CATEGORY

Airlines

Global airlines offer global contracts covering their own and alliance network. Such large airlines primarily offer contracts in region in which they are based or have a strong market share.Â

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Airlines.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoAirlines Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Airlines category is 11.87%

Payment Terms

(in days)

The industry average payment terms in Airlines category for the current quarter is 58.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

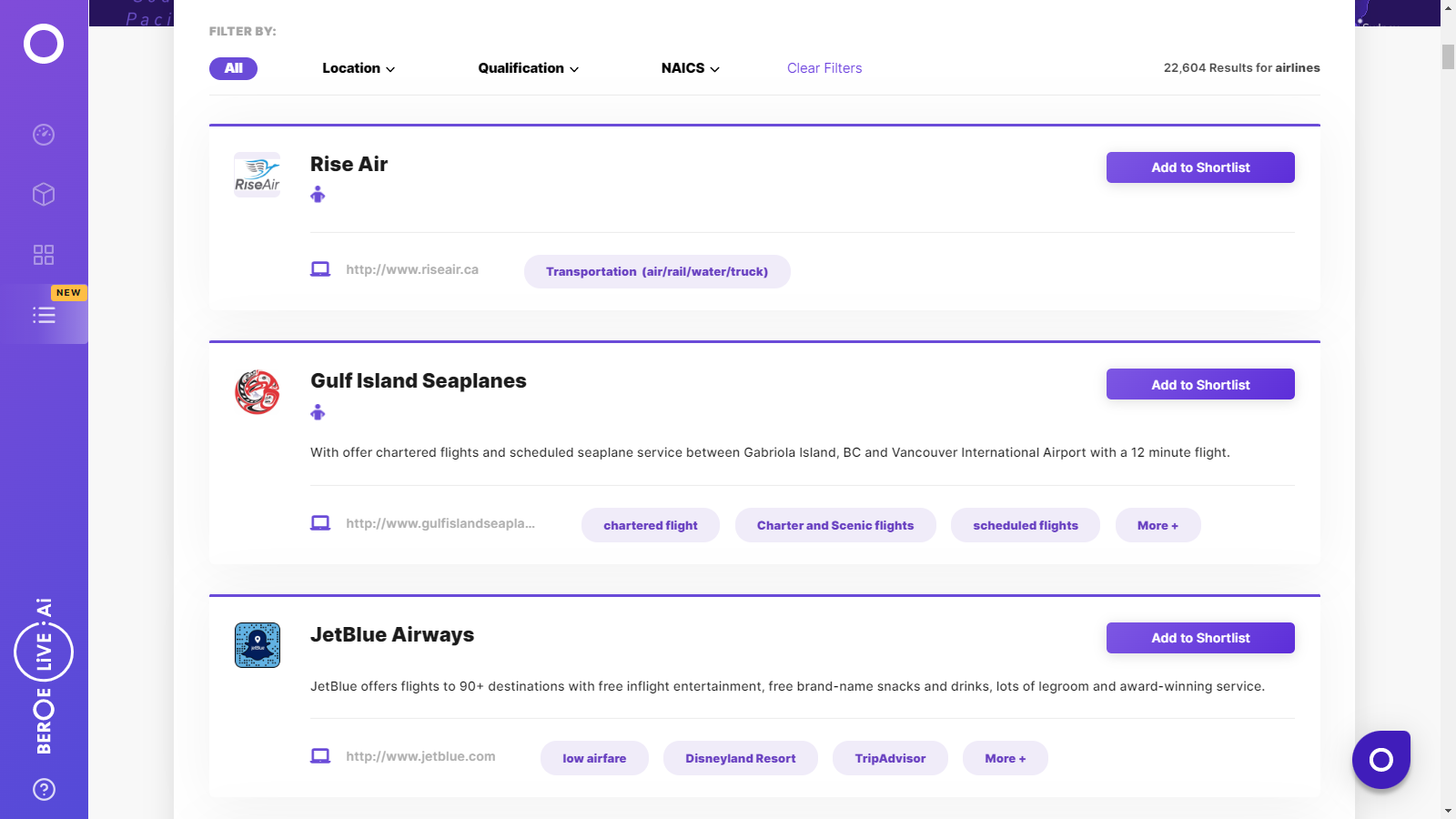

Airlines Suppliers

Find the right-fit airlines supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Airlines market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAirlines market frequently asked questions

As per Beroe's market reports, - Middle East-Asia has a market worth of $600 Mn - The North American market is valued at $16.4 Bn - The European airline market is valued at $11.5 Bn - The Asia Pacific market is valued $9 Bn

The airline industry can see significant growth with the support of the government by implementing security standards, reasonable taxation, better regulation, and building cost-efficient infrastructure to keep up with the rising demands.

Some of the key trends in the global airline industry are ' - Traveler retention through loyalty programs by encouraging passengers to pay a premium - Demand for lower fares by passengers accompanied by unbundling of specific services like cabin upgrade, baggage, meal choices, etc. - Incorporation of fuel-efficient aircrafts to reduce costs - Focus on aircraft tracking and psychological fitness of the pilot - Development of next-generation payment solutions to improve customer satisfaction and convenience - Advancements in ancillary product offerings

The major alliances in the airline industry are SkyTeam, Vanilla Alliance, The Star Alliance. - SkyTeam ' the second largest alliance in the world formed in 2000 - Vanilla Alliance ' formed in 2015 to improve air connectivity within the Indian Ocean - Star Alliance ' formed in 1997 and is the largest global alliance in terms of passenger count

Airline alliances are formed between two or more airlines where they agree to cooperate on a substantial level. Air alliances provide branding to facilitate travels and make inter-airline codeshare connections within countries.

Airlines market report transcript

Airlines Global Market Outlook

-

The global airlines industry contracted by 55 percent to reach 373 billion in 2020

-

The airline industry revenue is estimated to grow by 25–30 percent in 2021

-

Vaccines and testing, along with safety precautions, followed by airlines, might help to recover the global travel demand (measured by RPK) at ~40 percent of 2019 levels in 2021

Impact of COVID-19 on Airlines Industry

-

COVID-19 had a devastating impact on the airlines industry. The industry witnessed a 66 percent drop in demand and a total loss of $138 billion in 2020.

-

The demand for air travel is slowly picking up

-

Domestic travel is expected to reach pre-crisis levels in 2022

-

Carriers are issuing health passports to securely manage the health credentials and to ensure safe travel

-

Airlines are using advanced cleaning techniques and contactless technology, such as voice-activated screens, biometric scanners, etc., to curb the spread of virus

-

Airfares have started picking up gradually, but is still 5–10 percent lower than the pre-crisis levels

-

Countries have started accepting IATA travel pass. It helps travelers to understand travel requirements and present their verified travel health credentials, and hence, ensures a seamless travel

Global Airlines Market: Drivers and Constraints

The major drivers of airlines industry are advanced technology, reduction in airfares, and global nature of businesses. Low demand, due to the pandemic, availability of travel alternatives, and liquidity crisis, faced by airlines limits the growth.

Industry Drivers

-

Technology – Advanced cleaning techniques and touchless technology are expected to bring back the demand.

-

Reduction in airfares – Air fares have reduced over the years, which have made flying affordable.

-

Global nature of businesses often demands direct meetings leading to higher demand.

Constraints

-

Uncertainty in the demand for travel, due to the impact of COVID-19.

-

Alternate to travel, like video conferencing and online meetings, is gaining prominence.

-

Airlines have accumulated financial obligations and are facing liquidity crisis.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now