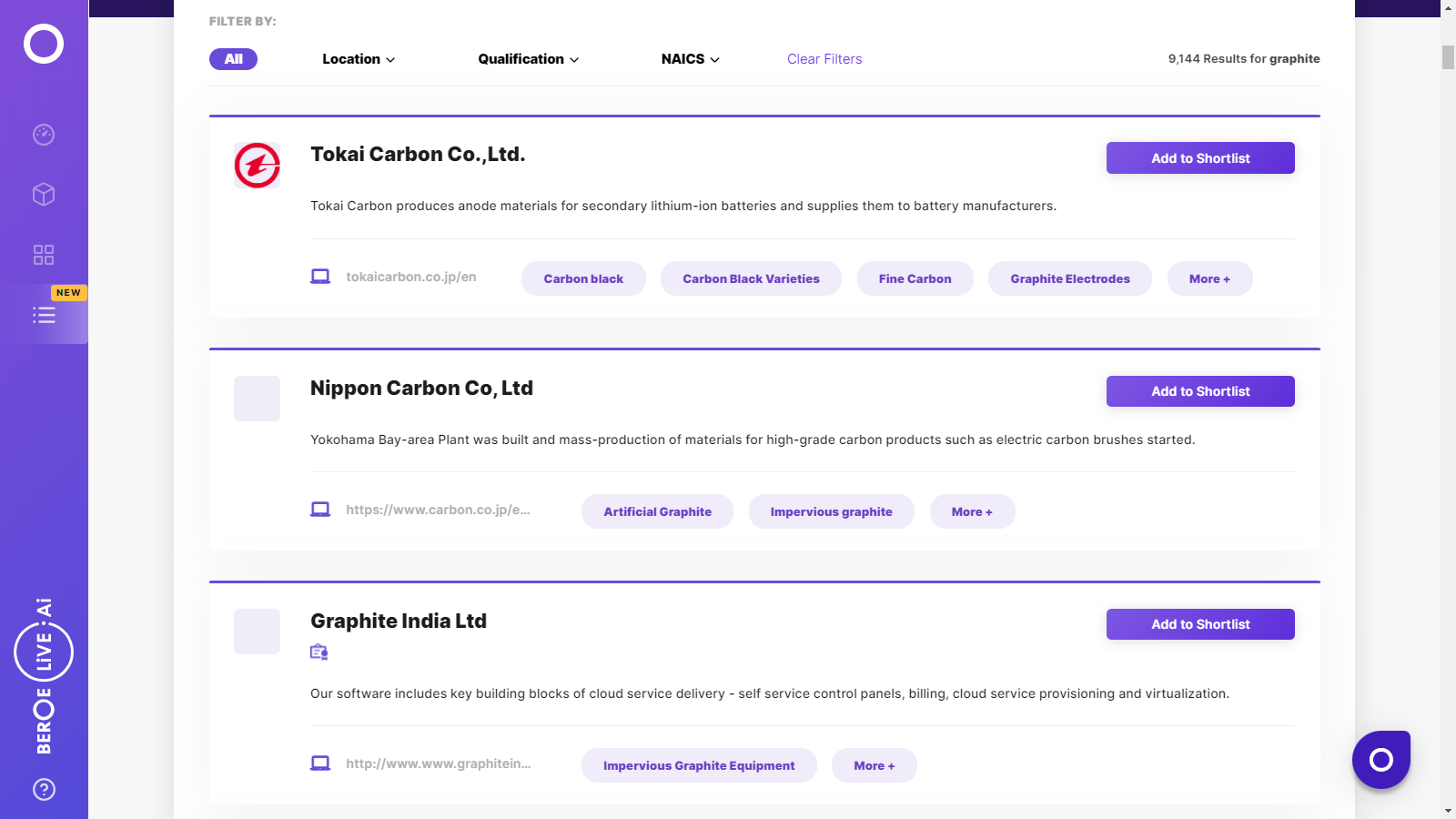

Graphite Suppliers

Find the right-fit graphite supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Graphite market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoGraphite market report transcript

Graphite Global Market Outlook

-

The most dominant player in the natural graphite market is China, producing about 65–70 percent of the global natural graphite. Around 40 percent of the natural graphite produced in China was amorphous, while the rest 60 percent was flake

-

Mozambique was the largest natural graphite mining country by volume outside China. However, the suspension of Balama graphite mines in 2020, due to COVID-19 restrictions and lower EV demand, led to a significant drop in the graphite production in the region

Impact of COVID-19 on Graphite Industry

-

The mining volume of natural graphite fell in 2020 by 7 percent, due to mine closures and COVID restrictions across various regions.

-

China is expected to remain as the dominant player, in terms of supply as well as consumption of graphite. China accounts for about 69 percent of the global natural graphite mine production. About 60 percent of the graphite produced by China was flake, while the rest 40 percent was amorphous

-

The demand for graphite will be moderate–high in 2022, as the demand from the end-user segment, like refractories, battery, and foundry, are expected to increase. The cost of labor is expected to increase in the short term. Labor shortage and unemployment benefit claims suggest firms’ need to raise wages & salaries, which is expected to result in higher wage growth in the medium term, supporting demand growth prospect.

Global Graphite Market: Drivers and Constraints

Industry Drivers

Demand from Steel Industry:

-

The increasing use of electric arc furnaces to produce steel in most parts of the world will boost sales of electrodes, the leading synthetic graphite product. The Chinese government is driving the shift of steel manufacturing through EAF, which has increased the demand of graphite electrode. Moreover, the rising steel demand could also lead to and increase in the demand for refractory materials

Demand from Downstream Markets:

- The rise of advanced products, such as graphene and fuel cells, will boost demand for synthetic graphite

Demand from Battery Segment:

-

Rapid growth in the lithium-ion battery market will result in increased demand for both natural and synthetic graphite

Constraints

Strict Supply of Primary Raw Material: Coke

-

Barrier entries are high, as creating new petroleum needle coke capacity is expensive

-

Since 1980s, no new greenfield capacity, ex-China has been added

Supply Disruption, Due To Environmental Laws in China:

-

Purification process of graphite is impacted, due to implication of strict environmental regulations in China

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now