Inflation trends on Forklift Equipment and Forklift Maintenance Services- South Africa

The global economy has taken a hit due to the ongoing war situation between Russia and Ukraine. The African MHE Market predominately depends on imports of both equipment and spares. Top manufacturing countries such as Germany, Italy, and the UK are relying on Russian gas and commodities for their equipment manufacturing, which they then export to the African continent.

Market Overview- South African Forklift Market

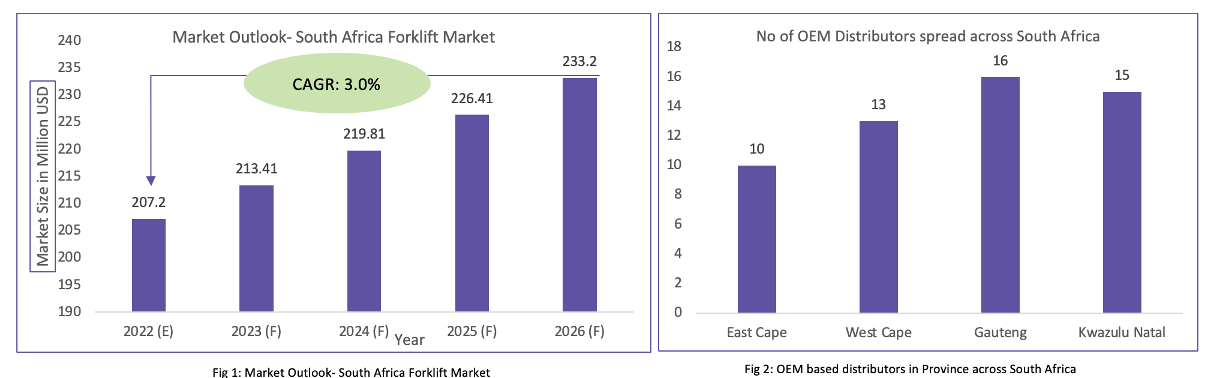

South African lifting equipment market size is estimated to be at $207 million in 2022 and expected to grow at a CAGR of 3 percent until 2026, as per Beroe estimate. The forecasted market size in 2026 is expected to be at $233 Million. The manufacturing sectors such as Food & Beverage, Steel and Metal Working, and Plastics are expected to drive the South African Forklift market during the forecasted period.

There are around 2500 food and beverages companies in the region, which include some of the Fortune 500 companies as well, which require Forklifts for their day to day operations. Mining industry demand for forklift is also expected to increase as there are around 100+ mines in the region, of which 39% are Platinum, 21% Coal, 20% Gold and 20% comprises of various others commodities .

Most of the Global OEMs do not have direct manufacturing facilities across South Africa -- in turn, goods are distributed through the authorised distributors spread across South Africa. The market is consolidated amongst 5 players namely Caterpillar, Clark, Heli, TCM, and LiuGong, due to their presence in majority of the provinces (through their authorised distributors).

The prime focus of the OEMs is to become one-stop-supplier for intelligent automated supply chain solutions. Electric walk-in (Class I) warehouse forklift is the main type used in warehousing operations with a share of about 60%. Also Warehouse forklift segment is expected to witness substantial market growth over the period 2022-2028. Some dealers like Kempston Material Handling equipment are providing refurbished forklifts on rental basis along with maintenance support.

Cost Structure on Forklifts and the inflation trends affecting the cost structure

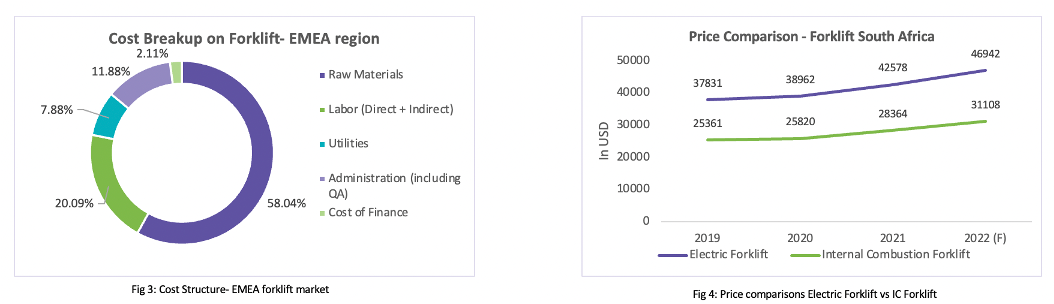

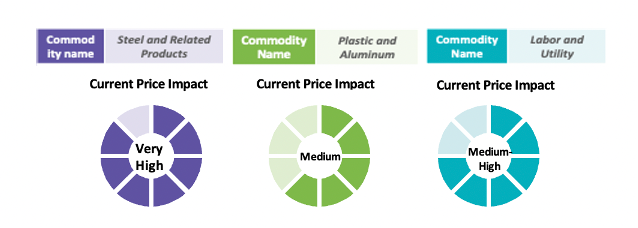

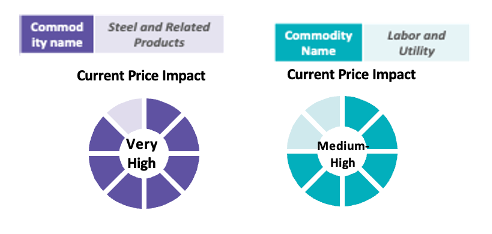

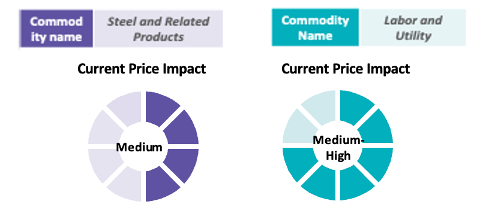

Commodity price increase such as prices of steel, petrol/plastics, iron, aluminum and all similar material/commodity prices have increased with an average of 74% in the region (as of Q1-2022 vs YAGO). Current price levels for commodities are considered as too high, and there is a sign of correction and downward price trend expected to come during Q4-2022.

Energy/utility prices has similar upward trend since Q3-2020. In the South African market, utility prices witnessed a 6.5% price increase in the last 12 months.

There would be no more significant price increase expected for the forklift/MHE category as the commodity prices are expected to be stabilized in the Q4 2022 and Q1 2023. Progress of Russia- Ukraine shall possess some uncertainty in global commodity prices. Other elements such as labor wages and other cost drivers (utilities, rents, insurance fees, etc.) are expected to increase which might have a slight impact on the overall cost structure of the forklifts.

|

Major Category Updates regarding inflation |

Level of Impact on Category Inflation expected 2023 |

|

Commodity price of steel, petrol/plastics, iron, aluminium and all similar material/commodity prices have increased with an average of 74% in the region (Y-o-Y, Q1 2021-2022). Current price levels for commodities are considered as too high, but there is a sign of stability in prices in later part of Q4 2022 and Q1 2023. however, the progress of Russia- Ukraine war will possess some uncertainty |

|

|

Labor shortages: South Africa is experiencing a shortage in skilled labor for the manufacturing sector, operation and maintenance services of forklift. This supply shortage is causing an additional wage hike which is expected to impact the overall cost index of forklift in 2023 as well |

|

Cost Structure of Forklifts spares/ MRO and the inflation trends affecting it

|

Major Indictors likely to Impact Category |

Level of Impact on Category Inflation 2023 |

|

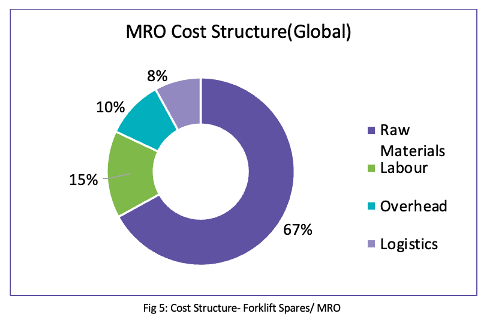

The Purchasing Manufacturing Index(PMI) in South Africa based on ABSA showed a rise to 54.8 in May 2022 from 50.7 in April 2022. A PMI indictor of >50 suggests expansion in the manufacturing sector in the country. This is expected to drive MRO Category demand moving forward. However, considering Supply challenges this scenario is expected to inflate prices. |

|

|

Labour Costs have been found to increase as per indictors which stood at 172.30 points in Q3 2021 as compared to Q2 2021 165.10 points. This trend is expected to continue due to anticipation of high attritions levels and decrease in productivity which is expected to affect Supply. Since Labour is the 2nd key driver of MRO cost a higher impact is expected. |

|

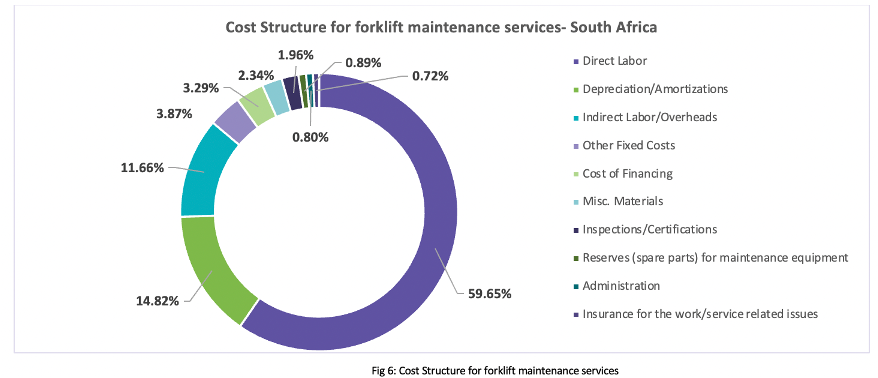

Cost Structure of Forklifts maintenance services and the inflation trends affecting it

The top 3 cost drivers for the forklift maintenance services are direct labor, depreciation of service equipment and indirect labor which all collectively makes around 84% of the total costs. Due to an average 10% increase in the direct labor costs, 24% increase in the depreciations and 6% increase in the cost of indirect labor, and overall cost increase of 15.4% is seen for the forklift maintenance services in the last 12 months (Q2-2022 vs YAGO).

|

Major Indictors likely to Impact Category |

Level of Impact on Category Inflation 2023 |

|

Lack of skilled (technical labor), due to increase in the automotive industry in the country. Technically skilled labor is able to find more jobs, therefore asking for more salary and compensation. This situation is increasing the costs of technical labor and causing shortages for the buyers. This situation is resulting in less number of headcount for engineering/in-house maintenance teams. So, external maintenance service is increasingly becoming an option, as the buyers prefer to focus on their core activities rather than searching/employing technical service teams |

|

|

The increase of rental services is also driving the demand for the maintenance services, as rental companies tend to focus on purely renting the equipment and acquiring technical services from specialized companies, in order to reduce their in-house fixed costs (less number of employed technical service team, less investment in service equipment and less workshop space etc.) |

|

Key Takeaway and Mitigation Route

-

Short Term: Wait and watch approach -- until prices settle down -- is the best policy if there is no need for urgent contract renewal.

-

As per Beroe estimate, there would be no more significant price increase for the forklift/MHE category as the commodity prices are expected to stabilize in Q4 2022 and Q1 2023

-

In categories like MRO/Spares, Buyers shall engage in long-term contract of 2-3 years with incumbent suppliers with fixed surcharges and hedging , in order to mitigate market volatility

Sources

- Industry Expert Discussion

- Metal Bulletin

- www.trademap.org

- EMIS

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe