Volume-Based Procurement (VBP) - MedTech

The Chinese MedTech market has been growing at a rapid pace over the past decade. This significant growth rate is driven by strong underlying demand, healthcare infrastructure buildup, and supply-side innovations. The objective of volume-based procurement is to provide uniform pricing throughout the nation, increase technological advancements and innovation in China, focus on high-performing medical devices and affordable medical devices for patients, and lower healthcare costs for the government.

Volume-based procurement (VBP) is a set of drug procurement regulations implemented in China with the goal of promoting generic substitutes and lowering the price of medications that have outlived their exclusivity periods. Notably, VBP was rolled out in November 2018 for pharmaceuticals to lower the prices of drugs. Furthermore, China rolled out a VBP policy for medical devices in 2019. Essentially, VBP aims to lower the price of medical consumables by tendering the market volume of cities, provinces, or the country to manufacturers at the lowest price. Moreover, VBP is expected to reduce revenue for medical device companies with an increase in the number of tenders at the provincial and national levels. As a result, medical device suppliers need to be ready for high-price cuts or risk losing their market share gradually.

Developments in China MedTech

|

June 2019 |

|

|

July 2019 |

|

|

January 2020 |

|

|

September 2020 |

|

Timelines for VBP in China till date

|

Parameters |

4+7 Program |

VBP Round 1 |

VBP Round 2 |

VBP Round 3 |

VBP Round 4 |

|---|---|---|---|---|---|

|

Tender date |

2018 |

2019 |

2020 |

2020 |

2021 |

|

Product negotiated |

Twenty-five products (only QCE-passed) |

Drugs included in the 4+7 program |

Thirty-two products (non-NRDL / GQCE-approved drugs) |

Fifty-five products (non-NRDL / GQCE-approved drugs) |

Forty-five products (non-NRDL / GQCE-approved drugs) |

|

Geographical scope |

Four municipalities and seven provinces |

National |

National |

National |

National |

|

Procurement contract duration |

12 months |

≤ 2-bid winners: 1 year 3-bid winners: 2 years |

1 winner: 1 year 2-3 winners: 2 years ≥ 4 winners: 3 years |

1 or 2 winners: 1 year 3 winners: 2 years ≥ 4 winners: 3 years |

1 or 2 winners: 1 year 3 winners: 2 years ≥ 4 winners: 3 years |

In China, VBP is based on the principle of group purchasing organizations (GPOs). A GPO is the result of efforts made by medical facilities to reduce expenses and encourage precise administration. Notably, GPOs are primarily involved in supply chain management and competitive bidding for the purchase of drugs, hence enabling better service delivery through economies of scale and enhanced negotiating power. Drug producers, distributors, retail pharmacies, bidding and procurement organizations, health insurance organizations, public hospitals, physicians, and patients are some of the stakeholders in VBP and drug supply chain. The following five major stakeholders were recognized in this investigation based on the availability of documentary evidence: pharmaceutical firms, public hospitals, doctors, and patients, as well as health insurance management organizations.

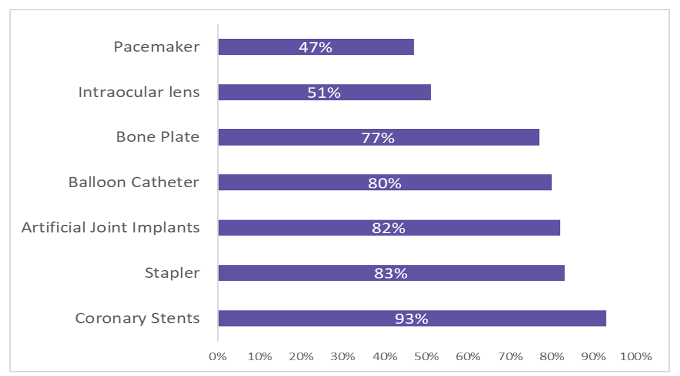

Impact on Major Medical Devices – Average Price Cuts and Range

-

The top 10 high-value medical consumable companies have all undergone VBP tenders at the provincial level, with median publicly reported price cuts of approximately 70%.

-

With the expected reduced revenue and margins among legacy products, medical device companies can focus on new state-of-the-art medical technologies.

Price cut for high-value consumable VBP

China's market for high-end medical devices is shaken by volume-based buying

The VBP of high-value medical consumables has been conducted in China since 2020. In 2022, there will be a constant increase in the number of devices on the federal or provincial VBP lists. A major VBP project, which began in 2021, was the national procurement of hip and knee implants. Trauma fixation devices and spinal implants are on the national procurement list in 2022.

Various parameters are considered to ensure that better products at reasonable prices are used clinically. For instance, medical device products were categorized into two groups based on hospital demand, manufacturer capability, and raw materials in the national procurement of hip and knee implants.

With the help of the VBP policy, there was a sharp decrease in the prices of medical devices. The average selling price of a total knee replacement system was $5,000 before VBP. As the price of knee implants has dropped to much less than $800 on average, few patients who have been hesitant to undergo surgical treatment due to economic constraints are now capable of undergoing the procedure.

Domestic competition in China has drastically increased over the past few years. For instance, the drug-eluting stent market was dominated by major Western device manufacturers, with a 75% market share. A few years later, domestic Chinese stent-makers accounted for over 75% of the market share.

Winning companies need not spend a lot of money on marketing or administrative costs if they win a bid through VBP, and a lower winning price reduces the overall profit.

How can foreign medical devices companies succeed in China?

The Chinese market can be achieved by focusing on selling unique medical devices, and there is a need for unique products that would solve this problem and address the current need. The reimbursements are still relatively good, and VBP will not drop prices, but it can still generate significant sales.

Western companies and brands are always considered to be of higher quality than domestically produced products and are favored by Chinese patients if the prices are reasonable. Other strategies for success in China include licensing or selling technology, as there is more Chinese capital today. Another factor for improvement, although still insignificant, is better intellectual property rights protection in China. Western companies also manufacture more of their products in China, and this can bring the company closer to customers, in a few cases, easier registration and lower production costs.

VBP Impact Mitigation Strategies

Medical technology portfolio expansion

- VBP has negatively impacted commoditized products, and Medtronic could focus on the pre-launch registration and post-launch commercialization of innovative medical devices in pipeline.

Increase in portfolio synergy

- Companies have taken multiple steps, such as combining primary care portfolios across therapeutic areas. Other companies combined specialty and primary care teams and reduced headcount by 40% through transfers and rationalization.

Redesign distribution channels

-

Medtronic can consider consolidating distributor layers, as VBP is expected to reduce margins.

-

Distributor would focus more on logistics in such a scenario.

Changes in customer engagement

-

Procurement decisions are expected to shift from individual clinician decision-making to hospital administrators making portfolio decisions.

-

Medtronic can consider developing talent and commercial organizations to support portfolio- and account-level management strategies.

Increase in remote engagement

-

The impact of VBP will be felt gradually at the category and provincial levels, and not overnight.

-

On a case-to-case basis, investment tradeoffs can be made in tail-end hospitals and remote cities.

Conclusion

The Chinese medical device market still offers foreign companies many profit opportunities. Foreign companies are increasing exports or setting up manufacturing operations and/or joint ventures to manufacture products in China for the Chinese market. However, foreign device manufacturers must understand that domestic Chinese medical device manufacturers are becoming increasingly sophisticated. It also causes competition among Western product manufacturers in the Western market. Medical device companies can look at increasing localizing operations in multiple ways, such as technology licensing, partnerships, OEMs, R&D, and so on, which could help improve their position over the long term in China and mitigate revenue losses owing to VBP.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe