CATEGORY

Legal Services Australia

Legal services includes service rendered in the conduct of proceedings before any court or other authority or tribunal and the provision of advice on legal matters

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Legal Services Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

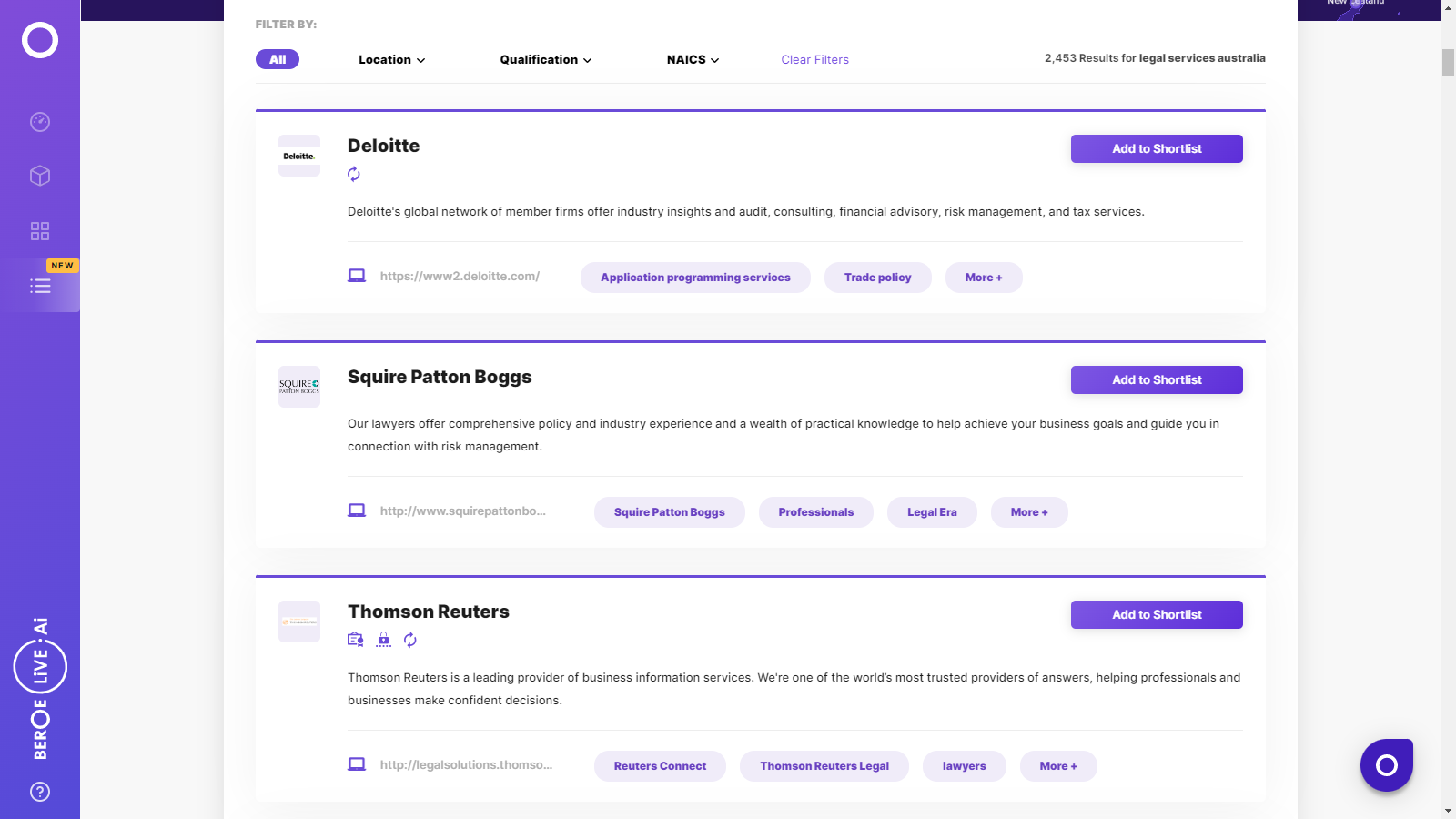

Legal Services Australia Suppliers

Find the right-fit legal services australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Legal Services Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLegal Services Australia market report transcript

The legal market in Australia was valued at $20.8 billion in 2018. The legal industry in Australia is primarily driven by demand for practice areas, like commercial law, IPOs, and restructuring initiatives. In-house legal departments (that are insourcing part of outsourced work) and ALSPs are hampering the industry's revenue.

Australia Market Trends

- Slump in demand for core practice areas, such as general corporate law and banking & finance

- Contract staffing: Few markets in the APAC employ temporary staffing, like Singapore and Australia, with more regions employing FTEs and in-house attorneys

- Lateral partner movement: Partners moving from one law firm to another, due to the competitive nature of the industry

Porter's Five Forces Analysis: Australia

Buyers can look at the rising buyer power in the Australian legal market and assess the opportunities and options, in terms of expanding supplier base, optimized billing rates, better expertise & outcome management, and better negotiation power.

Supplier Power

- Critical practice areas: Law firms providing critical services, like commercial law, restructuring, M&As, etc., command substantial power

- Declining supplier monopoly: Despite the regional expansion of global firms, supplier power has been declining, especially due to rising buyer awareness and increase in supply options. Law firms are forced to offer transparency to buyers with regard to scheduling, staffing, work-process efficiencies, and costs, which is eventually decreasing the supplier domination on buyer

Barriers to New Entrants

- Local firms: The domination of global firms in Australia is declining because of the emergence of low cost and specialist boutique, started by partners of large law firms, who have proven capabilities and established clientele

- Low barriers: As buyers have a commanding power in the market and due to the gradual abolition of international firm monopoly, the entry barriers are moderate, which are further helped by the readiness of buyers to experiment

Intensity of Rivalry

- Growing competition: Supplier diversity has strengthened with the entry of many non-traditional suppliers, along with domestic law firms

- Areas of competition: Competitive billing rates are one of the most important factors that buyers look at, along with quality of expertise and experience. Rivalry among suppliers is defined on the aforementioned lines

Threat of Substitutes

- Entry of LPOs: The Australian legal market has not been any different from the other mature markets in bringing in LPOs for better cost efficiency and productivity

- Entry of Virtual law firms: Virtual law firms have started entering the Australian legal market and are being considered by buyers because of their ability to cut down on overhead costs

Buyer Power

- Rise in buyer power: With the increasing availability of information on the law firms' capabilities and their comparative analysis with other law firms, commoditization of legal services, increased penetration of legal technology, emergence of alternative legal service providers, etc., have empowered buyers like never before. Some of the most critical aspects of legal work are being driven by buyers

- Lower negotiation power: When it comes to crucial legal aspects, the corporates exhibit restricted bargaining power, given the stakes involved

Supply Landscape

The legal market in Australia is composed of international law firms (sought after for an all-round expertise), boutique firms (for specialized practice area expertise) and other suppliers, like LPO service providers, consulting firms (for competitive prices).

Global/International Law Firms

- The global law firms are big brands, which have presence in APAC and Australia. They can cater to almost all practice areas

- These are the AmLaw and Magic Circle firms, ranging in size from 150 lawyers to 4,000 lawyers and in revenue $85 million to $2 billion. They are listed based on revenue, PEPP, scale, and type of deals taken up, etc.

- Allen & Overy LLP, DLA Piper, etc., are few examples

Boutique Law Firms

- This category includes law firms offering specialized services in niche practice areas and are able to compete against large global firms in providing specialized legal work, at competitive prices

- These are started by well known attorneys and cater to very niche subject matters, like local regulations, and are preferred by corporates for local law matters

Alternative Legal Service Providers (Non-traditional Suppliers)

- This segment comprises of LPOs, legal arms of the Big 4 consulting firms, virtual law firms, staffing agencies, etc.

- These suppliers have increased the diversity of supply market and introduced competitive rates, dissolving the monopoly established by big law firms

Australian Legal Services Market Overview

- Broadly, AFAs are of three types, such as fixed fee, contingent fee, and discounted hourly rates.

- AFAs are mostly used for commoditized type of works, like insurance, IP-patent, IP-trademark, and employment & labor matters

- Engagement with local/domestic law firms recommended for niche cases, like patent filing/licensing or real estate

- Engagement with global law firms recommended for complex and large-scale cases and for legal matters, such as M&A, criminal disputes, etc.

- Normally, the Australian corporates undertake multiple supplier engagement, which includes a few ‘all service firms, encompassing global/local law firms’ and a few ‘local firms for IP, real estate, and regulatory services

- High penetration by global law firms indicates that the maturity of service providers is high. Buyer maturity looks average.

- Buyers are increasingly looking to avail discounted rates and are forcing law firms to use AFA

- Australian law firms are engaging legal innovation consultants, process engineers, developers, and design thinkers to narrow down on their innovation strategies and explore new service verticals

- The adoption of AFAs is quite low in APAC, with the time and material model still the most widely adopted

- According to Acritas’ survey of corporate legal departments, the Australian market is below the global average when measured on the number of technologies used by in-house legal teams.

- There will be significant lateral movements, as lawyers look out for opportunities that are compatible with their practice, values, and career development plans.

Why You Should Buy This Report

- Information on the Australian legal services market, overview, outlook, regional analysis, etc.

- Porter’s five forces analysis on the Australian legal services industry

- Supply analysis, landscape, key parameters, tiering of law firms and profiles and SWOT analysis of major players like UTZ, King & Wood Mallesons, etc.

- The pricing structure, saving opportunities, sourcing models, KPIs, billing rate benchmarking, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now