Could Xanthan Gum Be A Provisional Replacer Of Guar Gum In Oil Well Drilling?

Abstract

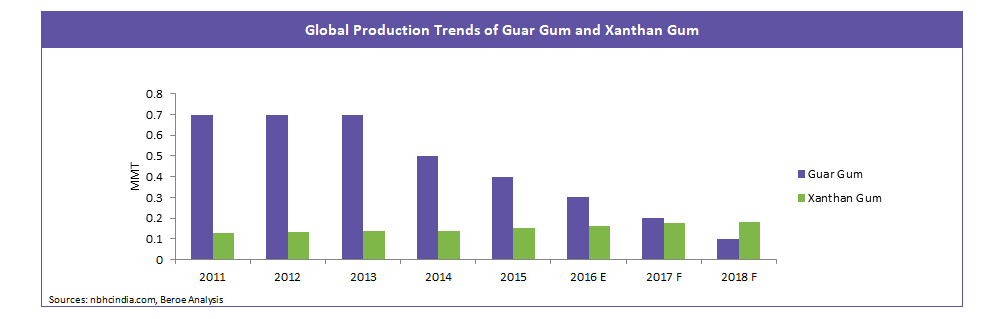

The sudden surge in the oil and gas market in 2011, resulting from the exploration of shale gas, spiked the guar gum market since it is an integral component of the fracking fluid that is used for enhancing the oil recovery. However, oil production fell significantly by 28.5 percent from 2013 to 2014 mostly due to the crash of the crude oil market. This led to a decline in gas and oil exploration and thereby impacted the import demand for guar gum from India. Weaker export demand and the stock burden were responsible for the debilitation of the guar gum market, leading to the closure of 70 percent of its processing units in India. However, after two years of down cycle in the shale gas industry, explorations were quite high in 2017, owing to the Energy and Oil Policy of the new U.S. government. Therefore, the industry is anticipated to recover in 2018 and consequently lead to the recapitulation of oil well drilling activities. By the time the market for guar gum revives to meet the demand from the oil sector, it is expected that xanthan gum, which is the best sustainable substitute, would replace guar gum transiently.

Key Highlights

- Increased drilling activities in North America on account of the growing demand for petroleum and petroleum-based products are likely to augment the oil and gas industry and shale gas explorations, which, in turn, is anticipated to boost the hydrocolloid demand in future.

- The restrained availability of guar seeds in the future and the longer duration for making the guar seeds available for further processing might strengthen the demand for xanthan gum temporarily in the oil well drilling segment, especially since it is the only potential substitute for guar gum.

Xanthan Gum-The Most Conceivable Substitute for the Dissipating Guar Gum Segment

- The food grade guar gum, which accounted for 50 percent of the usage between 2008–2012, came down to a mere 18 percent in 2016 as food manufacturers shifted to alternative sources, such as carboxymethyl cellulose (CMC) and xanthan gum, due to the insufficient supply of guar gum for food applications. Therefore, the market for xanthan gum in food sector expanded after the boom in shale gas market and subsequently stabilized.

- The projected increase in the shale gas explorations and the new oil well drilling activities in the U.S. are likely to revitalize the guar gum market. However, the constraints of the seasonal nature and the long growing season of guar, which is nearly four months, makes xanthan gum a viable substitute to guar gum for companies striving to meet the immediate demand from the oil sector.

- The guar seeds are normally sown during the second half of July to August and harvested during October and November. The crop requires three to four spells of rain, during the first and last weeks of September, during seed setting and maturing. Therefore, Guar gum will be available for the end use industries only by the end of the year.

- Meanwhile, the estimated increase in the explorations and the current supply shortage of guar gum underscores the suitability of xanthan gum as a transitory alternative.

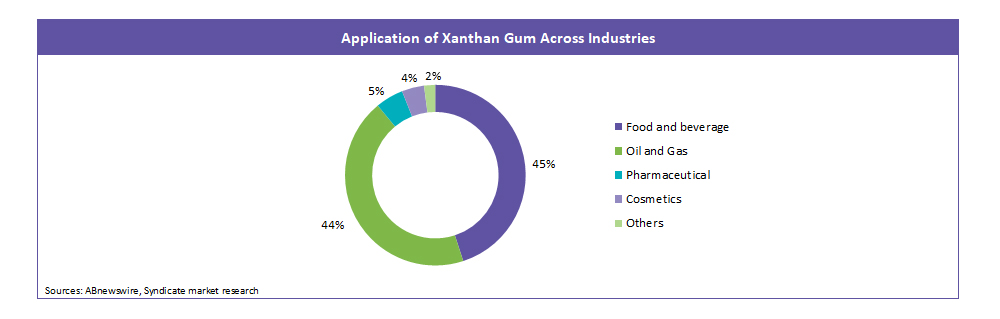

- Moreover, the global xanthan gum market is being driven by a higher preference for xanthan gum than other hydrocolloids in the food and beverages industry, which has resulted in its better performance as a stabilizer. The oil and gas and food segments together account for more than 80 percent of the xanthan gum market.

- The influx of low-quality xanthan gum from Chinese to the U.S. markets at a very low price, in comparison to the international market, has resulted in the implementation of strict anti-dumping policy for xanthan gum imports from China. Companies operating in China, including Fufeng and Deosen, are negatively impacted by the implementation of anti-dumping duties in the U.S. that are in the range of 77 percent to 154 percent in the country.

- This has decelerated xanthan gum imports from China and Austria into the U.S., thereby driving the players within the U.S. to increase their xanthan gum production. Thus, it has created a highly beneficial opportunity for the existing regional players to increase their shares in the global xanthan gum market by expanding their production capacity and making it a sustainable resource for oil drilling applications.

Substitution Analysis

|

Hydrocolloids |

Type of application |

Target industries |

Percentage Consumption by End-use Industries |

Sustainability |

|

|

2012–2014 |

2014–16 |

2016–2018 (F) |

|||

|

Guar Gum |

Food grade |

Bakery; Dairy, Processed Foods like ketchups and jams, Beverages |

20 |

18 |

? |

|

Xanthan Gum |

42 |

45 |

? |

||

|

Guar Gum |

Fast-hydrated gums |

Oil and Gas Drilling, Mining, Explosives |

70 |

62 |

? |

|

Xanthan Gum |

39 |

44 |

? |

||

Conclusion:

The increasing use of xanthan gum as a low-priced alternative to guar gum in a wide range of food applications coupled with the projected increase in shale gas explorations are likely to propel xanthan gum demand for oil exploration activities until guar gum can support the projected demand from oil sector. Moreover, an increase in the production capacity of xanthan gum by the U.S. players in the near future along with the ongoing demand from food sector and anticipated demand from oil drilling activities can compensate the guar gum market for a short span until guar gum becomes available in the market. This also indicates that the initiation of shale gas exploration activities in the U.S. could propel the demand for the xanthan gum over the forecasted period as it is an important component employed in drilling fluids, which can replace the bound availability of guar gum.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe