Four Essential Levers to Capture Procurement Synergy in a Post-merger Scenario

Introduction

Inorganic growth strategies do not just provide scope to expand market shares but also create opportunities that generate savings from increased scale and coinciding operations. However, those with experience will agree that the real challenge often begins after a deal closes and focus shifts to driving the expected value from acquisitions. Pre-merger phases are undoubtedly very critical for the success of the deal. However, what about the post-merger activities that leads to the actual goals? Often inadequate attention to post-merger activities contribute to the failure of entire goals to integrate businesses in order to develop cost synergies and generate value for shareholders.

Procurement as a Key Lever that Pulls Synergy Post-M&A

Cost and revenue synergies from M&A activities are always derived from multiple pockets. Companies plan meticulously to achieve savings in all departments, such as operations, procurement, sales and marketing, and general and administrative. However, among these functional areas, procurement synergies are considered to be very crucial and the quickest to generate the best value proposition.

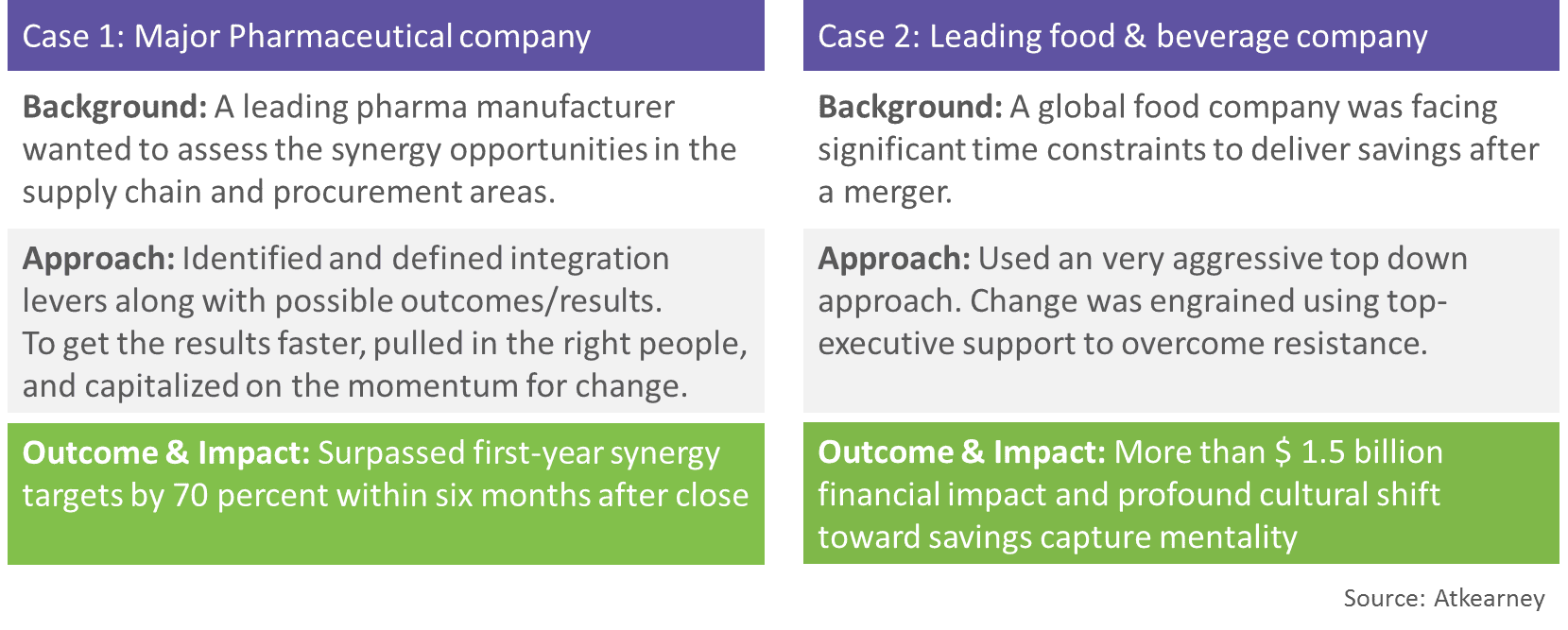

Given the number of recent merger activities in the pharma world, the question of how to attain enhanced procurement savings early on in the merger process has become more prominent. As per brokerage firm Canaccord Genuity, the global beverage giant Anheuser-Busch InBev had estimated more than $2 billion in cost savings from the $107 billion acquisition deal of SABMiller, of which around one fifth of this total was expected from the procurement function alone. Following are few more successful cases which showcase the large-scale synergies through mergers.

Evidently, the Procurement Organization of two merging companies can optimize the external spend collaboratively to reduce costs, increase productivity, and maximize savings. However, the question is, how do we achieve this procurement synergy?

Post-merger Activities to Achieve Synergy

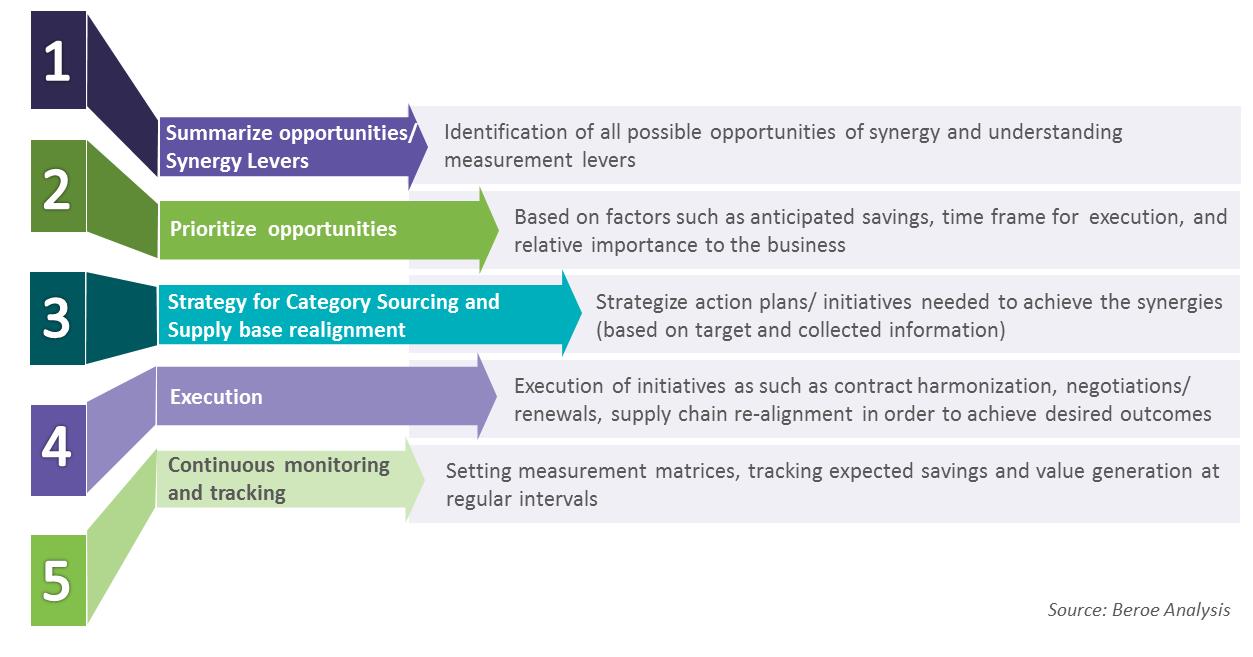

Mergers and acquisitions are built on opportunities that each company possesses and leverages benefits of diversity together. To achieve post-merger economies of scale, companies need to examine and analyse through the post-merger integration (PMI) team. Following the merger closure, the PMI team takes a lead in the execution with the support of respective category managers and operation leads. The following are the necessary steps involved in the post-merger integration process.

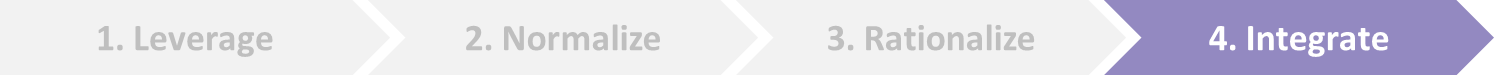

Figure 1: Steps to Achieve Synergy Post-merger

Most of the successful M&A deals pursue synergies with rigor and speed. This needs in-depth analysis, planning, research, and necessary refinement in the program much before the closure of the deal. Again, it is crucial to understand the strategic intention of the involved parties. Based on operational aspects, organizational capability, and structures, an implementation plan should be developed, which will eventually enable the procurement department to identify opportunities and achieve savings. A clearly defined process along with key capability development initiatives is always essential to derive the required savings.

However, how do we generate these synergies from procurement in a post-merger scenario? There can be multiple ways to execute post-merger activities. We have distilled these different tactical approaches into four essential levers that enable companies to capture synergies.

Deriving Synergy from Procurement—Four Essential Levers

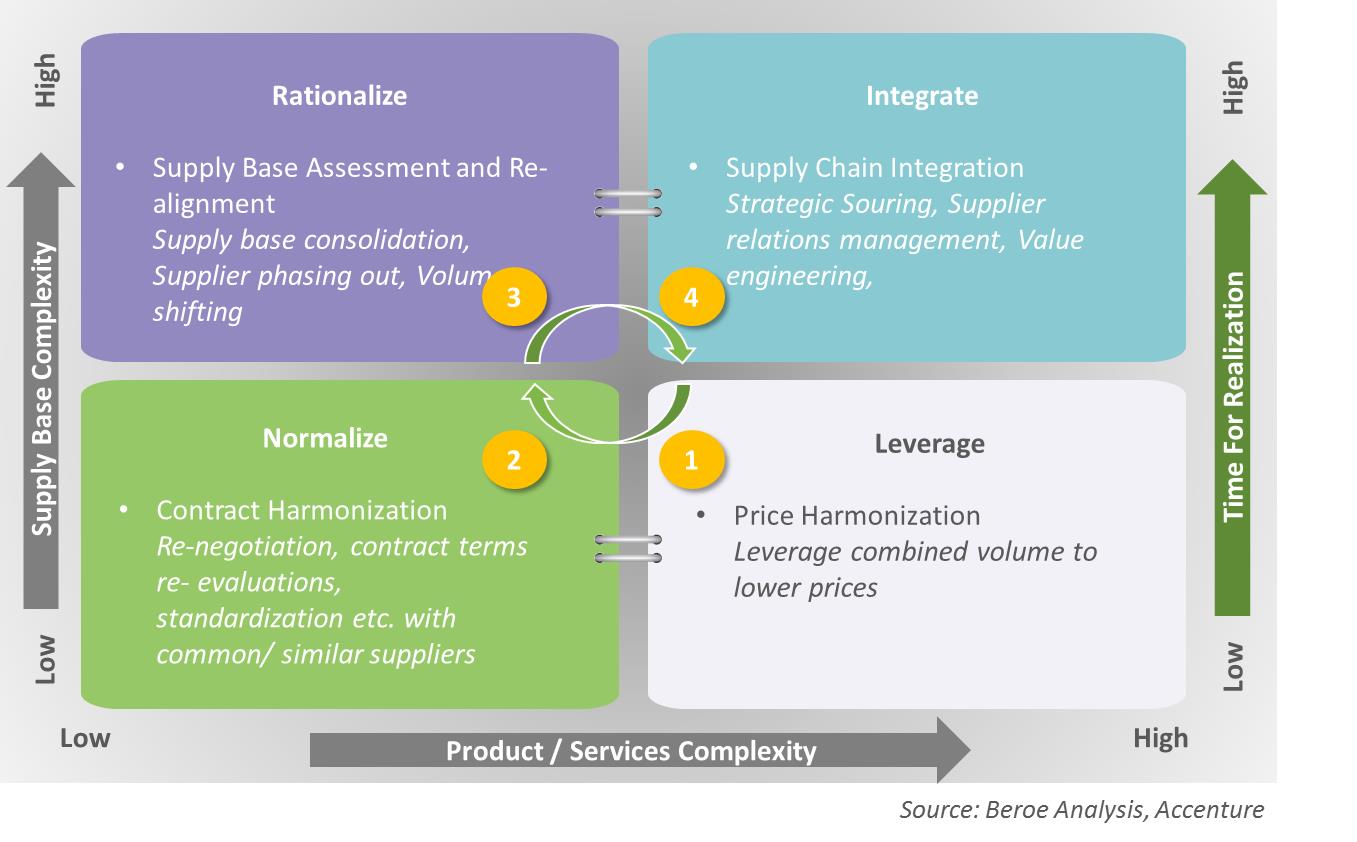

Figure 2: Four Essential Ways to Capture Synergy

1. Post-merger Action 1: Leverage

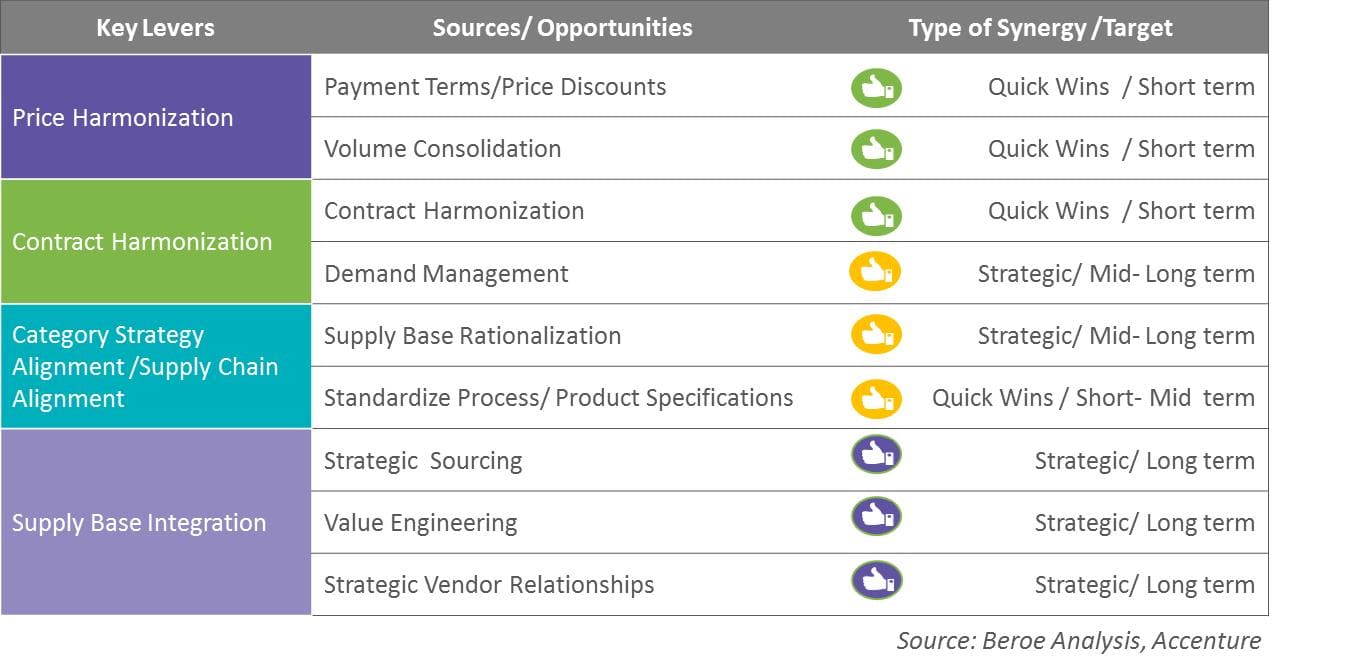

In the first stage, companies need to leverage on the existing procurement set up. This can be initiated with spend analysis followed by price harmonization among the current set of suppliers.

1a. Spend Analyses and Segmentation of Spend

Spend analysis is the antecedent to any successful planning. It actually helps in understanding the combined supply base and enables greater visibility across the enterprise into amalgamated spend.

1b. Price Harmonization

Key opportunities include price and contract harmonization covering the cost, delivery terms, availability, etc. If both the acquiring and target companies buy similar goods from a highly overlapping supplier base, the focus should be on consolidating spend for both companies and seeking any possible volume discount. In case the suppliers do not overlap (i.e., both companies sourcing from different suppliers), a competitive bidding or price negotiation can bring better deals. Any non-addressable spend or contracts that cannot be renegotiated should not be considered for savings estimation.

Generally, raw materials spare parts, components, packaging, etc. can save between 3–12% of the addressable combined spend, whereas indirect spend such as construction; logistics; maintenance, repair, and operations; and utilities offer savings of 1–5%. Other indirect spend such as marketing, HR, IT, telecoms, and facilities management offer potential savings of between 5–10%, as spend can be more easily leveraged across both companies.

2. Post-integration Action 2: Normalize

Organizations with a well-managed contract management process are always well prepared to ensure that contractual commitments are optimized. If not done earlier, M&A integration phase is the best time to reassure this.

2a. Reassessment and Harmonization of Contracts

In this stage, the existing contracts are consolidated and normalized, which allows the Procurement Organization to grasp the ‘low-hanging fruit’ in the short term. The PMI team needs to understand core business requirements and desired functionality of the goods/services to be purchased. Based on these requirements and specifications, any potential synergies plan can be derived. For example, if it is discovered that both the companies have similar suppliers, despite buying different goods or services, then the focus should be on harmonizing specifications. However, the companies can plan for harmonizing contracts by comparing terms across its common/similar suppliers to determine best possible ways to rationalize the contract.

Selecting the best terms is usually the quickest and easiest source for synergy. An early analysis helps in establishing the foundation from day one of the new organization’s operation. The company can go to market as a single entity to purchase the combined volume under a single contract. This increased volume can allow for greater negotiation leverage with suppliers, resulting in better pricing, or achieving greater rebates or better tier-based pricing. However, it is equally important that the renewed contract terms should be chosen based on holistic consideration, including quality, service level, lead time, and overall supplier performance, and not just on cost/price. In many cases, the procurement department can negotiate new contracts prior to finalization of the merger, so that cost savings begin from day one.

3.Post-integration Action 3: Rationalize

Some of the expected synergies may not be realized without supply base realignment. This starts with the integration of the supply chain of both the companies, and then leads to the rationalization of the supply base.

3a. Supply Base Integration and Supply Base Assessment

The key objective of the supply base integration process is to categorize suppliers to prioritize the deployment of limited integration resources during the initial months (approx. 12–18 months). The primary objectives of this exercise are to

- identify strategic suppliers,

- maintain a win-win situation with strategic suppliers to achieve agreed goals,

- identify and stabilize non-strategic suppliers, and

- achieve integration-related savings and supplier consolidation.

Organizations with a well-managed supply base comprising preferred suppliers with strong business relations are best positioned to achieve savings quickly.

3b. Supplier Base Rationalization and Realignment

One of the most critical exercises after the closure of M&A deal is to rationalize the supplier base. For example, if both the companies buy similar goods or services from different suppliers, it is advisable to check for phasing out a few of these overlapping suppliers. In this phase, the company should conduct capability assessment of existing suppliers and re-evaluate them based on the synergy with the current set up. First, the company should look for negotiation at a lower price with the current supplier or phase out the supplier and shift the volume to a supplier who can provide other added value.

However, if there is limited overlap of suppliers and of goods or services, the procurement department needs to critically assess the sourced goods and services and check if any transformational changes are required either to rationalize the supplier base or standardize the sourced goods/services. The expected synergies with this approach are significantly higher because in such cases, the procurement department will influence the future demand. In addition, this approach reduces the proliferation of suppliers and/or goods and thereby business complexity.

These activities are primarily focused on supplier rationalization and category integration. Ultimately, the procurement department needs to harmonize commercial conditions, compare existing and new suppliers’ performance, and utilize its market position.

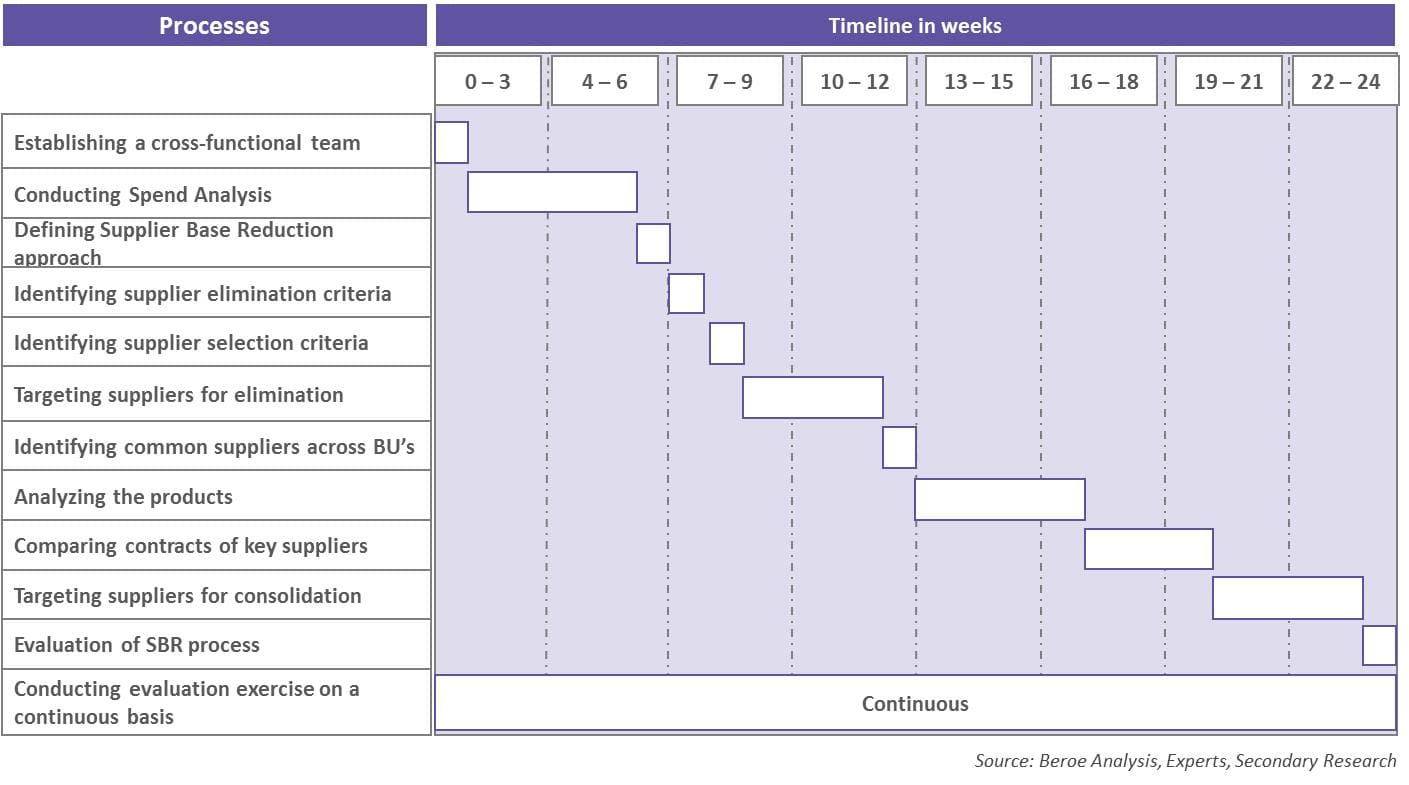

Figure 3: Steps and Timeline for Supplier Rationalization (Sample)

Figure 3: Steps and Timeline for Supplier Rationalization (Sample)

4. Post-integration Action 4: Integration

The final phase covers the more complex exercise. Based on category strategies and supply risk considerations, an appropriate consolidation strategy can be decided for the supplier base.

4a. Supply Chain Alignment and Strategic Sourcing

Key sourcing levers to be applied for categories in this phase would be the harmonization of specifications or ‘make-vs-buy’ analysis. The following could be a few of the exercises:

- Value Engineering: Employing this, very complex specifications of goods/services (mostly used for direct categories) can be simplified. It could also involve stock keeping unit (SKU) standardization, such as using functional industry standard specifications or designs, product differentiation/customization, and rationalization of SKUs to ensure the most cost-effective specifications.

- Global Sourcing: This involves exploring opportunities to combine and leverage low-cost country sourcing, expanding the geographic coverage of the supply base, and exploring the benefits from global supply/demand situations. It is also a good exercise for developing new suppliers and reduce supply risk for the company.

- Strategic Vendor Relationships: Identifying strategic suppliers, taking collaborative approach for category sourcing, and developing joint cost-saving initiatives (e.g., share productivity gains, integrate logistics operations, exploring opportunity for vertical integration or building supplier capability to justify make-versus-buy options) are few of the examples.

Figure 4: Summary of Four Essential Steps for Driving Post-merger Synergy

Figure 5: Summary of Sources and Expected Synergy Realizations

Key Considerations for Smoother Execution

- Procurement opportunities should be identified and addressed during the early phase of M&A activities. An advanced spend management capabilities can improve the ability to forecast cost reduction opportunities accurately and capture synergies quickly.

- To establish alignment, key industry performance metrics need to be assessed. We need to look beyond cost savings to the impact of cash flow benefits from standardizing payment terms, reducing inventory, increasing innovation, etc.

- Changes in procurement strategies can impact the entire organization, and thus, it is critical to understand the changes needed. Effectively engaging appropriate stakeholders and changing management resources will help with this process.

- Communication and higher management involvement are equally crucial in making any M&A deals successful.

Conclusion

Post-merger procurement integration is challenging. For example, a new company that emerged out of the merger of two US-based retailers recently realized $740 million in savings in cost through synergy—way more than what was originally base-estimated during due diligence. Moreover, the merger of two American pet food companies that were large-scale unions of brick-and-mortar and e-commerce found it very difficult to pass the litmus test and establish synergy within the estimated time. The success of the earlier case was only possible due to proper goal setting, meticulous planning, disciplined execution, and regular tracking. However, the latter case is an example that demonstrates patchy and incoherent integration that can make it difficult to achieve the expected synergy or achieve any synergy at all.

Thus, the procurement department must grab the opportunity and put itself in a more strategic role within the organization during the post-merger integration. A clear and transparent sourcing strategy will always help it to ensure the optimum benefit from the supply side synergies from day one.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

C