CATEGORY

Business Jets

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Business Jets.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

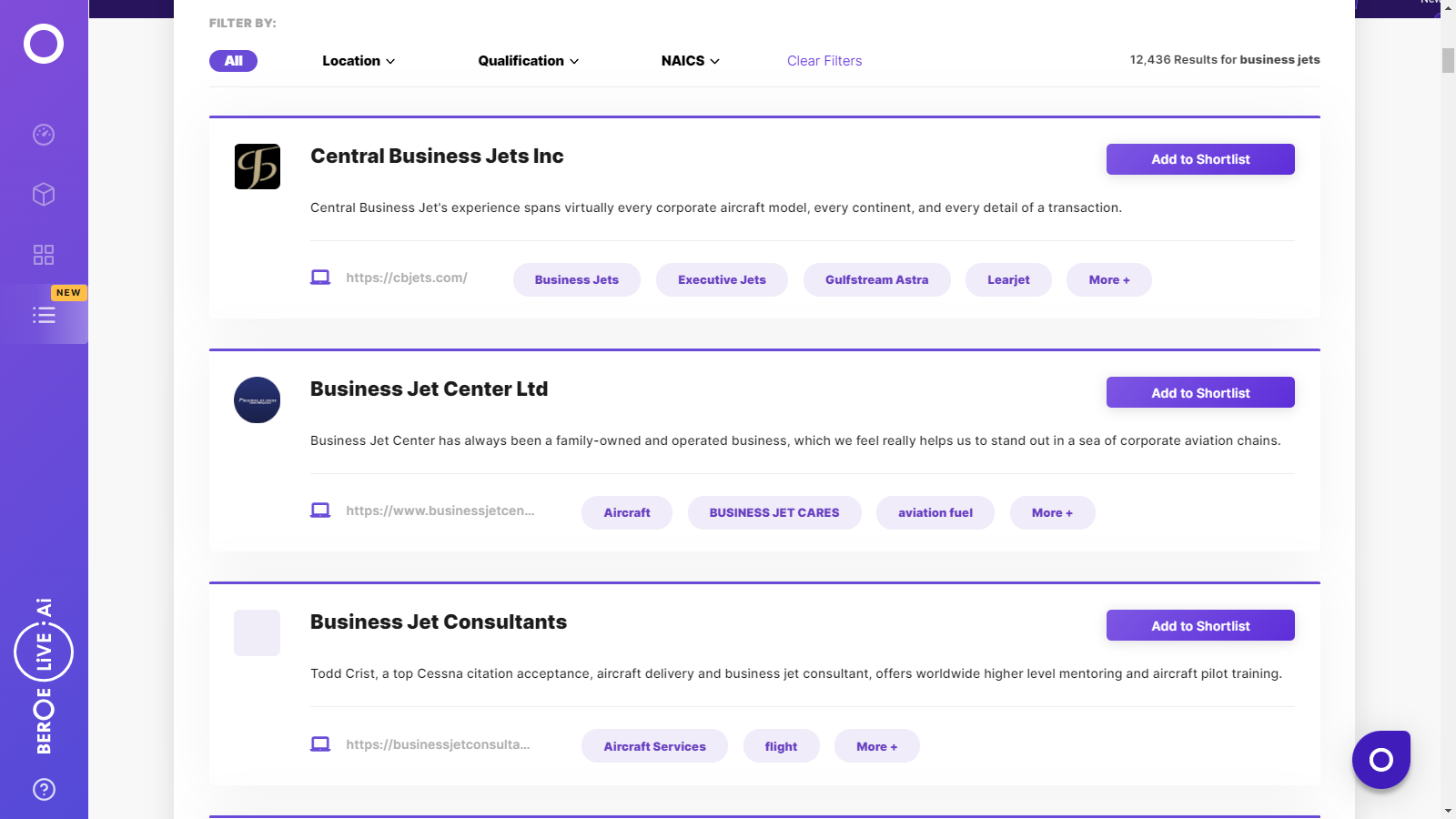

Business Jets Suppliers

Find the right-fit business jets supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Business Jets market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBusiness Jets market report transcript

Global Market Outlook on Business Jets

- COVID-19 has brought some uncertainty to the business jet market, where some buyers might be financially impaired and some may be more convinced of the value of aircraft ownership, due to slower rate of depreciation. However, in few regions, the adoption of private jets has increased due to theCOVID-19 crisis, as commercial aviation options are reduced or eliminated

- The outlook is based on business aviation demand as measured in new business jet aircraft deliveries. In the next 8–10 years, it is forecasted that the demand for business jets will increase by 8,750 aircrafts, at a CAGR of 6 percent

- The business jet market is expected to reach $37.5 billion by 2030, growing at a CAGR of 7.30 percent between 2020 and 2030. Theregional distribution indicates that North America has slower growth because public companies have contracted their spending and the generation of corporate and personal wealth has shifted to other regions

- Corporate owners and operators are planning to replace or add up to 20 percent to their current fleet size

Global Business Jets Market: Drivers and Constraints

- The major drivers of the business jets market are geographical new models, technological advancements, and globalization of trade

- Airport infrastructure and high taxes are some of the major constraints in the business jets market

- During the COVID-19 crisis, the demand is strong for mid-size, large, very large, and ridiculously large corporate jets with really long legs, i.e., those capable of flying at least 7,000 miles unrefuelled. The recent COVID-19 pandemic showcased how useful private planes can be when commercial aviation options are reduced or eliminated in response to geopolitical or in this case of health emergencies

Drivers

New models in the business jets market and technological advancements: New models in the business jets market and technological advances are the major growth drivers that would also provide customers with alternatives to full aircraft ownership

- Globalization of trade: Globalization of trade, thereby leading to expansion from inter-regional partners to globally connected economies, is also a growth driver in the business jet market

- Rapid technological advancements in avionics, addition of new models, entry of new playersin business aircraft market and growing economies are some major factors supporting the growth of the business jet market

- Usage of private jets during pandemic: A new set of high net worth individual customers and corporate users looking for safe travel with social distancing

Constraints

- Airport infrastructure

- Slot allocation

- Rising fuel prices

- Regulations

- Security issues

- High taxes

- Overall drop in business and leisure travel due to the pandemic

- Economic impact of the pandemic

Business Jets Market Overview

- According to business jet market analysis, North America, Europe and CIS are mature markets while Latin America, Middle East and Africa, and APAC are growth markets. As product and service supply chains become more established and complex, the need for global business transport becomes a value advantage.

- Also, the business jet market outlook shows that increasing complexity in regulations, ownership structures, reporting requirements and safety initiatives in 2018, and beyond, are requiring higher levels of experience and knowledge from aircraft management firms

- An aircraft management company helps to remove this burden on an aircraft owner, or lead pilot, by providing a team of experts, who work cohesively behind the scenes and provide the best solutions with a greater influence of technology

- Technological advancements are a driving force across multiple industries including business aviation

- Ground and satellite-based in-flight Wi-Fi, with speeds of 15mbps to over 70mpbs, are recently being made available on business jets. Travellers are also looking to stream and conduct video conferencing in the air. Apart from technology directly benefiting clients during travel, charter booking systems are also improving. Booking a private jet charter online without human interaction is now a reality

- There are significant advancements in the cockpit, with improvements to safety and situational awareness such as synthetic vision, active side-stick technology, near-visible and infrared spectrum sensors like the revolutionary FalconEye system developed by Dassault Falcon

- Business jet operators face challenges due to environmental regulations.

Why You Should Buy This Report

- Information on the business jet market outlook, maturity, key trends, business jets market drivers and constraints, business jet market analysis, etc.

- Industry outlook and Porter’s five forces analysis of the global business jets market

- Supply trends and insights and profiles and SWOT analysis of major players like Gulfstream, Bombardier, Cessna, etc.

- Cost element, pricing models, rental and ownership models, negotiation practices, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now