CATEGORY

Alumina

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Alumina.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoAlumina Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoAlumina Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Alumina category is 6.44%

Payment Terms

(in days)

The industry average payment terms in Alumina category for the current quarter is 64.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

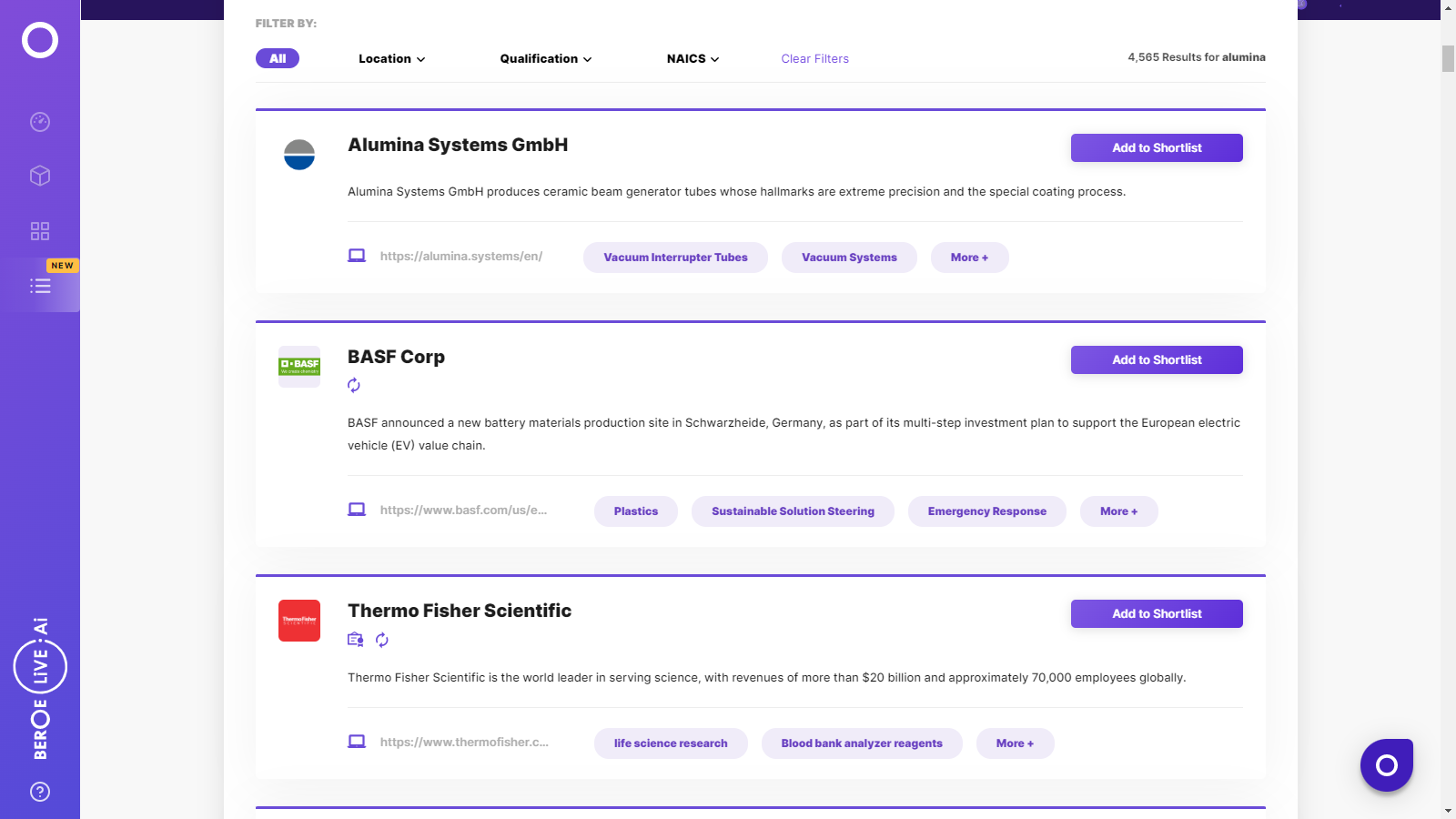

Alumina Suppliers

Find the right-fit alumina supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Alumina market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAlumina market report transcript

Alumina Regional Market Outlook

-

The Asia Pacific region will continue to dominate the market, in terms of growth prospects in the forecasted region, owing to rising demand for metallurgical-grade alumina (aluminum production) and chemical-grade alumina, especially from China, due to high consumption from industries, such as refractories, ceramics, and abrasives

-

Metallurgical-grade alumina primarily used for aluminum production reported the largest market share in 2020, owing to growing consumption in other end users, such as automobile, construction, packaging, and consumer durables

-

In the forecasted period, the alumina market is expected to witness a demand surge, especially for the metallurgical-grade alumina, due to growth of these downstream industries.

Impact of COVID-19 on Alumina Industry

-

Engaging in the short-term contracts/partnerships with sourcing destinations, which started to recover from the impact of the pandemic (China, Brazil, India, Indonesia, Russia, etc.), will help to alleviate a certain degree of uncertainty in the market.

-

Due to heavy rainfall in the Shanxi region, Xinfa Group closed its two operations line in Xiaoyi and Jiaokou with an annual alumina production capacity of 1.2 million tons and 800,000 tons, respectively

-

Alumina refineries (Alumar and Jamalco) that were closed in July 2021, due to fire accidents have recently resumed production

-

Subsequent waves of the pandemic in China, South Asia, and Europe have disrupted operations in the downstream industries, affecting alumina demand

Porter’s Five Forces Analysis on Alumina

Supplier Power

- Major alumina producers, such as Nalco, Hindalco, etc., are fully integrated with their own mines for key raw material, like bauxite, thereby having full control over supply

- Non-integrated and semi-integrated players depend upon the upstream producers for the raw material. Any underlying deficit in the bauxite raw material market, coupled with the relatively consolidated nature bauxite market, makes the supplier power high

- Thus, the non-integrated players constitute to only a small portion of the alumina industry. Hence, the bargaining power of suppliers is low to moderate

Barriers to New Entrants

- The need to control resources, given the deficit in the bauxite market, is expected to increase the barriers to new entrants

- High barrier to entry is also due to a combination of factors, like the requirement of large amount of capital, long gestation period, etc.

- High barriers to new entrants result in low threats for new entrants

Intensity of Rivalry

- Industry rivalry is medium, as handful manufacturers can manufacture certain calcined alumina grades with customized specifications and desired alumina content

- Due to the supply disruptions, COVID-19 pandemic, many small suppliers in China have merged to strengthen their financial as well as expand product portfolio for the long term

Threat of Substitutes

- In case of major end uses of calcined alumina, such as refractories, ceramics, abrasives, flame retardants, etc., only flame retardants are produced in large numbers from other materials

- About 40 percent of the total production of flame retardants is from materials other than calcined alumina. Therefore, the threat of substitutes is low to medium

- In case of brown-fused alumina during COVID-19 pandemic, demand from buyers was replaced by white-fused alumina on the account of low price

Buyer Power

- About 6 percent of the global alumina is reserved for non-metallurgical industrial applications

- In addition, switching from one supplier to another can increase the total procurement cost, especially in case of unprecedented situations, such as the COVID-19 pandemic

- Thus, buyer power for the non-metallurgical alumina sector is low to medium

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now