Negotiation Insights on Employer-Sponsored Health Insurance Premiums

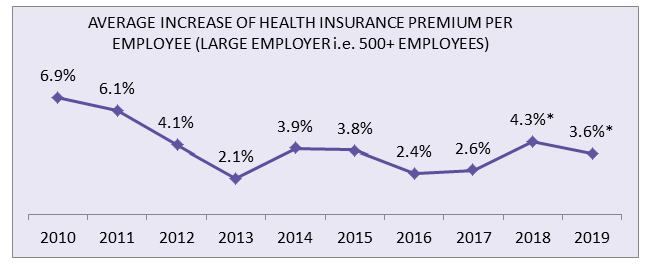

In 2018, following planned changes such as raising deductibles or switching carriers, large employers anticipated an average increase of 4.3 percent on health insurance premiums per employee—the most significant increase since 2011.

Therefore, it is essential for large employers to understand the pricing mechanism of group health insurance plans to attain better negotiation leverage on potential suppliers’ proposed premium quotes.

MERCER’S 2017 National Survey Findings (Large-Employers)

- In 2018, following planned changes such as raising deductibles or switching carriers etc., employers anticipated an average increase of 4.3 percent on health insurance premiums per employee.

- The average increase of 4.3 percent in 2018 is the highest since 2011.

- Without planned changes, large employers are likely to experience an average increased premium of 6 percent in 2018.

- In 2017, the total health benefit cost per employee (large-employer category) averaged $12,615 or around 14 percent of total employee payroll.

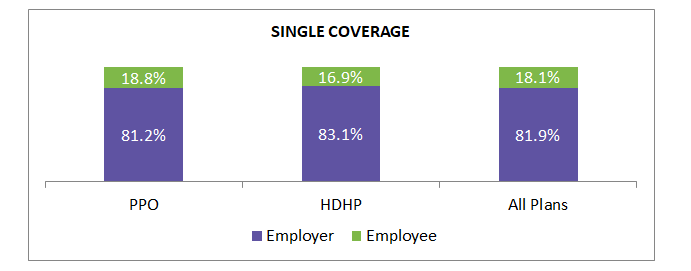

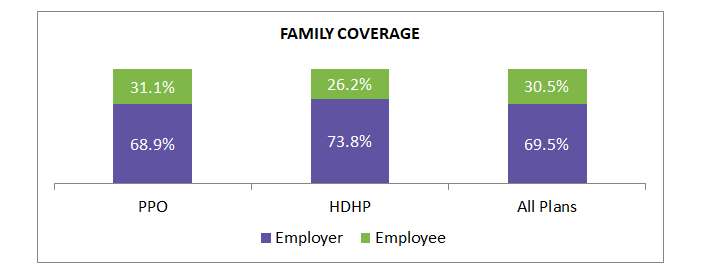

Annual health insurance premium contribution share (national average): employer-sponsored health insurance (all sizes)

The national average on the premium contribution of single and family coverage by an employee stood at around 18 percent and 30 percent, respectively, of all plan types.

Note:

PPO refers to Preferred Provider Organization

HDHP refers to High Deductible Health Plan

Basic Factor That Inflates Employer-Sponsored Health Insurance Premium: RATING

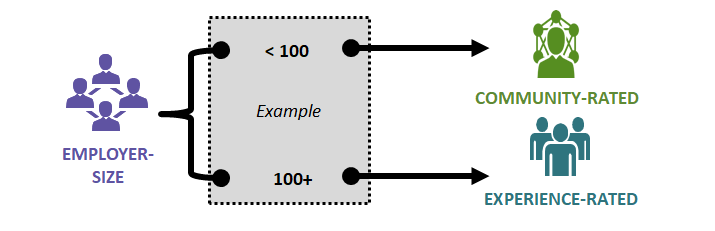

The group threshold size varies among insurance providers. As a result, an employee benefits broker plays a vital role in ascertaining ideal ratings and suppliers for procuring health plans.

RATING: A rating factor is basically a characteristic about insured members, which health insurance companies (i.e. suppliers) utilize to evaluate the probability of filing claims by members.

COMMUNITY RATED: Health insurance carriers ascertain the insurance premium considering the claims experiences of all insurance carriers in a particular territory.

EXPERIENCE RATED: Health insurance carriers ascertain the insurance premium based on claims data (to some extent) of that particular client. The higher the covered members, the more the claims data is relied upon to ascertain the insurance premium.

Health Insurance Premium Calculation by the Service Provider

-

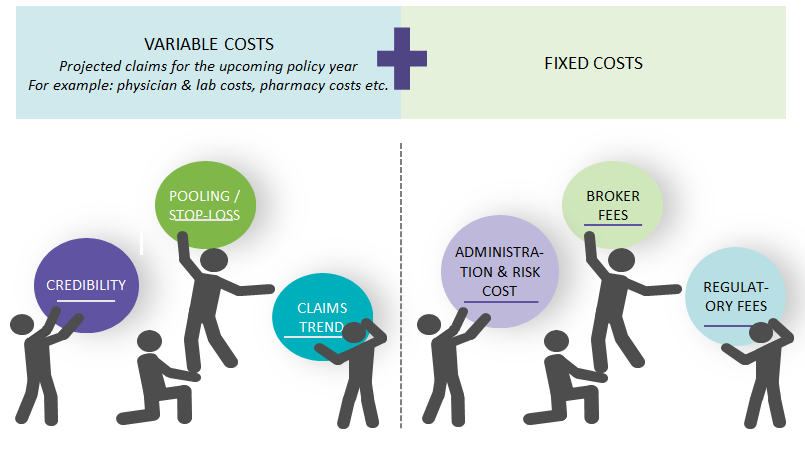

Health insurance providers estimate the rate of premium increase for employer-sponsored health plans, based on projected medical claims for the upcoming policy year.

-

As experience-related rating (mostly) applies to large-employers, it is essential to understand various predominant constituents that are factored by the supplier in variable costs to attain maximum negotiation leverage (i.e. cost savings) on the proposed premium.

Negotiation Insights on Variable Cost Components

In addition to fixed cost components, analyzing the predominant variable cost components of insurance premiums in-depth either through benefits brokers or internal HR teams provides greater cost-optimization insights to large-employers.

Identifying providers whose business claims are closely aligned with the employees claim data (existing and previous years) is pivotal to minimizing premium increases and obtaining negotiation leverage for large-employers.

Credibility

-

Defined as how closely-aligned the current insurance claims are to the provider’s book of business claims.

-

As a result, large-employers should choose brokerage firms that are able to recommend providers whose business claims are aligned with the employee’s claims data of previous years.

-

On the other hand, large-employers (besides the broker) should ensure the provider has estimated the premium based on their own employees claim data to contain the premium increase.

Pooling / STOP-LOSS Feature

-

Stop-loss feature protects health plans from the impact of calamitous claims. If one or two calamitous claims are factored into the renewal agreements, it could skew the insurance premium higher.

-

However, insurance companies do not penalize plan sponsors (buyer or employer) by including calamitous claims in their entirety. Instead, a specific dollar amount is considered through pooling / stop-loss.

-

As a result, plan sponsors pay a pooling charge for this non-optional feature— whether or not there was a calamitous claim in previous years.

-

Hence, large-employers should ensure that the pooling / stop-loss feature premium is justly factored in estimating the premium by the provider. To ascertain the justly factored amount, employers should ensure the brokerage firm advisory on pooling / stop-loss feature is market determined.

Claims Trend

-

Insurance providers analyze historical claims data and adjust them for the projected increase due to healthcare cost inflation and increased frequency to ascertain the future policy period value of those experience period claims.

-

The projected claims also will be adjusted to population demographics and benefit changes (including regulatory mandates).

-

Hence, large-employers should analyze their employees historical claim data with the help of brokers or internal HR teams to ascertain actual claims trends. By this analysis, employers can attain greater leverage with providers at the negotiation stage.

References

- SourceMedia (Employee Benefit News)

- Society for Human Resources Management (SHRM)

- Mercer 2017 National Survey

- Kaiser Family Foundation—Health Research & Educational Trust

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe