CATEGORY

Fleet Management Australia

Company cars can be acquired in three ways - buying, leasing or renting. After the fleet is acquired, it needs to be managed, which includes various activities starting from vehicle purchase to vehicle disposal

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Fleet Management Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Fleet Management Australia Suppliers

Find the right-fit fleet management australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Fleet Management Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoFleet Management Australia market report transcript

Increased interest for automation of fleet management, high maturity of the leasing industry, benefits of outsourcing non-core functions, and road safety are driving the fleet leasing industry, however, alternatives to travel, like video conferencing, and alternate mobility solutions, like ride sharing and car sharing, are some of the constraints..

Drivers

Outsourcing benefits cost control

- Large companies in Australia are focusing on digitization and automation of fleet management functions. Outsourcing car leasing and fleet management helps them to reduce the administrative overhead and save cost. Fleet is not the core area of companies, and they prefer to outsource fleet management and focus on core business

Maturity of leasing industry

- Australia is one of the most matured market for fleet management in APAC. Interest rates are lower, while cost of purchasing a vehicle is higher

Safe roads for sales force

- An increasing sales force that requires mobility solutions results in increased fleet size, which drives the fleet management industry. Moreover, Australian roads are considered as one of the safest in the world, and organizations do not need to worry about the safety of drivers on the road

Constraints

Video conferencing and webinars

- With the advent of new technology, like live webinars and video conferencing, it is possible to conduct online meetings and sales presentations, reducing the travel time and cost

Support network

- The usage of support networks, like insurance, maintenance, servicing, and remarketing, which is required in this industry, is high and acts as a constraint to manage these small support service providers

Alternate strategies

- Mobility solutions, like ride hailing, car sharing, etc., have started gaining prominence in Australia. However, it is still in its nascent stage

Porter's Five Forces Analysis

The fleet management market in Australia is dominated by few local suppliers with majority of the market share, however, there is intense rivalry among suppliers, resulting in medium buyer and supplier power. There is a high barrier for new entrants. Threat of substitutes is low–moderate at this point.

Supplier Power

- Local suppliers dominate the market with global suppliers having a presence through partnership

- All fleet leasing companies provide the novated leasing model, along with operational leasing

- Fleet management companies have moderate power, owing to the competitive supply market.

Barriers to New Entrants

- The supply market is highly competitive, and it is complex for new entrants to capitalize the market

- Setting up maintenance network, providing widespread services across Australia, and initial investments are barriers for new entrants

Intensity of Rivalry

- There is intense rivalry among the existing players, and all of the companies offer similar services

- There is an intense rivalry among the top suppliers, owing to competitive pricing strategy

Threat of Substitutes

- Organizations have started to pilot alternate mobility solutions, like ride hailing services and avail taxi services, for other mobility needs

- Ride hailing companies are expanding geographic reach across Australia cities

- However, the threat of substitutes is low–moderate, as the geographic presence of these suppliers is low and adoption by corporate is minimal

Buyer Power

- Large organizations prefer the novated lease model

- Corporate leasing contributes to high percentage of leasing business

- However, the cost of switching the suppliers restricts the buyer power to be within the moderate level

Supply Market Outlook

Global/regional supplier

Increase in M&As and partnerships

- Regional and global suppliers are entering the Australian fleet management market through M&As and partnerships

- For Example, SG fleet acquired Fleet Australia, Custom Fleet represents Element Fleet Management in Australia

- Global fleet leasing and management companies, like Alphabet and LeasePlan, have a direct presence in Australia

Comprehensive fleet management services

- Most of the fleet companies offer operational leasing services, along with the novated lease model

- The top suppliers provide end-to-end fleet leasing and management services

Alternatives to company cars

- Ride hailing companies and car sharing companies have started to offer mobility services in Australia

- However, corporate adoption of mobility services is low in Australia

Tier-2/local supplier

- Local suppliers dominate the market with McMillan Shakespeare Group, SG Fleet, and Custom Fleet offering end-to-end fleet services

- Fleet companies offering diverse service lines are facing issues, due to poor performance of other business lines

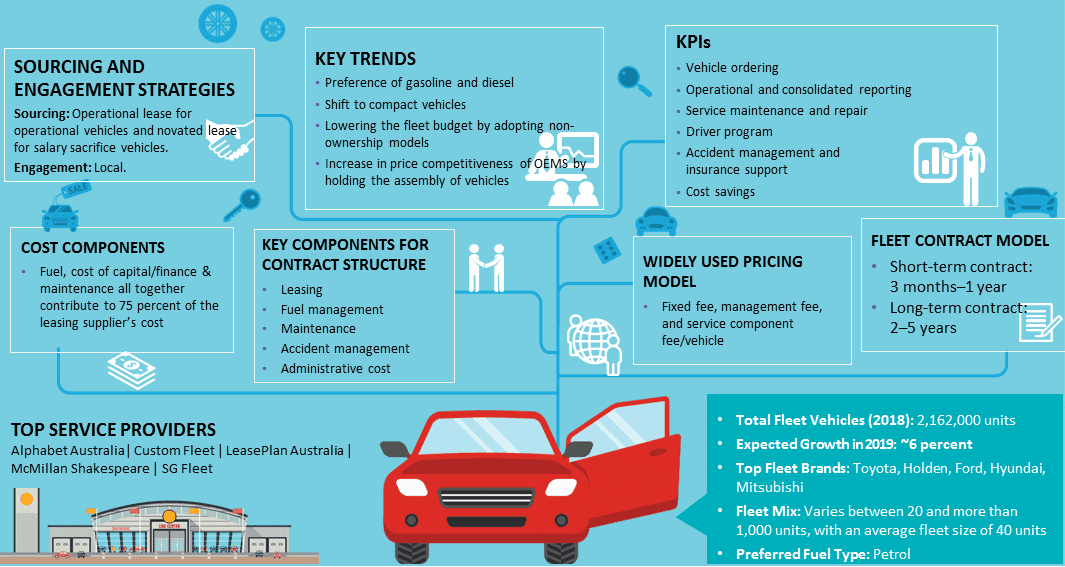

Engagement trends

- Most adopted model in Australia: Local sourcing strategy

- Why: Fleet leasing and management market in Australia is highly mature, with novated lease and operational leasing model preferred

- Pricing strategy: Fixed fee + management fee + service component fee/vehicle are widely adopted

Australian Fleet Management Market Overview

- New vehicle sales in Australia encountered a decline in sales, owing to an increase in interest rates and stringent lending model

- The SUV segment dominates the vehicle sales Maturity of the global service providers is medium in Australia

- Local suppliers dominate the market, fleet leasing companies offer both novated and operational leasing models

- Alternate mobility suppliers, like ride hailing and car sharing service providers, are expanding their services across Australia

- Fleet size varies between 20 and more than 1,000 units, with an average fleet size of 75 to 100 units per business

- SUVs and Sedan/Hatch vehicles are preferred for company cars

- The key trends in the Australian fleet management market include improved emissions, fuel efficiencies, weight, cost savings, accident avoidance, crash survivability, all weather drivability, engine reliability, component durability, preventive maintenance sensors, passenger comfort, constant connectivity, family entertainment, navigation capability, and more

- Previously, these trends translated into optional features (and not all were offered, even in premium models)

- Today, these trends are undergoing accelerated development and are being integrated into vehicles during the manufacturing process, and they are becoming standard features to meet consumer expectations and are proving to be a competitive advantage for OEMs

- As a result, the associated cost will become a necessary part of the direct cost

Why You Should Buy This Report

- Information about the Australian fleet management market size, drivers and constraints, regional market analysis, Australian fleet management market trends, industry outlook, etc.

- Porter’s five forces analysis of the Australian fleet management market

- Supply trends and insights, key element fleet supplier profiles and SWOT analysis of major players like Alphabet Australia, Custom Fleet, LeasePlan: Australia, etc.

- Cost structure, factors influencing fleet lease price, etc.

- Sourcing models, pricing models, contract models, KPIs, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now