M&A among medical device CMOs paves the way for therapeutic integration

Medical devices sector has household names such as Johnson and Johnson, Medtronic and Boston Scientific among others. These big firms, in turn, partner with Contract Manufacturing Organizations (CMOs) such as Accellent, Great Batch and many others to manufacture devices used to treat ailments in therapeutic areas such as cardio, vascular, neuromodulation and so on.

On the one hand, the healthcare industry has lately been witnessing hectic M&A activity. And on the other, even medical devices CMO sector has seen quite a few deals leading to supplier consolidation.

About 30% of top CMO players were involved in either M&A or expansion plans in emerging and developed markets, according to Beroe's medical devices expert Chanderkanth Gautham.

For example, the CMO space saw Accellent merging with Lake Region Medical, and Nordion combing operations with Sterigenics. Likewise there have been quite a few other deals that have resulted in a unique mix of CMO portfolio.

These deals have further bolstered the bargaining power of leading CMOs as top ten players account for 60% of medical device CMO market, as per Gautham's calculation.

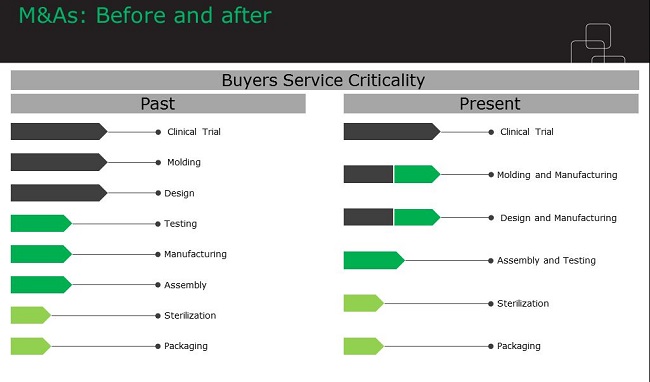

The usual buyer reaction to consolidation of supplier base is one of skepticism. However, Gautham opines that such consolidation offers hitherto hidden opportunities that could be made use of by buyers such as J&J and Boston Scientific.

The top ten medical device firms derive about 65% of revenue from the products launched in the last 24 months -- albeit in their respective therapeutic focus areas.

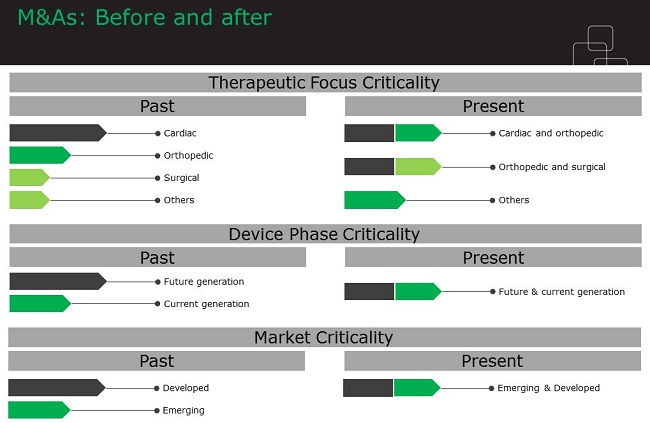

The spurt in the M&A activity among medical device CMOs, however, would not only deepen the companies' footprints in the current segment but also help them expand into new focus areas.

Yes, M&A would result in supplier consolidation and buyers are right in being skeptical about the development.

However, instead of looking at the market share, category managers should focus on increased capacity and therapeutic focus. For example, consolidation has helped Accellent expand its capacity as well as emerging market presence; has pushed Heraeus into surgical space; and increased the capacity of Orchid in orthopedic space.

Such consolidation blends both therapeutic and service areas, which could only be beneficial for the buyers as they can deal with the same supplier for multiple devices instead of dealing with multitude of suppliers.

To get a detailed perspective on various levels of therapeutic integration, please CLICK HERE to watch Chanderkanth Gautham's Webinar.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe