CATEGORY

Animal Fat

Tallow and Lard are fat trimmings from Cow and Pork respectively. They are widely used in oleochemicals in making wide varieites of products from soaps and detergents to biodiesel.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Animal Fat.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Animal Fat Suppliers

Find the right-fit animal fat supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Animal Fat market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAnimal Fat market report transcript

Global Market Outlook on Animal Fat

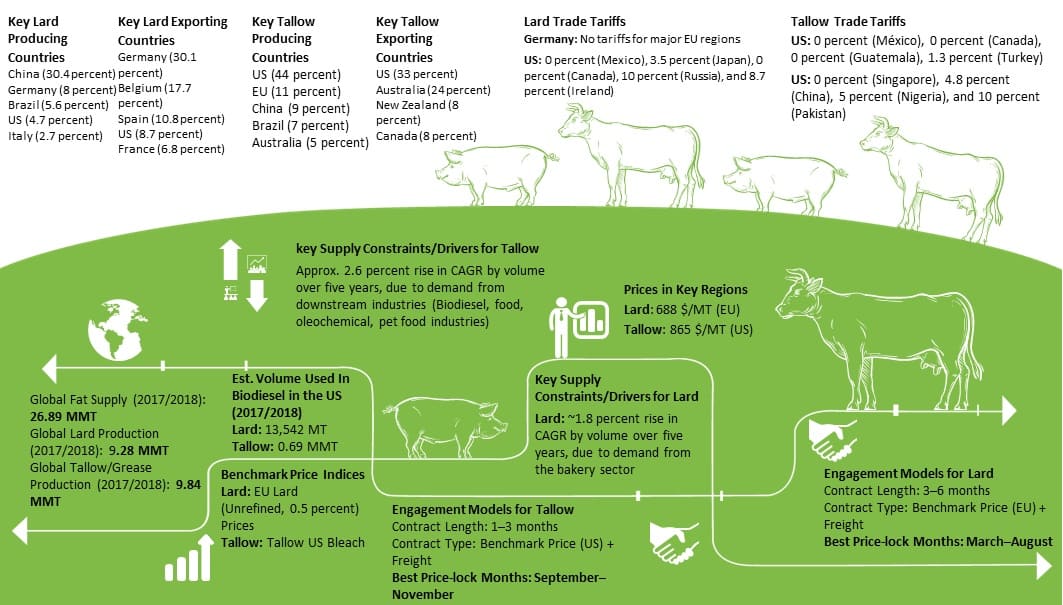

- Lard constitutes ~33.3 percent of total animal fat production and ~4.1 percent of the global production of fats and oils. Global lard production has increased at a CAGR of ~1.8 percent over a five-year period. Demand has been driven by preference for lard in place of butter in baked goods by consumers in rapidly growing regions, like the APAC

- Lard utilized for biodiesel in the US accounts for ~3 percent of the biodiesel feedstock, which amounts to ~13,340 MT in 2016–2017. This is ~2.8 percent of the total lard production in the US. Within the EU, Category 1 and 3 animal fats are preferred for use as biodiesel feedstock. Germany is the major region in the EU, utilizing lard for biodiesel

- Lard prices are expected to witness an upward trend in the coming months. Large buyers, who choose fixed price, long-term contracts (>3 months), should negotiate the length of their contracts to five months to leverage on prices and achieve significant cost savings. Small and mid-sized buyers could opt for spot buying until may 2018

- Prices are expected to start increasing from December 2018 from its lowest point. This month could be the best price-lock period for longer contracts for the successive months

-

Key animal fat processing countries are US (44 percent), EU (11 percent), China (9 percent), Brazil (7 percent) and Australia (5 percent).

-

Countries with key tallow fat suppliers are KUS (33 percent) Australia (24 percent), New Zealand (8 percent), Canada (8 percent).

-

Major renderers, who supply lard are EU based and therefore, the animal fat price can be taken as a benchmark.

Global Fats and Oils Market

- The global fats and oils market has grown by a CAGR of 1.6 percent in volume over the past five years and is projected to grow by a CAGR of 4.4 percent by value between 2016 and 2020. The value of the animal fat market is estimated to reach approx. $247.78 billion by 2020. APAC is expected to be the major region driving demand

- The global fats and oils market has grown by a CAGR of 1.16 percent over the past five years. In the US, Eastern Europe and Southeast Asia, demand has been driven by consumer preferences for healthier variants of olive oil, whereas in India and China, the market for soybean oil and olive oil is growing

- Fats such as butter are preferred by consumers in Asian countries, like India and Pakistan. In the US, butter is prominent, whereas margarine, lard, and shortening are major markets in Europe. The fats and oils market is projected to grow by a CAGR of 4.4 percent in value between 2016 and 2021, and is estimated to reach approx. $247.78 billion by 2021

Global Supply–Demand Analysis

- Global lard production has risen at a CAGR of ~1.8 percent over a five-year period. Lard constitutes ~4.1 percent of the global production volumes of oils and fats

- Demand has been driven by preference for lard, in place of butter, in baked goods by consumers in rapidly growing regions like the APAC

Estimated Lard Production by Country (2017–2018)

-

Lard as a category of animal fat constitutes 4.1 percent of the volume of global fats and oils production

-

Despite the fact that China and Brazil are among the top individual producers of lard in the world, these countries have a high internal demand and therefore, do not play a major role in exports

- The APAC is projected to show the greatest growth in consumption of animal fats, like lard, due to increase in population, advancement in technology, and growing consumption of lard by the bakery sector

Global Lard Trade Dynamics

- Global lard trade fell marginally by a CAGR of 0.12 percent in volume over the period of five years. Shares of major exporters and importers have remained stable, except for German export share and Spanish import share, which rose by 8.8 percent and 7.4 percent, respectively

- Key suppliers are present in the EU with branches worldwide. They are likely to drive the imports and exports of lard for these regions

Utilization of Lard in Biodiesel

- Lard utilized for biodiesel in the US accounts for ~3 percent of the biodiesel feedstock, which amounts to ~13,340 MT in 2016–2017. This is ~2.8 percent of the total lard production in the US

- Within the EU, Category 1 and 3 animal fats are preferred for use as biodiesel feedstock. Germany is the major region in the EU, utilizing lard for biodiesel

Est. Biodiesel Feedstock Breakdown for the US (2016–2017)

- Within the EU, lard is not a major feedstock for biodiesel. The EU classifies animal fats into Category 1, Category 2, and Category 3 fats as well as Lard/Tallow

- Category 3 fats are commonly used as biodiesel feedstock in France,whereas lard is not widely used

- In Italy, ~35,000 MT of lard was used as feedstock for biodiesel in 2011. Post 2011, the use of lard was discontinued in favor of other animal fats

- In Germany, Category 1 and 3 fats are widely used as feedstock, tallow and lard are being used to a lesser extent. Tallow constitutes a higher share as compared to lard, which accounts for <10 percent

Market Overview

Tallow constitutes ~35.4 percent of total fat production in the animal fat production and around 4.4 percent of the global production of fats and oils.

Global tallow production has risen at a CAGR of ~3 percent over a five-year period. Demand has been driven by a preference for tallow in the biodiesel industry

Tallow utilized for biodiesel globally accounts for ~9 percent of the biodiesel feedstock, which amounted to ~2.37 MMT in 2017-2018

The Key Drivers (2019–2020) of beef tallow market prices include slaughter rates, biodiesel mandates and vegetable oil prices.

The tallow fat suppliers have higher negotiation power than buyers, as they are huge players

Tallow fat production requires capital and equipment and the industry runs on economies of scale.

The US and EU animal fat markets are fairly consolidated by key suppliers.

Trends for the pork market could influence the lard market as well. Animal fat prices are likely to traverse a downward trend, due to slower pork export demand, which has increased local supplies, thus implying greater availability of lard as well.

Why You Should Buy This Report

Market analysis, supply-demand analysis and Porter’s five force model of the animal fat (lard, tallow) markets. It provides the lard and tallow supplier information and SWOT analysis of major players like Darling industries, Ten Kate, Baker Commodities Inc., etc. The report details the cost breakdown and pricing analysis of animal fat segments tallow and lard.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now