The fallout of Volkswagen's

In collaboration with Midhun Menon, Research Analyst, Fleet Services

Volkswagen had admitted in September that eleven million diesel vehicles worldwide were fitted with illegal software that "cheated" U.S. emissions tests.

Considering that the company car market consists of millions of units in both U.S. and Europe, the scandal that had rocked the auto world will have wide ramifications in the Fleet industry.

Fleet managers of large companies may have to deal with five different factors that arise out of the "diesel-gate" situation:

Residual Value: This denotes the market value of the cars when their lease period ends. Residual values for the affected Volkswagen cars went down by 6.5% from September till the middle of October in the U.S., whereas it fell by only 0.2 percent in UK.

"The situation is more serious in America than in UK," said Alan Pinder, an automotive consultant. Individual owners and fleet managers are not able to dispose the affected cars until the software fix has been sorted, Pinder said.

In case residual value goes below the value mentioned in the leasing contract, then buyers may have to pay the difference to the lessor at the end of lease period.

Also, for those companies that had bought cars directly from Volkswagen (i.e., not through a leasing company), there might be delays in getting a backup vehicle during the recall time. There is still no clarity on this front.

Operating Costs:Â VW is planning a recall of all affected cars and if the "cheat software" is taken out, experts opine they may end up using more fuel while lowering the performance - leading to user dissatisfaction as well as an increase in operating costs. As a result, ironically, when VW reconfigures the emissions software, people who own these cars may not like the fix.

"Operating costs are certainly going up. They aren't going up for the moment because many of those cars may be in the middle of leasing contract. And if you change the vehicle mid-contract, there are penalties to be had - something which large companies may want to avoid," Pinder said.

For now, owners have been told their vehicles will have to be refitted, but do not know if this will affect their fuel economy or performance -- key issues that could determine the number of lawsuits, according to Reuters. (http://beroeinc.co/1ZWs3zg)

Taxation: Once on the road, the VW cars with emission defeat devices produced nitrogen oxide pollutants at up to 40 times the permissible levels, as per a research finding. Removal of defeat devices could alter the level of CO2 emissions from the car. European Union, U.S. and Britain have varying taxes on CO2 emission, and an increase in pollution level can increase the tax on the employees who drive those cars.

At least there is some reprieve for those who drive the affected cars in Britain. Guardian newspaper has reported that the government has pledged that Volkswagen drivers whose vehicle was fitted with a device to cheat emissions tests will not have to pay higher taxes to reflect the extra pollution their car causes. (http://beroeinc.co/1NTvQJX)

However, it is not clear how the situation will play out in the EU and the U.S.

Indicative emission tax rates and car models:

Country |

CO2/Fuel Consumption Taxes |

Car Models within tax limit |

| United Kingdom | CO2 tax is £0 up to 130 g/km. It varies with slab and the tax is to £1,090 for cars emitting more than 255 g/km |

|

| Germany | The CO2 tax is € 2 per g/km for cars emitting above 95 g/km. Cars with CO2 emissions below 95 g/km are exempt from the CO2 tax component. |

|

| United States | In United States CO2 is regulated at 250 g/miles (156g/km) |

|

Source: ACEA, Manufacturers and other secondary sources

Depreciation: Depreciation and residual values are inversely related wherein if the residual value goes down then the depreciation goes up. Whether companies pay a higher depreciation or not depends on the leasing method that is adopted by the Fleet managers.

For example, in case of self-purchase, the buyer will have to bear the brunt of increased depreciation in case the residual value of affected cars goes down.

Under capital leasing method, buyer can claim depreciation on the asset each year and deduct the interest expense of fleet lease payments. Here again, buyer's depreciation costs can go up.

Operational leasing/service leasing is adopted in cases where the duration of usage is primarily from 12-48 months (less than capital leases). Here there is no depreciation impact but pre-closure of lease contract will lead to buyers paying extra money to lessors.

Green Fleet: The emission scandal can potentially give fillip to green fleet. Green Fleet Management focuses on reduced carbon emission, which helps fleet managers to achieve their sustainability goals. It also focuses on reducing fuel consumption, which helps organizations to cut operating costs. However, low mileage as well as absence of a large network of charging stations can impede expansion of green fleet beyond a point.

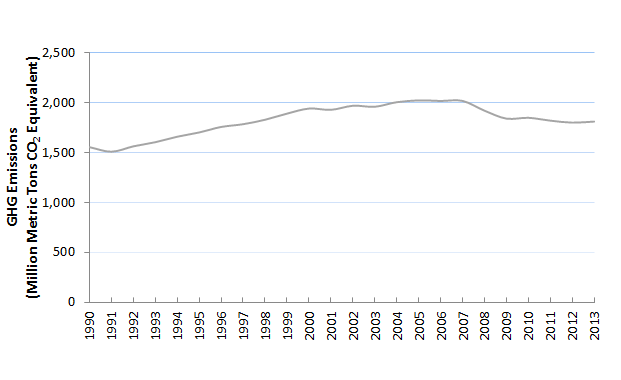

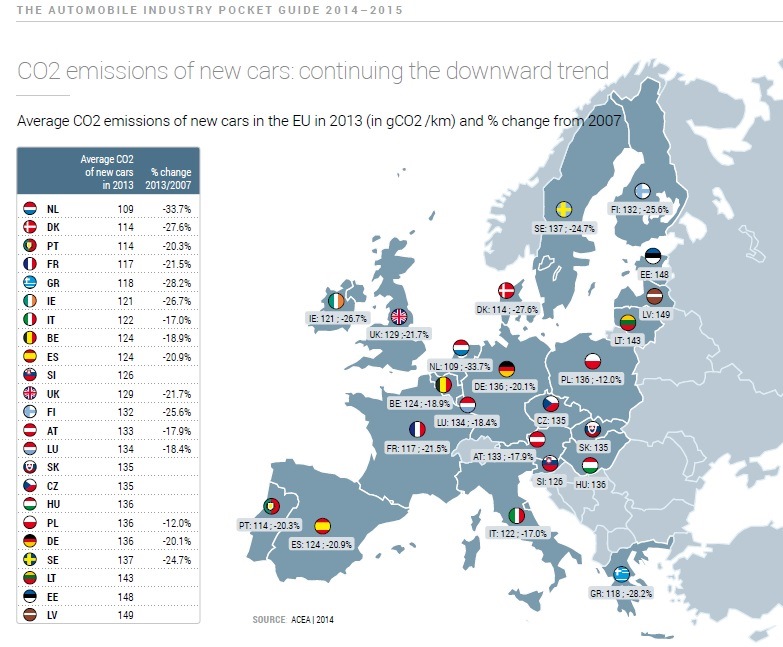

However, in larger scheme of things, vehicular emission is showing a downward trend in recent years as shown in below charts  - thanks to evolving technology and continuing environmental activism.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe