Impact of Afghanistan Political Crisis on Trade and Aviation

The crisis in Afghanistan has caused a huge impact on commodity trading, with a halt in transfer of commodities globally. This has led to a spike in prices of certain commodities being imported from Afghanistan, due to uncertainty in bilateral relations. Below are some of the highly impacted categories as a result of the crisis.

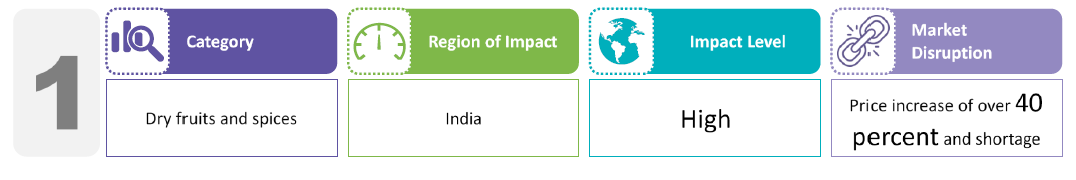

There has been a halt in import and export trade between India and Afghanistan since the Taliban takeover. As per the Director General of Indian Export Organization (FIEO), India is among the biggest trade partners of Afghanistan, and it has exported commodities worth USD 835 million in 2021. The block in cargo movement to Pakistan is the reason for this halt, however, the trade routes through Dubai and international north–south corridor among the countries remain functional [1].

The largest import to India comprises of dry fruits, which contributes to over 85 percent of the overall importations. The dry fruits and spices witnessed a price rise from 40 percent to 80 percent. For e.g., Mamra almonds shot up to USD 51.18 per kg in August 2021 from USD 28.28 per kg in July 2021 [2]. Similarly, the price of Kabul black grapes doubled, and pistachio is being sold at USD 26.94 per kg, which is a 40 percent spike from the last week [3]. Among dry fruits, India may witness a shortage of dried apricot and anjeer, as Afghanistan is the only source for these commodities.

Back in 2010, a report by the US military estimated that Afghanistan has nearly USD 1–2 trillion worth of rare earth minerals, especially lithium. A recent study in Kabul estimated the new wealth to be USD 3 trillion. With unprecedented growth of 20 percent for lithium and its use in electric cars, mobile phones, laptops, etc., the country’s lithium deposits could be equal to Bolivia’s reserve, the largest globally. Expansion of copper mining activities is also of interest in increasing Afghanistan's future mineral wealth [4].

China dominates with 35 percent of the global reserves for rare earths, and mined over 70 percent of the total rare earths in 2018, producing 120,000 MT [5]. Hence, China is keen to closely partner with the Taliban, as half of the world’s industrial goods are manufactured in China, with growing demand for commodities. The Metallurgical Corporation of China (MCC) already has a 30-year lease to mine copper in Afghanistan's barren Logar province. Thus, China is leading the race to support Afghanistan to build an efficient mining system to meet its mineral needs, which, in turn, will improve the supply chain of microchips and electric car batteries [6].

With China’s interest in trade, Pakistan is mutually benefited and has shown interest, as the minerals could be transported through the Pakistan–China transit route.

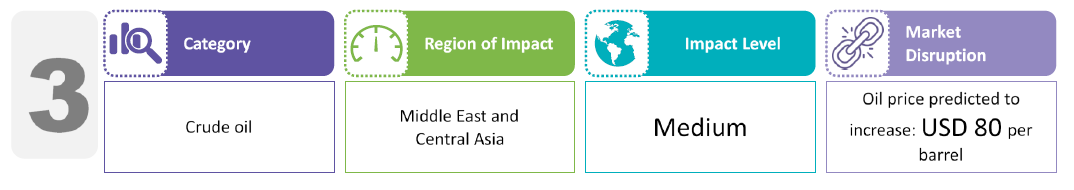

There is still an uncertainty around the impact of crude oil prices, due to the crisis in Afghanistan. Though the country is neither the major oil producer nor the major consumer, the impact could be felt in the neighboring countries of Iran, Saudi Arabia, and the UAE, who are the major oil producers. If the tension continues to rise, then the Middle East may potentially increase the prices, as commented by Barrons. Brent crude price already hit USD 66.74 per barrel, this is further predicted to rise to USD 80 per barrel. This would eventually impact the oil importing countries in Asia, such as India [7].

Presently, the new Taliban government has opened borders for trade with Iran to continue importing oil. It also cuts tariff on imports of fuel from Iran up to 70 percent to manage the gasoline price rise in Afghanistan [8].

The civilian airspace in Afghanistan has been shut, post the Taliban takeover. This has caused reduced air traffic through Afghan airspace, with countries nearby accommodating additional traffic. This has resulted in an impact on travel time, operational and fuel costs of the operating airlines. United Airlines, British Airways, Virgin Atlantic, Qatar Airways, Singapore Airlines, Taiwan's China Airlines, Air France KLM, Lufthansa, Vistara, Air India, etc., have already rerouted flights to avoid Afghan’s airspace. For e.g., flights from India to the US, Europe could take 30 minutes more time [9]. The reroutes are largely via Pakistan and Iran, while commercial airlines are flying at higher altitudes to avoid risk [10].

Overall, the above will have a direct impact on the airline ticket costs, with increased flying cost for carriers, due to uncertainty in oil prices and higher fuel costs.

References:

[1] The Quint, "As Taliban Halts India–Afghanistan Trade, Dry Fruit Prices to See Hike," The Quint, 19 August 2021. [Online]. Available: https://www.thequint.com/news/india/as-taliban-halts-india-afghanistan-trade-dry-fruit-prices-to-see-hike#read-more#read-more. [Accessed 25 August 2021].

[2] K. A. Bharadwaj, "Taliban takeover disrupts trade; prices of dry fruit, spices soar," The Hindu, 23 August 2021. [Online]. Available: https://www.thehindu.com/news/cities/bangalore/taliban-takeover-disrupts-trade-prices-of-dry-fruit-spices-soar/article36051733.ece. [Accessed 25 August 2021].

[3] T. Banerjee and S. Kanjilal, "Dry fruits pinch pockets as Afghan turmoil leads to supply shortage in Kolkata markets," Times of India, 21 August 2021. [Online]. Available: https://www.newsday24.com/afghanistan/dry-fruits-pinch-pockets-as-afghan-turmoil-leads-to-supply-shortage-in-kolkata-markets-kolkata-news-times-of-india/. [Accessed 25 August 2021].

[4] J. Stavridis, "Rare earth trillions lure China to Afghanistan's new Great Game," Nikkei Asia, 21 August 2021. [Online]. Available: https://asia.nikkei.com/Opinion/Rare-earth-trillions-lure-China-to-Afghanistan-s-new-Great-Game. [Accessed 25 August 2021].

[5] W. Tan, "China may align itself with Taliban and try to exploit Afghanistan’s rare earth metals, analyst warns," CNBC, [Online]. Available: https://www.cnbc.com/2021/08/17/taliban-in-afghanistan-china-may-exploit-rare-earth-metals-analyst-says.html. [Accessed 25 August 2021].

[6] N. Martin, "Afghanistan: Taliban to reap $1 trillion mineral wealth," DW, 18 August 2021. [Online]. Available: https://www.dw.com/en/afghanistan-taliban-to-reap-1-trillion-mineral-wealth/a-58888765. [Accessed 25 August 2021].

[7] IANS, "Will Afghanistan situation have bearing on global oil prices?," India TV News, 20 August 2021. [Online]. Available: https://www.indiatvnews.com/news/world/afghanistan-situation-affect-global-oil-prices-taliban-kabul-latest-news-727873. [Accessed 25 August 2021].

[8] B. Sharafedin, "Iran resumes fuel exports to Afghanistan after Taliban request, union says," ET Auto.com, 23 August 2021. [Online]. Available: https://auto.economictimes.indiatimes.com/news/oil-and-lubes/iran-resumes-fuel-exports-to-afghanistan-after-taliban-request-union-says/85563026. [Accessed 25 August 2021].

[9] A. Majumder, "US–India flights to take longer after Afghanistan's airspace shuts," Business Standard, 16 August 2021. [Online]. Available: https://www.business-standard.com/article/current-affairs/us-india-flights-to-take-longer-after-afghanistan-s-airspace-shuts-121081601784_1.html. [Accessed 21 August 2021].

[10] J. Freed, "Airlines told to avoid Afghanistan airspace," Reuters, 16 August 2021. [Online]. Available: https://www.reuters.com/world/asia-pacific/airlines-reroute-flights-avoid-afghanistan-airspace-2021-08-16/. [Accessed 21 August 2021].

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe