CATEGORY

Oil & Gas Production Chemicals North America

The oilfield chemicals market is expected to grow at a CAGR of 5% driven by increasing demand for petroleum-based fuel from the transportation industry.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Oil & Gas Production Chemicals North America.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

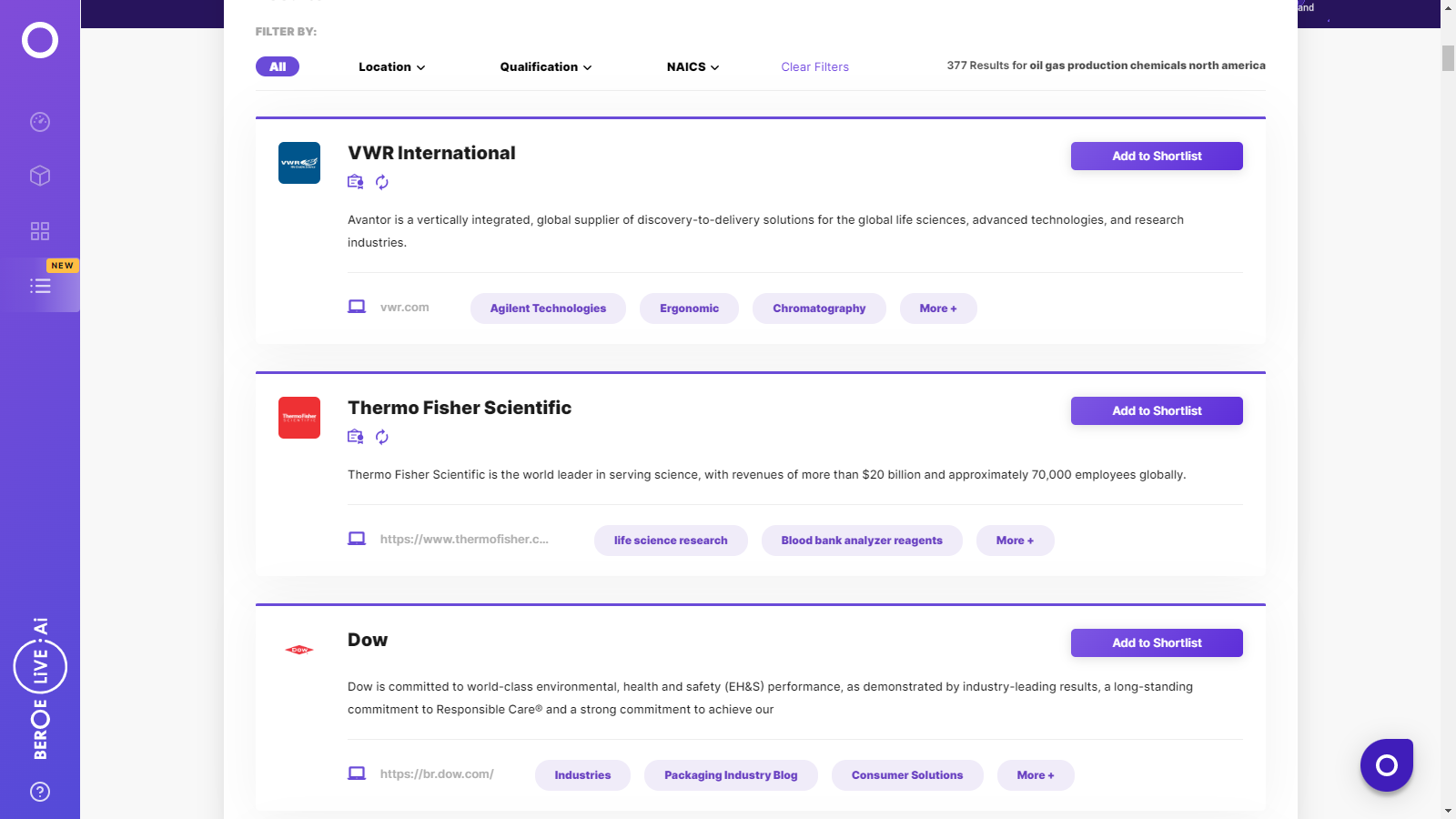

Oil & Gas Production Chemicals North America Suppliers

Find the right-fit oil & gas production chemicals north america supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a DemoCreditsafe Rating

Use the Oil & Gas Production Chemicals North America market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOil & Gas Production Chemicals North America market report transcript

Regional Market Outlook on Oil & Gas Production Chemicals

Corrosion Inhibitors Market Overview

The major price drivers for Corrosion Inhibitors will depend on the demand from the two major downstream applications - the Power generation followed by The Oil & Gas industry. As most corrosion inhibitors are amine/amide based and contain nitrogen groups, prices will also depend on ammonia and nitrogen.

Demand from downstream applications – The need for Power is witnessing a tremendous surge in demand especially in Asian and African countries and is expected to be the largest consumer of corrosion inhibitors till 2022. The oil and gas industry incurs a cost of ~ 1.4 billion USD every year due to corrosion making it the second largest user of corrosion inhibitors.

Growth rate for oilfield corrosion inhibitors – The overall growth rate of corrosion inhibitors market is expected to be around4.5-5%. However, the growth rate for the oil and gas industry is expected to be slightly lower. It depends largely on crude oil prices; as prices are expected to be stable or witness a declining trend after 2019, growth rates could lie in the range of 4-4.5%.

Major oilfield corrosion inhibitors – These include amides/imidazolines, Nitrogen quaternaries, Nitrogen heterocyclics, salts of nitrogeneous molecules with carboxylic acids, Polyoxyalkyated amines.

Types of corrosion inhibitors – There are two types of corrosion inhibitors – water based and oil based. Water based corrosion inhibitors was the largest application type owing to more eco-friendly properties such as lower volatile organic content emissions. They are more economical, turn transparent on drying, can be applied using a variety of methods and can be easily removed using water based cleaners as compared to the traditional oil based ones.

H2S Scavengers Market Overview

H2S Scavengers are a type of corrosion inhibitor with the major demand and price driver being the Oil & Gas industry. Ethanolamines are the most common type of H2S scavengers used and also play a role in driving prices.

- Growth rates - H2S Scavengers are a type of corrosion inhibitor/scavenger which is used to treat sour corrosion which is the process of removing the highly toxic and pungent H2S gas. The process of removing H2S gas is called gas sweetening. Regenerative scavengers are preferred over the non-regenerative ones. Growth rates are expected to lie in the range of 2.5-3%.

- Regenerative scavengers - Among the regenerative scavengers, amine based solutions are commonly used. Most modern gas sweetening processes are MDEA-based as they typically absorb only H2S gas. MEA, DEA and DGA absorb other gases such as CO2 apart from H2S.

- Non-regenerative scavengers -Triazine scavengers are the most common type of non-regenerative scavenger used.

- Downstream applications - H2S scavengers are predominantly used during Oil and Gas production processes as well as for Waste water treatment purposes. It is used for the removal of H2S gas from gas streams, sour hydrocarbon liquids, sour liquid vapor tank spaces, etc.

- Price drivers – The major price drivers will be ethanolamine prices (as it is the most common H2S scavenger used) which are in turn dependent on ethylene and ammonia prices. Prices are also driven by the demand from crude oil and natural gas production.

Biocides Market Overview

Oil & Gas application is not the major downstream application of biocides. The major price drivers are the Water treatment and Paints & Coatings industry.

- The global oilfield biocides market is expected to grow at a CAGR of 4% while the biocides market is projected to grow at 5%.

- The major oilfield biocides by type include Glutaraldehyde, Chlorine, Tetrakis(hydroxymethyl)phosphonium sulfate (THPS), Quaternary ammonium, Peracetic acid and 2,2-dibromo-3-nitrilopropionamide (DBNPA).

- Major trends in the market – Combined use of biocides with microbiocides for better microbial control solutions. For eg: Microbiocides such as Tris (hydroxymethyl) nitromethane (THNP) that control the growth and proliferation of common oilfield bacteria are paired with biocides such as Glutaraldehyde. THNP is used to control the spread of acid producing and sulfate reducing bacteria.

- Increasing use of CIO2 as a biocide due to rapid development of hydraulic fracturing and unconventional shale gas extraction

- Major driver – Increasing problems associated with microbiological growth in the oilfield industries.

- Major constraint – Known to be ecotoxic, allergic and carcinogenic to humans. It can disrupt the endocrine system in humans.

- Price Drivers – Demand from water treatment , Paints & Coatings industry along with feedstock prices.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.