China Current State–Small Molecule Synthetic API Market

The small molecule synthetic API market is widespread in China. Other alternative markets, such as India, Europe, and the U.S., also depend on China for API and key starting materials. After the China–U.S. trade war and the COVID-19 pandemic, Chinese suppliers are being off-shored. India, Europe, and the U.S. are taking measures to reduce their reliance on China. The major alternate regions after China are India, Europe, and the U.S. In this whitepaper, the current dependency state of these regions toward China, measures taken to reduce the dependency, and current geopolitical risk in the alternate sourcing regions are captured, to choose the best sourcing region for synthetic API.

Introduction

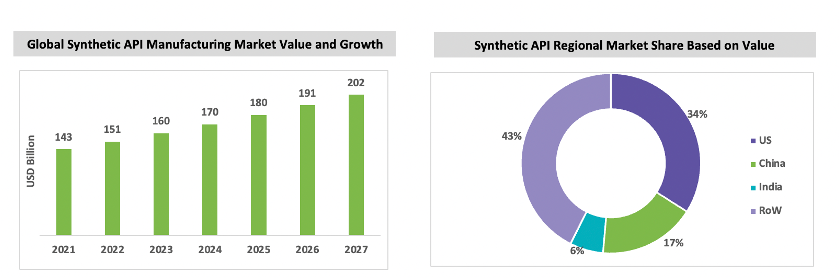

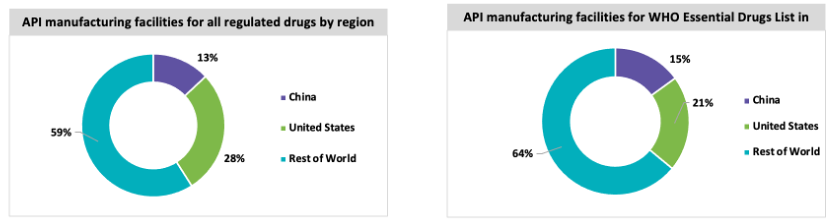

China is a major producer of API and an intermediate for synthetic API. The synthetic API manufacturing market is expected to grow with a CAGR of between 5 percent and 6 percent throughout the forecast period. China and India are major producers of API in the market, and India imports most of its key starting materials and APIs from China. Major pharmaceutical markets, such as the USA and Europe, also have synthetic API and DS manufacturing facilities. The U.S. accounts for approximately 34 percent of the market, and is one of the largest importers of synthetic API and intermediates. After the COVID-19 pandemic, the U.S., Europe, and India have taken measures to avoid reliance toward China.

|

Country/Region |

Overview |

|---|---|

|

China |

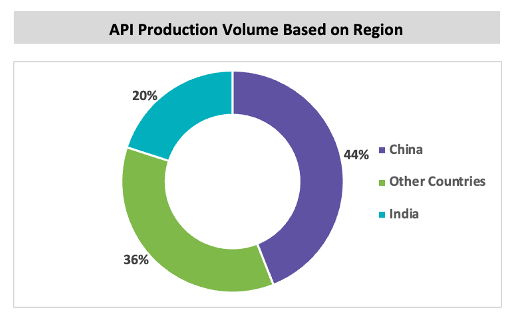

China is major manufacturing market for synthetic DS or API, key starting materials, intermediates, and raw materials, more than 40% of API is manufactured in China and is exported to different parts of the world. |

|

India |

India is another major market for synthetic DS or API manufacturing. Around 20% of API is manufactured and exported to different regions in world. India is reliant on some of the major API and key starting material from China. |

|

Europe |

As per FDA, Europe has around 26% of API manufacturing facility. |

|

U.S. |

According to FDA, U.S. has around 28% of API manufacturing facility for all drugs and is also reliant on China, India, and Europe for API. |

China API Market

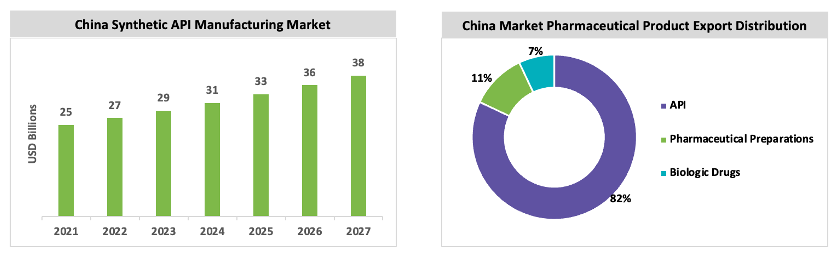

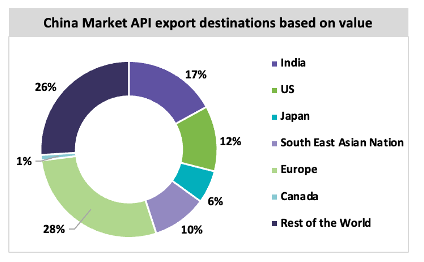

China is the largest manufacturer of chemical API in the market and exports API to 189 countries and regions in Asia, Europe, and North America.

The cost saving in this region is the main attracting factor for industries to source API and intermediates. China produces more than 2000 API molecules and has more than 1000 manufacturing facility. The Chinese government has supported many schemes to promote pharmaceutical API and raw material exports to other regions.

Pros of Sourcing synthetic API and raw materials from China

-

Chinese government provides subsides to promote the manufacturing of API and raw materials.

-

The cost of materials is low in China; hence, the overall product cost decreases, and the profit margin increases for the drug product manufacturer.

- China has a large capacity and infrastructure for API manufacturing and manufactures more than 2000 API molecules.

- Government provides liberal policies for industrial plants and business.

Cons of Sourcing synthetic API and raw materials from China

- China is a major single-sourcing option for many countries and for the pharmaceutical industry. Single sourcing can lead to a risk of high dependency; in case of supply disruption in the region, cost fluctuations can increase, which in turn increases the price of the final drug product.

- China has introduced environmental regulation controls on industrial plants, which has led to the shutdown of 150 API manufacturers between 2016–2018, affecting both domestic and international supply chains.

- The trade war between China and the U.S. has also made drug makers look for alternative sourcing regions for API and raw materials. The major supply chain disruption faced during the COVID-19 pandemic forced the industry to rethink domestic self-sufficiency and alternate sourcing.

|

Geopolitical Condition of China |

|

|---|---|

|

Political |

The Trade war between China and U.S. is major disturbance in the market and supply chain. If the tension between Taiwan and China rises, it may lead to supply disruption. |

|

Economic |

The China’s economy has got affected due to COVID-19 cases increase in first quarter of this year and the China’s zero-COVID policy. In June, the lockdown in Shanghai is removed to avoid economic fall. The regular lockdowns may affect the economy. |

|

Technological |

The average technological innovation efficiency score for China’s pharmaceutical industry from 2007 to 2019 is 0.832, which is an increase of around 27% in 2019. China is emerging and developing digital transformation in pharmaceutical industry. |

|

Environment |

The environmental regulations and policies began in China from 2018, which has made the pharma industry to slow down. The API plants not compliant with regulations are shutdown which has affected the supply chain. The energy crisis in China during 2021, has also led to shortage in supply. |

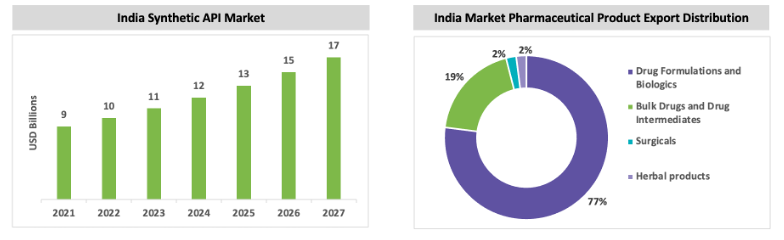

India API Market

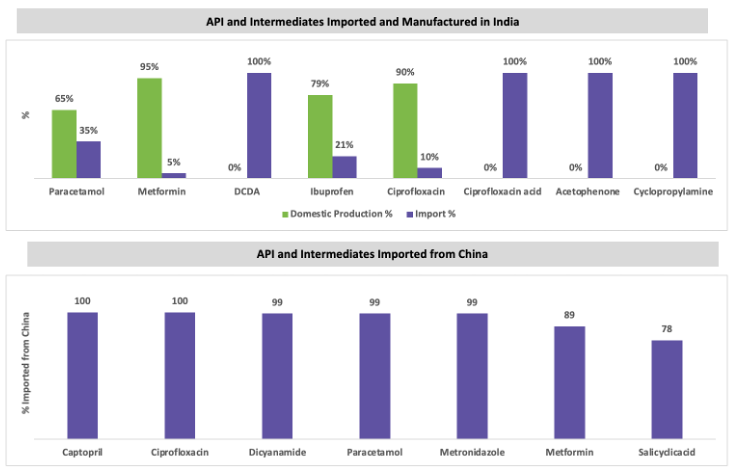

India is currently exporting around 19 percent of API by volume in the world, but raw materials and key starting materials are imported from China. India exports finished drug formulations and biologics globally, followed by bulk drugs, and intermediates. After the COVID-19 pandemic, the government has taken various measures to promote the domestic manufacturing of these raw materials to meet internal requirements and meet the global demand.

India’s Dependency on China

In FY21, India imported around INR 28,529 crores worth of major API bulk materials and intermediates, of which ~68 percent of these materials were imported from China. The quantity of such imports was approximately 3,90,475.7 metric tons. Paracetamol, citric acid, glycerol, potassium metabisulfite, sodium propyl paraben, and sodium benzoate are some of the major imports from China. Since 2019, the import volume in India has increased, and export volume has decreased. However, the export volume increased in 2020–21 compared to 2019–20.

Measures Taken by India to Reduce the Dependency of China

The Indian government is encouraging investment in setting up domestic API and raw material manufacturing plants. In March 2020, the government announced that it would invest around 3,000 crore rupees to set up three bulk drug parks. The government is also investing around 6,940 crore rupees to provide a production-linked incentive (PLI) package to march toward raw materials and bulk material self-reliance.

There are many initiatives in the development stage to establish API manufacturing clusters, financial incentives to manufacturers, tax holidays, single-window environmental clearances, income tax benefits, liberalization of FDI policies, tax exemption, price monitoring, and custom duty imposition. Ramping up or reviving domestic production may take a while; hence, the government is also trying to diversify sourcing options and study other potential options in countries such as the U.S., Italy, and Singapore as short-term solutions. Government initiatives may attract many medium- and small-sized manufacturers to expand their businesses. Big pharma in India, such as Aurobindo Pharma, Dr. Reddy's, Lupin, and Sun Pharma, will benefit from this and can expand their capacity further. Other key API manufacturers, such as Divis Laboratories, Aarti drugs, Hikal, Neuland labs, and Solara, can also benefit from these schemes.

Based on current initiatives, India expects to cut 25 percent of API and raw material reliance by 2024.

|

Geopolitical Condition of India |

|

|

Political |

India is highly reliant on China for pharmaceutical materials, after COVID-19 outbreak, India has initiated measures to slowly reduce the reliance toward China. The tension in India–China border is also one of the factors that affects the supply between India and China. The price control implementation is stringent and their impact on industry is high. |

|

Economic |

The COVID-19 outbreak has affected the economy, and now the economy is improving with operations being resumed. Per capita income is low in India; hence, individual spend toward health care is low. The current pandemic is also an opportunity for pharma industry to grow in the region. The Ukraine–Russia war has impacted the export of pharmaceutical goods to Ukraine and Russia. |

|

Technological |

Indian government is providing tax exemptions for R&D expenditure to improve the technology innovation in the pharma sector. Advancements in manufacturing technology and complete digitalization in the industry have boosted the efficiency of the industry. |

|

Environment |

Indian government is planning to provide single-window environmental clearance to bulk drug manufacturing facility construction approval, to reduce the time of the process. |

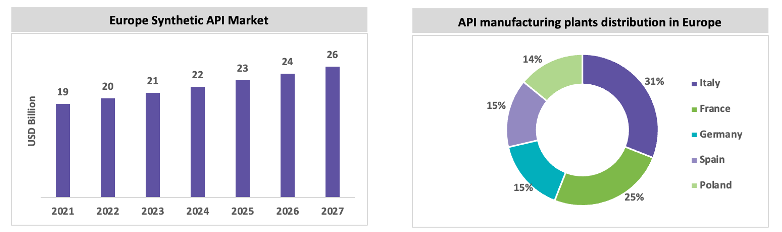

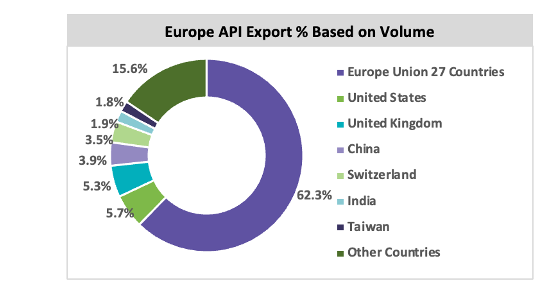

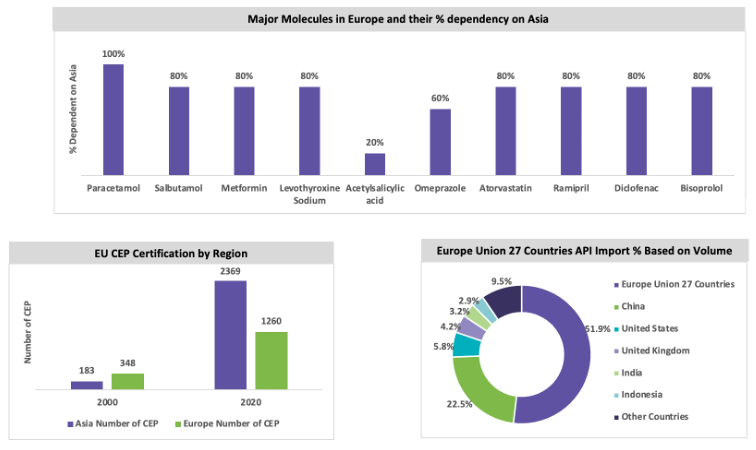

Europe API Market

The European synthetic API market is expected to grow, with a CAGR between 5 percent and 6 percent throughout the forecast period. Italy and Spain are the largest producers of generic API in Europe. The European market is subject to stringent environmental regulations, and the quality of the API is high; hence, the price of the API produced in Europe is high. Italy has a greater number of API manufacturing sites than other European countries. In 2019, around 2.8 million tons of API was exported from Europe to other regions, in which around 62.3 percent of the API volume was distributed across 27 countries in Europe. Around 51.9 percent of API are produced within Europe, and the market is dependent on China and India, some of the major API molecules. In 2019, Europe imported 51.9 percent of the API volume within Europe Union countries, 4.2 percent from the UK, and 1.5 percent from Switzerland. Around 3.5 million tons of API are imported in Europe, of which 22.5 percent of API volume is imported from China and 3.2 percent from India. Italy is a highly regulated market for API and exports 25.5 percent to other countries in Europe, 49.7 percent to North America, and 15.3 percent to Japan.

Measures Taken by Europe to Reduce the China Dependency

The European Union is taking strategic steps toward self-reliance after the China–U.S. trade war and the COVID-19 outbreak. The EU is a major supply base for high-quality, custom, patented, and innovative API. The major players in Europe can initiate further capacity expansion for large-volume generic API to reduce API dependency in China. The European Union, comprising 27 countries, is making decisions to reduce the dependency toward China in strategic areas such as raw materials, pharmaceutical ingredients, and semiconductors.

The major focus for EU countries is diversifying their supply base, diversifying demand by relying on different trading partners whenever possible, and stockpiling. The EU could create a pool resource for Important Projects of Common European Interest (IPCEIs) in fields such as hydrogen, low-carbon industries, pharmaceuticals, and the semiconductor industry. Major innovator API CMOs are concentrated in Europe, followed by the U.S.

With the strategic goals in place, the EU is expected to become self-reliant in the API market in the long-term.

Sanofi launched a spin-off company called Euro-API, which could lead to improved supply security. The Euro-API is a combination of Sanofi’s six API European production sites.

|

Geopolitical Condition of Europe |

|

|---|---|

|

Political |

The Ukraine–Russia war is impacting other European countries and western countries for natural gas and fossil fuel. Germany is dependent on the natural gas from Russia and is taking steps to reduce the dependency. European countries and Germany are trying to fill their storage before winter to avoid dependency over Russia. Germany has approved for the operation of coal-fired power plants to avoid the shortages. |

|

Economic |

Pharmaceutical industry in Europe contributes around 0.7% of the region’s GDP. Europe was emerging out from COVID-19 pandemic outbreak and the Russia–Ukraine War hit, though European countries were not involved in war, their proximity with Russia and Ukraine and their dependency for energy from Russia could impact their economy. |

|

Technological |

Digital transformation in industry is impacting the R&D and manufacturing in pharma industry. The application of Ai and supercomputing can help in identifying potential active substances for repurposing. |

|

Environment |

European market is subjected to stringent environmental regulations and the quality of the API is high; hence, the price of the API produced in Europe is high. |

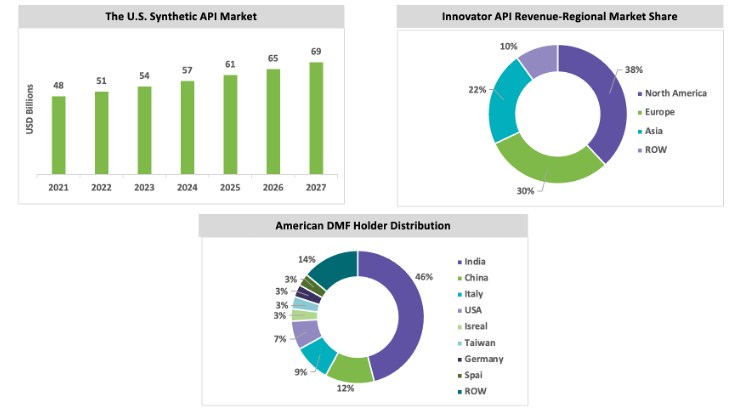

The U.S. API Market

The U.S. market is expected to grow with a CAGR between 5 percent and 6 percent throughout the forecast period. The U.S. market dominates the case of an innovative or patented API market. The capacity in the U.S. is greater than that in China; however, China leads the API market based on a greater volume of production. The API market, based on value, is led by the U.S. because of the high demand for life-saving drug products, advancements in medical technology, awareness among the population regarding health care, and higher rates of compensation by health insurance companies. The U.S. market dominates the case of an innovative or patented API market. The capacity in the U.S. is greater than that in China; however, China leads the API market based on a greater volume of production. The API market, based on value, is led by the U.S. because of the high demand for life-saving drug products, advancements in medical technology, awareness among the population regarding health care, and higher rates of compensation by health insurance companies.

|

Sl.No. |

Categories |

Molecules |

Manufacturing Site in U.S. |

Manufacturing Site outside U.S. |

|---|---|---|---|---|

|

1 |

Analgesic |

Fentanyl, Hydromorphone, Morphine |

39% |

61% |

|

2 |

Anticoagulant |

Enoxaparin, Heparin, Ondanstron, Cefepime |

14% |

86% |

|

3 |

Neuromuscular Blocking Agent |

Cisatracurium, Rocuronium |

4% |

96% |

|

4 |

Sedation/Induction |

Dexmedetomidine, Midazolam, Propofol |

8% |

92% |

|

5 |

Steroid |

Dexamethasone, Methylprednisolone |

8% |

92% |

|

6 |

Vasopressor |

Dobutamine, Norepinephrine |

9% |

91% |

The U.S. imports around 13 percent of APIs and around 18 percent is produced in India. Although there are 21–28 percent of API manufacturing facilities in the U.S., API manufacturing facilities are outside the U.S. for priority drugs and some of the essential drugs.

Measures Taken by U.S. to Reduce the Dependency of China

The U.S. government has introduced legislation in congress chambers to chart plans to reduce dependency on China for pharmaceutical raw materials and API. The U.S. Senate has signed innovation and competition legislation to promote and restore America’s manufacturing capability in the drug and medical device industry and to reduce its reliance on China. The bill passed by the U.S. will encourage both the U.S. and EU to work together to build a resilient supply chain without China. The U.S. FDA is working with the industry to make use of the latest technology and manufacturing methods and provide incentives to promote domestic API manufacturing. The big pharma and existing API manufacturers may further expand manufacturing capacity in the U.S. to reduce its dependency on China. Suppliers such as Curia and Cambrex are investing in the expansion of API manufacturing sites in the U.S. to promote “onshore” manufacturing of API in the U.S.

|

Geopolitical Condition of the U.S. |

|

|---|---|

|

Political |

The U.S.–China trade war has created a disturbance for export and import of goods between these regions. After COVID-19 outbreak and Russia–Ukraine war, the U.S. government is taking initiatives to reduce the dependency for API from China. The U.S. Commerce department have added around 37 Chinese suppliers and schools in the “unverified” list. The suppliers are in the field of precision optics, electronics, machine tools or aviation. |

|

Economic |

The inflation rates are increasing, and the GDP is decreasing in the U.S. The price of gas and fossil fuels are increasing. Hence, Europe may turn to U.S. for oil and gas to reduce the dependency toward Russia, this may be an opportunity for U.S. to increase their business in energy sector. The U.S. must increase their capacity in energy sector, which is expected to get completed by the end of 2022. |

|

Technological |

U.S. market have maximum innovator API or custom API manufacturing facilities. The major factors fueling the market growth in the U.S. is Innovator API. |

|

Environment |

Initially U.S. had a greater number of API production site; however, when it is observed that large volume API manufacturing facility has environmental liabilities, they shifted them to other regions. FDA Emerging Technology Platform supports Advanced manufacturing technology which can lower the environmental footprint. |

Conclusion

After the global COVID-19 pandemic outbreak and the U.S.–China trade war, many countries dependent on China initiated off-shoring from Chinese suppliers. The small-molecule synthetic API supply market is dominated by China, after which India has the next largest market for synthetic API. India is also dependent on many APIs and KSMs; hence, complete removal of Chinese suppliers from the value chain is difficult. Various regions and countries are taking measures to reduce dependency on China for API and key starting materials. The major alternate regions to China are India, Europe, and the U.S. All three regions are taking measures to reduce their reliance on China for synthetic API and key starting materials.

|

Parameters/Factors |

India |

Europe |

USA |

Comments |

|---|---|---|---|---|

|

Dependency Toward China – Generic Synthetic API |

High |

Medium-High |

Medium-High |

India, Europe, and USA are dependent on Generic API and raw materials from China |

|

Dependency Toward China – Custom, Patent, and Innovative Synthetic API |

Medium |

Medium-Low |

Medium-Low |

Europe and USA have API manufacturing facilities for innovative drugs. Europe and USA can become self-reliant faster since they already have high technology facilities |

|

Initiatives taken by government |

High |

High |

High |

India, Europe, and USA are actively taking measures and initiatives to become self-reliant |

|

Geopolitical Condition Risk |

Low-Medium |

Medium |

Low-Medium |

India and USA: Steps are initiated to avoid dependency toward China. Europe: Steps are taken to reduce energy dependency from Russia |

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe