CATEGORY

Benzene, Toluene and Xylene (Aromatics)

Aromatics chain (Benzene, Toluene and Xylene) is produced during naphtha cracking and is used as a strong solvent in key products that go into automobile, construction, soaps & detergents and packaging segments. Given that there are no substitutes for aromatics in its key enduse segments, changing feedstock dynamics that has reduced the availability of aromaticsin the Western markets is a key issue that the industry is facing.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Benzene, Toluene and Xylene (Aromatics).

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Benzene, Toluene and Xylene (Aromatics) Suppliers

Find the right-fit benzene, toluene and xylene (aromatics) supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a DemoCreditsafe Rating

Use the Benzene, Toluene and Xylene (Aromatics) market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBenzene, Toluene and Xylene (Aromatics) market frequently asked questions

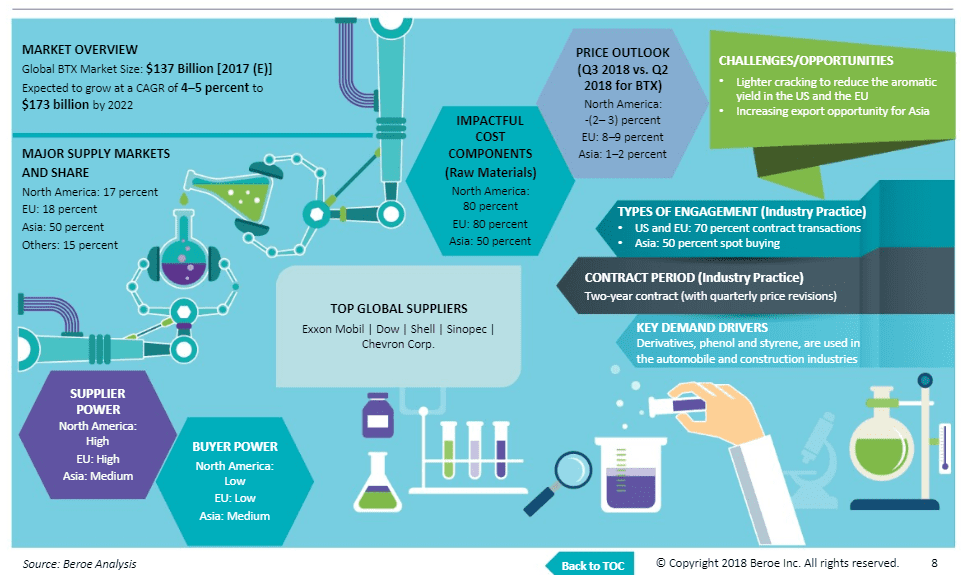

The aromatics market is expected to reach a size of $173 billion by 2022.

The major players in the xylene market are North America (17%), EU (18%), Asia (50%), and other countries (15%).

The benzene demand is expected to see a rise till 2022. A major part of the demand is expected to come from Asia because of a rise in automobile and construction activities. The change of feedstock in western markets is causing lesser yield of benzene and which is leading to lesser output of aromatics in the US and the EU.

The xylene market is expected to grow at a CAGR of 4-5% between the period by 2022.

Some of the key demand drivers for the aromatics market are the emergence of derivatives, phenol and styrene, to be used in the automobile and construction industries.

Benzene, Toluene and Xylene (Aromatics) market report transcript

Global Market Outlook on Benzene

- The global market is expected to grow at a CAGR of 4–5 percent during 2017–2022: The impetus for this growth comes from demand in Asia, which is expected to grow at 6–7 percent, due to increased automobile and construction activities

- Feedstock change in the western markets to yield less benzene: Lesser yield from lighter feedstock will continue to reduce the output of aromatics in the US and the EU, thus making the regions increasingly import dependent. This demand from the western markets will be met by surplus capacity additions, planned in the Middle East and Asia through 2022

Demand Market Outlook: Aromatics

- Downstream capacity additions planned in Asia: Major demand for aromatics is expected to come from the Asian region, since most of the derivative units (styrene, phenol, PET, and gasoline) are lined up in Asia. The automobile (4–5 percent growth) and construction sectors (5–6 percent growth) would be the key segments driving the demand. Around 1.5 MMT capacity additions planned for styrene in Asia and the Middle East would also contribute to benzene's demand growth

Industry Best Practices

- In the US and the EU, buyers engage in contracts with small producers to ensure a seamless supply, whereas in Asia, most of the players prefer spot market purchase, due to surplus supply of aromatics

- Spot buying is preferred in Asia: Due to surplus supply and low feedstock cost, buyers look for domestic market condition and buy spot volume ranging between 5,000 and 15,000 MT from the spot market

- The US and the EU engage in contract buying: Buyers engage in two-year contracts with small-scale producers to secure supply, and the prices are revised once in three months

Global Market Size: Benzene

- Downstream segments to drive the demand for benzene: The global benzene market is expected to grow at a CAGR of 4.42 percent, mainly driven by increased demand from derivatives, styrene, and cumene segments. One of the key growth contributors for the global benzene market is the increase in demand from the polyester industry, where styrene monomer is used for manufacturing textiles

- Key end-use industries, such as automobiles, construction, and personal care, are likely to witness high growth rates in Asia during 2017–2022

Global Capacity–Demand Analysis

- Shift to lighter feedstock in the US is likely to increase the import dependence on the Asian market

- Asia will continue to have surplus availability of benzene over the next five years

- Global demand will be driven by downstream chemical products phenol, styrene, cumene, and aniline

Market Outlook

- Decreasing gasoline production to impact domestic benzene supply: Declining gasoline production and switching to lighter feedstock, especially in the US, are expected to pull down the benzene production

- On-purpose benzene production depends on conversion margins: Voluntary production of benzene using toluene depends on the margins between toluene and benzene. Firm gasoline-blending demand for toluene is expected to keep the margins unattractive in the western market, whereas in Asia, it is expected to remain healthy

- Capacity additions planned in the Middle East and Asia: Major refinery expansion planned in the Middle East and Asia is expected to increase the availability of benzene for the export market

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.