China’s construction industry to benefit as local market opens up to foreign investments

Abstract

China is aiming for an economic growth of 6.5 percent in 2017. Large-scale infrastructure spending will only partially make up for slowing business investment, as overcapacity is a critical issue in several industries. The decline in surplus capacity will ease the downward pressure on producer prices; hence low consumer price inflation is more likely. Asia-Pacific continues to contribute the largest share in global construction industry, aided by large construction spend markets of China, Japan, and India. However, pace of China’s construction industry growth remains sluggish. The Chinese government is aiming to rebalance the economy over the long-term, with the help of large-scale spending plans. These positive economic developments can bolster China’s construction industry.

Introduction

China, being the world’s second largest economy had created a new rage in the global economy. China’s inevitable slowdown was due to significant shift from manufacturing and export-driven economy to a domestically-driven one. This has led to Chinese exports falling after decades, thus creating a major slump in the economy. However, China‘s factory output and retail sales grew more rapidly than expected in Q2 2016, as the high residential market and government infrastructure spending spree underpinned growth in the country's economy.

A significant increase is expected in China’s real assets and infrastructure investment, and in the construction services and building products exports into key global markets over the next decade. Moreover, lifting the restrictions on foreign investment in land development, high-end hotels, office buildings, international exhibition centers, and the construction and operation of large theme parks, eventually led to the reclassification of Chinese real estate industry from “Restricted” to “Permitted” in the latest version of Catalogue for the Guidance of Foreign Investment Industries.

China's Construction Industry

China’s construction market boomed with rapid, record-breaking sales and price growth in 2016 but recent policy tightening makes the outlook for 2017 quite diverse. The industry recorded 2 percent growth in 2015 down from 8.7 percent in 2014 due to an imbalance in the Chinese economy, while the infrastructure investment spree and residential boom have slowly started to spur demand for construction.

China's construction sector is expected to rise by an annual average of 4.2 percent between 2017 and 2025 in real terms, despite a significant slowdown from the 11.6 percent recorded between 2006 and 2015. Infrastructure investments in railways and airports will provide robust growth in 2017, as rail projects are gaining traction.

As China's energy and utility sector is focusing on improving coal-fired power plants and water infrastructure, the pipeline of coal-fired power stations in China remains important but will gradually decrease over the long term. This progressive decrease will be due to policy modifications by the government to limit the excessive build-up of coal-fired power generation. Water infrastructure will register the strongest growth over the next five-year forecast period, with many projects gaining momentum.

However, the early signs of slowdown in growth have lead China to cede its position as the fastest-growing Asian market to India. The slowdown will have a dramatic impact on commodity demand and also affects the mining construction and infrastructure needed to supply and move commodities to the market. Steep fall in crude oil prices could also impact the supply and demand side of the market.

Construction supply-demand, price inflation and volatile labor costs

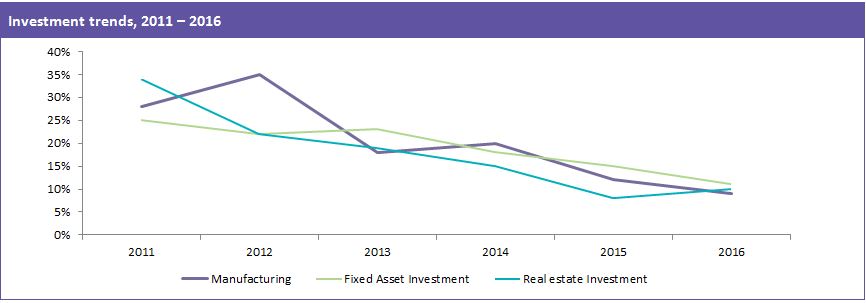

China’s fixed asset investment growth is 8.9 percent year-on-year in the first four months of 2017. Investment trends were mixed at a sub-sector level. Real estate investment continued to build up to 8.7 percent Y-O-Y (on a three-month moving average basis) from 7.3 percent previously; hence a rebound in construction activity has supported the industrial recovery in recent months. The rate of growth declined a little in May – although this was due to base effects of the imbalanced economy in 2015 - 2016.

Demand for the primary commodities such as steel, cement and copper boosts material supplies in the construction industry, and property prices have improved in the recent times rising by 10.3 percent Y-O-Y in May. China‘s consumer price inflation declined to its weakest pace in August 2016, pulled down by abating food costs, even though a positive moderation in producer price deflation is bolstering the growth of china’s economy. Construction costs are decreasing as contractors have high inventory, and this has impacted the property developers to restrict new projects, which means limited contracts for the construction companies, and hence contractors reduce profit margins. At the same time, substantial decreases in the costs of steel, copper, and nickel are helping to lower the cost of building materials.

China, as one of the resource intensive economies, has started to transform from labor intensive market to focus on more advanced technologies, the reason being a significant rise in cost of labor and other production factors in recent years prompting few international and domestic players to seek opportunities in other low-cost countries. The unit labor cost in manufacturing has tripled since 2000-2001, whereas the same has remained stable in developed countries such as the U.S., and Japan. China is taking active measures to tackle industrial overcapacity, and labor by investing more in advanced technologies and innovations.

Impact on Construction and Procurement

The massive flow of government investments into China will help in expanding their existing infrastructure and in building new ones. The construction projects arising as a result of these investments and associated infrastructure needs will drive China's construction demand to new heights.

To further re-shuffle the market and to standardize competitive regulations and rules for Green building industries, China’s Ministry of Housing and Urban-Rural Development (MoHURD) approved the “green building evaluation standard” related to the national standard (Numbers for GB - T50378-2014) that replaced the previous standard (GB3T50378-2006) on January 1st, 2015. As China’s National Urbanization Plan on New Urbanization (2014-2020): envisages a further 100 million urban dwellers settlement by 2020, the urbanization rate will further increase to more than 60 percent. China expects the access to social housing will reach at least 25 percent by 2020.

China’s construction market is highly fragmented and has been dominated by local construction companies. However, opportunities are provided to global construction companies to expand their presence in the country. This will help to improve infrastructure services in China. The improving face of China's construction industry will also provide a window for business recovery for the economy as the suppliers will be looking to offset their declining demand. A critical Beijing project investment is the Winter Olympic Games in 2022. This will entail sizeable investment, with a planned high-speed rail line to connect the venue with the city.

Conclusion

The modest construction investments into China and the associated infrastructure needs will increase the overall demand for construction. This is likely to increase the cost of construction inputs in China. However, the initiatives from the Chinese government are likely to expand China’s infrastructure which could transform the country into a region with excellent infrastructure facilities, and can compensate for the weak construction market in the APAC region currently. The aforementioned investment wave will attract buyers and global construction firms to expand into the Chinese market, which will provide the much-needed boost for the construction market that is yet to recover completely from the economic downturn.

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe