Sunscreen Product Prices Likely to Go Up Due To Raw Material Shortage

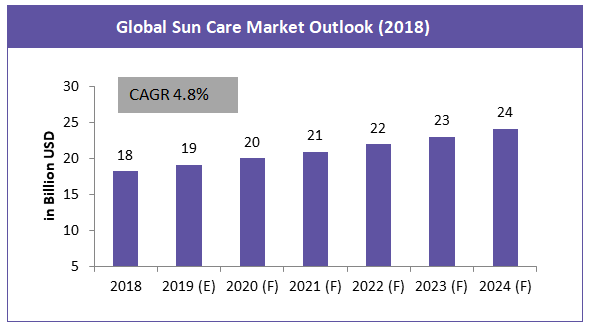

The global sun care market was valued $18 billion in 2018, which is expected to grow at a CAGR of 4.8 percent to reach $24 billion by 2024. Growing awareness about harmful UV radiations and increasing disposable income are the key factors that drive the global sun care market.

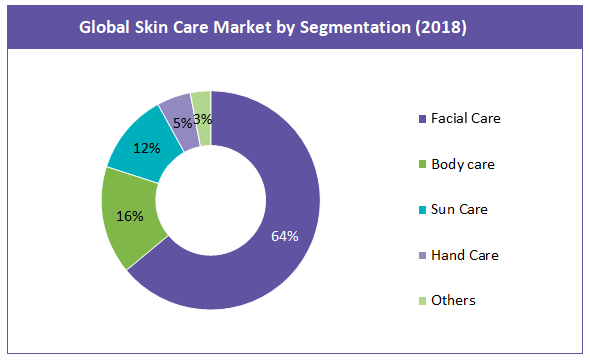

Sun care accounts for 12 percent of the global skin care market, and is further bifurcated into sun protection, self- tanning, and after-sun categories. Among these, sun protection is the most valuable segment, representing 86 percent of the total sun care market.

This article focuses on supply constraints on phenyl benzimidazole sulphonic acid (PBSA), one of the key raw materials used in sun care products. As it is a UVB filter, PBSA plays a critical role because a sunscreen’s sun protection factor, or SPF, only measures how effective the sunscreen is against UVB rays. This paper discusses the reasons for the supply shortage of PBSA and its impact on the price of sunscreen products.

Global Sun Care Market

The global sun care market, valued $18 billion in 2018, is expected to grow at a CAGR of 4.8 percent and reach $24 billion by 2024.

Sun care represents 12 percent of the overall global skin care product market. Products applied to protect the skin against harmful effects of UV rays emitted from the sun are known as sun care products. The sun protection factor (SPF) describes the measure of protection from UV rays to skin using sunscreen or any sun protection products. SPF 15 blocks approximately 93 percent of the UV rays, which is recommended when the skin burns for about 10 minutes.

The growing demand for sun protection products owing to the aforementioned factors, changing lifestyles of consumers in developed economies, and increasing demand for anti-aging products is projected to boost the usage of sun care products. Furthermore, an increase in skin cancer patients in the North American region due to UV exposure is expected to propel the self-tanner product over the forecast period.

Sun Care Product Segmentation

The sun care market is segmented into three product categories:

-

Sun protection products

-

After-sun products

-

Self-tanning products

The sun protection product category is the most valuable product segment, accounting for 86 percent of the global sun care market. The global sun protection market was valued $15 billion in 2018. Self-tanning and after-sun products are the other two key sub-segments, with a share of 4 percent and 10 percent, respectively.

Ingredients Used in Sun Protection Products

Most sunscreens contain a mixture of both chemical and physical ingredients. Chemical ingredients contain UVB and/or UVA absorbing ingredients. This is important because the sunscreen’s SPF only measures how effective the sunscreen is against UVB rays

There has been a growing trend among customers in the U.S. and Europe preferring organic ingredients in their sun care products to avoid synthetic chemicals.

Phenylbenzimidazole Sulfonic Acid

PBSA, also known as ensulizole, is an organic compound largely used in sunscreens and cosmetic products worldwide. It has the ability to primarily block or absorb UVB radiations. However, it does not give complete protection since it is unable to block UVA radiations; hence it is often paired with other ingredients such as avobenzone, zinc oxide, tinosorb, or titanium dioxide. PBSA has a characteristic quality that prevents its potency from degrading upon exposure to UV rays. PBSA has been considered to be non-carcinogen by the International Agency for Research on Cancer (IARC), American Conference of Industrial Hygienists (ACGIH), the National Toxicology Program (NTP), and Occupational Safety and Health Administration (OSHA). However the cosmetic databases consider it as a moderate hazard, as it can cause cancer related and cellular level change concerns if used for a prolonged period. Thus, this aspect is hampering the growth of the PBSA market and is a major growth barrier.

|

S.no |

Manufacturer |

Location |

|

1 |

Angchen Co., Ltd. |

China |

|

2 |

Chemspec Chemicals Pvt. Ltd. |

India |

|

3 |

DSM Nutritional Products |

The Netherlands |

|

4 |

Masteam Bio-tech Co. Ltd. |

China |

|

5 |

MFCI (Huangang) Co. Ltd./Huangshi Meifeng Chemical |

China |

|

6 |

Merck Performance Materials |

Germany |

|

7 |

Syntharo Fine Chemicals GmbH |

Germany |

|

8 |

Symrise |

Germany |

|

9 |

Vivimed Labs Ltd. |

India |

Phenylbenzimidazole Sulfonic Acid Supply Constraint

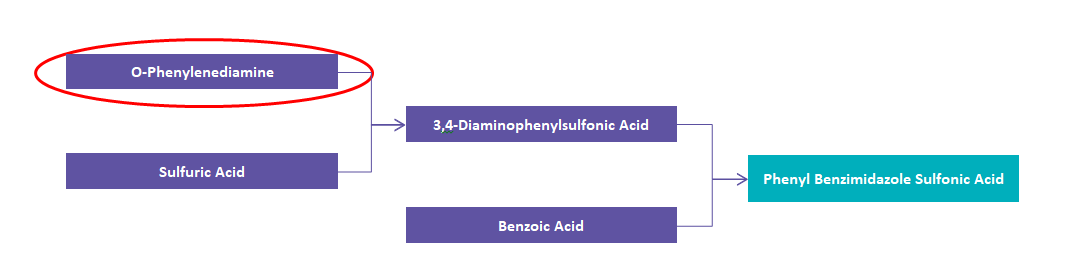

O-phenylenediamine is one of the key feed stock components required in the production of PBSA. As the current commercial production of o-phenylenediamine follows a highly complicated, hazardous multi-step process creating excessive unwanted hazardous by-products, many of the production units are closed in China. This has globally affected the supply of o-phenylenediamine.

Conclusion

There had been a huge supply-demand gap for o-phenylenediamine. With the plant shutdown and supply shortage, product availability has become very critical. Manufacturers who meet the standards are selling the product to the highest paying bidders, resulting in a tremendous increase in price. This price hike is expected to pass over to PBSA, and eventually, to the final product.

References

-

www.dsm.com

-

chemspec.co.in

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe