Going green or Going Cheap – the Protein Market Conundrum

The world will need to prepare its resources to feed nearly 9.8 billion people by the year 2050, while land and water resources will largely remain constant – there is no doubt that alternative proteins have taken the center stage of the sustainability theme. There are increasing fund flows in relation to climate-smart technology, renewable energy, and electric vehicle investments, all of which are directed to mitigate climate change and its negative effects. Each of these industries apparently obscures an alternative protein segment. Over the past decade, alternative proteins have captured the market buzz, with many firms investing in R&D for the future protein market. However, at the current stage of development, are we looking at both cheaper protein alternatives and climate-friendly alternatives, or each of them individually? The question requires a deep dive into the market and the choices available to the consumers.

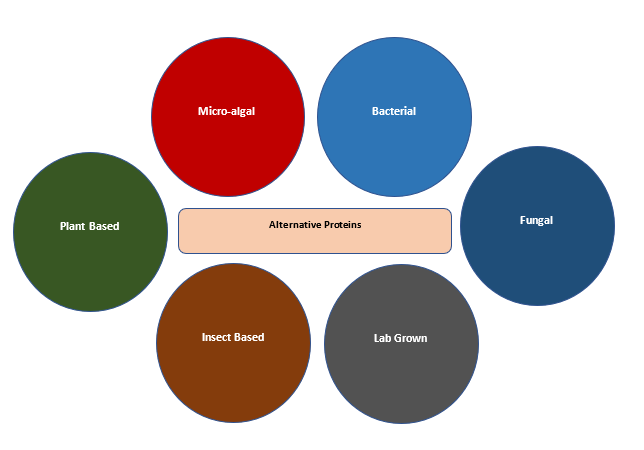

The term “alternative protein” may be used to describe any food technology-based protein alternative to the conventional proteins available in the market. Compared to the conventional proteins, alternative proteins require fewer inputs and generate fewer Greenhouse Gases (GHGs).

A few of these categories are currently available to consumers, including plant-based and fermentation-derived proteins. Cultivated meats are still being tested for taste, quality, and protein absorption by the human gut, among many other assessments.

Growth prospects for alternative proteins

Market Size and Growth

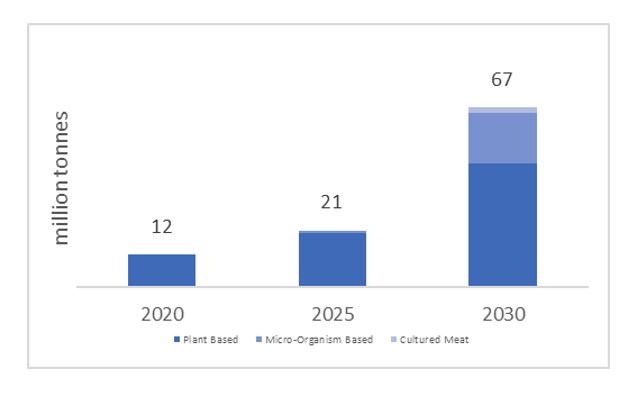

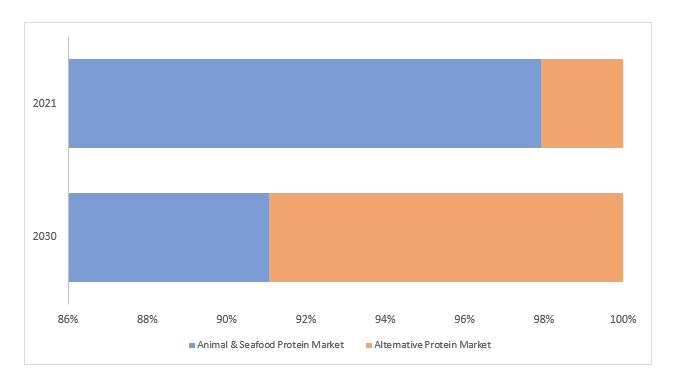

The researchers believe that nearly 12 million tons of alternative proteins found their way to individuals’ regular diet in the year 2021, which represents 2 percent of the global animal and seafood protein market. As the acceptance of alternative proteins is projected to increase, the share of new protein formulations could improve to 9 percent by the year 2030. With further regulatory stimulus and technological advancement, this share could even rise to a sixth of the global protein market in the same period, with a CAGR of nearly 35 percent, and a prospective market size of approximately $200 billion.

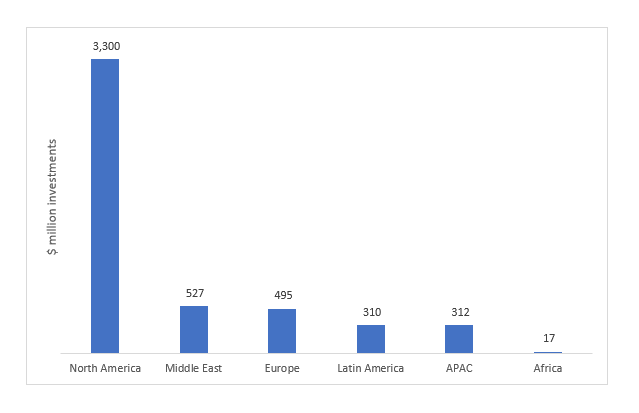

Nearly $4.9 billion worth of investment is said to have been infused into the alternative protein market in the year 2021 alone. The APAC region has witnessed a surge in investments, with a double-digit rise in investments on a yearly basis. A recent study concluded that consumers aged between 18 and 44 years are most likely to be attracted to alternative protein products, citing health, animal welfare, and sustainability. With a considerably young population in Asia as compared to the EU or the U.S., the demand is expected to register a marked growth in APAC.

Share of Alternative Proteins in Global Proteins Market

The shift to the alternative protein market is regarded as major progress in achieving the UN’s Sustainable Development Goals (SDGs). The effort to produce animal proteins is too taxing in the environment. Any study on the annual global emissions would underline how the food industries involving beef, dairy, pork, and chicken continue to contribute to a major share of GHG emissions. An increasing number of consumers are willing to try and test alternative proteins because they believe that the protein thus served is free of antibiotics and is planet-friendly.

However, despite being packed in proteins, consumers are still hesitant about the taste, texture, and accessibility of alternative proteins. Meanwhile, another debate progresses on the dietary protein quality-amino acid composition, protein digestibility, and availability, which the researchers will attempt to address on a different occasion. Other consumers mentioned that lectins and phytates in plants reduce protein digestibility.

Price, Market Preparedness and Consumer Acceptance

While nutritionists still demand more technological progress to ensure that the plant proteins and lab-cultured meats are at par with the conventional proteins, an increasing number of consumers across the globe are willing to try and test the new protein available in the supermarket shelves. Alternative proteins are required to achieve congruence with conventional proteins in three key areas, namely:

-

Taste: Alternative proteins should mimic the taste of conventional proteins such as beef, poultry, eggs, or pork. While research is underway to bring them closer to conventional proteins in terms of taste, consumers are still skeptical about the uniformity and consistency of each repeat purchase.

-

Texture: Visual stimuli plays a major role in the adoption of alternative proteins. As the advertisement goes, one eats by their eyes first; hence, the texture of the protein is of paramount importance. The fibrous texture of meat and the flaxy appearance of fish should be replicated in alternative proteins. Certain complex meat products, such as steak, are difficult to mimic in terms of their texture and taste.

-

Price: Price parity with conventional proteins is one of the most debated aspects that many producers are striving to achieve. Conventional proteins with the current large-scale manufacturing (as in the case of poultry) make it difficult for researched, lab-based, and tech-intensive proteins to be developed at a cheaper cost than conventional ones.

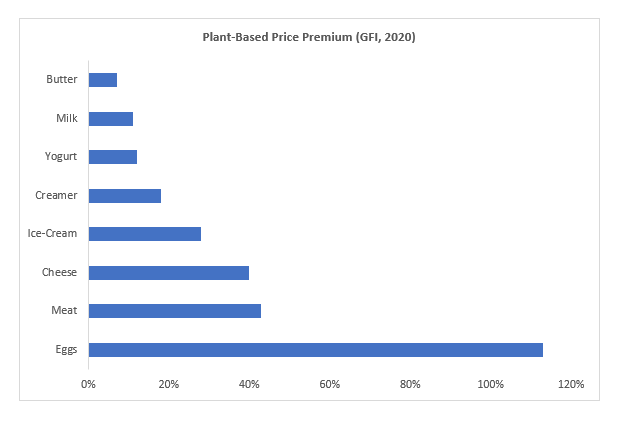

Undoubtedly, many consumers prioritize taste and price as the two key differentiators when choosing which alternative protein to purchase. The price premium for plant-based proteins versus their animal counterparts is depicted here. An increasing number of alternative protein manufacturers are striving to achieve price parity so that it helps reach out to conventional protein consumers as well. It is a continuous battle between the established animal protein market and the alternative protein market that is forging its way.

The alternative protein market requires large infrastructural investments in the race to parity. In addition to price, the taste and availability of appetizing options also play key roles in defining the acceptance of alternative proteins. Advancements in price parity can be achieved when:

-

Production costs of alternative proteins are reduced

-

The production costs of conventional proteins increase due to the market impact – high input costs, rise in labor costs, forage depletion, supply chain issues, as well as diseases, among others.

While conventional proteins have seen an increase in production costs, those pertaining to alternative proteins have not seen a fair decline.

The researchers believe that production costs will decrease as manufacturing operations scale and become more efficient. However, based on the regulatory support it receives across various nations, the timelines for achieving price parity might vary. In addition, there could be considerable R&D costs and IP rights involved, which could keep the prices at a premium when compared to conventional meat. Nevertheless, in this race for the novel protein market, most brands are likely to attain price parity by the year 2025 for plant- and fermentation-based proteins, while that for cell-cultured proteins might be even longer.

The benefits of alternative proteins are clear, and their acceptance among consumers is bound to rise as fears are alleviated.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe