CATEGORY

Tallow and Biodiesel North America

2016 saw huge difference in price premium between vegetable oil and tallow, however the gap closed in 2017 and it is estimated that in 2018 soybean oil will have higher price against tallow

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Tallow and Biodiesel North America.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

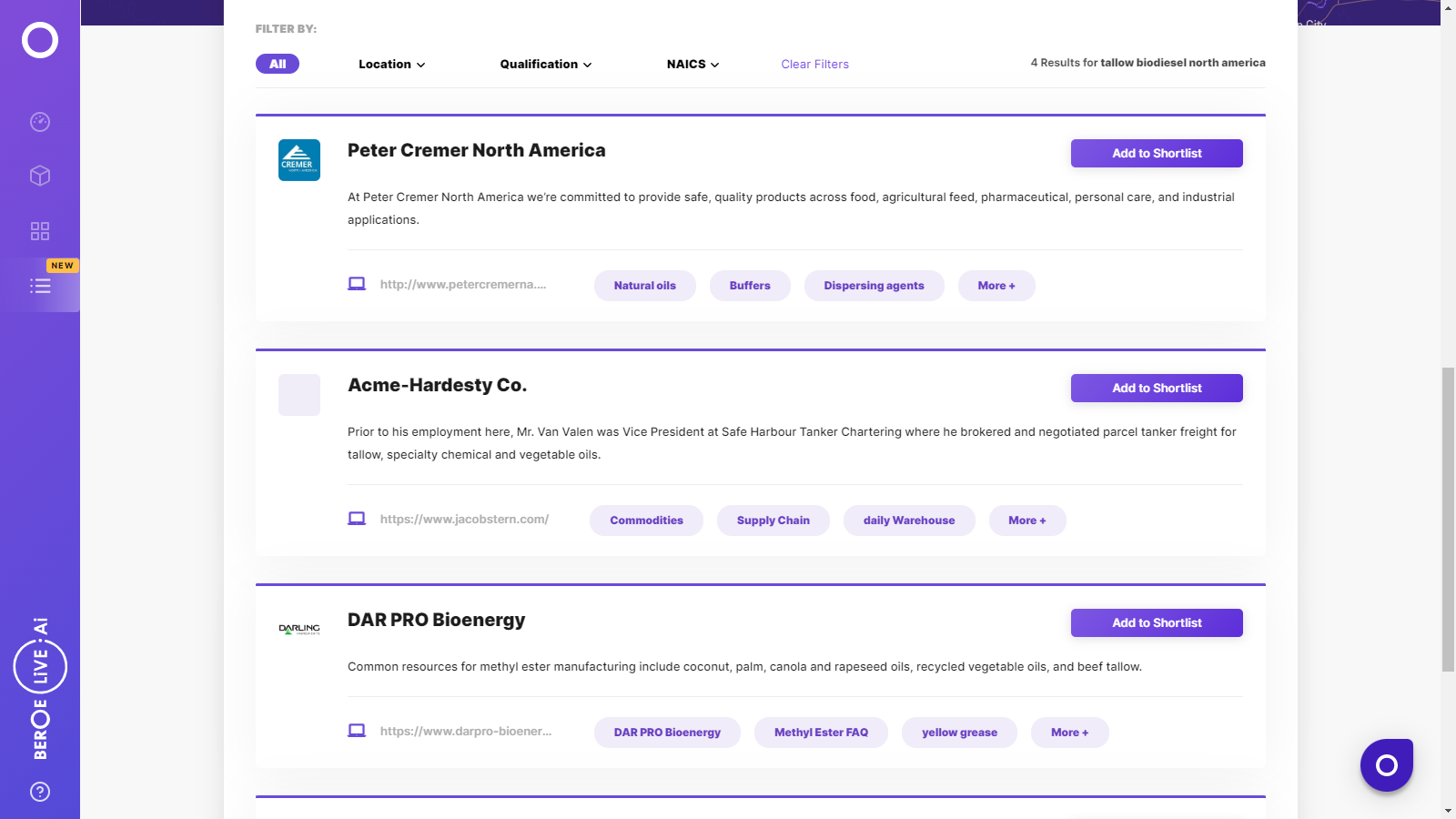

Tallow and Biodiesel North America Suppliers

Find the right-fit tallow and biodiesel north america supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Tallow and Biodiesel North America market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoTallow and Biodiesel North America market report transcript

Regional Market Outlook on Tallow And Biodiesel

2016 saw huge difference in price premium between vegetable oil and tallow, however the gap closed in 2017 and it is estimated that in 2018 (if slaughter rates are same as 2017) soybean oil will have higher price against tallow. That being said, demand for tallow will be slightly improved due to new regulations that are proposed in US and EU for low carbon emissions where the preferred feedstock has been used cooking oil and tallow.

LCFS regulation

Low-carbon Fuel Standard (LCFS) is a regulation designed to control vehicle emissions by using alternative environmental friendly fuels. The major crux of LCFS is to decrease carbon di-oxide from vehicles while also considering entire life-cycle of the fuel used also called as “wells to wheels”.

Impact on Tallow: This is one of the reasons for tallow to have a price premium over other vegetable oils

Future of tallow market in US and Canada

California's Low Carbon Fuel Standard carbon cap-and-trade scheme for the road transport fuels sector has carbon counting approach now across other western states and parts of Canada. Oregon plans a 10 percent cut in state transport GHG emissions by 2025

Impact on Tallow: Usage of tallow for bio-diesel production could increase, thereby increasing prices

Biodiesel producers in Houston area (Texas)

The LCFS regulation also defines to minimize transporting distance (~100 kms) between slaughter area to biodiesel producer to bring down the total carbon value.

Impact on Tallow: Texas producers do not have any new technologies that favor tallow usage as feedstock, however Texas is one of the top meat producers. Thereby making it easier for biodiesel producers to procure tallow much easier.

Low-carbon Fuel Standard

Low-carbon Fuel Standard (LCFS) is a regulation designed to control vehicle emissions from conventional fuels to lower it by using alternative environmental friendly fuels such as fuels from plants and animals such as biodiesel, CNG, LPG etc. The major crux of LCFS is to decrease not only tailpipe emissions but also all other associated emissions from production, distribution and use of transport fuels within the state also called as “wells to wheels”.

There are several bills that have been proposed in different part of the world with subject to LCFS, however the first bill was proposed in

- California in 2007 but taking effect only in 2011. The LCFS directive calls for a reduction of at least 10 percent in the carbon intensity of California's transportation fuels by 2020

- 11 US Northeast and Mid-Atlantic states signed for single Low-carbon Fuel Standard in 2011

- A similar legislation was approved by Canada in British Colombia in 2008

- European union along with the UK approved the legislation in 2008/09.

Major feedstock used to adhere to LCFS

Tallow

- Top meat producing states in the US such as Nebraska, Iowa, Kansas, Texas and Illinois

- It is critical to keep the transportation range of the feedstock within 100 km to stick with LCFS regulation and hence the biodiesel producers using tallow would be from the high slaughter rate states such as mentioned above

- Oregon targeting similarly aggressive carbon cuts will bolster California's demand. Oregon plans a 10 percent cut in state transport GHG emissions by 2025 relative to a 2015 baseline by adopting a declining average carbon intensity for transport fuel suppliers to hit each year

Used Cooking Oil

- The UK's new Renewable Transport Fuel Obligation (RTFO) came into effect and will act as a bullish factor for the European biodiesel market and add 350,000-400,000 mt/year to existing demand, underpinning the market's bullishness

- The previous mandate was 4.75% on a volumetric basis for transport fuels. This has now risen to 7.25% to last until the end of the year, and 9.75% by 2020, effectively doubling the mandate in two-and-a-half years. This will improve the demand for used cooking oil and tallow.

Tallow properties in biodiesel

The ecological footprint of different types of biodiesel ranges from -1.2 m²a / MJ combustion energy for biodiesel from used vegetable oil (a negative value indicates larger positive impact of the replacement of fossil glycerol by the byproduct of this production) to a value between -1.2 and 2.8 m²a/MJ for tallow methyl ester and up to 10.3 m²a/MJ for rapeseed methyl ester (RME) compared to 26.1 m²a/MJ for fossil diesel.

- Cloud point: This refers to the temperature below which wax begins to form in fuels. Solidified waxes can clog engine fuel filters and injectors. Biodiesel produced from feedstock such as inedible tallow may require the use of additives or blending at higher levels with lower cloud point diesel to mitigate cold weather concerns.

- Cetane number: Cetane number is an indicator of the fuel's propensity to auto-ignite predictably in a compression-ignition engine. Higher cetane is often associated with improved performance and being a cleaner burning fuel. The minimum allowable cetane value is of 40.

- Oxidative stability: This measures the ability of fuel to resist oxidation during storage and use. Fuels with a lower oxidative stability are less likely to form peroxides, acids, and deposits that adversely affect engine performance. Because it generally has lower oxidative stability, petroleum diesel can be stored longer than biodiesel feedstock such as white grease and tallow. Biodiesel producers may use additives to extend the storage and usage timelines of biodiesel.

North American Market Overview of Biodiesel

US is the major producer and consumer of biodiesel in the North American market. US represents approximately 80% of the North American market. Canadian market is growing fast in biodiesel market and there are new plants opening due to increased demand.

- US leads in the market share of biodiesel in North America with volume of 1595 million gallons in 2017 and forecasted 1640 million gallons in 2018. The demand of biodiesel is high due to concerns to emissions and damage to the environment.

- The Canadian market is also expected to increase production volume in 2018 and is forecasted to 166.32 million gallons in 2018. There are new plants that are being opened due to increase in demand.

Annual Usage of Tallow by North America

USA and Canada both use a total around 400-450 million pounds of tallow to produce biodiesel. Most states in the US are currently focusing on using low carbon fuel standard regulation to support transport emission to be lowered by 2020. Many countries such as EU have emission targets as far as 2030. In order to support this, tallow and used cooking oil are going to be major

- While the Canadian biofuels industry had received support from production and consumption subsidies, provincial subsidies have sunset and federal production subsidies ended on March 31, 2017. However, Canadian biofuels continue to benefit from provincial-level volumetric requirements stretching from British Columbia to Ontario, which range from 5 to 8.5 percent for ethanol and from 2 to 4 percent for renewable content in diesel. Quebec's Sustainable Development Action Plan would enact the province's first-ever volumetric requirements on renewables, starting at 5% for gasoline and 2% for diesel, by 2020.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now