CATEGORY

Essential Oils

Essential oils is widely used in flavors and fragrances market. Increasing demand for natural essential oils in personal care products, rising per capita income and increasing awareness on personal hygiene in developing countries, wide product ranges have been supporting steady growth of this industry across all end use categories.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Essential Oils.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

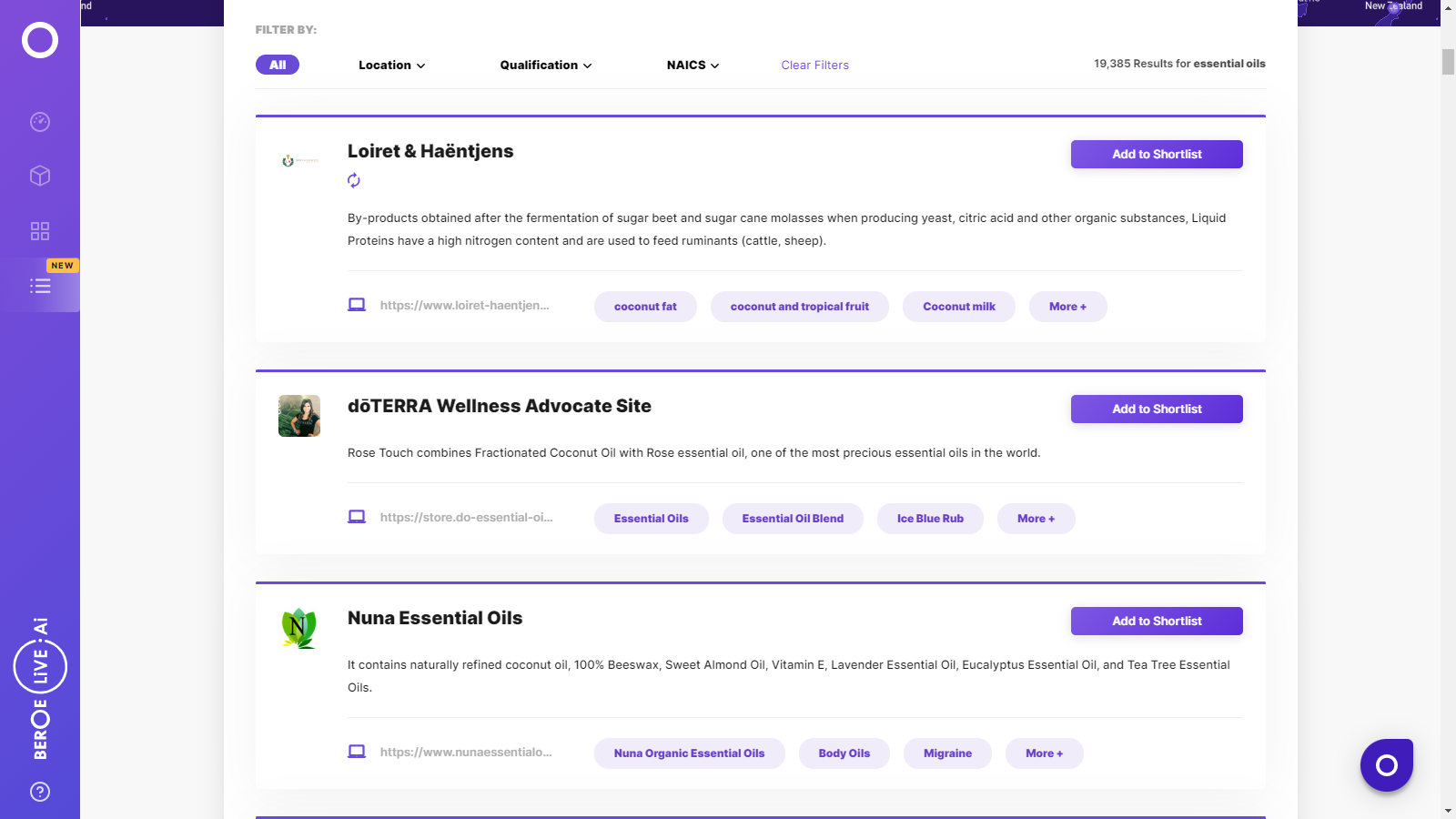

Essential Oils Suppliers

Find the right-fit essential oils supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Essential Oils market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEssential Oils market report transcript

Essential Oils Market Analysis and Global Outlook

- Sustainability strategies were initiated by controlling carbon emission and by-product/waste utilization. Currently, companies engage in sustainability activities by partnering with various stakeholders in the essential oil supply chain.

- Companies mostly engage with distributors along with major flavor houses such as IFF, Symrise, Firmenich, and Givaudan. This is done to dilute the supply risk in essential oil sourcing, which is a critical element due to supply restriction and high-quality requirements.

- Essential oils market analysis shows that the key producer of mint oil is India (80%), for orange oil is Brazil (58%) and for clove oil is Indonesia (76%).

- Cost of essential oils in key regions 2018/2019: Mint oil, India: $42–45/kg, orange oil, Brazil: $8.3–10.9/kg and clove oil, Indonesia: $23.7–27/kg.

- The essential oil market trends indicate that sustainability initiatives and technology investments will improve yield rates

- On the basis of end-use, the essential oils market is divided into Food, Beverages & Tobacco, Perfumes & Cosmetics, Household & Personal Care, Aromatherapy & Dental Care, Pesticides, Automobiles, Paper & Print, Rubber, Plastics, Textiles and Adhesives, and, Medicines & Veterinary

Essential Oils Industry Overview

- Global essential oil production is estimated to grow at 8-9%, with a few key essential oils such as orange oil, mint oils, clove oil, and patchouli oil holding a major share.

- The global edible oil market is set to grow at a CAGR of 8–9%, from 143,000 tons in 2015 to an estimated 173,000 tons in 2018, and an amount equivalent to $ 11.67 Bn by 2022.

- Demand for essential oils in the Asia Pacific (APAC) will show the highest growth, about 9%, from 2015 to 2022.

- Orange oil leads the segment, capturing approx. 29% revenue share during 2016–2017 and projected growth of approx. 9%/year. The food & beverages segment leads all applications with over 30%.

- Europe and APAC together account for over 40% and projected growth (approx. 9%/year).

- Growing consumer awareness is a key driving factor for the global essential oil market over the speculated period. A major shift from synthetic to natural additives is seen owing to the growth in the organic products industry.

- Increasing use of essential oil in the preparation of natural flavors and fragrances citing their increasing demand across key end-use industries is also expected to fuel the market growth.

- Most of the developing countries such as India, Indonesia, and Brazil are the key producers and exporters of several essential oils in the global essential oil market.

- Some essential oil market trends and practices include steam distillation, supercritical CO2 extraction, hydro-distillation and hydro-steam distillation.

- The major clove oil-producing countries are Indonesia and Madagascar. Indonesia dominates the production of eugenol from clove leaf oil. Most of the Indonesian clove oil output is absorbed by local derivative manufacturers.

- The current orange oil markets are dependent on the US harvest. The production cost is dependent on the supply of raw materials from major regions such as the US.

Market Drivers

Increasing consumer awareness about the medical and relaxing properties of E.Oils are the key driving factors of the market. This trend is supported by various government policies intended at improving the environment

Increasing Demand

- Sri Lanka, which was earlier the top producer, was overtaken by countries such as Indonesia, China, and Vietnam. Nevertheless, the island country still has the monopoly over the “true cinnamon” grade, supplying 85–90% of the global share (27%).

- Sri Lanka, to regain its position, has proposed LKR 250 Mn in its budget in 2016 for the Spice Council to undertake a branding exercise, lease out underutilized fertile government land and strengthen cinnamon research.

Government Policies

- Sri Lanka, which was earlier the top producer, was overtaken by countries like Indonesia, China, and Vietnam. Sri Lanka still has monopoly over the “true cinnamon” grade, supplying 85–90 percent of the global share (27 percent)

- The country, to regain its position, has proposed LKR 250 million in its budget in 2016 for the Spice Council to undertake a branding exercise, lease out underutilized fertile government land and to strengthen Cinnamon Research

Increasing Usage of Natural Ingredients

The consumption of “all-natural ingredients” has been surging majorly owing to the rising awareness regarding the benefits of natural ingredients in tandem with increasing health consciousness among consumers.

Numerous manufacturers across all sectors are designing innovative ways of including healthy and natural ingredients in their formulations to deliver maximum benefits to the consumers.

“Natural claims” have a huge impact on the purchase of cosmetic and food & beverage products. Essential oils fill that “all-natural” gap across various industries including home care, feed, and cosmetics, to name a few. Such trends will contribute to the essential oil market size.

Rising Shift towards Aromatherapy

- Essential oils benefit the psychological as well as physiological activity in sync, as such, they are commonplace in aromatherapy.

- The rising demand for aromatherapy is attributed to various factors, the most vital being the gradual rise of disposable income over the past decade.

- Consequently, consumers’ preferences have also moved towards more sophisticated products or services.

Market Constraints

- Weather fluctuation and seasonality, along with quality issues arising due to poor harvesting and processing techniques adopted in the major producing belts are major constraints of the industry

- Weather Impact/Seasonality: El Nino, being really strong in 2016/2017, at a degree of +1.5, is not a good sign for Indonesian products, especially cloves and cinnamon. This could impact production, and thereby support the increase in prices in 2017/2018. Since essential oils are plant-derived, supply is dependent on crop seasonality

- Quality Constraints: Most essential oils produced in developing countries that invest little in developing the overall production process leads to many supply chain risks and loss of crop yields. E.g. Clove oil produced from Sri Lanka, Madagascar, and Tanzania suffers largely from the improperly planned production process

- Surging Production Costs: Production costs of lemon oil surged by 118% over the past five years owing to the constant increase in fresh lemon price. Production of citronella grass takes place on a small scale, where handling cost and quality are the main constraints for its use in the pharma and fragrance industry

- Lower Supply and Labor Cost: Collection and processing of raw materials are labor-intensive processes as the majority of the harvesting regions are developing countries. Reduced supply of raw materials, especially spices like clove, cinnamon, etc. puts pressure on the essential oil market

End-use Industry Analysis

- Essential oils are mostly used in the flavor and fragrances industry, and the industry is expected to grow at the rate of 6–7% against the demand growth of 3–4%. The presence of large volume buyers in this segment may push suppliers to increase their product portfolio.

- The global flavor and fragrance market is expected to grow at a CAGR of 6–7 % from 2017 to 2022, and it is anticipated to create a similar demand trend in essential oil consumption.

- Currently, less than 10% of the essential oil is used in the personal care segment. FBT and pharmaceutical industries drive the major essential oil market share.

- Essential oils are now extensively studied as an alternative for antibiotics in poultry due to apprehensions around the overuse of antibiotics and added health benefits. A prominent example is Cargill's ongoing research of using essential oils derived from thyme, cinnamon and oregano as non-medicated feed additives.

Why You Should Buy This Report

- The essential oils market research study details the industry trends, cost breakup and price analysis, driver and demand analysis of essential oils including mint oil, cedarwood oil, and orange oil and their derived products.

- It lists the key market drivers and constraints of the essential oils market in India, USA, Brazil and other countries.

- This essential oils market report explains Porter's five forces model of the industry and lists out the best procurement strategies.

- Benchmarking of essential oil suppliers such as Robertet, Biolandes, and Sydney Essential Oils, to name a few.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now