PFAS (Forever Chemicals) – Where the future is headed?

PFAS Types and End-Use Applications

-

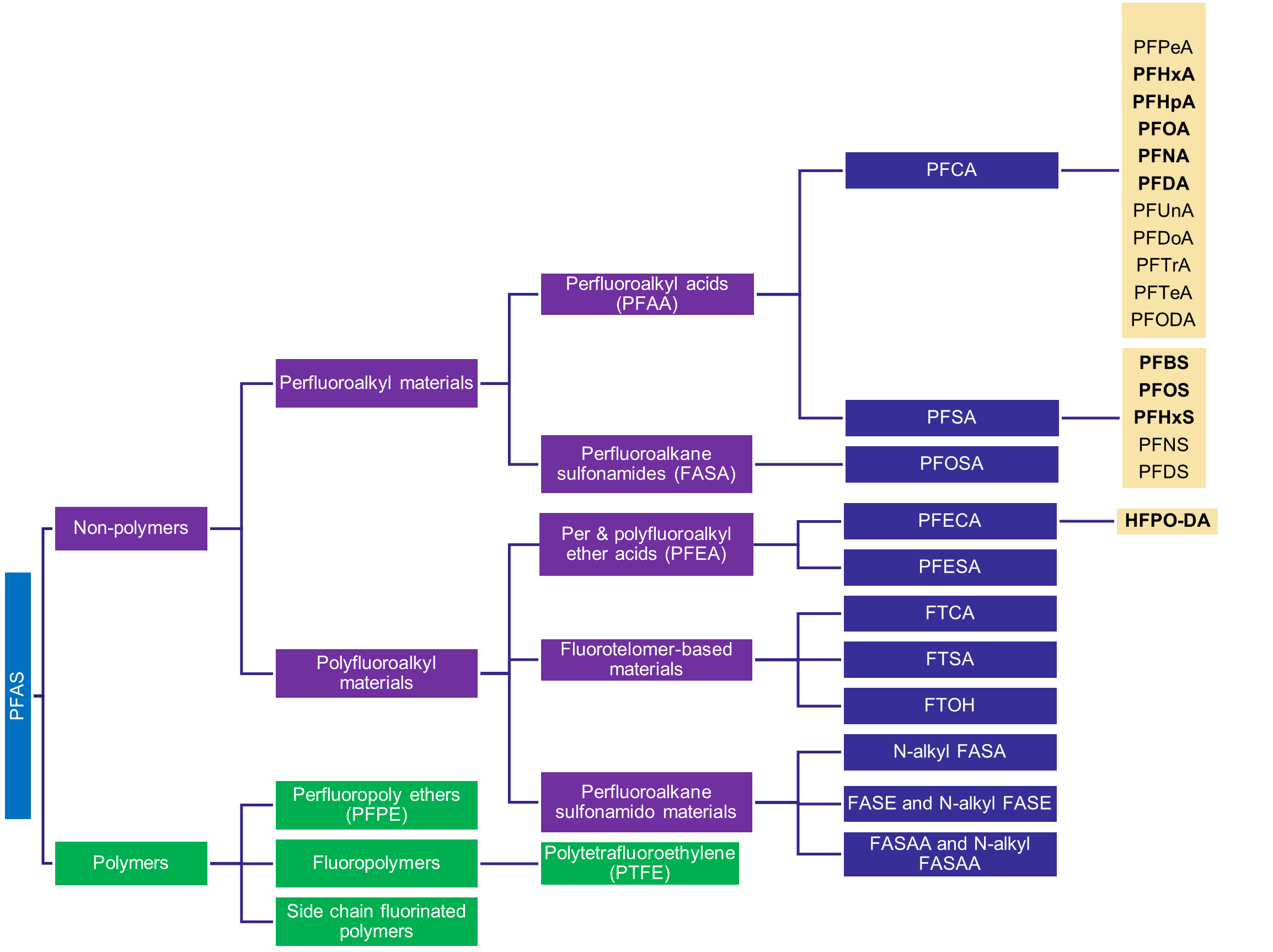

PFAS are a group of synthetically derived chemicals used across a wide range of consumer goods. There are over 9,000 chemicals that are considered PFAS. The US FDA also recognizes that some PFAS are intentionally added and some are present unintentionally “as the result of raw material impurities or due to the breakdown of PFAS ingredients that form other types of PFAS”

-

PFAS likely to be highly impacted are PFOA and PFOS, along with their salts and isomers, as EPA has included them under the Superfund Act requiring the stakeholders to ensure a transparent listing and accountable for clearing the contamination to the environment

-

During mid-March 2023, the EPA announced NPDWR, including six PFAS, PFOA, PFOS, PFNA, HFPO-DA/ GenX, PFHxS, and PFBS. The regulation is expected to be finalized by the end of 2023

Classification of PFAS

Note 1: The PFAS classification listed above does not include all the PFAS chemicals, as the intent is to illustrate the supply chain of the high-impact PFAS as per the status of the EPA regulations.

Note 2: PFAS highlighted in bold are likely to be impacted by the regulations.

Sources: News Articles, EPA Website, Industry Reports, and Beroe Analysis

End-Use Applications

-

PFAS are used across a diverse range of end-use applications as below:

End-Use Applications of PFAS

Impact of PFAS Usage on the Environment

-

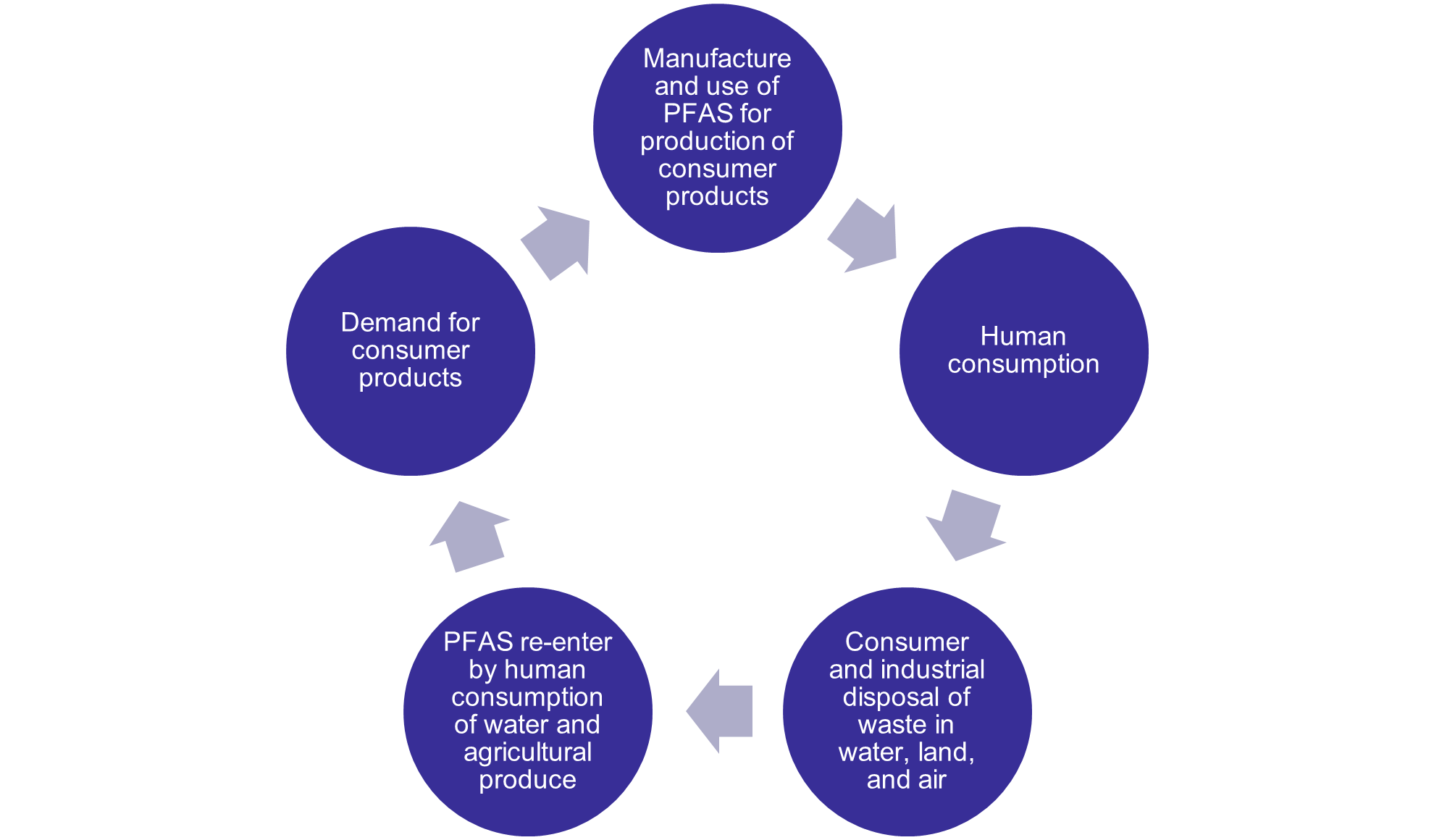

PFAS are considered “forever chemicals”, as they do not readily breakdown and end up in various landforms, like land, water, and air-posing health risks for humans

-

Usage of PFAS in a variety of consumer products, like teflon-coated cookware, food packaging, clothing, cosmetics, electronics, and cleaning products, supports the forever presence of PFAS in the household, leading to increased health risks

Sources: News Articles, Industry Reports, and Beroe Analysis

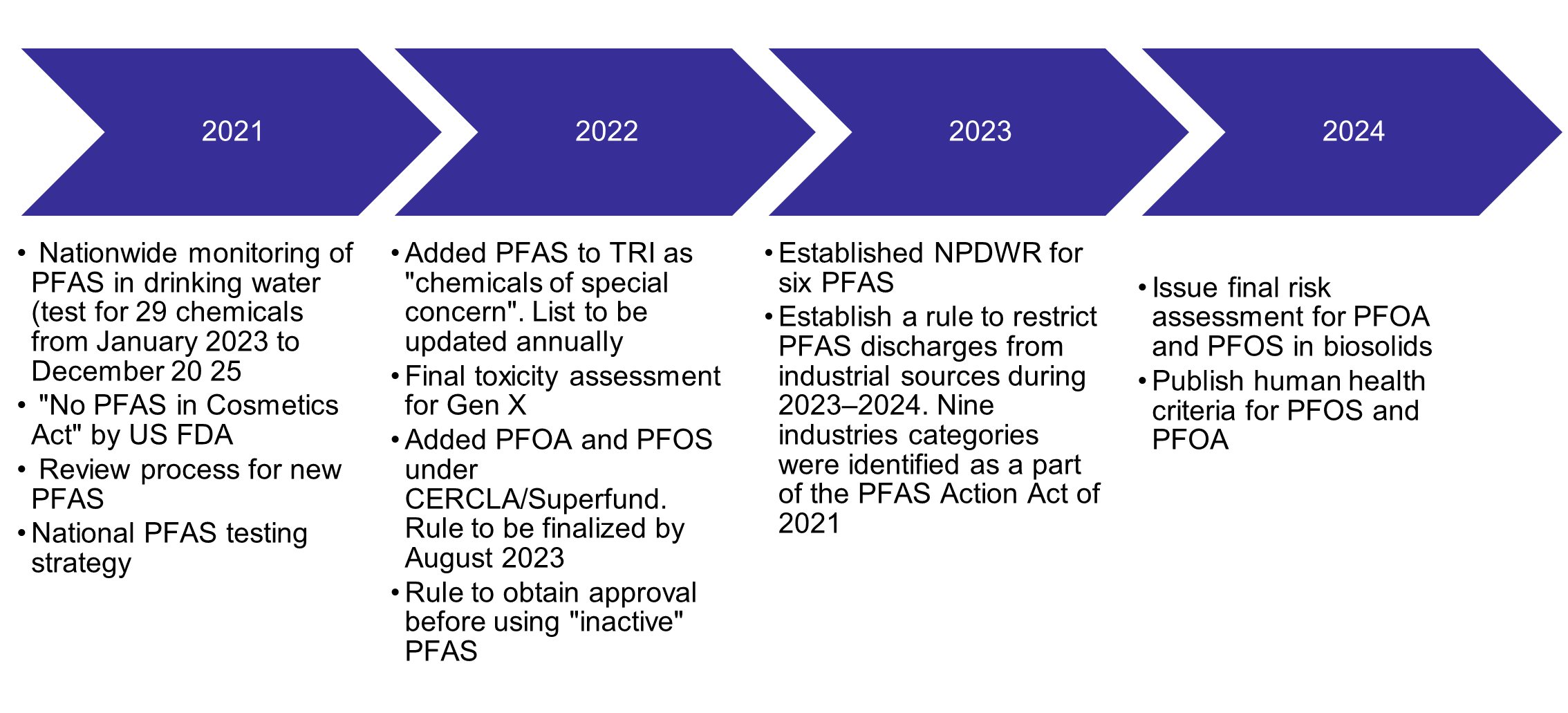

Recent Developments on PFAS Regulations

-

Increasing concerns about the health risks associated with PFAS exposure have led to regulators across all the major geographies, analyzing the facts, and conducting several tests to enact appropriate regulations proactively to protect the environment from PFAS contamination

-

The major constraints to impose immediate regulations are:

– Wide usage

– Large number of chemicals to be reviewed

– Unintentional presence of PFAS that may have formed by reacting with other chemicals in the formulation

– Lack of transparent listing by the manufacturers

-

A proposal to restrict the usage of about 1,000 PFAS to reduce PFAS environmental emissions was submitted to the ECHA by Germany, Denmark, the Netherlands, Sweden, and Norway in mid-January 2023. The ECHA would evaluate the proposal during 2023 and send their opinions to the EU to formulate appropriate regulations

-

Several states in the US have passed bills in their assembly to ban the intentional use of PFAS in consumer products enabling phasing out PFAS by 2030

– For instance, Maine has banned the sale of new products with intentionally added PFAS, except if the use is unavoidable, which has to be reported. Ban of textile products, like carpets and rugs, is effective from January 2023 and other products from January 2030 with recommended phased-out approach.

-

The key end-use applications prioritized for the ban of intentionally added PFAS are:

– Food packaging

– Cosmetics

– Children products

– Household textiles, like carpets and rugs

– Firefighting foams (non-consumer use)

Key Timeline of Actions on PFAS Regulations by the EPA (2021–2024)

Note 1: Only the key PFAS regulations are listed above to suit the scope of this article and the information provided is not exhaustive.

Sources: News Articles, EPA Website, Industry Reports, and Beroe Analysis

Mapping of PFAS by End-Use Industry

-

Mapping the PFAS chemicals to their end-use industry is challenging, due to vast number of PFAS chemicals, which are present both intentionally and unintentionally, leading to limited transparent listing by the industry participants

-

On a best-effort basis, we have mapped the PFAS to their industrial use, based on reports published by the EPA on the PFAS found in the wastewater concentrations of the industry manufacturers and formulators

-

Below is the definition of industry classification:

– Chemicals: Manufacturers of PFAS and manufacturers who use PFAS in the production of resins, plastics, rubber, synthetic polymers (teflon/PTFE), protective coatings, cleaning agents, carpet cleaners, and other basic & specialty chemicals

– Paper & Packaging: Manufacturers who produce paper, pulp, paperboard, and cellulose-based products from wood using PFAS to provide water/stain/grease-resistant products used in food packaging and other products, including recycled paper-based products

– Metals: Manufacturers who undertake electroplating, anodizing, electroless plating, coating, PCB manufacturing, etching, and milling. PFAS is majorly used as appearance enhancers, wetting agents, metal fumes suppressants, and corrosion inhibitors

– Textiles: Manufacturers various textile products, like yarns, threads, and carpets using PFAS for water/heat/grease resistance for carpets, outdoor clothing, and household textiles

– Cosmetics & Personal Care: Manufacturers of cosmetics & personal care products using PFAS as surfactants/emulsifiers/film-forming agents/texture enhancers majorly in water-based formulations, skin care creams, sunscreens, and hair conditioners.

Potential Mapping of PFAS by End-Use Industry Based on Wastewater Concentrations

| PFAS Group | PFAS Chemical | PFAS Chemical Name | End-Use Industry | ||||

| Chemicals | Paper & Packaging | Metals | Textiles | Cosmetics & Personal Care | |||

| PFCA | PFOA | Perfluorooctanoic acid |  |

|

|

|

|

| PFBA | Perfluorobutanoic acid |  |

|

|

|

|

|

| PFPeA | Perfluoropentanoic acid |  |

|

|

|

|

|

| PFHxA | Perfluorohexanoic acid |  |

|

|

|

|

|

| PFHpA | Perfluoroheptanoic acid |  |

|

|

|

|

|

| APFO | Ammonium perfluorooctanoate (ammonium salt of PFOA) |  |

|

|

|

|

|

| PFNA | Perfluorononanoic acid |  |

|

|

|

|

|

| PFDA | Perfluorodecanoic acid |  |

|

|

|

|

|

| PFUnA | Perfluoroundecanoic acid |  |

|

|

|

|

|

| PFDoA | Perfluorododecanoic acid |  |

|

|

|

|

|

| PFTrA | Perfluorotridecanoic acid |  |

|

|

|

|

|

| PFTeA | Perfluorotetradecanoic acid |  |

|

|

|

|

|

| PFHxDA | Perfluorohexadecanoic acid |  |

|

|

|

|

|

| PFODA | Perfluorooctadecanoic acid |  |

|

|

|

|

|

| PFSA | PFOS | Perfluorooctane sulfonic acid |  |

|

|

|

|

| PFPeS | Perfluoropentane sulfonic acid |  |

|

|

|

|

|

| PFHxS | Perfluorohexane sulfonic acid |  |

|

|

|

|

|

| PFHpS | Perfluoroheptane sulfonic acid |  |

|

|

|

|

|

| PFNS | Perfluorononane sulfonic acid |  |

|

|

|

|

|

| PFDS | Perfluorodecane sulfonic acid |  |

|

|

|

|

|

| FASA | PFOSA | Perfluorooctane sulfonamide |  |

|

|

|

|

| FTSA | 4:2 FTSA | 4:2 fluorotelomer sulfonic acid |  |

|

|

|

|

| 6:2 FTSA | 6:2 fluorotelomer sulfonic acid |  |

|

|

|

|

|

| 8:2 FTSA | 8:2 fluorotelomer sulfonic acid |  |

|

|

|

|

|

| N-Alkyl FASA | NMePFOSA | N-methyl perfluorooctane sulfonamide |  |

|

|

|

|

| NEtPFOSA | N-ethyl perfluorooctane sulfonamide |  |

|

|

|

|

|

| FASE and N-Alkyl FASE | NMeFOSE | N-methyl perfluorooctane sulfonamido ethanol |  |

|

|

|

|

| NEtFOSE | N-ethyl perfluorooctane sulfonamido ethanol |  |

|

|

|

|

|

| FASAA and N-Alkyl FASAA | NMeFOSAA | N-methyl perfluorooctane sulfonamido acetic acid |  |

|

|

|

|

| NEtFOSAA | N-ethyl perfluorooctane sulfonamido acetic acid |  |

|

|

|

|

|

| PFECA | HFPO-DA | Hexafluoropropylene oxide dimer acid, chemical used in the GenX fluoropolymer processing aid technology |  |

|

|

|

|

| NaDONA | Sodium dodecafluoro-3H-4, 8-dioxanonanoate |  |

|

|

|

|

|

| PMPA | Perfluoromethoxypropyl carboxylic acid |  |

|

|

|

|

|

| PFMOAA | Perfluoro-2-methoxyacetic acid |  |

|

|

|

|

|

| NFDHA | Perfluoro-3,6-dioxaheptanoic acid |  |

|

|

|

|

|

| PFO2HxA | Perfluoro-3,5-dioxahexanoic acid |  |

|

|

|

|

|

| PFO3OA | Perfluoro-3,5,7-trioxaoctanoic acid |  |

|

|

|

|

|

| PFO4DA | Perfluoro-3,5,7,9-tetraoxadecanoic acid |  |

|

|

|

|

|

| PFO5DA | Perfluoro-3,5,7,9,11-pentaoxadodecanoic acid |  |

|

|

|

|

|

| PFECA-G | Perfluoro-4-isopropoxybutanoic acid |  |

|

|

|

|

|

| PFESA | K-9Cl-PF3ONS | Potassium 9-chlorohexadecafluoro-3-oxanonane-1-sulfonate (potassium salt of F-53B major) |  |

|

|

|

|

| K-11Cl-PF3OUdS | Potassium 11-chloroeicosafluoro-3-oxaundecane-1-sulfonate (potassium salt of F-53B minor) |  |

|

|

|

|

|

| PFESA-BP1 | Perfluoro-3,6-dioxa-4-methyl-7-octene-1-sulfonic acid |  |

|

|

|

|

|

| PFESA-BP2 | Perfluoro-2-{[perfluoro-3-(perfluoroethoxy)-2-propanyl]oxy}ethane sulfonic acid |  |

|

|

|

|

|

| Fluoropolymers | PTFE | Polytetrafluoroethylene |  |

|

|

|

|

Sources: News Articles, EPA Website, Industry Reports, and Beroe Analysis

Impact to the Chemicals Industry

-

The major impact to the end-use industries, such as chemicals, is expected to be moderate–high, especially for chemical producers who are heavily reliant on PFAS in product formulations

Key Risks/Impact Factors

|

Key Impact Factors |

Impact Level |

Comments |

|---|---|---|

|

Increased waste management cost |

|

Increase in cost, due to adaptation of innovative technologies for wastewater management to avoid discharge of PFAS. |

|

Increase in regulatory cost/transparent labeling |

|

Increase in regulatory cost, especially for manufacturers of PFAS and end-use industries who intentionally add PFAS for formulation purposes to adhere to the revised reporting mandates of transparent labeling and increase in the frequency of reporting. Small–medium scale companies are anticipated to incur significant costs with about $850–900 million estimated for one-time reporting. |

|

Reduced imports |

|

Reduction of imports of both end products and feedstock, especially from China, which is one of the major production hubs for large-scale manufacturing of PFAS, included consumer products. |

|

Identification of alternatives/ increased R&D spend |

|

Increase in R&D spend, as the industry participants would be forced to evaluate the entire supply chain and identify alternatives for chemicals involving PFAS in the production process. |

|

Supply disruptions/increased lead times |

|

Potential changes in the product formulation and manufacturing process to limit PFAS discharge levels within the revised stringent threshold limits would lead to improved cost and temporary supply disruption with an increase in lead times. |

|

New supplier evaluation |

|

New supplier evaluation may incur additional costs if the raw material suppliers have facilities manufacturing PFAS and do not have appropriate wastewater and land disposal management techniques. |

Source: Beroe Analysis

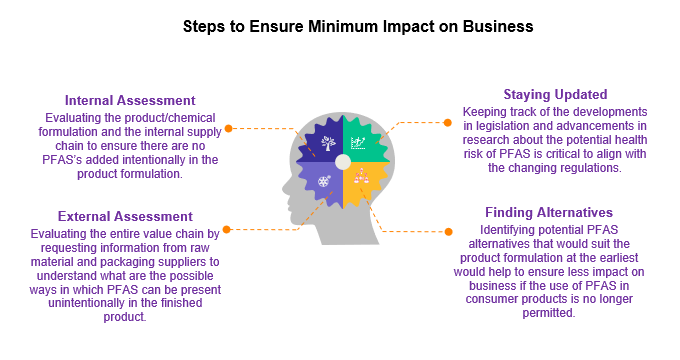

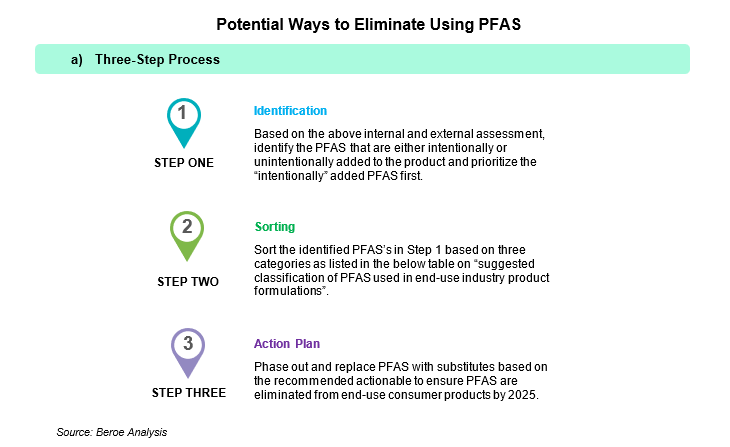

Recommended Steps to Ensure Minimum Impact on Business

-

EPA’s major objective in the long term is to restrict the PFAS before they are released into the environment and clean-up the contamination already caused

-

Phasing out the use of PFAS in consumer products and eliminating its use before 2025 completely, either by substitution or re-formulation is the key to ensure no major disruption to the business if a ban is imposed

b). Suggested Classification of PFAS Used in End-Use Industry Product Formulations

|

|

Substitutes Available |

Must-Have & Not Substitutable |

Good-to-Have & Not Substitutable |

|---|---|---|---|

|

Classification Description |

The PFAS used is essential to the formulation and there are viable substitutes that can perform an equivalent function. |

The PFAS used is essential to the formulation and there are no substitutes available. |

The PFAS used is not an important part of the formulation and there are no substitutes available. |

|

Recommended Long-Term Approach |

PFAS used can be substituted in a phased-out approach and completely replaced by the substitute before 2025. |

Identification or development of a suitable substitute and completely replace the PFAS before 2025. |

PFAS used can be removed from the formulation in a phased-out approach and eliminated completely before 2025. |

|

Recommended Actionable |

Identification of substitute suppliers. |

a) Check with current raw material suppliers if a substitute can be developed. b) Invest in R&D for the development of the substitute. |

Changes to formulation if needed. |

Potential Substitutes for PFAS

-

A trend of end-use industries replacing long-chain PFAS with short-chain PFAS is observed as short-chain PFAS are considered to take a shorter time to breakdown in the environment, supported by the advantage that both short and long-chain PFAS can be manufactured in the same facility. However, it is observed that some short-chain PFAS are also present in the environment as outlined by the EPA on PFAS present in wastewater concentrations of the end-use industries. Hence, non-fluorinated alternatives can be considered as better substitutes for PFAS compared to short-chain PFAS

-

Case Study: 3M exiting PFAS

– 3M had replaced PFOS used in the manufacture of its Scotchgard brand stain repellent with a short-chain alternative PFBS since mid-2003. However, PFBS is listed in EPA’s TRI list in 2022 as a chemical of special concern

– 3M announced in December 2022 that the company would stop production of PFAS and would phase out the use of PFAS across its entire product portfolio by 2025, owing to regulatory concerns and anticipated customer disinterest in using PFAS-based products

-

Some of the potential substitutes for PFAS are listed below:

|

End-Use Application |

Potential Substitutes for PFAS |

|---|---|

|

Food packaging |

Polylactic acid-derived from corn, seaweed-coated boxes, palm leaf, sugarcane, bamboo-based fibers |

|

Non-stick cookware |

Ceramic coatings, silicon-based coatings, carbon steel |

|

Textiles (carpets, water-resistant clothing) |

Nylon, paraffin wax, chitosan |

|

Cosmetics & personal care |

Silicones, bio-based surfactants, emulsifiers, emollients |

Conclusion

A clear trend of regulations aiming at restricting or phasing out the usage of PFAS during the next five years is observed. The continued use of PFAS by the end-use industries is most likely to increase the overall cost of the industry participants, due to upcoming regulations requiring frequent reporting standards, adoption of new technologies for wastewater treatment, and remediation of contaminated sources. This increase in cost would hamper the profit margins. Hence, it is recommended that consumer end-use industries adopt a strategy to identify potential alternatives for PFAS used in their product portfolio and aim to eliminate its use in a phased-out approach. Reducing or eliminating the use of PFAS would be the key to combat the implications of the increasing regulatory standards.

Moving away from these “forever chemicals” is also expected to support the long-term sustainability goals of the end-use consumer applications industry participants. This move would also contribute to better brand positioning, as the consumer purchasing pattern is also highly likely to be in favor of “PFAS-free” products.

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe