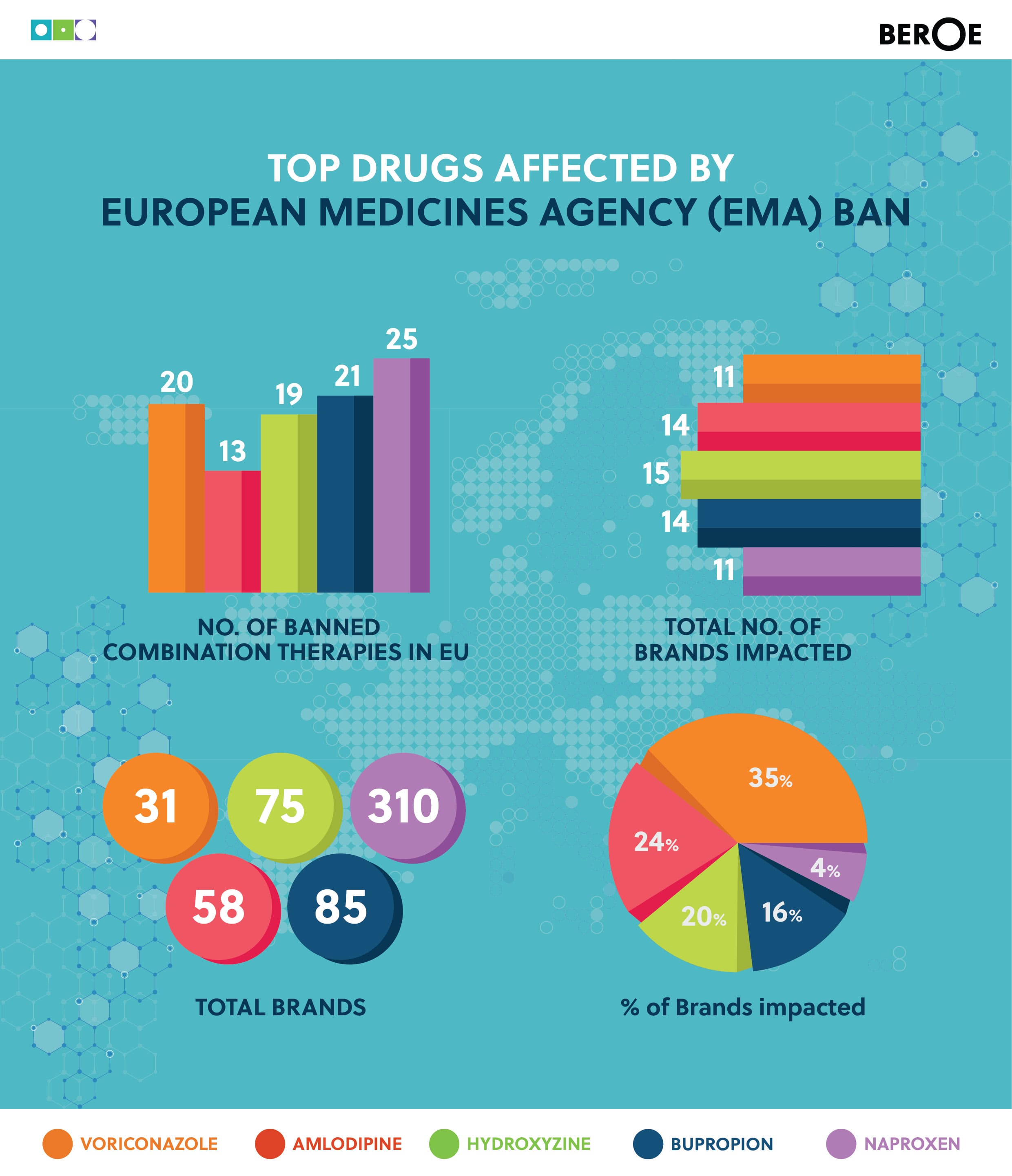

Top drugs affected by European Medicines Agency (EMA) ban

In collaboration with Sapna Rani, Senior Research Analyst - Clinical Research

In March, The European Medicines Agency (EMA) suspended all drugs which were tested for bioequivalence(BE) at Micro Therapeutics Labs. The data provided between June 2012 until 2016 on BE were not acceptable for market authorization.

Impact for Pharma:

Who were the major Market Authorization Holders for Drugs that were suspended?

Sandoz, Teva, Mylan, Sanofi Aventis, Glenmark, Lupin, Bristol Laboratories Limited, Aurobindo Pharma, Zydus, Orion, Accord

Are there risks of adverse events?

EMA mentioned that “there is no evidence of harm or lack of effectiveness of medicines authorised and being evaluated in the EU based on studies at the sites”

What is the background for India on Clinical Trial Deficiencies?

- In May 2015 EU banned the marketing of about 700 generic drugs tested at GVK’s facility in Hyderabad for systematic manipulation of Bioequivalence Studies.

- In July 2016 French Medicines Agency identified flawed BE studies at Semler Research Centre, Bangalore and suspended around 250 generic drugs across various EU member states.

Are there Regional Regulatory Standards for BE Studies in India?

Yes, Central Drugs Standard Control Organization has guidelines on the conduct of BE studies and outlined new requirement for BE studies in their latest articles published on 2015.

What should be the best procurement standard moving forward?

Indian suppliers are expected to reorganize their services owing to repeated lack of compliance. Although the relative cost of supply is higher, the risk of suspension of market authorisation is relatively low in the alternate supply base of EU and the U.S.

Engagement Model 1: Procure project-based BE studies from regional suppliers in EU and U.S. at a relative premium pricing.

Engagement Model 2: Bundle BE studies along with Early Phase studies from regional suppliers in EU and U.S. with relatively lower premium pricing and payments made as milestones of overall engagement. The turnaround period will be relatively slow here.

Engagement Model 3: Identify end-to-end service provides for clinical trials and identify if one of the supplier can manage all BE studies with quicker turnaround time.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe