Wuhan Virus Scare: Category Impact Assessment

Public health officials around the world are scrambling to understand, track, and contain a new virus that appeared in Wuhan, China at the start of December 2019. Thus far more than 500 people have died, mainly in the Hubei province. These are still early days, but a prolonged spread of the infection can begin to have a significant impact on global supply chains.

Beroe has provided a snapshot of category impact. For detailed report, please write to us contactus@beroe-inc.com

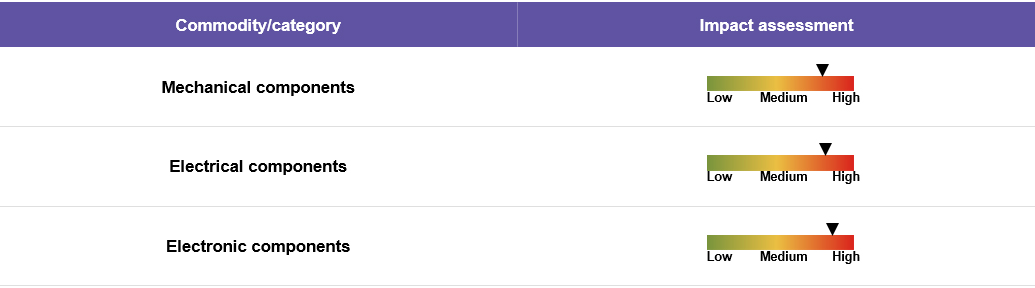

1) Industrial Manufacturing Durables

- In China, the key provinces for the procurement of mechanical components, and electronics and electrical components/services in China include Guangdong, Fujian, Zhejiang, Shanghai, Jiangsu, Shandong, Beijing, Hunan, Jiangxi, etc. The majority of these provinces has reported 100+ cases of coronavirus.

- For the next two months, raw material supply for components that are made of steel, aluminum, lithium, etc., is expected to be affected.

- Component production is expected to be affected due to labor shortage. This is likely due to precautionary factory shutdowns and numerous people being affected by the virus.

- Delays are expected with regard to current order deliveries since all logistics that move goods from China to most foreign countries have been halted for a minimum of 30 days.

- In the short term, there could be price hikes in component procurement from alternative sources like Taiwan, Thailand, South Korea, etc.

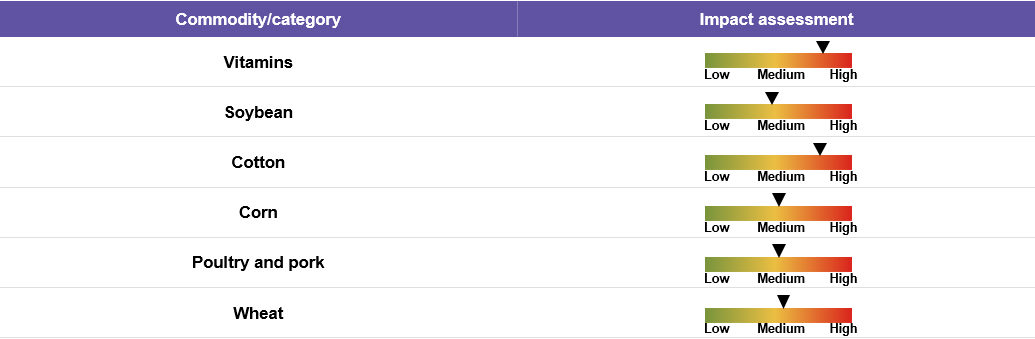

2) Agro-Commodities and Food Ingredients

- Concern over the wide reach of the coronavirus has forced India to stop cotton trade with China. Given that China is the top cotton importer, cotton spot prices in India have declined 3-4 percent as a result. If the situation worsens, India will seek other potential importers like Bangladesh, Vietnam, Indonesia, etc. These circumstances will limit cotton supply in China, leading to further shrinkage of the cotton stockpile.

- Lowered demand for soybean meal is expected in China, resulting in a decrease in the crushing of soybeans and a decline in large soybean stocks. This could lower soybean import volumes until the existing stock is depleted.

- In the U.S., corn and wheat prices have fallen sharply because investors are selling most of their stocks for fear of lowering demand from the Chinese market due to the coronavirus. U.S. corn farmers will likely be pressurized given that forecasts predict a bearish market environment. To offset this, foreign buyers are looking to U.S. corn to meet their import needs due to lowering prices that have boosted exports.

- Poultry and pork prices in China are expected to experience downward pressure on account of lower than anticipated demand during the peak Lunar New Year period amid the coronavirus outbreak. With China being the major vitamins manufacturer and exporter, the duration of supply impact due to factory shutdowns is estimated to be around 4-6 months.

Supplier News Alerts

- Kotak Commodity Services, one of the major cotton exporters in India, has confirmed that, due to the coronavirus, cotton shipment from India to China has stopped.

- Major vitamins manufacturers are located in Hubei province, which is one of the most affected areas. The factories are going to be shut down owing to feedstock shortage and a locked down transportation system.

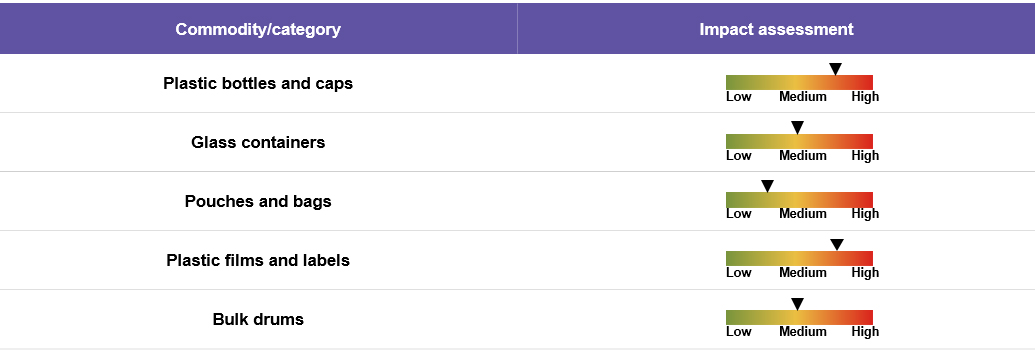

3) Rigid and Flexible Packaging

- Wuhan province contributes less than 5 percent of the overall plastic manufacturing units in China. Major plastic packaging provinces such as Shanghai, Shenzhen, and Jiaxing are currently not suffering serious coronavirus effects.

- Demand for personal and hygiene products is expected to spike, impacting both rigid and flexible packaging products, especially HDPE containers, pumps, and pharmaceutical bottles.

- Due to travel restrictions, the consumption of bottled food and beverages may experience a sharp decline in the short term. Food and beverages account for over 30 percent of PET consumption and suppliers that cater to these segments could experience low operating rates.

- There is an expectation that thermoform trays, skins, and flexible wraps will be affected owing to a decline in the demand for meat, fresh fruits, etc.

- With the curbed export of multiple commodities, the demand for bulk drums is expected to suffer a considerable reduction.

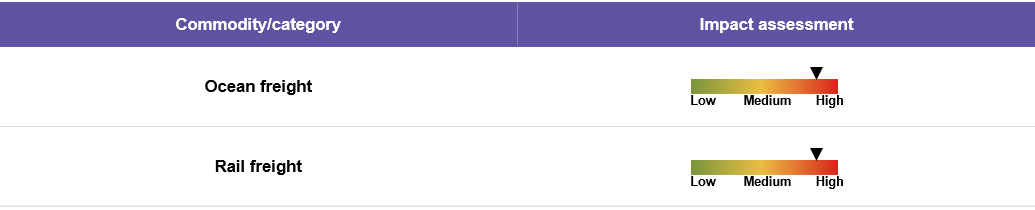

4) Logistics

Ocean freight:

- Major ocean freight shippers are expecting delays in the movement of goods in and out of China since a large number of ocean freight carriers have stopped operations across the country due to the new airborne disease (coronavirus).

- Most manufacturing companies have responded to the situation by changing their shipping schedules. All major sea ports in China and key terminal operations are normal except for Wuhan where carriers’ feeder services in and out of Wuhan and local terminal operations in Wuhan are both temporarily shut down and under quarantine. En route shipments will be idle at other ports until the lockdown is lifted.

Rail freight:

- Rail freight from the Chinese province of Hubei, which is the capital of Wuhan, has stopped. Trains are not permitted to leave the province until the end of February 2020. Rail freight traffic from other provinces is still in operation

- All other major rail routes in China are in operation. Most shippers are planning to move their cargo from ocean freight to rail. Since demand for rail freight has increased drastically, its available capacity will be relatively low until March 2020.

Alternative options:

- Shippers can expect delays with regard to Wuhan-bound shipments. All major routes (air, ocean, and road) leading to the city have been temporarily restricted. Shippers can opt for rail freight as an alternative means of moving shipments across China.

Supplier News Alert

- Airlines such as Delta Airlines, British Airways, United Airlines, etc., have either suspended flights to China or reduced their frequency.

- British Airways, Lufthansa, and Lion Air Group are confirmed to have suspended flights to and from China.

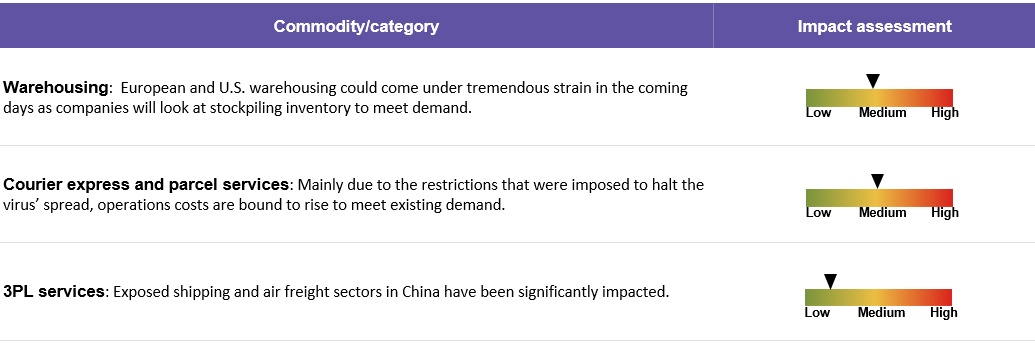

5) Warehousing

- A 50 percent reduction is expected in imports from China due to the lockdown that is in effect in Wuhan and the cessation of operations in certain other regions.

- Cargo flights to Wuhan and other regions have been cancelled. Until services resume, this will have a major impact on warehousing suppliers both within and outside of China.

- The 3PL companies that facilitate the movement of goods and services across China will have to find alternative strategies in order to avoid any disruption in deliveries.

- Parts of the supply chain may originate or pass through Wuhan for manufacturing, assembly, or finishing. In those cases, we can expect widespread shortages or delays with regard to materials that are sourced or manufactured there. The length of the lockdown in Wuhan is unknown, potentially putting the global supply chain for raw materials, parts, and finished goods at risk.

Supplier News Alert

- FedEx has pledged coronavirus emergency aid in the form of transportation support.

- The coronavirus’ direct effect on Amazon sales is likely positive since shoppers are staying at home rather than frequenting brick-and-mortar businesses.

- The air cargo industry is bracing itself for the impact of the measures that have been taken to halt the spread of the deadly coronavirus in China.

- E-commerce giants have already experienced a significant uptick in mask and thermometer sales.

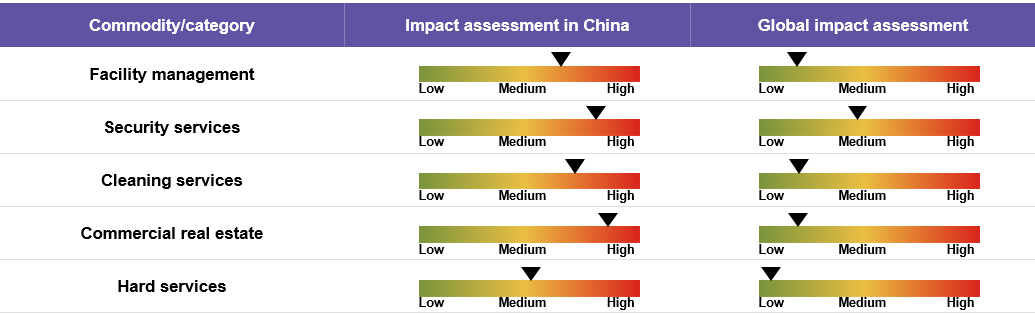

6) Facility Management

- Facility management: Given the virus’ rapid spread across mainland China, with active cases reported in every region, the local government and the municipality have announced that non-essential businesses will be closed. These closures will impact the facility management industry.

- Commercial real estate: Since the Chinese retail industry has suffered reduced footfall because customers are avoiding public places, real estate firms are stepping in to relieve the pressure that the Wuhan coronavirus outbreak has exerted on stores and restaurants by cutting rents and offering zero-rent periods.

- Security services: There has been a global increase in traveler screening to minimize the risk of the coronavirus infection spreading to the general public. Security guards have been instructed to follow PPE standards, which require the use of gloves, eye and face protection, and respiratory protection such as the N99-grade mask. The instructions state that in virus-prone areas a complete PPE kit must be used while conducting premises entry scans and guard duties.

- Cleaning services: In order to defend against the coronavirus threat, large corporations have started performing frequent deep cleanings. They are also regularly spraying disinfectants/sanitizers. Housekeeping/cleaning staff are to be provided with face masks and gloves for use while cleaning. Once the cleaning is done, the mask and gloves are to be disposed of properly, and the cleaners are strictly instructed to sanitize/wash their hands at regular, frequent intervals.

Supplier News Alert

- International real estate and facility management service provider CBRE has advised its employees that any worker "who visited the Hubei province within the past two weeks, or at any time while these travel restrictions are in place, may not go into a CBRE office or worksite (or client worksite) for two weeks.”

- The DOW CEO has reported that there has been a 10 percent rise in cleaning product demand due to the coronavirus outbreak.

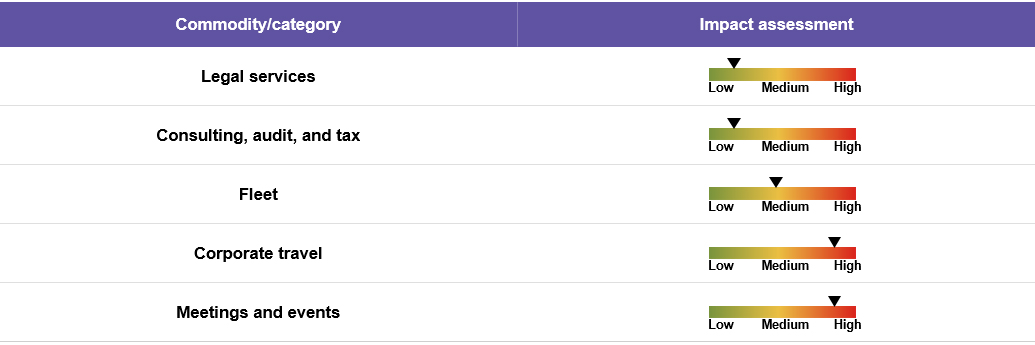

7) Professional Services and Travel

- Fleet: Manufacturing in China is expected to be halted until February 2, 2020 until further notice. Since Wuhan is a major automotive hub that is home to plants belonging to Nissan, PSA, Honda, General Motors, etc., as well as a large range of car parts suppliers, it will be severely impacted. The automobile industry is expected to enter a traumatic phase for the next few months, at least, with consumers likely delaying car purchases.

- Corporate travel: The global travel industry has been seriously affected by the coronavirus outbreak. As concerns grow about the virus’ continued spread beyond China, large companies like Apple, Kraft Heinz, HSBC, etc., have restricted their employees’ China and Hong Kong business travel and have asked employees who have recently returned from China to work from home for the time being. Airline stocks have also been adversely affected: Air France fell by almost 6 percent, BA-owner IAG fell 5.5 percent, and Germany’s Lufthansa dropped by more than 4 percent.

- Meetings and events: China has halted all domestic and international group tours. Hong Kong, which is a major destination for international meetings, has stopped all Chinese visitors from Hubei province from entering the region. Most organizations have cancelled meetings that were scheduled in China, and a few companies have already started planning to hold their conferences and events outside of China.

Supplier News Alert

- International carmakers including Nissan, PSA, and Renault have begun relocating foreign staff out of plants across parts of China.

- Air Canada, American Airlines, Cathay Pacific, Delta, and United Airlines have all waived cancellation fees on flights going through Beijing and Shanghai until February 7, 2020. They have also suspended all flights to and from Hubei province for one month, at least.

- Hilton and Accor have announced free cancellations on all bookings in Wuhan and Greater China, respectively, through February 2, 2020.

- Marriott International will waive cancellation fees for hotel stays through February 29, 2020 for guests who have reservations at their hotels in mainland China, Hong Kong SAR, Macau SAR, and Taiwan, as well as for guests from mainland China, Hong Kong SAR, Macau SAR, and Taiwan who have scheduled outbound travel to other Marriott destinations around the world.

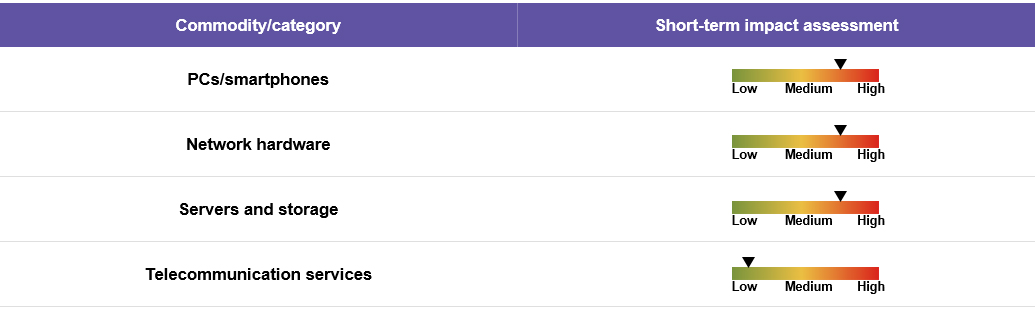

8) IT Hardware and Telecommunications

- More than 80 percent of all global IT hardware and electronic equipment parts, such as mobile displays, open cell TV panels, printed circuit boards, capacitors, memory, and LED chips, are manufactured in China.

- The Lunar New Year holidays were scheduled to end by January 31, 2020. However, due to the rapid spread of the coronavirus in mainland China, major IT parts manufacturers like Foxconn have already ceased operations in China.

- Some Chinese manufacturers have hiked prices by 2-3 percent due to decreased production due to factory shutdowns. Apart from price increases, OEMs can also expect 15-20 day delays in components delivery, significantly affecting overall delivery timelines.

- Hence, in the coming weeks, IT procurement managers can expect increases in the prices of IT hardware such as PCs, smartphones/tablets, network hardware, servers, and storage.

- Telecommunications service prices are not expected to increase amidst the coronavirus epidemic. However, telecommunication service providers might face challenges in 5G testing and deployment due to network hardware component price hikes and delivery delays.

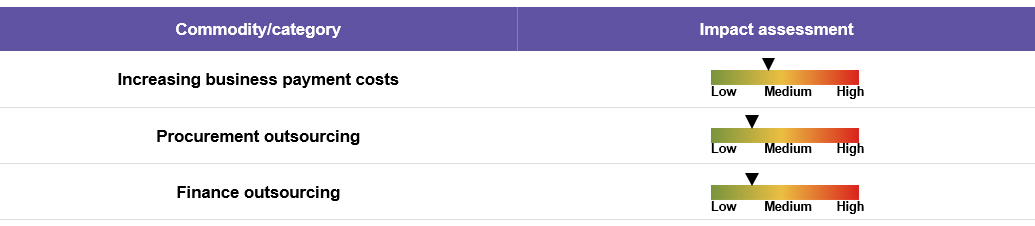

9) Banking, Procurement, and Finance Outsourcing

Banking Advisory Insights

- Increased borrowing costs (interest rates) for businesses in the near future: The primary economic impact on the banking sector is likely to be as follows: increased credit card defaults, less loan applications, higher non-performing loan ratios and consequent loan-loss provisions, and a hiatus in wholesale and investment banking deals. In the short term, central banks will be forced to cut interest rates to support companies that are struggling because of the outbreak. This might lower borrowing costs in the short term. However, in the long term, borrowing costs are likely to increase as banks try to recover the losses they will have suffered due to increased costs and reduced revenue.

- Increased payment processing costs: Branch traffic will likely be routed to safer channels, resulting in increased internet banking. An increased demand for processing due to higher volumes of online and mobile person-to-business (P2B) transactions might drive up processing prices in the long run.

- However, since China is primarily a domestic market that is reliant on large internal players across payments markets, the impact of increasing international business-to-business (B2B) transaction costs is likely to be limited.

Procurement and Finance Outsourcing Advisory Insights

- No Tier 1 or 2 procurement and finance outsourcing service providers have delivery centers in Wuhan. However, for the next few weeks, backend procurement and finance operations that are performed at key delivery centers in other locations within China such as Hangzhou, Shanghai, Chengdu, and Dalian may be suspended.

- However, since most outsourcing providers will have business continuity plans for normalizing operations, the impact is not expected to be severe.

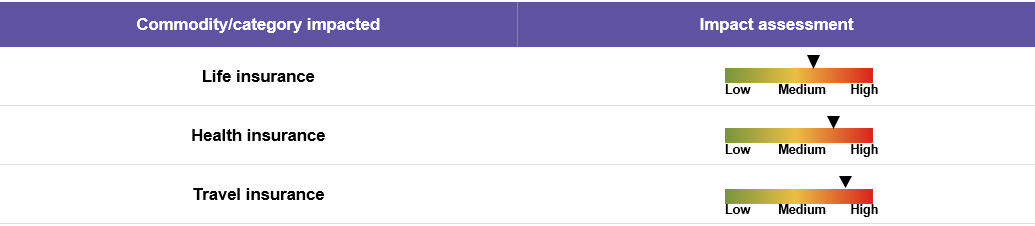

10) Insurance

Advisory Insights

- It has been observed that the coronavirus could impact health, life, and travel insurance since the bulk of outbreak-induced claims are expected to come from businesses, mainly travel, hospitality, and event firms, followed by mortality and healthcare costs.

- Although global firms buy coverage for communicable diseases, most “standard insurance policies” exclude outbreaks (like the coronavirus) to keep payout costs low.

- Global insurers typically cover risks such as earthquakes and plane crashes, but they have been paring back their exposure to certain types of risks. Since previous viruses such as SARS, Ebola, and Zika, have led insurers to be more cautious about exposure, specific virus exclusions have been added to basic coverage policies. It has been reported that most event cancellation policies will not cover the coronavirus.

- Due to the outbreak, many airlines and hotels are offering their customers refunds. Without adequate insurance in place, these airlines and hotels are absorbing the associated financial losses themselves.

- Most travel insurers are likely to reimburse costs associated with trip cancellations and medical expenses for policies that were bought before the spread of the virus; however, a few insurance companies are excluding coverage for select destinations.

- It has been observed that some insurers’ policyholders, namely Aviva, Allianz, and AXA’s, will be covered if they are impacted by the virus, provided they follow government travel advisories.

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe