A primer on MRO industry in Africa: opportunity exists for cost savings

Authored by Anup Varghese, Senior Research Analyst, MRO (Maintenance, Repair and Operations)

The global Industrial MRO (Maintenance, Repair and Operations) industry, being highly fragmented, has a large number of buyers and suppliers that contribute to the dynamics of the market.

Here, ‘MRO' is used to depict the industry that handles industrial equipment and services, spare parts and industry supplies that constitute sub-categories such as industrial supplies, bearings and power transmission products, plastics, electrical supplies and components, fasteners, hand and power tools, lubricants, filters, PVF, fluid power components, safety supplies, HVAC, plumbing, sanitation, janitorial and cleaning products and excludes parts and equipment catering to industries such as aviation and aerospace.

MRO, being a highly unpredictable indirect spend area, is generally unaddressed by the category manager having fewer contracts in place. This means a lot of MRO spend is not effectively captured and improved.

Category managers could reap significant savings if they focus on effective MRO sourcing and procurement.

Fortune 500 companies have already begun to improve their MRO spend visibility and consolidation. Over the last 5 years, companies have been able to save millions of dollars by addressing their MRO spend.

Companies that strive to stay ahead of the curve, by addressing their MRO spend, find it extremely difficult to incorporate a strategic sourcing model for MRO sourcing in Africa.

The reason being Africa lacks the same opportunities that are available in other geographies.

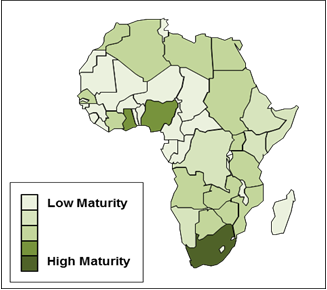

MRO Maturity in the African Subcontinent

For example, one-stop providers (also known as integrators) are present all across the world. Europe and North America have more than a dozen integrators each who provide world-class MRO consolidation and integration opportunities.

Even emerging regions such as Asia have 5-6 integrators. However, the continent of Africa has absolutely no integrators that buyers can approach for consolidating their MRO spend. This forces buyers to buy products on a regional basis.

Suppliers don't feel inclined to invest in Africa owing to the continent's market size of about $25 billion, which is relatively lower compared to Asia ($200 billion) and North America ($150 billion).

Currently, buyers in Africa source from locally available suppliers near their factory or city.

However, this method has a flip side though. The number of engagement with suppliers increases tremendously when companies operate across the country or continent. This increases the number of invoices and time spend to process and follow up with plethora of suppliers.

Currently there is no strategy in place for buyers in Africa, who are looking to dramatically save on their MRO spend. This is because buyers don't get much external help to formulate a sourcing strategy for Africa. Strategic contract models with regional and national suppliers are the only avenues where sourcing can be better streamlined.

Regions in Africa that are relatively mature in terms of MRO have a few national distributors with whom buyers can engage. However, countries that do not have significant MRO demand or maturity, lack any significant cost saving opportunity that a category manager in that locality can consider.

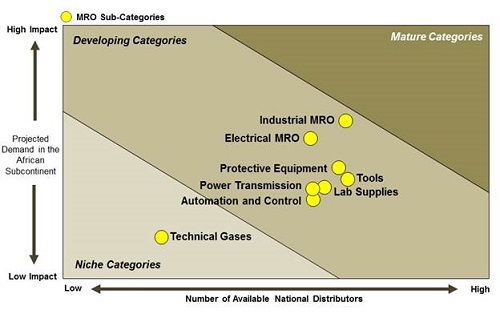

Though the MRO cost saving opportunities in Africa is not very apparent, buyers who are present in mature regions such as South Africa, Nigeria and Ghana and who operate in relatively mature MRO categories such as industrial and electrical MRO, can adopt a criticality-based sourcing model to achieve cost savings in Africa.

This would mean sourcing critical products from national distributors who are present in mature regions. Sourcing from them would enable partial consolidation across categories and plants. Emerging service providers can also help buyers improve their procurement and logistics spend.

However, products that are non-critical to production can be sourced locally/ regionally from available smaller suppliers (which mean continuing the currently followed model). Criticality can be estimated based on factors such as lead time for getting the parts, the frequency of failure of the parts and the importance of each part in the production line.

This is because lead time and down time for non-critical products would not create irrecoverable losses as in the case of critical parts. Hence, regional sourcing is affordable for non-critical parts.

Category managers can reap rich dividends if they go ahead and implement this strategy. For example, a company can on an average save up to 4-10% of their MRO spend by adopting this model.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe