Growth potential in peptide and protein therapeutics to enhance supplier capacities

Abstract

Advances in fermentation and purification technologies have enabled the development of drugs from peptides and therapeutic proteins. While few peptide-based drugs have reached the market, several proteins and peptides are currently under clinical trials.

This whitepaper will cover the various protein and peptide drugs that are in pipeline and current technologies that are available to support the development of these drugs. It also provides an overview on contract manufacturing organizations (CMOs) who offer peptide-based active pharmaceutical ingredients (APIs) and other CMOs who offer appropriate manufacturing processes that are available in the market.

As companies look to outsource peptide manufacturing, they need to have a clear understanding on CMOs and their capabilities in protein and peptide drug manufacturing. To summarize whitepaper covers supply and competition in peptide market

Introduction

Peptides are the short strings of amino acids that are linked together by peptide bonds. Several peptides linked together are called polypeptides, whereas several polypeptides linked together make a protein.

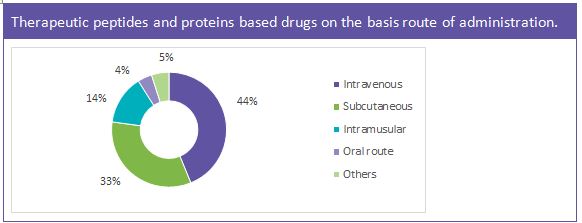

Peptide and proteins drugs are available in the market but have their own advantages and disadvantages. Peptide drugs have always been effective in their activity and specificity but lack some of the other qualities of a drug to sustain in the market. Peptides have a complex chemical structure that makes them expensive and complicated to manufacture. Peptide drugs due to their low oral bioavailability need to be administered through parenteral route.

The global market for peptide drugs is expected to grow in the coming years from $14 billion in 2011 to around $25.4 billion in 2018.

- With the support from developing technologies, new drugs based on peptides and proteins are expected to flourish with high potency and low toxicity

- Contract manufacturing organizations (CMOs) that are developing the peptide and protein active pharmaceutical ingredients and formulation are also improving their capabilities to meet the growing demand

- Various pharmaceutical companies have also stepped into partnerships with smaller companies who offer specialised peptide-based or protein-based technologies to develop or manufacture therapeutic peptides and proteins

All developing techologies will account for further development in the protein and peptide therapeutics market and improve their overall position in the pharmaceutical industry.

Peptides and Proteins in Pharmaceuticals

Several therapeutic peptides and proteins are approved by the FDA and have been in use. One of the most common therapeutic proteins is insulin. Small molecule and peptide-based drugs are classified under New Chemical Entities (NCEs) during FDA licensing, while protein-based drugs are classified under New Biological Entities (NBEs).

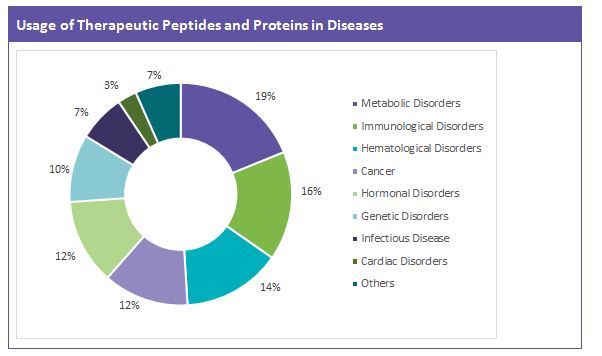

Most of the approved therapeutic peptides and proteins available in the market are used to treat metabolic and immunological disorders. Their contribution is also found in the treatment of cancer, hematological disorders, etc.

Almost all peptide-based drugs are to be administered through parenteral route. However, alternate routes of administration such as oral and topical use are also gaining traction nowadays.

Current market scenario

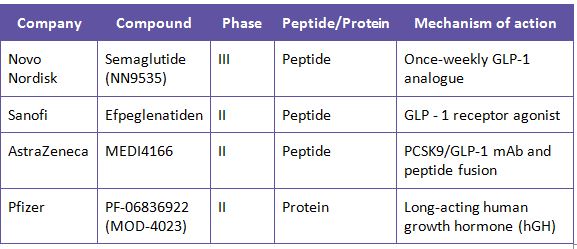

Several innovator companies such as Amgen, Novo Nordisk, Pfizer, Eli Lilly, Roche and AstraZeneca have peptide and protein drugs in their pipeline. Some of the top selling peptide drugs include Victoza (Novo Nordisk), Copaxone (Teva), Lupron (Abbott), Zoladex (AstraZeneca). Most of the drugs currently available in the market are mostly used in the treatment of Type 2 Diabetes. Glucagon-like Peptide 1 (GLP-1) Receptor is one of the widely developed peptide molecule in the pipeline. GLP-1 receptor antagonists offer glycemic control with a low risk of hypogycemia which makes it an attractive option for drug developers.

Some of the peptide and protein drugs that are currently in development are:

CMOs for peptides and proteins

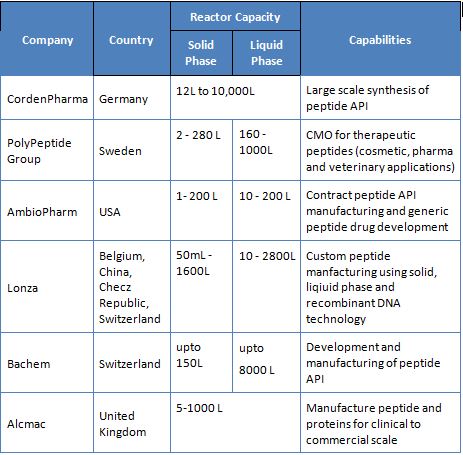

Global Peptide API demand is around 1400 kg per year. Currently nearly 50 percent of the total peptide API demand has been outsourced to CMOs and the percentage is expected to increase further by 2017. Outsourcing decision is mostly based on expertise and experience in peptide synthesis.

Some of the major CMOs and their capabilities are listed below.

Most of these companies use solid-phase, liquid-phase or receombinant DNA technology to manufacture their peptides. Other smaller companies who are in the development and manufacturing of peptides and proteins include AmbioPharm, CPC Scientific Peptide Company and Chemi Peptides.

To meet the growing demand several CMOs have equipped themselves by making acquisitions and expansions.

· Bachem acquired American Peptide company (USA) in February 2015. American Peptide Company’s services range from small scale catalog business to large scale custom manufacturing

· Almac announced the expansion of its peptide and protein technology services for 3.5 euros in April 2015. The expansion is a part of the relocation of their peptide and protein operations from their existing Elvingston facility to a custom designed facility in Scotland

· Corden Pharma acquired ORPEGEN Peptide Chemicals GmbH in January 2015 adding cost effective peptide API manufacturing capabilities to their peptide technology platform

· In August 2015, AmbioPharm announced the expanison of its manufacturing operations in South Carolina with an investment of $18.8 million

Technologies in the market and Partnerships

With several manufacturers available in the market to support peptide and protein manufacturing, pharma companies engage with these CMOs for their peptide and protein API manufacturing. However, the delivery of peptide drugs is a limiting factor that prevents the growth of thrapeutic peptides market. To overcome this bottleneck pharma companies have entered into partnerships with technologically strong companies to utilise their technology platforms.

· Pfizer partnered with Heptares Therapeutics in November 2015, to develop drugs aimed up to 10 G protein-coupled receptor (GPCR) targets. Heptares uses its proprietary StaR technology to develop protein therapeutics

· In Oct 2015, Novo Nordisk signed license agreement with Emisphere to develop and commercialize oral formulations. Emisphere’s Eligen technology is a proprietary oral drug delivery platform which facilitates absorption of small and large molecules without altering their chemical form or pharmacological properties

· J&J announced a collaboration with enGene, Inc. to develop and commercialise drugs for inflammatory bowel disease (IBD). J&J will utilise enGene’s drug delivery platform ‘GenePill’which will make oral delivery of protein drugs a reality

Companies that have their own proprietary technologies for peptide and protein development include:

- Enteris BioPharma – Peptelligence is their oral drug delivery platform which enables oral delivery of molecules which are usually injected (e.g. peptides and proteins) in an enteric-coated tablet formulation

- Provepep – the company holds exclusive licence for a patented technology called SEA peptide ligation. This technology supports production of high purity proteins at affordable cost

Therefore, big pharma companies can look at collaborating with similar technology specific companies to develop affordable and easy to deliver proteins and peptides.

Conclusion

In recent times there has been increased traction in the pharmaceutical industry for peptide and protein therapeutics. This is mainly due to their efficient management of numerous disease indications. With several new technology platforms emerging in the market to address the issues of low bioavailability and high protein production cost, more peptide and protein drugs are expected to enter the market.

- Currently there are limited number of CMOs who offer peptide and protein API and formulation manufacturing in the market. With major growth happening in the peptide and protein therapeutics market more CMOs are expected to enter the market in the near future

- Several small companies having proprietary technologies for peptide and protein drug development are available in the market. Companies seeking technical platforms to improve the bioavailability and efficacy of their peptide and protein drug candidates have started collaborating with their technically strong counter parts. This trend is expected to increase in the coming years as there are many companies in the market that offer technical expertise upon collaboration

- Most peptide and protein drugs currently in pipeline are used in the treatment of indications such as oncology and metabolic disorders. Use of peptide therapeutics in the treatment of diabetes is one of the major reasons for the growth of this maket. However, expansion into other areas such as inflammation, infectious diseases and hematology will drive major growth in the market

All these factors will also create a healthy competition in the market among pharmaceutical companies and contract manufacturers. Pharma companies will look for new areas of development while contract manufacturing companies will consider increasing their capacities for peptide and protein therapeutics.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe