Coronavirus Impact: China Production Rebounds but Faces Demand Slump

In collaboration with Shobana J and Jason Zhong

Large parts of China were under lockdown for nearly three months. However, the country is easing the restrictions as the Covid-19 infection rate slows down.

In a move loaded with powerful symbolism, China ended its lockdown of Wuhan, the city where the coronavirus first emerged, providing hope that the economy can get back on track after months of disruption.

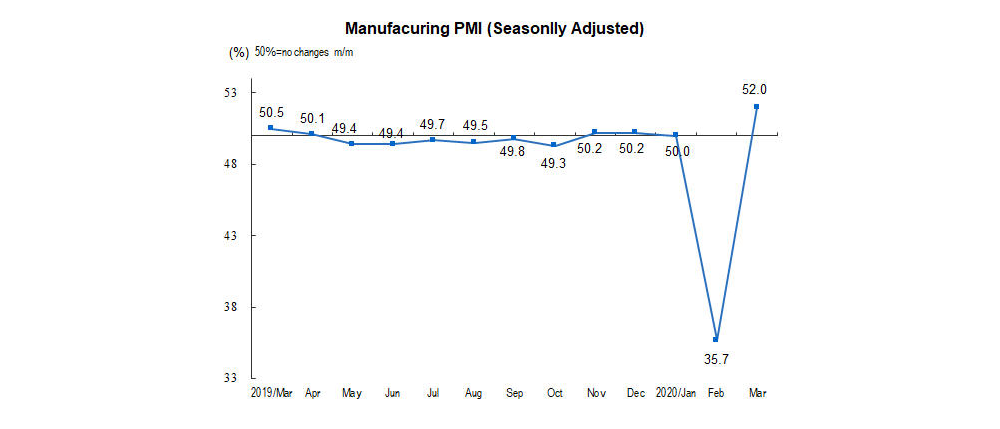

The initial economic data seems to follow the trajectory of hope. China’s official Purchasing Managers’ Index (PMI) unexpectedly rose to 52 in March from a record low of 35.7, above the 50-point mark that separates monthly growth from contraction, according to the National Bureau of Statistics (NBS).

NBS, however, cautioned that the recovery of PMI did not mean that China's economic operation had returned to normal. On the contrary, the rebound after the sharp drop in February only shows that more than half of the surveyed enterprises had returned to work and production better than last month.

The caution note sounded by NBS last week was validated by the quarterly GDP figure. China’s economy shrank 6.8 percent in the first three months of 2020 compared with a year earlier. This marks the country’s first economic contraction since it began reporting quarterly GDP way back in 1992.

As China opens up, large parts of the world have closed down due to the fast-spreading virus. This is especially problematic for China since its major export destinations such as Europe and the U.S. continue to remain shut. People are forced to stay home and many are out of work.

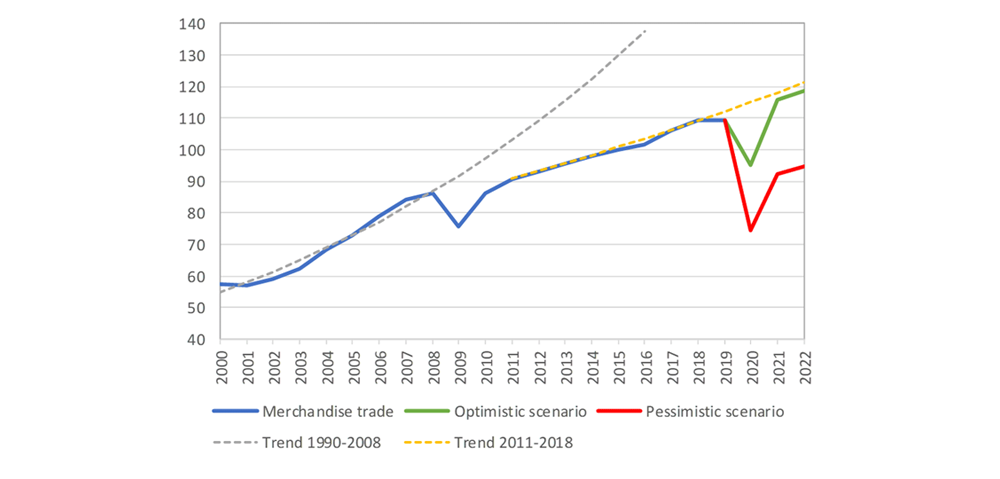

World trade is expected to fall by between 13 percent and 32 percent in 2020 as the COVID-19 pandemic disrupts normal economic activity and life around the world, as per World Trade Organization (WTO).

China’s exports are expected to have fallen 14 percent in March from a year earlier, according to a median estimate from the survey of 31 economists conducted by Reuters News, slowing the downturn somewhat from a 17.2 percent contraction in January-February period.

Imports, meanwhile, are set to have shrunk 9.5 percent from a year earlier, the sharpest drop since July 2016, versus a 4 percent decline in January-February, Reuters reported.

Source: National Bureau of Statistics

As lockdown prolongs across the globe, normal business operations have taken an unprecedented hit. The 2020 outlook for global growth looks negative; economists continue to debate whether it will be a “V”- or “U”-shaped recovery.

"This crisis is first and foremost a health crisis which has forced governments to take unprecedented measures to protect people’s lives. The unavoidable declines in trade and output will have painful consequences for households and businesses, on top of the human suffering caused by the disease itself," WTO Director-General Roberto Azevedo said in a statement.

World merchandise trade volume, 2000‑2022

Source: WTO Secretariat

China Suppliers: Lack of Demand is New Worry

To be sure, the economic recovery won’t be without any difficulties. Production shutdown is no more the main issue -- on the other hand, the new challenge facing Chinese manufacturers is lack of market demand due to prolonged shut down in key export markets.

The lack of demand is reflected in the new export orders received by the Chinese manufacturers: the index for March rose up to 46.4 from 28.7 in February. A reading less than 50 shows contraction, while above that number means expansion.

In March, Supplier distribution time index was 48.2 percent, rose by 16.1 percentage points than February, indicating that the delivery time of raw material suppliers in manufacturing industry was still slower.

At the height of the pandemic in February, Beroe contacted over 100 suppliers to determine the ground reality. Likewise, we got in touch with scores of suppliers over the past week to figure out the extent of economic rebound, especially with transport and logistics yet to fully recover.

Almost all the suppliers Beroe spoke to said 90-95 percent of employees were back to work. We did hear from them about weak export demand in U.S. and Europe, but few of them said Asia market demand, in general, is not affected much.

Given below is a compilation of responses from Chinese suppliers. Beroe has not named any supplier considering the sensitivity of the situation prevailing in China.

-

A Chemical manufacturer based in the Shandong Province said Europe and U.S. are facing business disruptions, and comparatively speaking, the market demand in Southeast Asia is less affected. The spokesperson told Beroe that production is back to pre-crisis level and the company doesn’t expect shortage of warehouse space due to inventory build-up. Also, they did not receive any request for late payments from customers.

-

A manufacturer of concrete and cement admixtures based in the Hebei province said the company is experiencing demand slump from overseas customers and that they foresee risk of not finding warehouse space with rising inventory. Also, the spokesperson said some customers have requested for shipping the products on credit.

-

When questioned about the demand slump and payment issues, a manufacturer of concrete admixture based in Zhejiang province said it is business as usual because their Asian customers were not affected. The spokesperson said the company had delivered the goods to Cambodia two weeks ago and received the payment last week.

-

A producer of advanced construction materials based in Liaoning Province said that more than 90 percent of overseas customers have suspended purchases. “We haven't received the customer's order cancellation notice, only delayed delivery time,” the spokesperson clarified.

-

A maker of pharmaceutical intermediates based in the Shandong province told Beroe that some of their customers are requesting extended payment terms. The spokesperson also said some international orders were cancelled but did not quantify the extent of order cancellations.

-

A spokesperson for a printed circuit board (PCB) manufacturer based in Shenzen said companies, in general, faced labor shortage during the pandemic but many factories have changed their minds in the past week or so. “They don't want to hire any more -- they will maintain their current low capacity because the Coronavirus is very serious in Europe and the United States,” he said.

Factories are experiencing a fall in export orders and few of them may go out of business, according to him. “Currently the production time is still longer than before. The most important thing for the factory right now is to survive,” he said before concluding that he feels anxious about the quick spread of the infection across the globe.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe