Procurement Approaches for Document Imaging Solutions in the BFSI Industry

Abstract

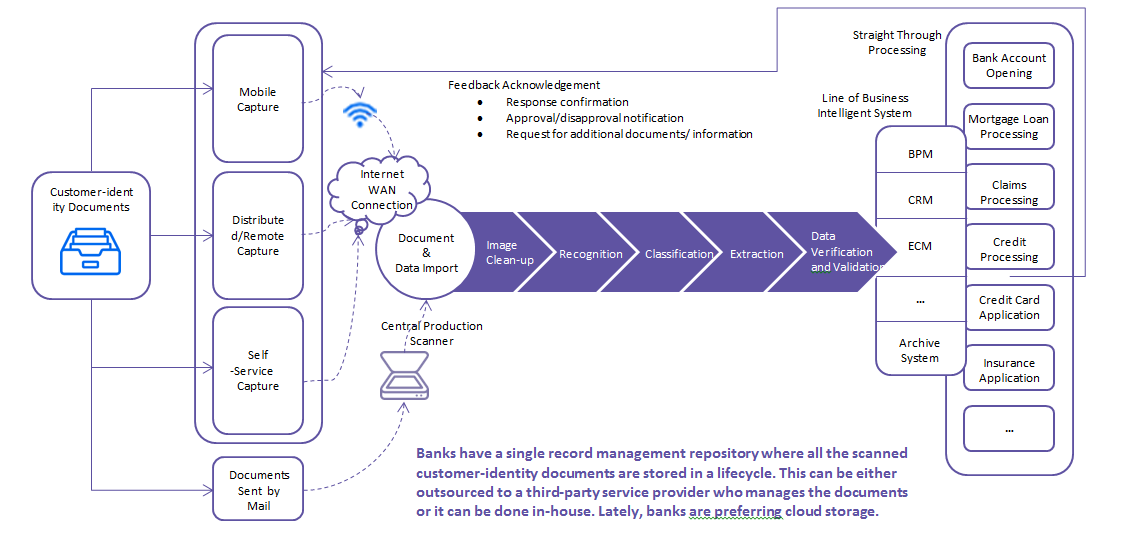

This article will discuss the various procurement approaches that can be followed in the BFSI industry, which is highly document intensive. Companies in the BFSI industry have started to reduce the use of paper as part of their GO GREEN initiative and to provide speedier services to their customers. This has resulted in a process re-engineering in the BFSI industry that involves many process changes and workforce retraining. New solutions with more features are continuously being introduced in the market to ease processes. Both centralized and decentralized scanning are often used simultaneously, depending on the business applications and volumes and what fits best with process design and current infrastructure.

Many organizations that aligned their business processes to route mail directly to a centralized scan center have adopted a centralized capture solution. The incoming documents are routed to a mailroom, digitized, classified, and then forwarded directly to the relevant employee or business process.

Conversely, banks and insurance companies, for example, also have offices and agents located globally. This makes the physical transfer of documents difficult and expensive. A distributed scanning process allows documents to be captured quickly and easily, reduces storage cost, and improves security by reducing the risk of unauthorized access to confidential paperwork.

The following deliverables will cover the various aspects of process re-engineering in the BFSI industry for document imaging solutions:

- Are the customer-identity documents created electronically at the branch or do the banks print and courier them to the document imaging team, which then scans and manually indexes them to the appropriate account and folder category?

- Do banks have a centralized scanning and manual indexing team for customer-identity documents or do they scan the documents at the source itself?

- Is there a way for all bank branches to convert these customer-identity documents into digitally readable PDF documents and store them securely in the records management repository using bar codes or OCR/machine learning (ML)/artificial intelligence (AI)?

- Do banks have a single record management repository where all the scanned customer-identity documents for any loan or deposit account are stored?

- With respect to document imaging of customer-identity documents, what are the OCR, ML, and AI solutions that other banks have deployed to replace manual indexing efforts, multiple handoffs, and time lag?

Centralized Vs. De-Centralized

Banks have offices and agents located globally, which makes the physical transfer of documents difficult and expensive, if not impossible. Distributed scanning allows documents to be captured quickly and easily. It also reduces storage cost and improves security by reducing the risk of unauthorized access to confidential paperwork.

| Centralized | De-Centralized |

|

The conventional method of handling remote sites where the banks ship the customer documents from all the branches to a central team for scanning and indexing. |

An approach where the documents are scanned and indexed at the branch and uploaded electronically into the server database |

|

Pros:

|

Pros:

|

|

Cons:

|

Cons:

|

Case Study

|

Challenge |

Solution |

Benefits |

|

BBVA Peru’s existing process to consult with a new customer and open a new bank account took approximately seven days, a delay that was causing BBVA to lose prospective customers. |

Xerox Consulting Services installed 378 DocuMate 262i scanners in all branches and retrained employees to automatically scan all bank credit documents including applications and plastic identity cards. |

|

In-house Vs. Outsourcing

Banks can look for in-house document management systems from service providers like Xerox, rather than outsource the entire value chain to a third party, such as Iron Mountain.

| In-house | Outsource |

|

The documents are scanned and indexed in-house. |

The scanning and indexing services are outsourced to service providers, who take care of the entire document management, in some cases |

|

Pros:

|

Pros:

|

|

Cons:

|

Cons:

|

Case Study

|

Challenge |

Solution |

Benefits |

|

Citibank Egypt faced many obstacles in productivity improvement and incurred unnecessary expenditure on its outdated document management system. |

Citibank engaged its existing print solutions vendor—Xerox—for document management solutions. Xerox offered the following solutions: 1. Xerox® Office Document Assessment to streamline the office environment |

|

Conversion and Integration

Document solution providers like Xerox, Canon, Epson, and others are increasingly offering solutions to enable banks to convert their customer-identity documents into digitally signed, readable PDF documents. The system also stores these documents securely in the records management repository using bar codes, or OCR/ML/AI.

| Challenge | Solution |

|

|

|

|

Record Management Repository

Case Study—Implementation of AI

|

Technology |

Implementation |

|

For customer on-boarding, the self-learning solution enables a dynamic and customized questionnaire that can adapt to the customer’s responses and prior intelligence gathered from various sources |

One of Africa’s largest banks:

|

|

Banks can benefit from AI/ML solutions in numerous KYC aspects, such as identity and background pre-checks for remote KYC, customer on-boarding, real-time transaction-based KYC anomaly detection, and KYC workflow automation. |

One of the largest U.S. banks:

|

References

- http://www.xeroxscanners.com/en/us/Press/documents/FinalBBVAPeruSuccessStory.pdf

- https://www.accusystem.com/blog/centralized-vs-decentralized/

- http://www.fujitsu.com/nl/Images/151010_Whitepaper_Banking_EN.pdf

- https://doxtek.com/wp-content/uploads/2015/02/Weighing-the-pros-and-cons-of-centralized-scanning-and-decentralized-scanning-final1.pdf

- https://www.alarisworld.com/~/media/files/im/positionpapers/the_future_of_intelligent_document_capture.pdf

- https://www.xerox.com/downloads/usa/en/gdo/casestudies/Citibank_Egypt_LR.pdf

- https://www.aiim.org/PDFDocuments/38054.pdf

- https://cbps.canon.com/assets/pdf/CaseStudy_RM_FinSvs_ShorterLoanCycleTime_CanonBusinessProcessServices.pdf

- https://www.xerox.com/downloads/gbr/en/f/Financial_Services_Compendium_XE_en.pdf

- http://www.fujitsu.com/nl/Images/151010_Whitepaper_Banking_EN.pdf

- http://www.fujitsu.com/nl/Images/151010_Whitepaper_Banking_EN.pdf

- https://emerj.com/ai-sector-overviews/ai-in-banking-analysis/

- https://www.finextra.com/newsarticle/32917/standard-chartered-picks-instabase-to-automate-client-onboarding/ai

- https://www2.deloitte.com/content/dam/Deloitte/in/Documents/financial-services/in-fs-deloitte-banking-colloquium-thoughtpaper-cii.pdf

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe