Ways of extending payment terms without hurting suppliers | supplier payment terms

Saranya Sundararajan -- Team Lead and Sujeet Pandey -- Senior Research Analyst; additional inputs by Sakthi Prasad

Working Capital Management has been considered as one of the top 5 priorities for CFOs every year. It plays a key role in determining the solvency of a firm, maintaining goodwill, and for smooth business operations.

Working capital management system ensures the right balance of inventories and cash in the business. Optimizing working capital helps companies by improving their cash flow and reducing their inventory and capital costs.

While there has been no significant change in the working capital days in the last five years -- having deteriorated by 0.8 days -- it appears this may have been achieved in a manner which is placing increased pressure on the supply chain, PWC said in a recent report. The firm added that higher Days Payables Outstanding (DPO) “may be indicative of increased creditor stretching activity, which might not be sustainable in the long term.”

In an ideal scenario, a supplier gets paid on invoices almost immediately -- but that almost never happens. A delay in customer payments or ad hoc extension of payment terms can be a frustrating experience for any supplier.

Efficient working capital management, hence, becomes crucial and it needs to be done in a manner without stressing out the supply chain.

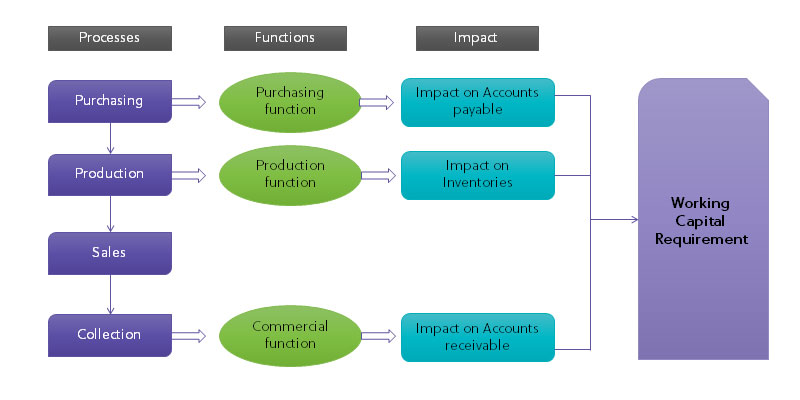

Objective: The aim of an effective working capital management system is to increase the accounts payable period, while reducing the accounts receivable period and inventory.

Measures to improve Working Capital:

|

Components |

Objective |

Ease of Impact |

|

Accounts Payable |

|

High |

|

Accounts Receivable |

|

Medium |

|

Inventory Management |

|

Low |

Driven by the targets to increase cash flow and increasing pressure from stakeholders, companies undertake various actions as follows:

|

Key Actions |

Working Capital Component |

Procurement Involvement |

Savings |

|

Extending Payment Terms |

AP |

High |

High |

|

Flexibility in Calculating Payment Due Dates |

AP |

High |

Medium |

|

Setting a Beneficial Payment Cycle |

AP |

Medium |

Medium |

|

Enabling Implementation of Supply Chain Finance |

AP |

Medium |

High |

|

Swift Billing |

AR |

Low |

Medium |

|

Collection Calling and Dunning |

AR |

Low |

Medium |

|

Reducing Credit Term |

AR |

High |

High |

|

Factoring |

AR |

Low |

Medium |

|

Inventory Optimisation |

Inventory |

Low |

High |

Extending Payment Terms:

Of all the options listed above, let us examine how best to extend the payment terms without stressing the supply chain.

Large organizations usually have a standardized payment term, which is favorable for their cash flow position, and all deviations would require high level authorization.

Segmenting Vendor Groups: Companies should segregate group vendors and then choose those groups, who provide the best opportunities for altering the payment terms.

- Strategic Suppliers: These are the core vendors who represent the highest savings potential for a buyer. However, care should be taken not to antagonize these suppliers. As the savings potential is higher from this segment, payment terms need to be negotiated carefully. Otherwise, it would amount to killing the goose that lays the golden egg.

- Non-strategic Suppliers: All vendors below a certain limit of spend could be unilaterally changed to the standard payment term (unless on better terms) via a master data upload.

Setting up a Help Desk: Secondly, a help desk should be set for better handling of supplier queries.

Optimize Discounts for Early Payments: Where buyers are willing to pay early, companies should optimize the dynamic discounts with the suppliers.

Benefits: This will lengthen the DPO profile, helping release large amounts of cash. Extension of payment terms can account for 5-20 percent uplift in the value of accounts payable balance.

Risks: Any short term progress will be eroded over time without the right organisation and tracking mechanisms. Visibility of performance will prevent this occurrence.

Ideal Communication process to suppliers for Payment Extension

- For new suppliers: The desired payment term to be mentioned in contracts to make it a contractual obligation.

- For Existing suppliers: Formalize by letter to non-strategic suppliers. For example, existing PT +15 days as DPO from now on.

- Invite strategic suppliers for a collaboration on increase in any potential days (+) without cost impact and gradually plan a way forward to the existing payment terms for next fiscal year or in next two years.

Develop a possible Reverse factoring program with local Banks/Fintech service providers who can provide attractive discount rates.

How best to drive Payment Terms with Suppliers?

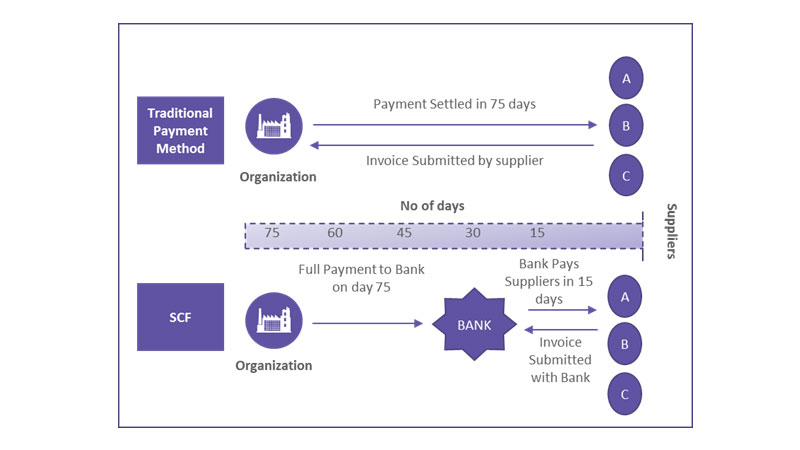

- Supply Chain Financing or Reverse Factoring is the most used Procurement Lever deployed by many Fortune 500 companies in case challenges are faced in extending the payment terms through direct negotiation with suppliers.

The model works best with medium and small suppliers who are short on cash. Organizations have successfully implemented SCF by interacting directly with the finance team and bypassing the sales team in case of large suppliers. Markets such as U.S. and Europe have lower bank interest rates -- hence SCF is easier to implement.

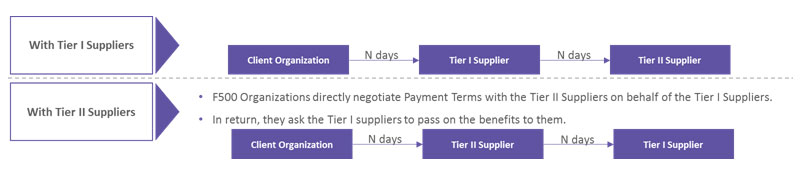

- Fortune 500 organizations first negotiate with their immediate suppliers with regards to payment terms extension. However, in cases where the Tier I supplier doesn’t agree, organizations negotiate the terms with Tier II suppliers and ask Tier I suppliers to pass on the same benefit. In most cases, Tier II suppliers agree to the extended payment terms owing to the brand value of the client organization. This option is applicable to select Direct Category suppliers.

Engagement Models

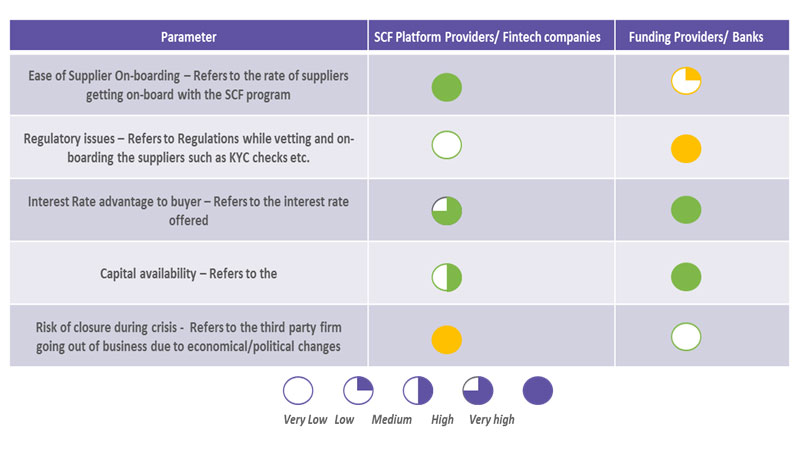

With the advent of Reverse Factoring programs, Best-in-Class organizations started partnering with a single bank. However, they later moved on to a multi-bank approach while deploying the program in more regions, or expanding the program to smaller suppliers, owing to the fact that different banks are leaders in different regions.

Currently, organizations are moving towards Fintech companies as Reverse factoring partners. Fintech companies have simpler onboarding process, hence easier to on-board smaller suppliers. Moreover, Fintech companies help in on-boarding more suppliers on the platform who do not have a system such as e-invoicing functionality.

Even though traditional banks are tied down by various regulations, they still offer a secure and risk free option when it comes to cash availability.

Single Bank vs Multi-Bank

With time and expanding supplier base in different regions, best-in-class organizations have moved to a multi-bank approach. Instances have also been seen where a bank partners with multiple banks in order to expand its scale of operations.

| Single Bank | Multi-Bank | |

| Software/Platform | Properietary platform develop by the bank is used to deploy SCF programs. | Supply Chain Finance (SCF) platform developed by SCF platform providers is used by multiple banks to offer SCF program on a single platform. |

| Scope | Limited Scope as the funding bank can fund only some countires/region. | Participation of multiple banks enables buyer organizations to increase the scope. |

| Price | The participating bank syndicate the pricing. Suppliers/Buyer have less options to negotiate on pricing. | The lead platform bank manages the pricing band of the buyer. |

| Control | Buyer organization has more control over the SCF program. | Buyer organizations tends to loose control on the SCF program. An effective SCF program provider or Lead platform bank (depending on the engagement) ensures more control over the programs. |

Conclusion:

Intensifying competition in the field of Supply Chain Finance (SCF) has created many options to optimize payment terms. If planned well, a firm’s supply chain can act as a source of inexpensive capital without having to ruffle the buyer-supplier relationship.

FAQ

-

What are the consequences of an extension of payment terms for a supplier?

The extension of payment terms applies tremendous pressure on the supply chain, causing frustration for the supplier. It will lead to cash flow problems for suppliers relying on timely payment to maintain their budget. The supplier is bound to negotiate higher prices to balance the extended payment terms.

But if the negotiation is a failure, then his profitability is reduced. The supplier might feel exploited and miss out on investing for his growth.

-

What are some of the alternatives to extending credit?

There are several alternatives to extending credit for the suppliers that would put them in adverse conditions. A wise negotiation with the supplier can expand your cash flow, reducing the overall cost.

Good negotiation is possible if you purchase bulk from the supplier and pave the way for better discounts, thus preventing the need to extend credit.

Bartering is also an alternative to extending credits through an exchange of goods and services to the supplier in return for the same.

-

What is the benefit of extending payment terms?

Extending payment terms can help strengthen the Days Payable Outstanding (DPO) profile, allowing businessmen to enhance their cash flow.

The increased working capital will enable them to purchase and invest in better goods and services and expand their operations.

The payment term extension also results in a 5-20 percent boost in the accounts payable balance value. It allows businesses to manage their finances and allocate their resources more proficiently.

-

What are the best ways to deal with and pay suppliers?

Certain practices need to be followed for a smooth deal with your suppliers. The payment terms shall be negotiated well with the affirmation of both parties before entering into a business relationship.

There should be effective communication regarding deadlines and payment status on time.

An automated payment processing system should be implemented for error-free payment. To ensure that the payment is made on time and securely, it is advised to use electronic payment methods.

-

What are the benefits of Supply Chain Finance for businesses?

Supply Chain Financing assists when there is a conflict with suppliers regarding extending payment terms. It secures commercial transactions with added flexibility. In case of a delay in payment, the supplier applying to Supply Chain Financing should receive the payment immediately, thus maintaining the cash flow.

It strengthens the relationship and reliability between the buyer and the supplier. SCF opens a way of low-cost financing options for businesses by allowing better negotiation.

-

How does Supply Chain Finance differ from traditional financing?

Supply Chain Financing focuses on optimizing payment terms for an efficient cash flow, whereas traditional financing involves getting a loan or credit from the bank.

The interest rates for Supply Chain Finance are comparatively lower than traditional financing.

The invoices and purchase reports serve as collateral in Supply Chain Finance, whereas traditional financing requires expensive collateral from the borrower. All in all, SCF provides a collaborative approach to finance without compromising the interests of both parties.

-

How can technology be used to improve Supply Chain Finance?

Supply Chain Financing can be advanced by using automation to accomplish manual tasks of processing invoices and financing approvals.

Incorporating data analytics can give better insights into the latest finance trends to make good decisions and better strategies.

The invoicing process can be made simpler, more accurate, fast, and error-free by Electronic invoicing. Machine learning algorithms can help to predict possible risks of supply chain financing. Hence, technology can make the process of supply chain financing efficient.

-

How can businesses implement Supply Chain Finance?

The businesses should do thorough research to find a financing provider that will cater to all their supply chain financing needs and be willing to work with both parties.

Before doing business with them, there should be a proper discussion about the collateral, payments, and interests with the SCF provider.

The businesses should recognize the right technology that can help to make the SCF program efficient and reliable. The performance metrics and supplier satisfaction shall be monitored from time to time.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

E

V