Emerging markets hold the potential for makers of biosimilars

Abstract

1 Introduction

Over the past several years, biologics have gained significance in the pharmaceutical industry, representing more than $210 billion in global sales in 2016 and is expected to reach $480 billion in 2024 by growing at a CAGR of 10-11 percent. By 2020, 11 biologics drug patents will expire which account for global sales of more than $60 billion. In addition to this, with the increasing worldwide focus on improving health care access and the cost of healthcare provides an attractive opportunity for biosimilars manufacturers.The global biosimilars market is about $3.4 billion in 2016 and is expected to reach $10.9 billion by 2021 by growing at a CAGR of 26-27 percent. By 2020, biosimilars have the potential to compete with a number of key biologics drugs that have current sales of more than $40 billion.

2 Main

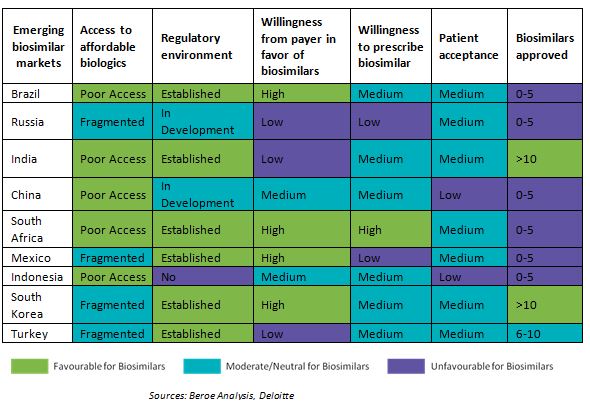

This whitepaper focuses on the huge potential available in the emerging markets for biosimilars which pharma MNCs can utilize for their benefit. Major opportunities exist in emerging markets, especially in India and South Korea. Although selling low cost biosimilars in emerging markets may appear to be a less attractive strategy when compared to developed markets, venturing into emerging markets would reap long-term success for biosimilar companies.

3 Recommendation

While many pharma MNCs want a presence in developed markets, considerable opportunity exists in emerging markets for biosimilars.

Adopting a long-term strategy to provide affordable products can help biosimilars players to increase their sales and be successful in the emerging markets. They need to select the therapeutic area for biosimilars that have the largest potential impact for the local population. Some of the best approaches for capitalizing on the emerging markets include participation in joint ventures, licensing arrangements and other types of alliances. Partnership with a domestic pharmaceutical or biotechnology firm is often necessary to gain access to the market.

Biosimilars potential in emerging markets

Less stringent or relaxed regulatory requirements for biosimilars in emerging markets are driving the growth of biosimilars. The emerging pharmaceutical markets of Asia, Latin America and Eastern Europe would turn as attractive locations for biosimilars research and commercialization. Growing middle class income, increasing healthcare expenditure and generics-driven pharmaceutical markets in these emerging nations provide a positive medical and commercial environment for biosimilars.

Drivers:

- Emerging biotech companies are now outsourcing as frequently as big pharma, at the Discovery, Preclinical, and Phase I stages of drug development. In near future, 30 percent of biosimilars manufacturing is expected to be outsorced

- Popularity of biologic drugs is increasing mainly for chronic diseases (diabetes, arthritis, and heart diseases) which are difficult to treat with small-molecule drugs

- Many biologic blockbuster drugs are facing patent expiration and the need to reduce healthcare costs is also driving biosimilars growth, which would significantly reduce cost by 30 percent to 50 percent compared to patented drugs

- Increase in awareness and affordability in the growing middle classes in emerging markets with improved healthcare infrastructure

Constraints:

- In the emerging markets, biosimilar guidelines may not be fully established and may differ from country to country unlike the EU where all the countries follow the same guidelines established by EMA. This creates challenges to global development programs in the emerging markets

- Biosimilars companies planning to receive approval for a biosimilar in an emerging market may face additional quality, non-clinical, or clinical procedures, depending on the country

- The need to invest extensively in facilities, human resources, and technology also make it quite costly to develop biosimilars when compared to small-molecule generics

Key regions in emerging markets

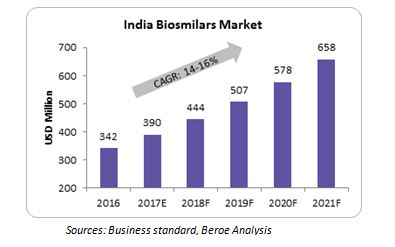

India Biosimilars Market

Key factors to consider for big pharma to enter India’s Biosimilars market

- Biosimilar guidelines established in 2012

- 80 percent of pharmaceutical spend is out-of-pocket

- Indian companies have extensive experience with generics and have made in-roads in other countries as well through exports

- Indian companies struggle with the image of unsafe manufacturing and poor quality drugs

- Partnerships between global pharmaceutical companies and domestic companies are helping to improve the quality of biosimilars marketed in India

- About 19 biosimilars are in the development pipeline and there is large proliferation of non-original biologics

- Large middle class with growing income prefer branded products. So there is a good opportunity for branded biosimilars

- About 70 percent of the country’s population live in rural areas. So, the focus will be on the cost of therapy – a 20-30 percent discount on originator biologics may not be sufficient

Few examples of biosimilar launches in India

- In 2016, Hetero drugs launched rituximab, a biosimilar version of Roche’s MabThera

- Torrent Pharmaceuticals recently launched its biosimilar for adalimumab which is the second biosimilar of adalimumab in the world

- Zydus Cadila launched the first biosimilar for AbbVie’s Humira (adalimumab) at the end of 2014

- Dr. Reddy’s Laboratories received approval for its biosilmilar of rituximab (Reditux) in India in 2007

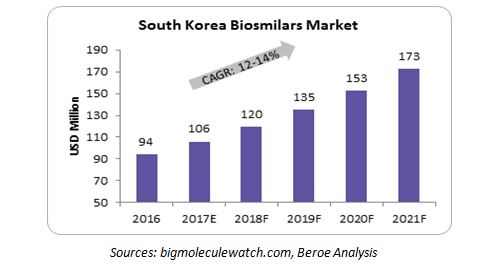

South Korea Biosimilars Market

Key factors to consider for big pharma to enter South Korea’s biosimilars market

- Most mature biosimilar “development” market

- Enabled by unprecedented support from the South Korean government: 35 percent of the national medical R&D budget was invested into biosimilars development in 2012

- Government-set goal for domestic biopharmaceutical companies to win 22 percent of the global biosimilars market by 2020

- 12 biosimilars have been approved and another 36 biosimilars are in the pipeline

- Leading the race in the high-risk and complex development of monoclonal antibody (mAb) biosimilars with 17 mAbs in the pipeline

Few examples of biosimilar launches in South Korea

- In 2016, Celltrion received approval for Truxima, a biosimilar version of Roche’s MabThera (Rituximab)

- In 2015, Merck/Samsung Bioepis launched biosimilar Brenzys, a biosimilar version of Amgen’s Enbrel (etanercept)

- In 2014, Hanwha Chemical launched Davictrel, a biosimilar version of Amgen’s Enbrel (etanercept)

- In 2014, Celltrion launched Herzuma, a biosimilar version of Roche’s Herceptin (trastuzumab)

Emerging Market Strategy

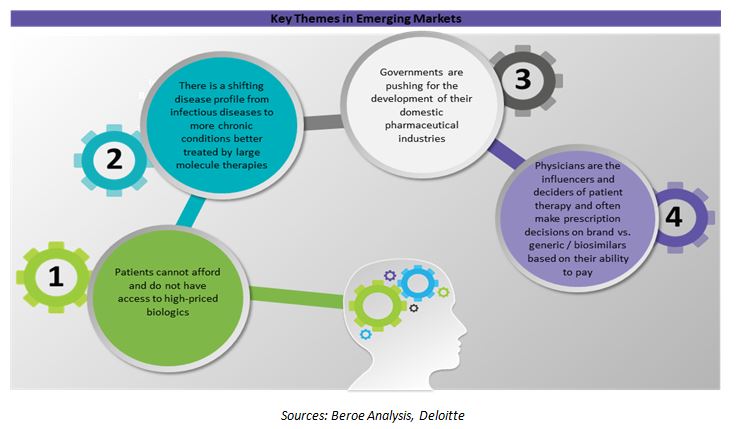

The large untapped demand characterized by poor physical and financial access to currently high-priced biologics provides favorable long-term growth opportunities. Additionally, macroeconomic factors such as high GDP growth rates, increasing purchasing power and health care spending, strong regulatory focus on reducing costs and increasing treatment access also contribute to the growth of the biologics segment.

Cost is a huge barrier for the use of biologics in the emerging markets, and physicians would increase prescription rates if less expensive biosimilar alternatives were available. In most of these countries, patients are unable to afford branded biologics which is a powerful driver for biosimilars. In addition, many of these countries already have biosimilar approval pathways in place or are finalizing guidelines.

Key business models

Lower margins, higher volumes

Big pharma companies need to adapt traditional business models in several ways when entering/expanding in emerging markets. Emerging markets will not provide huge profit margins as earned in developed markets. Margins will be lower due to lower prices and upfront investments required to build the markets. Manufacturers will need to shift approaches to hunt for higher volumes at a lower margin.

Brand matters

Big pharma should not look to promote biosimilars by any differentiation (other than price) because differentiation from the branded drug could create fears in customers, especially in markets where counterfeiting can be widespread. 75 percent of pharmaceutical growth is expected to come from branded generics in emerging markets. Moreover, 80 percent of consumers in developing Asian markets and 60 percent of consumers in Latin American markets buy products and services from a trusted brand.

Patient- and physician-driven uptake

In emerging markets, physicians and patients are expected to play a bigger role in biosimilars uptake. In many emerging markets, physicians are the sole decision makers of patient therapy based on their perception of a patient’s ability to pay for high-priced therapies.

Physician awareness

One challenge facing biosimilars in emerging markets is low physician awareness of biosimilars. Hence, biosimilars manufacturers should develop education programs to educate physicians (and nurses) on the need to treat patients, how to administer the product, and the side-effects and benefits.

Patient Awareness

Patient awareness may be another way to drive biosimilars adoption. Direct-to-patient marketing is not permitted in most markets, many emerging markets have growing ‘patient advocacy groups’ that can drive market access, and physician and patient awareness. This provides an opportunity for biosimilars companies to work with these groups to educate patients on the therapy options available, including the price advantage of biosimilars and the long-term benefits of the medication.

How to Win

Conclusion

While most players want a presence in developed markets, a considerable opportunity exists in emerging markets for biosimilars. Biosimilar players need to chart a long-term strategy to provide affordable products to capture these markets. They also need to select therapeutic areas with the largest potential impact for the local population. Although the strategy of selling low-cost biosimilars in emerging markets may appear less attractive, it helps to achieve long-term success for biosimilars players.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

A