Sourcing from developing markets benefit glass tubing buyers

Abstract

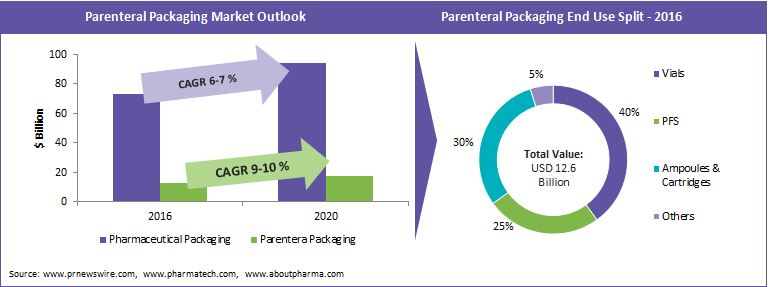

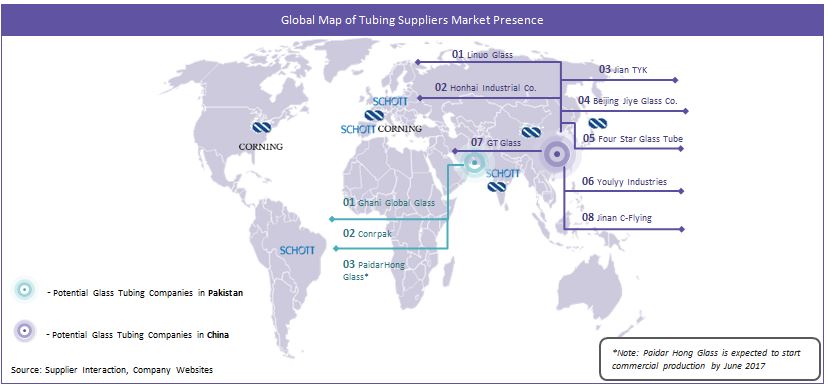

The supply base of type I borosilicate glass tubing, which is the primary component for manufacturing parenteral containers, is highly consolidated with top three suppliers i.e., Schott, Nipro Pharmapackaging and Corning Pharmaceutical Glass(earlier Gerresheimer) having the largest market share. For parenteral administration, the glass convertors have to mandatorily use Type I neutral glass for manufacturing vials, ampoules, prefilled syringes, etc. which offer the highest resistance to aqueous solutions. Global parenteral packaging market is expected to grow at a rapid rate of 9-10 percent in the next 5 years. However, the supply of glass tubing is at a standstill and no large capacity additions or new entrants in the market were witnessed over the last 3-5 years. This has created a highly consolidated glass tubing supply base for the parenteral packaging convertors. In order to break the deadlock and find an alternative supply source, the convertors are shifting their focus to the rapidly emerging South Asian markets especially China, where multiple mid-scale glass tubing companies are emerging as strong alternatives to the global leaders.

This article will try to highlight the potential opportunity to shift the sourcing base to the developing markets, identify key regional suppliers with the capability to manufacture low expansion glass tubing and discuss feasibility to source glass tubing from growth markets.

Introduction

Globally, over 80 percent of the glass vials and ampoules are made from neutral Type I borosilicate glass tubing which is the key component for manufacturing tubular glass components. Global players such as Schott, Nipro, and Gerresheimer are predominantly leading the parenteral packaging market owing to their large integrated production facilities and glass tubing abilities to supply to conversion lines giving them control of over 60 percent of the overall parenteral packaging market.

Pharmaceutical glass is classified under three heads:

Type I: Borosilicate neutral glass used to package aqueous solutions for parenteral uses

Type II: Surface treated soda lime glass typically used for packaging acidic, non-parenteral products

Type III: Soda lime glass which is not suitable for parenteral use and mainly used for Oral solid doses and Cosmetics

Among these three types, Type I glass is the only glass type suitable for parenteral administration. However, in the recent past Type I glass has been facing challenges such as higher cost and low availability owing to the recent surge in demand for parenteral packaging coupled with quality challenges such as delamination of container and drug contamination.

Rapid growth in parenteral packaging – the imminent pressure on borosilicate tubing demand

Biopharmaceutical drugs, a key end-use application for parenteral packaging, expect the fastest growth in pharmaceutical application growing at about 10 percent Y-o-Y. A report suggests that from 2000-2012,companies such as Novartis, Merck, BMS and Pfizer have registered over 20 percent increase in revenue from biopharmaceutical drugs, whereas Sanofi, Roche and Abbvie revenue share from biopharmaceuticals have been over 50 percent. Predominantly, all the biopharmaceutical drugs require parenteral routes of administration packaged in either vials, ampoules, prefilled syringes or auto injector format. However, growing quality challenges and stringent regulation on drug device combination has completely ruled out the use of Type II or Type III glass containers.

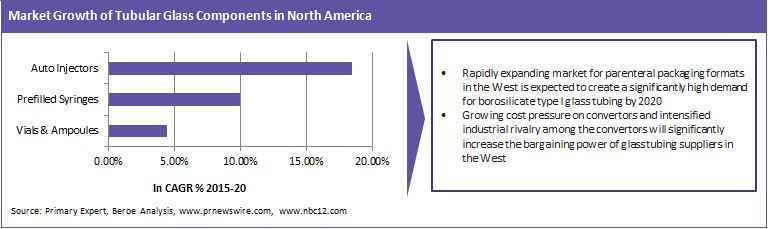

Quality-related issues such as delamination, extractable and leachable have further strengthened the position of Type I borosilicate glass as the only choice in the packaging format available for packing biopharmaceutical drugs. A significant challenge for the packaging convertors and pharma buyers is the highly consolidated nature of the supply of pharma grade glass tubing (Type I Borosilicate glass). With only two convertors of pharma glass tubing residing in North America (Nipro and Corning) and three suppliers (Schott, Nipro and Corning) in Europe, it creates the challenge of high cost, low availability and low bargaining strength for the packaging convectors.

Global parenteral packaging market is driven by the growing complexity of drugs, fostered by increasing lifestyle diseases, growing health awareness, and aging population and is expected to grow around 9-10 percent from 2015-20. Parallely, the emerging region markets such as China, India, Brazil and Africa also expect high growth rate of around 10 percent in the forecasted period. Prefilled syringes and auto-injectors expect the fastest growth rates driven by growth in biopharmaceutical drugs and need for self-medication. Increasing need for patient compliance packaging and high spending on healthcare in the U.S. and Canada are also driving the demand for PFS formats in the North American market.

The key driver for growth in the parenteral segment towards tubular glass is the growing complexity of drugs, and a majority is within the biopharma space. This significantly increases the dependency of pharma buyers and package convertors on the consolidated tubular glass players such as Schott, Nipro, Gerresheimer (Corning) who are integrated and manufacture the tubing for vials.

Plastics – Is it a potential alternative to tubular glass?

Plastics were expected to become a strong alternative to tubular glass owing to their durable nature and claims of being resistant to delamination, which was the key reason for the shift in market preference from glass to plastics in parenteral packaging formats. So most of the top players restrained from capacity addition/expansions in the tubular glass segment or glass tubing, and instead, heavily invested on plastic conversion for parenteral use. Companies such as Gerresheimer and Schott started to shift the focus on developing plastic-based parenteral packaging components.

Industry citing: In 2015, Gerresheimer sold its glass tubing business to corning to focus on developing medical devices. In the same year, they bought Centor, one of the largest prescription plastic vials convertor in the U.S.

In the light of the shift from glass to plastic, the latter market started to register 18-20 percent growth in the recent past. However, plastics vials had various challenges such as:

Higher Cost: COC/COP plastic vials are 20-30 percent more costlier than glass vials of the same size and quality

Compatibility Issues: Neutral Glass or Type I Borosilicate glass is neutral/non-reactive to aqueous solution owing to the chemically inert nature of the glass. Whereas plastic, especially polyethylene does not have the intrinsic property

Lack of product innovation to match the complexity of biologic: Growing complexity of drugs, especially new proteins, enzymes and peptide-based biologics that are being developed in the market require chemically stable and non-reactive packaging containers. There is only a minimal number of high quality plastic vials that can withstand the composition of complex drugs

The cost of multilayered COP/COC vials developed to withstand complex biologics is exorbitant

Permeability: According to FDA guidelines on container closure systems for human drugs and biologics, plastic vials, especially LDPE vials are more susceptible to oxygen and water permeation through container surface or diffusion through seal. This can lead to microbial contamination of the drugs leading to potential drug recall

The penetration of plastics in parenteral packaging segment is only minimal (around 10 percent). Given the quality challenges, plastics are not expected to match the rapid demand from the parenteral packaging segment in the near future. Hence, the tubular glass market is expected to remain the dominant raw material for parenteral packaging components.

10 years after the emergence of plastic vials in the market, the penetration has been very minimal contrary to the expectation of the industry. And this has resulted in a scenario where the glass tubing demand has increased rapidly with little or no expansion in Type 1 tubing supply.

Can China be a potential answer for glass tubing lock down in the West? - Emergence of alternative glass tubing convertors in Asia.

Chinese market has never been considered as a potential supplier for glass tubing requirements owing to low quality of the produce in the market.

Borosilicate glass tubing and rod manufacturers in China were largely catering to end use segments such as lighting, solar panels and labware containers. Also, China imported a large number of parenteral containers from the West owing to the immature supply base for packaging convertors and tubing producers in the markets.

However, in the recent past, regional players such as Linuo Glass, Shandong Honhai, Fourstar Glass Co. and Jian GT in China have emerged as potential suppliers for both the regional and international borosilicate glass tubing requirements due to low cost of production and capability to meet industry-level quality certifications, i.e., USP, EP and JP.

In light of developing production and achieving international quality standards of Type I Borosilicate glass, some suppliers have collaborated with leading neutral glass technology providers such as OCMI-OTG, Italy for supply of high-end equipment for glass tubing lines.

Burgeoning sourcing alternative: two-staged sourcing

Sourcing of finished products (vials, ampoules, PFS, etc.) from the Chinese suppliers might not be a feasible option for glass convertors due to stringent quality regulations and trade restrictions. However, procuring the key raw material for tube conversion can be a profitable feat owing to:

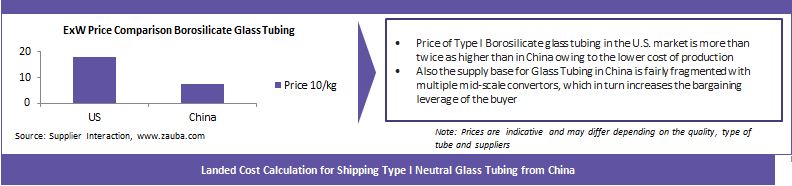

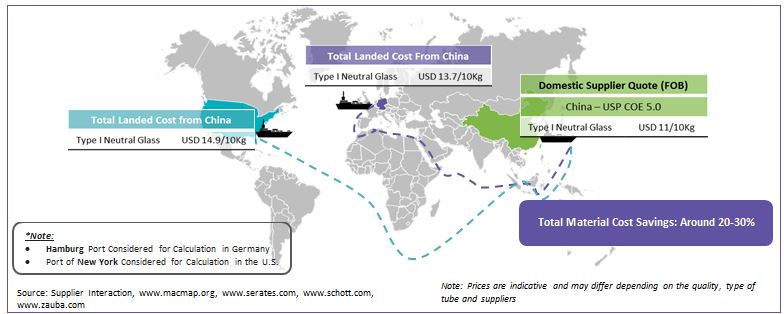

Cost Advantage: Major advantage for the packaging convertors will be the raw material cost. The convertors will be able to cut the raw material cost by about 20-30 percent with the inclusion of Chinese suppliers

Better Leveragability: Large convertors of finished products such as BD, Ompi, Muller & Muller, and Wheaton Science procure large volumes of glass tubing from global leaders (Nipro, Schott, Corning) which gives the buyer marginal bargaining strength against the highly consolidated supply base. Sourcing medical grade glass tubing from Chinese market will significantly improve the buyers negotiability owing to the lower cost and fragmented nature of the supply base

Better Control Over Quality: Sourcing only glass tubing from the Chinese suppliers and filling and forming the glass vials, PFS in-house will help the supplier in maintaining container and ancillary components quality certification to match the regional regulatory requirements on drug device combination

Cost perspective of sourcing glass tubing from China:

Benefits of sourcing glass tubing from China

Larger Supplier Pool: Unlike the West where the local pharmaceutical glass tubing supply is entirely dominated by Schott, Corning and Nipro, China has multiple medium and large scale suppliers who can match the chemical requirements of USP type I neutral glass. Regional suppliers such as Linuo Glass Group, Shandong Honhai, Four Star, and Jinan GT are some of the eminent suppliers who have high-end glass tubing capacities in China. Shandong Honhai has a furnace plan to install a new production line for pharmaceutical grade glass tubing by 2017

Economical Logistics: All the major producers of glass tubing are concentrated around the coastal provinces of Shandong and Jiangsu. Proximity to coastal regions facilitates cheaper and efficient in-land logistics and also facilitates in fetching cheaper freight charges for overseas shipments

Conclusion

Parenteral packaging convertors can gain over 20-30 percent cost saving in the raw material (glass tubing) cost while collaborating with emerging suppliers in the Chinese market. The shift in sourcing from the regional leaders to Chinese suppliers can in turn help the convertors in achieving better bargaining for raw material sourcing and become more competitive against the large integrated companies such as Schott, Gerresheimer and Nipro. Shifting the overall raw material (glass tubing) requirements towards the developing market might not be a suitable option as the market is still in a nascent phase to deliver high quality large contracted volumes. However, as the shift towards two-staged sourcing evolves, the competitiveness of the packaging convertors will grow in tandem. In the long run the market leaders such as Schott, Gerresheimer and Nipro might lose the high leveragability they currently hold, especially in the glass tubing division.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe